Can You Lose Money In A Roth Ira

The short answer is, yes. Theres always going to be an element of risk when you invest, but you can minimize your risk by spreading out your investments evenly across four different types of stock mutual funds: growth and income, growth, aggressive growth, and international. That way, youll balance and diversify your portfolio between higher-risk investments and more steady and predictable ones.

And listen, if the market has a bad day, dont panic and take all your money out of your Roth IRA. That is the worst thing you can do, because all youre doing is locking in your losses. Dont do it!

Investing in the stock market is like riding a rollercoasterthe only people who get hurt are the ones who jump off. The investors who keep their cool and give their money time to grow are the ones who get to the end of the ride safe and sound. When in doubt, reach out to an investment pro for guidance!

Neglecting To Take Required Minimum Distributions

This is a mistake that beneficiaries can often make. Non-spouse beneficiaries who inherit a Roth IRA are usually required to begin taking distributions from it by December 31 of the year after the year in which the original account owner died.

If the beneficiary fails to do so, they may be forced to withdraw all of the money within five years instead of spreading the distributions out over 10 years. There can also be substantial tax penalties for failing to comply with the RMD rules.

Tax Advantages Of Roth Iras

For those just starting out, the power of this tax shelter may seem a tad obscure, but it can really pay off big. If a 25-year-old contributes $5,000 each year until she retires and makes an average annual return of 8% on her investment, she’ll have over $1.6 million saved by the time she retires at age 67. And the money is all hers she won’t have to give the IRS a cent of it if she waits until retirement to withdraw the earnings.

If that same 25-year-old invested that same $5,000 a year in a taxable account earning the same 8% return, she’d have less than $1 million when she turned 67 if her earnings were taxed at 22% each year. That’s more than one-third less money than if she’d gone with the Roth. If state taxes bit into the earnings each year, too, she’d be down even more.

You May Like: Where’s My Tax Refund Ga

What Are The Benefits Of A Roth Ira

The Roth IRA has some serious benefits.

Lets start with the tax impact. When you make contributions post-tax, that means youve already paid taxes on the money you set aside for retirement. That helps your retirement savings go a lot further! Heres why:

So, if your account grows by hundreds of thousands of dollars over time, you wont owe taxes when you withdraw that money in retirement! Thats a huge perk, especially for folks who expect to be in a higher tax bracket when they retire. Talk about a win!

Here are a few more benefits of a Roth IRA:

- Youre not required to take distributions at a certain age, unlike the traditional IRA .

- You can keep contributing to your Roth IRA if you choose to work past retirement age, as long as your income still falls within the income limits.

- You can choose beneficiaries to inherit your account, and they will be able to withdraw funds tax-free as well.

Eligibility For Savers Tax Credit

Individuals who contribute to a Roth IRA with modified adjusted gross income below certain levels for the year may be eligible to claim a savers tax credit for their contributions. The AGI eligibility levels for 2017 are:

- $62,000 for married couples filing jointly,

- $46,500 for heads of household, and

- $31,000 for singles and married individuals filing separately

These modified AGI thresholds may be adjusted in later years to reflect cost-of-living increases.

Individuals must also be age 18 or older, not a full-time student, and not be claimed as a dependent on another tax return to be eligible for the Savers Tax Credit.

Eligible individuals can take the tax credit by filing Form 8880 with their tax return or working with a tax preparer. The chart below shows the amount of the savers credit for different kinds of filers for 2017:

Also Check: Www Michigan Gov Collectionseservice

What Do Canada Revenue Tax Rules Say About Roth Iras

Historically these accounts that been treated as tax free in Canada by virtue of the Canada-US tax treaty. Under Article XVIII of the treaty if a distribution from a pension account is considered to be tax free in the US, it will also be tax free in Canada. Considering that in most cases ROTH distributions are considered tax free in the US it would also be tax free in Canada.

Canadian residents should also consider whether these accounts qualify for reporting under CRAs T1135 foreign income verification rules. Under these rules regular 401k and traditional IRA accounts are exempt from reporting requirements. Its currently not clear whether this exemption relates to ROTH accounts as well. Considering the potential penalties involved in not reporting required accounts adding these accounts to your annual T1135 reporting requirements may be a good idea.

With This Indispensable Savings Tool Your Money Grows Tax

One of the smartest money moves a young person can make is to invest in a Roth IRA and setting one up is easy.

