Enrolling As User On California E

Before you can apply for a California SEIN, or payroll tax account number as its commonly known, youll need to set up an account on the EDDs e-Services for Business portal. To do this, navigate to the e-Services page and click the Enroll for a username and password link. Once you enter the requested information and create a username and password, EDD will send an email to verify the address you provided. In order to gain access to e-Services and apply for an SEIN, you must verify your email address within 24 hours of enrolling.

If Your California Llc Is Owned By Another Company:

The IRS made changes in 2018 that no longer allow an EIN Responsible Party to be a company. The EIN Responsible Party must be an individual person. So its best to list one of the individual owners of the parent company.

Note: If you have a California LLC that is owned by another company and you try to get an EIN online, youll just get an error message at the end of the application.

Obtaining A California State Id Number

If you are operating a business in California and it is paying more than $100 worth of wages to employees per quarter of the calendar year, you must obtain a SEIN for your company. To get a SEIN, you must first make sure you have an EIN, which can be obtained for free from the IRS and which will usually be generated within minutes of application completion. Once you have this number, you must then register your company with the EDD. This occurs at their e-Services for Business website, and the registration process is as follows:

Don’t Miss: Pastyeartax

Do You Need An Ein For A California Business

The IRS has specific criteria for which companies need an EIN and which do not. The following criteria are from the IRS itself. If your business falls into one of the following categories, you will need to obtain an EIN.

- You formed a California corporation or partnership

- You have employees

- You are required to file Employment, Excise, or Alcohol/Tobacco/Firearms tax returns

- You withhold taxes on income paid to a non-resident alien

- You have a Keogh plan

- You are involved with: a trust, estate, real estate mortgage investment conduit, non-profit, farmers co-op, or plan administrator

It should be noted that most banks will require an EIN before opening a business bank account.

How Much Does It Cost To Get A Resale License In California

There is no cost to get a sellers permit or resale license in California. You might, however, have to provide the CDTFA with a security deposit. This will potentially cover future unpaid taxes if your business closes. The CDTFA uses your application to decide how much of a security deposit they require.

You May Like: Efstatus/taxact

Finding Your Employer’s Ein

If you are seeking the EIN for a company you work for, you may have access to the same information as the owners of the company. If you don’t have such access to company tax and financial records, the company’s EIN may be on your paystubs, W-2 forms, or other tax-related documents you may have received.

What Is An Ein And Do I Need One In California

EIN stands for employer identification number and is sometimes also referred to as a tax identification number. This nine-digit number creates a more reputable business and allows you to do several important things. Use the number to open company bank accounts or lines of credit, hire employees and much more. All California entities require a federal EIN.

