H&r Block Plans Pricing And Features

H&R Block uses an interview-style tax preparation process that methodically guides you through your federal and state returns, making sure youve entered all sources of income and checked for all appropriate credits and deductions, including commonly missed deductions, along the way.

Whether you have only the barest familiarity with online tax filing or boast years of complex self-prep, you can find a plan or package that fits your needs. Thats the case even if you need to file a Schedule C for self-employment income from freelancing or solopreneurship.

H&R Block has four DIY pricing plans, one hybrid plan with expert assistance at predefined checkpoints throughout the prep process, and a customizable CPA- or EA-aided plan thats a remote version of in-office prep.

Like many tax prep software providers, H&R Block raises its fees as Tax Day approaches. The step-up date varies from year to year and generally isnt revealed well in advance. It pays to begin your return as early in the season as possible, even if you dont yet have all the documentation necessary to complete your return.

On the bright side, H&R Blocks pricing is transparent you know your final price as soon as you select a plan .

H&r Block Pricing & Packages

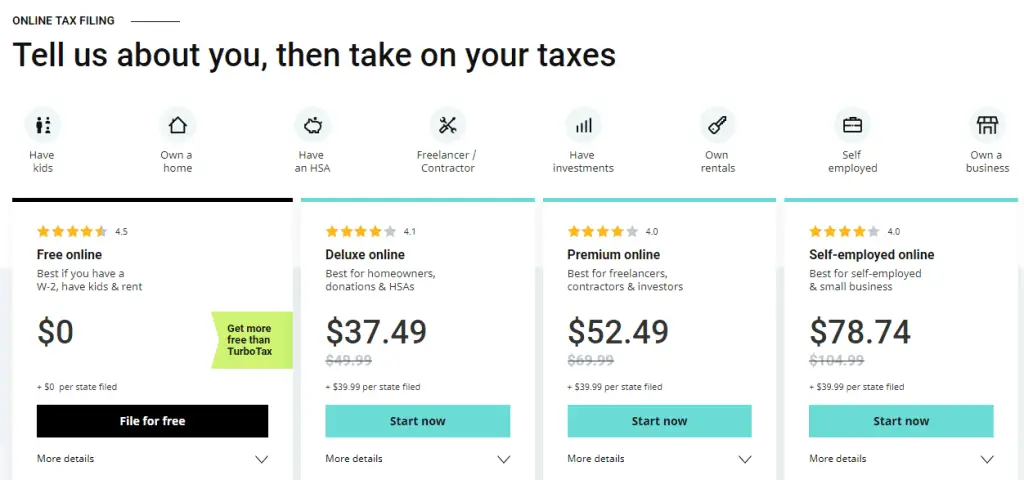

H&R Block offers four packages to file your taxes online: Free, Deluxe, Premium, and Self-Employed. There are also add-ons where you can get varying levels of support from the companys tax professionals. Click Help Me Choose to fill out a quick questionnaire that can help you find the right plan for you, or check out the full details on each tier right here.;

How Much Does It Really Cost To File Your Taxes Online At H&r Block

There are ways to file your taxes online for free. But, many of us will end up paying something to get through tax season. To take the guessing out of doing your taxes, weve made a complete guide to exactly what youll end up paying to file your taxes this year with H&R Block.;

From basic packages to add-ons, we break down the costs so you dont get a surprise bill when youre finally ready to file. Bonus: Dont miss out on all the savings available to you on the Groupon Coupons H&R Block coupons page.;

Read Also: How To Get Tax Exempt Status

What Is The Time Commitment

The course generally meets 6 hours a week either on weeknights or weekends. I went two nights a week from 6-9 pm.

This included 50 hours of instructor-led sessions and 10 hours of self-study. The 10 hours of self-study is a little misleading because in addition to that there is homework for the instructor-led sessions.