Follow the rules, and any money you put into one of these retirement-savings accounts grows absolutely tax free: You won’t owe Uncle Sam a dime as you let your savings accumulate, or when you cash out in retirement. Plus, an IRA is more flexible than a 401 and other retirement plans because you can invest it in almost whatever you want, from stocks and mutual funds to bonds and real estate.

If you haven’t yet opened this gift from Uncle Sam, do it now. You have until your tax return deadline to set up and make contributions for the previous tax year. The government sets a limit on how much you can contribute to a Roth. The limit is $6,000 for 2021 . And, although you have until next year’s tax deadline to kick in your 2021 contribution, the sooner your money is in the tax shelter, the sooner the tax-free earnings begin to accrue.

Don’t Miss: Www Aztaxes Net

Who Manages A Roth Ira

You are responsible for deciding how much you contribute to your Roth IRA and what you want to invest your money in. But your custodian dictates which investment options are available to you, so you must choose yours carefully.

All IRAs are required to have a custodian by law. The custodian could be a bank, an insurance company, or a mutual fund company, but brokerage firms are the most popular because they offer a wider range of investments. Your custodian is responsible for holding your assets and making sure all of your investments comply with IRS guidelines, as well as completing necessary reporting requirements.

You are free to change up how you invest your money at any time, and you can switch custodians as well by rolling your Roth IRA over to a new account. There’s also no rule that says you can only have a single Roth IRA, though juggling multiple accounts with different custodians can make it more difficult to see what you have and to keep track of how close you are to the annual contribution limits.

Roth Ira Advantage #: Roth Iras Are Typically A Good Retirement Planning Tool For Younger Folks

Roth IRAs typically are a great retirement planning tool for young folks.

Thats because if youre young, you are typically at the beginning of your working career, earning the lowest wages in your life:

- Youre in one of the lowest tax brackets

If youre in a low tax bracket, that means it probably doesnt hurt you too much if youre taxed on Roth IRA contributions today .

Down the road, lets say when you are 40 or 60 years old, you are typically toward your peak earning years:

- Youre in a higher tax bracket

If youre in a higher tax bracket, youll likely want to consider other options like a Traditional IRA, since contributions will be deducted immediately from your income tax returns, which means youll have a lower tax bill in the current year.

| Consider Contributing to a Roth IRA | Consider Contributing to a Traditional IRA | |

|---|---|---|

|

If you are young |

||

|

Expect your income to stay the same |

Read Also: Efstatus Taxact Com Login

Is Converting To A Roth Ira Right For You

Compare estimated values of keeping a Traditional IRA vs. converting it to a Roth, and see estimated taxes.

Your eligibility to open a Roth IRA and how much you can contribute is determined by your Modified Adjusted Gross Income . If you are a single or joint filer, your maximum contribution starts to reduce at $124,000 and $196,000 for tax year 2020, and $125,000 and $198,000 for tax year 2021, respectively. See which IRAs youre eligible for with our Roth vs. Traditional IRA Calculator.

Compare different retirement accounts and learn their tax benefits and rules with our Roth IRA vs. Traditional IRA infographic.

Roth Ira Advantage #: Extended Contribution Deadline

I had this experience the first year I opened my Roth IRA: It was the middle of December and I only had made $500 of Roth IRA contributions.

All of a sudden, I found myself scrambling to hit the December 31st contribution deadline until I realized that the Roth IRA contribution deadline is extended .

This means that:

In the following situations:

- Pay for a disability or death

- Pay for qualified education expenses

- Pay for qualified birth or adoption expenses

- Pay for a first-time home

- Pay for unreimbursed medical expenses or health insurance if youre unemployed

You May Like: How To Buy Tax Lien Properties In California

Roth Ira Withdrawal Rules

The withdrawal rules for Roth IRAs are more flexible than those for traditional IRAs and employer-sponsored plans like 401s. You can withdraw your Roth IRA contributions at any time, for any reason, without owing tax. And withdrawals of earnings during retirement are tax-free as well.

Of course, if youre a Millennial today, that doesnt help you now. But there are exceptions to the withdrawal rules that can help Millennials who are struggling with financial issues.

One nice one is called the first-time homebuyer exception. You can use as much as $10,000 of your Roth to buy, build, or rebuild a home, provided youre a first-time homebuyer. Meeting that restriction is easier than it sounds: The IRS considers you a first-time homebuyer if it’s been at least two years since you owned a home. That $10,000 could be used toward a down payment on a property, or to cover unexpectedly high closing costs.

