State And Local Tax Brackets

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876%; remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89%; Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

Claiming Children For The Eitc

If you claim children as part of your EITC, they must pass three tests to be a qualifying child:

Heres What You Need To Do

Itemize your deductions instead of taking the standard deduction as long as your itemized deductions are more than the standard deduction. To determine this, youll need to do the math.

In 2019, for example, the standard deduction for a married couple filing jointly was $24,400 . If you dont have more than that to write off, it makes sense to just take the standard deduction.

Swecker points out that itemizing this deduction usually makes the most sense for someone that is single and blowing it out of the water financially, he says.

Think about it with a couple, you are two people, but theres just one mortgage deduction. A single person could buy the same house and would only need to find $12,200 in deductions, whereas a couple still needs to find $24,400.

If our hypothetical homeowner itemized their taxes, they could deduct approximately $5,500 in mortgage interest from their taxable income .

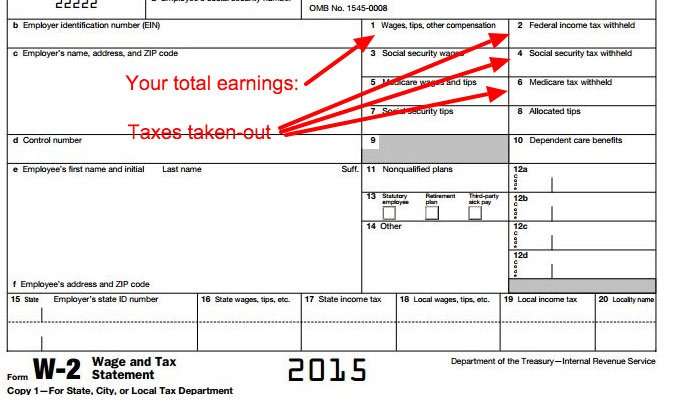

Take note: Your loan provider will send you a tax document outlining exactly how much interest youve paid on your mortgage each year.

Read Also: What Is California State Tax Rate

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000, but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

You May Like: How To Register For Tax Id

Child Tax Credit Phaseout Limits

Phaseouts are not tied to the inflation rate and start with the Modified Adjusted Gross Income of $200,000 for all taxpayers other than taxpayers who are married and filing jointly. For these taxpayers, their MAGI is $400,000.

If you earn more than these numbers, the value of the tax credit will begin to phaseout.

What Is The Payment Schedule For Unemployment Tax Refunds

With the latest batch of payments in July, the IRS has now issued more than 8.7 million unemployment compensation refunds totaling over $10 billion. The;IRS announced it was doing the recalculations in phases, starting with single filers with no dependents and then for those who are married and filing jointly. The first batch of these supplemental refunds went to those with the least complicated returns in early summer, and batches are supposed to continue for more complicated returns, which could take longer to process.;

According to an igotmyrefund.com forum and another discussion on;, some taxpayers who filed as head of household or as married with dependents started receiving their IRS money in July or getting updates on their transcript with dates in August and September. No other official news from the IRS has been issued regarding payment schedule for this month.;

Recommended Reading: How Do I Pay My State Taxes In Missouri

How To Track Your Tax Refund

Many taxpayers prefer to get their tax refund via direct deposit. When you fill out your income tax return youll be prompted to give your bank account details. That way, the IRS can put your refund money right in your account, and you wont have to wait for a check to arrive in the mail.

If you file your taxes early, you dont have to wait until after the tax deadline to get your tax refund. Depending on the complexity of your tax return, you could get your tax refund in just a couple of weeks. To get a timeline for when your refund will arrive, you can go to www.irs.gov/refunds. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return .

In a given tax year, you may want to know how big your refund will be so you can plan what to do with it. You may want to use it to boost your emergency fund, save for retirement or make an extra student loan or mortgage payment.

How Do I Get My Tax Refund

Luckily for you, the IRS is very good about getting your tax refund to you.

In fact, you can check out the IRSs Wheres my refund? tool to find the status of your tax refund right now. And according to the IRS, they issue nine out of ten refunds;back to the taxpayer within 21 days after they file their taxes.

Ultimately, though, how soon you get your refund back depends on two things:

- How you file your taxes

- How you elect to receive your refund

If you decide to file your taxes through good old fashioned pen and paper, its going to take considerably longer to get your refund back. In fact, youre going to have to wait four to six weeks before youre even able to check your status on their Wheres my refund? tool.

There is another route though: Electronic tax filings.

You receive your tax refund even faster when you file it electronically via platforms like TurboTax or IRS e-file. There you can elect to receive your refund through direct deposit . Its secure, fast, and the same way the government deposits millions of Social Security and Veteran Affairs benefits each year.

When you get your money back, be sure to put it to good use:

So you know how much youre getting back and how to get your money. Now lets get into what you might be getting WRONG about your tax refund.