The homework consists of reading the chapter for the next class, completing questions/exercises, and preparing case study tax returns by hand. The homework took me roughly 6 hours a week, bringing my total time commitment to 12 hours per week . You could probably get away with spending less time on the homework but probably wouldnt get as much out of the class.

Yeah Yeah Yeah But Is It Worth It To Take The Course

Honestly, that depends on what you are hoping to get out of it. Lets take a look at some of the Pros and Cons and see if it might be worth it for you.

Pros:

- You learn a lot about how to prepare taxes and tax concepts in general

- Tax professional can explain difficult to understand concepts in instructor-led sessions

- Opportunity to interview for a job at H&R Block if you pass the class

- If you work at H&R Block:

- Flexible hours and schedule

- Opportunity to earn commissions after the first year

- You can do your own tax return for free

- Access to advanced tax classes year-round

- Social interaction a lot of tax preparers that have been around a while see the same clients year after year and enjoy catching up with them

Cons:

- Costs $150 for course materials

- Big time commitment

- Not guaranteed to be hired by H&R Block

- Required to sign an agreement that you will not work for a competitor after taking the class

- If you work at H&R Block:

- Pays minimum wage for the first year

- In subsequent years, can take tests to increase certification level, which increases commissions. Total compensation is the greater of hourly pay or commissions. Excluding people who have worked there for 10+ years, many people I spoke with had compensation very close to their hourly pay rate.

- Unpaid 18 hours continuing education requirement each year $35 Annual Fee to access H&R Blocks continuing education classes

For all of those reasons, I wouldnt recommend the course if:

Read Also: How Much Can You Get Back In Taxes

Tips For Choosing A Tax

- Tax season is a good time to take stock of your overall financial picture.;Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- TurboTax and H&R Block are two of the most well-known tax-filing services. There are other great services to consider, though, so make sure to shop around. Check out our list of the;best tax filing software, as well as the;best free online tax software.