Roth Vs Traditional Ira

The main difference between the two kinds of IRAs is whether you want to fund your IRA with pre- or post-tax dollars. A traditional IRA is funded with pre-tax dollars. When you retire and access funds in a traditional IRA, you are responsible for paying income tax on the funds. A Roth IRA is funded with after-tax dollars, and any contributions made are not subject to taxes when withdrawn. Contribution limits for Roth and traditional IRAs are the same, and both can be funded up until any age.

If you opt for a traditional IRA, you must take a required minimum distribution starting at age 72. As per the IRS, traditional IRA owners must begin taking minimum amounts beginning April 1 of the year following the year they turn 72. Beneficiaries are also subject to the RMD rules if they inherit a traditional IRA. Non-spousal beneficiaries who inherit Roth IRAs are also subject to RMD rules.

Also Check: Buying Tax Liens California

Key Differences: Tax Breaks

Both traditional and Roth IRAs provide generous tax breaks. But its a matter of timing when you get to claim them.

Traditional IRA contributions are tax-deductible on both state and federal tax returns for the year you make the contribution. As a result, withdrawalsofficially known as distributionsare taxed at your income tax rate when you make them, presumably in retirement.

Contributions to traditional IRAs generally lower your taxable income in the contribution year. That lowers your adjusted gross income , possibly helping you qualify for other tax incentives you wouldnt otherwise get, such as the child tax credit or the student loan interest deduction.

With Roth IRAs, you dont get a tax deduction when you make a contribution, so they dont lower your adjusted gross income that year. But, as a result, your withdrawals in retirement are generally tax-free. You paid the tax bill upfront, so to speak, so you don’t owe anything on the back end.

In other words, it’s the opposite of the traditional IRA.

You can own and fund both a Roth and a traditional IRA however, your total deposits in all accounts must not exceed the overall IRA contribution limit for that tax year.

What Is A Roth Ira And How Does It Work

A Roth IRA is a retirement savings account that allows you to pay taxes on the money you put into it up front. The growth in your Roth IRA and any withdrawals you make after age 59 1/2 are tax-free, as long as youve had the account more than five years.

Because you pay taxes on the front end with a Roth IRA, you dont owe them in retirement.

If you want to contribute to a Roth IRA, you must open and maintain it outside of your employer-sponsored retirement savings plan.

Don’t Miss: How Can I Make Payments For My Taxes

No Required Minimum Distributions For Roth Iras

With traditional IRAs, you have to start taking required minimum distributions when you turn 72, even if you don’t need the money. That’s not the case with a Roth IRA. You can leave your savings in your account for as long as you live, and you can keep contributing to it indefinitely, as long as you have qualifying earned income and your modified adjusted gross income doesn’t exceed the annual limit for making contributions.

These features make Roth IRAs excellent vehicles for transferring wealth. When your beneficiary inherits your Roth IRA, generally, he or she will have to take distributions that could be stretched out over 10 years. This can provide years of tax-free growth and income for your loved ones.

Roth Ira Vs Traditional Ira

Whether or not a Roth IRA is more beneficial than a traditional IRA depends on the tax bracket of the filer, the expected tax rate at retirement, and personal preference.