Don’t Miss: What Is The Date To Pay Taxes

Legal Ways To Maximise Your Tax Refund

As in many other countries, Germany allows you to deduct a variety of expenses from your taxable income, thereby lowering your tax burden and increasing your refund. Some of the expenses which you can specify in your tax return are listed below:

Income-related expenses including

- Expenses for moving house for professional reasons,

- The costs of applying for jobs, including those applied for from abroad

- Expenses for traveling from your home to your place of work

- Costs of vocational further training, such as work-related books, training courses, language courses etc.

- Expenses for work-related equipment, e.g. laptop, desktop etc.

- The costs of running two households within Germany or in Germany and abroad, e.g. if you have a primary household abroad where your family are living: flight and train tickets, telephone calls, rent paid in Germany

Special expenses , including

- Retirement insurance expenses, i.e. insurance premiums and contributions to private pension schemes

- Expenses for additional retirement savings

- Charitable and political donations to German entities

Exceptional costs , including

- Personal expenses which most taxpayers inevitably incur; e.g. personal medical costs

- Financial support to close dependents in need

- Professional training

The following is provided for each child under 18

- A tax-free child allowance and an allowance for the childâs care, educational or professional training requirements OR

- Child benefit.

Dont Overbuy A House To Gain Tax Benefits For Homeowners

No amount of tax deductions justifies buying a house extremely outside of your budget. If you cant hang on to the house by comfortably making the payments each month, it then becomes a not so great investment.

Make sure you buy a house you can afford without undue financial stress. Home purchase tax deductions you claim later should only be looked at as a bonus.

Recommended Reading: Can I Check My Property Taxes Online

How Much Can I Contribute To My Tfsa

The TFSA contribution limit for 2021 is $6,000. You can also carry forward any unused contribution room from previous years. The annual TFSA contribution limits per year, since TFSAs were introduced in 2009, are listed below.

- The annual TFSA dollar limit for the years 2009-2012 was $5,000.

- The annual TFSA dollar limit for the years 2013-2014 was $5,500.

- The annual TFSA dollar limit for the year 2015 was $10,000.

- The annual TFSA dollar limit for the years 2016-2018 was $5,500.

- The annual TFSA dollar limit for the years 2019-2020 was $6,000.

- The annual TFSA dollar limit for the year 2021 is also $6,000.

The annual TFSA contribution limit is subject to change by the federal government.

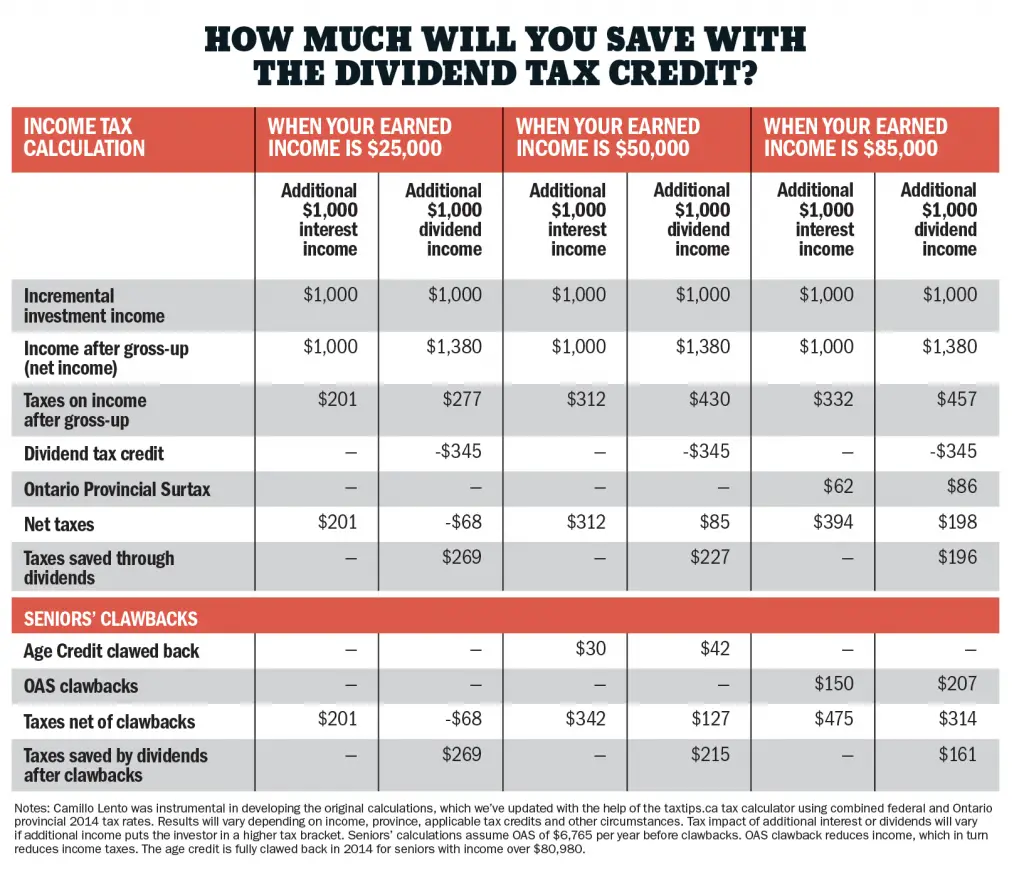

Maximize Your Tax Credits

Tax credits are different than tax deductions and come in two flavours: refundable and non-refundable.