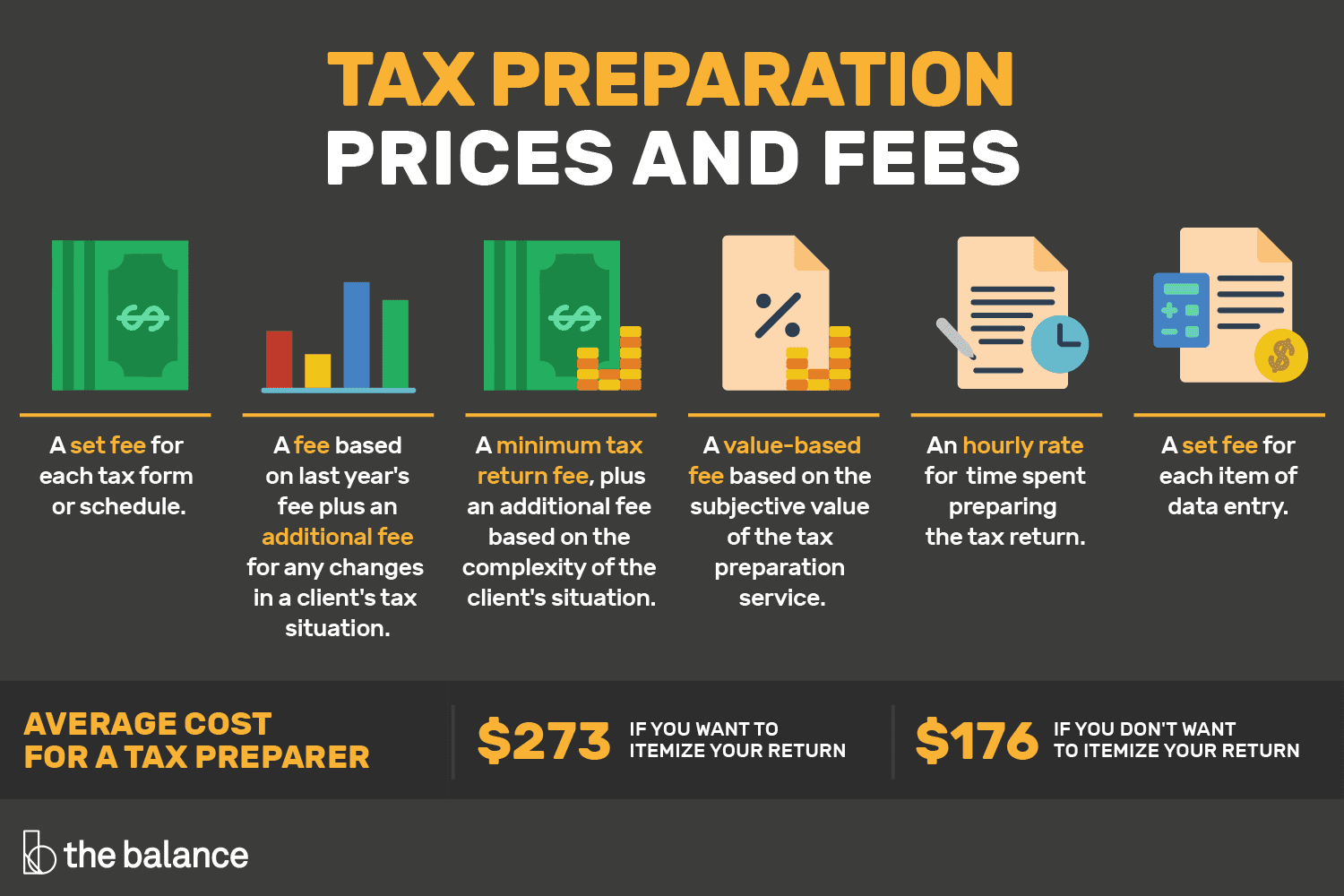

How Much Does It Cost To Get Your Taxes Done

If you’ve never hired a tax preparer before, you’re probably wondering, “How much does it cost to get your taxes done by a professional?” And the answer is, it depends.

It all comes down to the amount of time spent preparing your tax returns. Average tax preparation fees depend on three factors:

How organized are your taxes?

Where do you live?

How complicated are your taxes?

Don’t Miss: Did The Tax Deadline Get Extended

How To Contact H&r Block

You can contact H&R Block for help at 1-800-HRBLOCK. You also have the option to connect via live chat while using the software. Screen-sharing is available as well, making it easy to get your questions answered.

If you decide you don’t want to handle your filing online, you can also visit a local H&R Block office at one of more than 11,000 locations across the United States but you will have to pay a fee for in-person tax filing.

Can I Do My Taxes Online With H&r Block

H&R Block tax filing software makes it easy to complete your taxes online if you don’t want to go to a local office. You can opt to use H&R Blocks software and complete your forms yourself or can get expert tax help from home with Tax Pro Go.

With Tax Pro Go, you simply upload your tax documents and you’re matched with a professional experienced with situations like yours. You can schedule a phone call to talk with your tax pro if you have any questions, and the pro will complete your taxes for you. The cost for Tax Pro Go starts at $69 and increases from there based on the complexity of your return as well as other factors.

You May Like: How Are Reit Dividends Taxed

A Quick Look At Turbotax

TurboTax has been around since the mid-1980s. Part of its popularity is due to the fact that its owned by Intuit. Intuit also makes a software called Quickbooks, which millions of companies use to manage their accounting. But TurboTax is also popular because it offers a user-friendly design and straightforward step-by-step guidance.

Like H&R Block, TurboTax has a free filing option that allows you to file your federal return and one state return at no cost. However, the free option only supports simple returns with form 1040. If you want to itemize your deductions with schedule A , you will need to upgrade to a;paid plan.;There are three paid plans that run from $60 to $120 for federal filing. State filing is always $45 per state, with paid plans. The free option includes one free state return.

| TurboTax Filing Options | |

| Federal: $170.00 State: $50.00 | Best for self-employed, independent contractors, freelancers, consultants and small business owners; Comes with all previous features, plus access to self-employment tax experts, maximizing business deductions |

TurboTax doesnt have any physical locations like H&R Block, but it does provide access to tax experts . It will cost extra for you to get access to an expert, but there are four plans available, corresponding to the four plans listed in the table above.