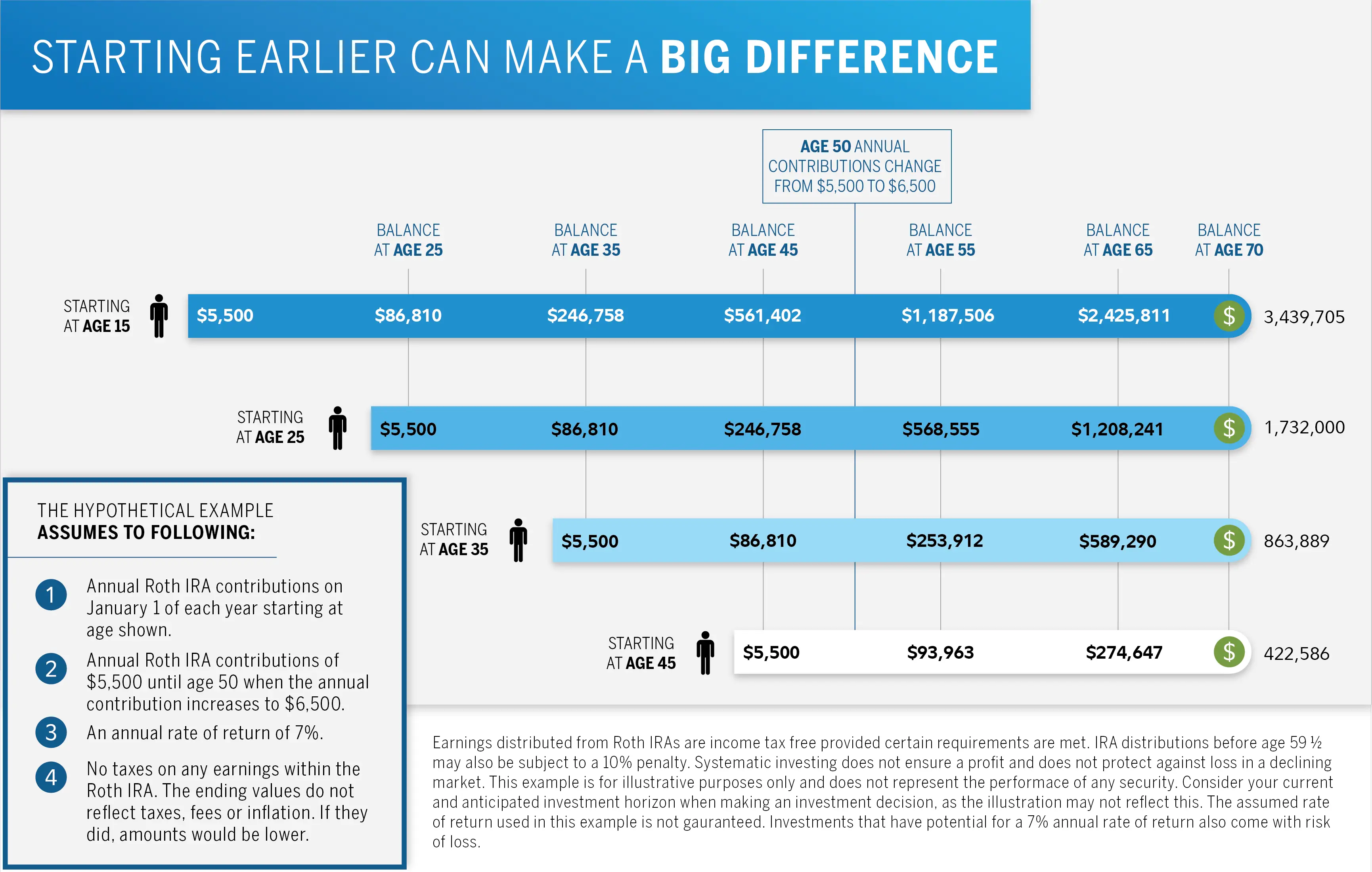

Individuals who expect to be in a higher tax bracket once they retire may find the Roth IRA more advantageous since the total tax avoided in retirement will be greater than the income tax paid in the present. Therefore, younger and lower-income workers may benefit the most from the Roth IRA. Indeed, by beginning to save with an IRA early in life, investors make the most of the snowballing effect of compound interest: Your investment and its earnings are reinvested and generate more earnings, which are reinvested, and so on.

Consider opening a Roth over a traditional IRA if you are more interested in tax-free income when you retire than in a tax deduction now when you contribute.

Of course, even if you expect to have a lower tax rate in retirement, you’ll still enjoy a tax-free income stream from your Roth. Not the worst idea in the world.

Some open or convert to Roth IRAs because they fear an increase in taxes in the future, and this account allows them to lock in the current tax rates on the balance of their conversions. Executives and other highly compensated employees who are able to contribute to a Roth retirement plan through their employers can also roll these plans into Roth IRAs with no tax consequence and then escape having to take mandatory minimum distributions when they turn 72.

Also Check: Do I Need W2 To File Taxes

Vs Roth Ira: An Overview

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Contributions to a 401 are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

These Key Factors Can Help You Decide

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

The earlier you start a Roth IRA, the better, but opening a Roth IRA when you’re close to retirement can still make sense under some circumstances.

A Roth IRA is an individual retirement account that allows certain distributions or withdrawals to be made on a tax-free basis assuming specific conditions have been met. However, Roth IRAs do not provide a tax deduction in the years they’re funded, meaning they’re funded with after-tax dollars. Although there is no age limit to open a Roth IRA, there are income and contribution limits that investors should be aware of before opening and funding a Roth IRA.

Read Also: Tax Lien Investing California