- A non-refundable tax credit is applied directly against your tax payable. That means if you have tax owing of $500 and get a tax credit of $100, you now only owe $400. If you dont owe any tax, non-refundable credits are of no benefit.

- A refundable tax credit, such as the GST/HST credit, means you will receive the credit even if you have no tax owing.

Here are the best ways to take advantage of tax credits:

- Basic Personal Amount: Every Canadian resident is entitled to claim the basic personal amount on his or her tax return. For 2019, the basic personal amount is $12,069. What this means is that instead of paying taxes on your entire income, youll just be taxed on the remaining income once the basic personal amount has been applied. In other words, think of it as your first $12,069 worth of income being considered tax-free or tax-exempt.

- Spousal Amount: If you support your spouse or common-law partner, and their net income is less than $12,069, you can claim all or a portion of the spousal amount . The amount is reduced by any net income earned by the spouse. The spousal amount can only be claimed by one person for the spouse or common-law partner.

Other Eligible Tax Credits:

- , and exam fees

- Medical expenses

- Donations or political contributions

You May Like: What Is Schedule D Tax Form

Child Oncology Patients And Children With Permanent Disabilities

In the case of children receiving treatment for cancer and children with permanent disabilities, you can claim taxrelief on the following as health expenses:

Telephone: Where a child oncology patient or a child with apermanent disability is being treated at home, you can claim a flat ratepayment to cover telephone rental and calls where those expenses are incurredfor purposes directly connected with the treatment of the child.

Overnight accommodation: Tax relief is also allowable forparents or guardians of child oncology patients and children with permanentdisabilities where the child needs to stay overnight in a hospital as part oftheir treatment and the parent or guardian is required to stay nearby. Reliefis allowable on payments made to the hospital and/or hotel or bed-and-breakfastnear the hospital for accommodation.

Travel: The cost incurred in travelling to and from any hospital for:

- The patient and accompanying parents or guardians and

- Parents or guardians of the patient

Where such trips are shown to be essential to the treatment of the child.There is a mileage allowance if you use a private car.

Hygiene products and special clothing: Tax relief is alsoallowed for parents/guardians of child oncology patients and children withpermanent disabilities for the cost of hygiene products and special clothing.This is subject to a maximum of â¬500 per year.

Irs Online Tax Calculator

If your anticipated refund took a disheartening turn in the wrong direction, you may owe more taxes than you’ve already paid. The IRS provides an online calculator to help you adjust the amount you have withheld from your paychecks . From the IRS website, type “IRS withholding calculator” into the search field. When the search results load, click on “IRS withholding calculator” to begin using this interactive tool.

You May Like: How To File Past Years Taxes

How To Estimate How Much I Will Get Back In Taxes

Receiving a tax refund is like coming upon found money, but a refund has actually been your money all along, which you overpaid through payroll deductions or quarterly tax payments returned to you. When you complete your tax return, youll be able to estimate the amount of taxes you overpaid, which means any surplus will be headed back your way. So sharpen your pencil, turn on the calculator and tackle that tax return or you may avail yourself to an online tax return estimator that does the math for you.

Tips

-

You can estimate your tax refund by comparing your yearly tax contributions to your income tax bracket while simultaneously factoring in the various credits and deductions you have taken.

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points; the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Also Check: How Fast Can You Get Your Tax Refund

Support Your Favourite Cause And You Can Receive As Much As 53% Back Through Charity Tax Deductions See The Difference That Charitable Tax Credits Make When You Donate To Your Favourite Charity And Claim Your Charitable Donation Receipts

Not only is giving to charity a great way to make a difference to your favourite cause, but when you claim your charitable tax credits you can also take advantage of federal and provincial government tax incentives. Here are just some of the ways that giving charitably might pay off for you!

Federal and provincial tax incentives add upDonate securities, eliminate the capital gains tax and get a larger tax credit

Securities are the most efficient way to give charitably. When you donate publicly traded securities directly to your favourite charity, you can eliminate the capital gains tax as these securities are sold, and still receive a tax receipt for the fair market value on the date the security is received by our broker. Plus, your charity also gets the full value of the securities.

Consider carrying donations forward for larger charitable tax credits.

You do not have to claim all of the donations you made in the year they were made. When you donate over $200, you are automatically eligible to carry them forward and claim them on your tax return for any of the next five years. This flexibility means that the unclaimed carry forward portion may qualify for a larger tax deduction for you, in the future.

What Is The Child Tax Credit

The Child Tax Credit is a major tax credit for those with children under the age of 17. There are a number of qualifications attached to the Child Tax Credit, which we will discuss.

This tax credit subtracts an amount from the amount of tax you owe. This makes it much more valuable than a deduction, which only decreases your total taxable income.

The Child Tax Credit is partially refundable, so even if you owe nothing to the IRS, you could claim the child tax credit.

Recommended Reading: Can You Refile Your Taxes