Recommended Reading: Doordash Tax Deduction

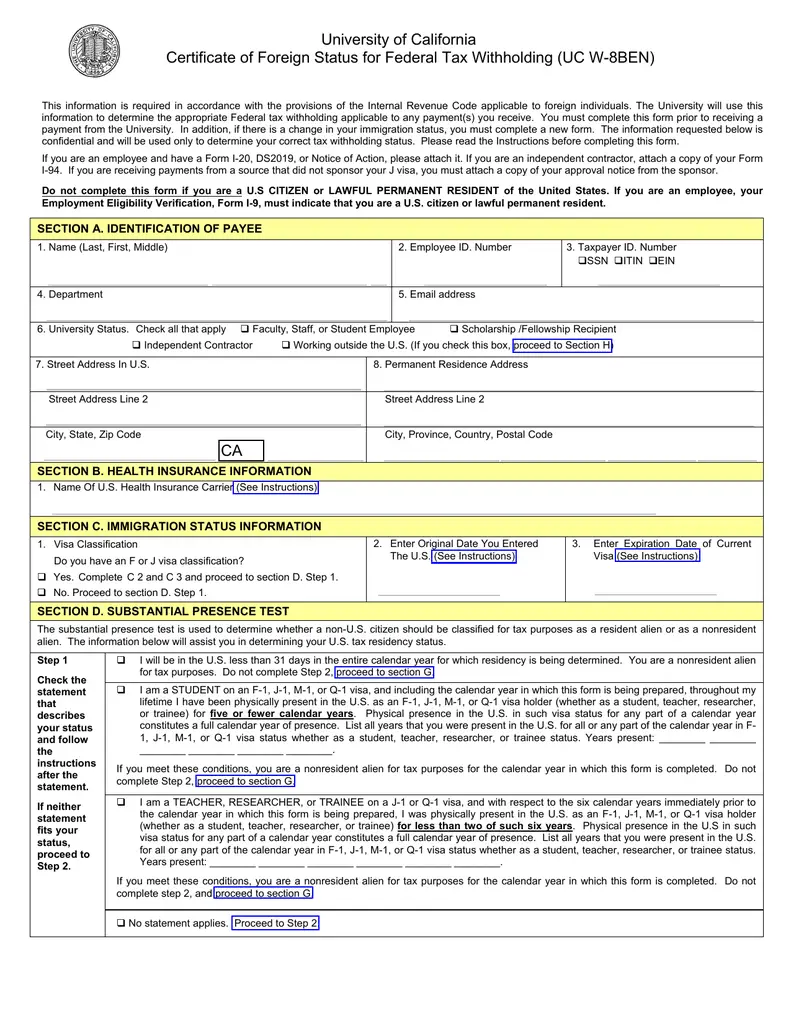

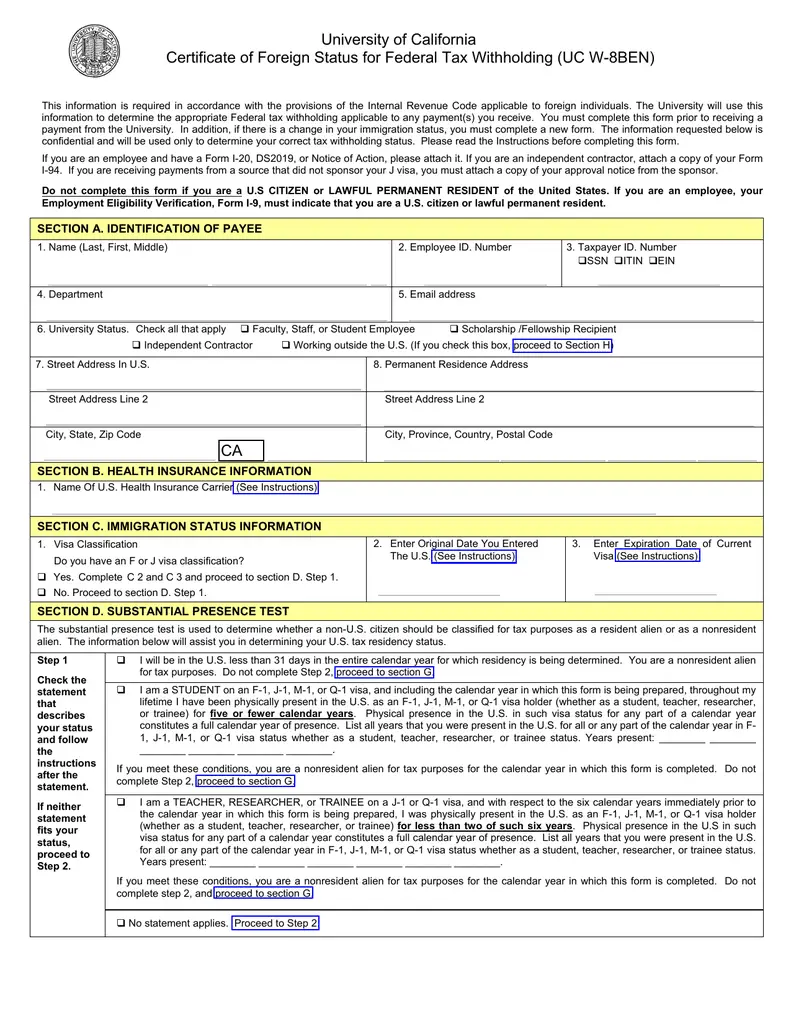

Foreign Persons And Irs Employer Identification Numbers

Foreign entities that are not individuals and that are required to have a federal Employer Identification Number in order to claim an exemption from withholding because of a tax treaty , need to submit Form SS-4 Application for Employer Identification Number to the Internal Revenue Service in order to apply for such an EIN. Those foreign entities filing Form SS-4 for the purpose of obtaining an EIN in order to claim a tax treaty exemption and which otherwise have no requirements to file a U.S. income tax return, employment tax return, or excise tax return, should comply with the following special instructions when filling out Form SS-4. When completing line 7b of Form SS-4, the applicant should write “N/A” in the block asking for an SSN or ITIN, unless the applicant already has an SSN or ITIN. When answering question 10 on Form SS-4, the applicant should check the “other” block and write or type in immediately after it one of the following phrases as most appropriate:

“For W-8BEN Purposes Only””For Tax Treaty Purposes Only””Required under Reg. 1.1441-1″”897 Election”

To expedite the issuance of an EIN for a foreign entity, please call . This is not a toll-free call.

Can I Get A California Tax Id Number

If you operate a small business out of California that pays more than $100 in wages to employees each calendar quarter, youll need to obtain a payroll tax ID number. To obtain the State Employer Identification Number, or SEIN, youll need to register with the California Employment Development Department, or EDD. Once obtained, your eight-digit SEIN acts essentially like a Social Security number for your business and gets reported on various California payroll tax filings.