Available Packages And List Prices

|

FREE |

|

Federal: $109.99 State: $44.99 This package does it all for small-business owners, freelancers and independent contractors. It also imports Uber driver tax information. |

One note about prices: Providers frequently change them. Well keep updating this review, but you can verify the latest price by clicking through to H&R Blocks site. H&R Block also offers desktop software, where your return doesn’t reside in the cloud, but its not part of our review.

Recommended Reading: When Is Sales Tax Due

H&r Block Plans And Prices

H&R Block online tax filing software comes in four different editions:

- Free Online: $0 plus $0 per state filed

- Deluxe Online: $29.99 plus $36.99 per state filed

- Premium Online: $49.99 plus $36.99 per state filed

- Self-Employed Online: $79.99 plus $36.99 per state filed

Heres a basic rundown of what each of these plans offers and why you might want to sign up.

How Much Does It Cost To File Taxes With H&r Block Accountant

Even though many people are starting to use computer programs in order to accomplish their accounting goals, some find that they may not always be completely accurate. This can sometimes be due to common mistakes of the program itself, in which it may have missed important information that could potentially have saved someone money. It may also be a result of human error, since many individuals dont know about things that they could deduct from their actual taxes, or even what might need to be added.

With a human professional working on ones taxes, however, the chances are that people will likely benefit more from using them. This is because they have the ability to catch common mistakes or advantages, often more so than what a computer will be programmed to do on its own. Overall, a perceptive accountant can often prove to be a vital tool when it comes to saving finances and keeping things in order. Stay updated with h&r block fees in Canada quotes to avoid unexpected costs.

A human accountant will also be able to inform people of ways that they could potentially save money. This can include when some individuals may be doing something to jeopardize things, such as with their tax preparation fees in Canada and so forth. This is something that a computer system wont always be able to do when in comparison.

You May Like: What Will My Property Taxes Be

A Quick Look At H&r Block

H&R Block has provided consumer tax filing service since 1955. Its become one of the most popular filing services since then, because it combines simple tools and helpful guidance. Thats useful whether youve never filed taxes or whether youve been filing for decades.;Of course, tools and guidance come at a price. H&R Block currently offers four digital filing options. You can see the options and pricing in the table below.

| H&R Block Filing Options | ||

| Filing Option | ||

| Federal: Free State: Free | Best for new filers or simple tax returns; supported forms include 1040 with some child tax credits | |

| H&R Block Deluxe | Federal: $29.99 State: $36.99 | Best for maximizing your deductions; includes all free features plus forms for homeowners; allows you to itemize |

| H&R Block Premium | Federal: $49.99 State: $36.99 | Best for investors and rental property owners; all More Zero and Deluxe features, plus accurate cost basis; Schedule C-EZ, Schedule D, Schedule E, Schedule K-1 |

| H&R Block Self-Employed | State: $36.99 | Best for small business owners; all Free, Deluxe and Premium features, plus Schedule C |

H&r Block Customer Service

Customer support is available around the clock during prime tax filing seasonJanuary 13 to April 19. And its available during extended business hours the rest of the year. You can access support through online chat, phone, and email.

As with most tax services, the free customer service option is for technical issues with the product. But if you need actual help with your taxes beyond very basic questions, youll need to pay for the additional services to access a live CPA to help with your taxes.

Read Also: How Do You Report Bitcoin On Taxes

H&r Block Vs Turbotax: Comparing Free Options

TurboTaxs Deluxe option is the more comprehensive option for the average filer, but lets briefly consider the free options again.

H&R Block and TurboTax both offer a free option for filers with simple returns. You can often use those options if you dont own a home, you have no investment income other than simple dividends or interest and you dont have rental properties or business expenses.