Don’t Miss: 1040paytaxcom

California State Tax Id Number

A state tax ID is the same as a federal tax ID, in that it identifies the business to authorities for taxation purposes, however, a California state tax ID only applies to local state taxes and employee withholding requirements. Most businesses need both Federal and State Tax ID Numbers to operate in the state of California.

Primary types and uses of a State Tax ID:

- Sales/Use Tax All businesses that sell, rent, or lease tangible property and some services have to apply a sales tax. Sales tax applies to all retail sales. Use tax is imposed on consumers of tangible personal property that is used, consumed, or stored in the state. The California State Tax ID Number allows all of these transactions to be tracked and appropriately taxed.

- Withholding Tax Employers withhold tax from employees to pay their revenue service. If the employer does not withhold tax from employee wages, they are still liable for the tax applied to the employee. Your California State Tax ID Number is used to track this process.

Apply For California Payroll Tax Account Number

When you log in to e-Services, select New Customer and hit Submit. To initiate the application, select Register for Employer Payroll Tax Account Number. You then will be asked a number of questions about your business, such as the type of entity it is, the industry it operates in and its federal tax ID number. According to the California EDD, you may receive an SEIN within minutes of completing the registration, but in some cases it can take up to three days.

Read Also: Do You Get Taxed On Plasma Donations

What Is A California Tax Id

A California Federal Tax ID Number which is also known as an Employer ID Number or Federal Tax Identification Number is a unique, nine-digit ID assigned by the Internal Revenue Service for tax purposes for businesses as well as Non-Profit organizations, Trusts and Estates. The Tax ID or EIN serves as a way to easily identify the entity similar to how a Social Security Number is used to uniquely identify individuals.

How Is A California Llc Taxed

Meaning, an LLC is just taxed in the default status set by the IRS and the LLC doesnt elect to be taxed as a Corporation .

The default tax status for a California Single-Member LLC is a Disregarded Entity, meaning if the LLC is owned by an individual, the LLC is taxed like a Sole Proprietorship. If the LLC is owned by a company, it is taxed as a branch/division of the parent company.

The default tax status for a California Multi-Member LLC is Partnership, meaning the IRS taxes the LLC like a Partnership.

If instead, you want your California LLC taxed as a C-Corp, youll first apply for an EIN and then later file Form 8832. If you want your LLC taxed as an S-Corp, youll first apply for an EIN and then later file Form 2553.

If you choose to have your California LLC taxed as a Corporation, make sure you speak with an accountant as there are a lot of details you need to consider. Having an LLC taxed as an S-Corporation is a much more popular choice than having an LLC taxed as a C-Corporation. S-Corporation taxation usually makes sense once an LLC generates about $70,000 in net income per year.

Don’t Miss: Where Can I Amend My Taxes For Free

California Wage And Hour Laws

Employers covered by California’s minimum wage law must pay employees at least $14.00 an hour for employers with 26 or more employees, $13.00 for employers with 25 or fewer employees.

All employees are covered, except those specifically exempt by wage order among those exempt are:

- executive, administrative or professional employees

- outside salespersons and

- lawyers, doctors, dentists, optometrists, architects, engineers, teachers, accountants and other professionals licensed or certified by the state.

Federal Employer Identification Number

Employing workers in California means youll need to obtain a federal employer identification number, or EIN, as well. A federal EIN serves the same purpose as a California SEIN in that it must be entered on all federal payroll tax form the business is required to submit to the Internal Revenue Service. You can request an EIN on the IRS website, and in most cases have an EIN assigned within minutes of completing the application.

Recommended Reading: When Do You Do Tax Returns

Apply For A California Tax Id Number By Phone Mail Or Fax

It is possible to apply for your tax ID through other methods, however you can apply through one of a few other processes. You can call a representative and answer the application questions over the phone, or you can fill out a paper application by hand. After completing a physical application, you can mail or fax it in. This usually takes longer than applying online, but the real disadvantage here is the processing time. Compared to the hour it takes to process an online application, these applications can take up to 4 to 6 weeks to finish processing, at which point youll receive your tax ID via traditional mail.

Dont Have An Edd Number

The easiest way to get an EDD number is to enroll online with the EDDs E-Services for Business portal. If prompted to enter a payroll agent, select No. You should register for your EDD number as though you do not have a payroll agent. Once you successfully enroll, youll receive an EDD number for your business.

Alternatively, you can call the EDD at 888-745-3886 on weekdays from 8 a.m. to 5 p.m Pacific time to speak with a staff member.