You cannot use either form if you itemize deductions. However, there are a few deductions available with the free plans. Notably, you can claim the EIC and;Additional Child Tax Credit. H&R Block also includes Schedules 1 through 6, unlike TurboTax.

So if your finances are simple, the biggest consideration is exactly what forms you need to file, because H&R Block includes more forms and schedules with its free plan.

Final Thoughts On H&r Block 2021

For those who qualify for free filing, H&R Block Online deserves to be on the short list. It is a premium software, and the free offering is expansive. Additionally, the Premium edition of the software could offer a good value for investors, and gig workers.

However, users considering the Deluxe Tier should think carefully before paying the price. Deluxe users may find a better by considering TaxSlayer Classic or FreeTaxUSA. These tools may also be a good alternative for self-employed people who dont have depreciating assets in their business.

Landlords and others with depreciating assets should also carefully consider whether H&R Block is the right tool to get the job done. TurboTax has a superior user experience for rental property owners which is important given the complexity of depreciation.

You May Like: How To Pay Taxes For Free

Is H&r Block Really Free

Yes, the service is free for both federal and state if you are filing a simple tax return. It covers unemployment income, retirement income, W-2 income, and interest and dividend income. You can also take the Earned Income Tax Credit , child tax credit, and deductions like tuition and student loan interest.

Does H & R Block Charge Up Front

This is sometimes a point of confusion. The RAC is not an option for how you can receive your refund. If you select H&R Blocks refund anticipation check, you will not have to pay the fee for tax preparation services up front. Instead, H&R Block will deduct those fees from your refund after the IRS issues it.

Also Check: How To Pay Llc Taxes

Also Check: Where Can I Get My Taxes Done By Aarp

Are There Other Fees I Should Know About

Like most companies, H&R Block allows you to pay for tax prep and other related fees right from your federal or state refund payment, but you’ll be charged a $39 Refund Transfer fee.;

That means that H&R Block won’t charge you when you file, but will take the amount you owe from your refund plus the additional fee. So, for example, if you went with the Deluxe option for $49.99 and added on the additional $39 Refund Transfer fee, H&R Block won’t charge you on the spot but will deduct the added charges from your final refund. If you don’t have the cash available to pay now and you expect to get a large refund, it might be worth the extra fee.

They Charge An Hourly Rate

If your tax advisor charges by the hour, make sure you find out how much they charge;and;how much time they expect to spend on your taxes. Usually, a tax pro will charge an hourly fee between $100200 per hour, depending on what kind of tax forms you need to file.6 If they can get your taxes done in less time, you wont get stuck with a high bill at the end.;

Also Check: How To Get Out Of Paying School Taxes

Is Turbotax Or H&r Block Better

Intuit makes both apps, and you can quickly transfer your financial data from QuickBooks to your tax forms. You might choose H&R Block if you want a premium experience for a lower price. H&R Blocks DIY filing options are less expensive than TurboTax across the board and edged out TurboTax in our overall ratings.

Advantages Of Online Tax Preparation

Those who prefer to do their own taxes are in the minority, but it’s a sizable minority – about 40%. Many prefer to do taxes themselves because it’s faster, cheaper, and private. The advantages to online tax preparation are:

- Affordability

You can prepare and file your taxes for free or at very low cost with many highly rated, online subscription services or downloadable software products.

- Speed

Eight in 10 taxpayers get their tax refunds faster by opting to e-file and have their refunds directly deposited into their bank accounts, according to the IRS.

In addition, you don’t have to gather up your documents, make an appointment, drive to an office, go through an interview, and then return to the office to review and pay for your return. You just download your software, complete your return, and file online.

- Privacy

Most online services allow you to complete the forms directly or work through an interview format, answering questions and allowing the program to populate the return. So you don’t have to talk to a human about your money if you don’t want to.

Recommended Reading: How Can I Make Payments For My Taxes