You May Like: Prontotaxclass

How Do I Get A State Tax Id Number For A Small Business

Related

It’s not enough to register your business and acquire a federal tax identification number. You also need the right permits, licensing and tax registrations to be compliant with federal, state and local regulations. Most new businesses obtain an IRS federal employer identification number for tax filing, but states assign special tax numbers as well. Once you’ve received an EIN, check your state franchise tax board to obtain the proper state tax identification numbers required by your state to operate your business.

California Tax Id Number And Business Registration

If you’re a prospective Californian business owner, then you’re likely aware that the process of starting a business will involve a large amount of tricky navigation. In this article, we’ll be focusing on what you need to do to obtain a Tax ID in California and well go over the primary requirements of starting a business in the state of California.

Your business’ tax ID is a unique reference number provided to your company. There are a number of different tax obligations for businesses in California, and your EIN is unique to your company. Your EIN will be used to identify your business to the California Franchise Tax Board, the Board of Equalization, and the Employment Development Department.

Read Also: Ccao Certified Final 2020 Assessed Value

How To Cancel An Ein

If there was a mistake with your first EIN application or you need to cancel your EIN Number for any reason, you just need to mail a cancellation letter to the IRS.

We have instructions here: how to cancel an EIN.

You dont have to wait for your EIN cancellation to be finalized before getting a new EIN for your California LLC.

Obtaining A Tax Id Number

When starting a business in California, serving as the administrator or executor of an estate, creator of a Trust or operating a Non Profit Organization obtaining a Tax ID is a key responsibility. A Tax ID also known as an Employer ID Number is a unique nine digit number that identifies your business or entity with the IRS for tax purposes, essentially like a Social Security Number for the entity. A Tax ID is used for opening a business bank account, filing business tax returns and in many cases is required when applying for business licenses. In most cases it is helpful to apply for a Tax ID as soon as your start planning a business to ensure that there are no delays in obtaining the correct licenses, financing and opening a business bank account that would be needed to operate.Information to Consider Prior to ApplyingBefore applying for your Tax ID you may want to consider a few things before starting the application including:

- Determine which structure your business or organization will operate as

- Determine the individual or organization that will serve as the responsible party

- Determine the physical address the business/entity will use A physical address is required for all Tax ID s and a separate mailing address can be specified

Definition of Entities

Don’t Miss: Cook County Appeal Property Tax

How Do I Find An Ein

For a company, an EIN is similar to a social security number for an individual. As such, most companies keep their tax ID numbers private, so you probably won’t find it published on the company’s website. However, many documents require the number. If you’re an employee of a company, look in box B on your W-2 statement. If you’re an independent contractor, you can find this number in the Payer’s Federal Identification Number box on Form 1099.

If you’re an employee of a company and have been unable to find your company’s EIN, you may call or e-mail the Department of Revenue for your state. You’ll need to provide your employer’s legal company name and any additional required information.

If you have a valid reason to know a business’s EIN, you can simply call the business and ask for it. If you are dealing with a small company, you can speak with the company owner or your usual contact person. If you are dealing with a large company, get in touch with the accounts payable department if you need to send an invoice. If you’ve received an invoice from a company, contact that company’s accounts receivable department. This is usually the contact person whose name is printed on the invoice.

If you are providing a product or service to another company and would like to know whether that company qualifies for tax exemption, you can ask your customer for the number. In some situations, this number will appear on a state-issued certificate.

What Information Do I Need To Get An Employer Identification Number

Applying for an EIN is pretty straightforward, but you will need to obtain some information beforehand, such as:

- Legal name of the business

- Business address

- Name of the principal officer, manager, or owner

- Name and contact information of the owners, directors, officers, or members

- Type of business and what activities the business performs

- Date the business was started or acquired

- Closing month of the entitys accounting year

- Number of employees expected to be hired

- Contact information

Within seconds, the IRS will provide the EIN that can be used immediately. A few weeks later, the IRS will send the official paperwork, known as an EIN Confirmation Letter .

Also Check: Efstatus.taxact.com

How Do I Get A Tax Id Number In California

Many California businesses will need a tax ID, also referred to as an employer identification number . Youll need this tax ID number if youre operating a business with more than one person . Youll also need one if you plan on hiring employees, as the name suggests. Youll be using this ID number for a variety of financial and logistical applications as well. For example, youll need one if youre going to apply for a business bank account or significant business loan, or if youre getting some types of business licenses and permits. If youre ready to get your tax ID, youll need to follow the application process. This process will register your business with the federal government and provide you with a tax ID you can use for these purposes. While there are several options for obtaining a tax ID, the best option is applying online, since its more convenient and youll get your tax ID much faster.