What Is A Tax Id Number And What Is It Used For

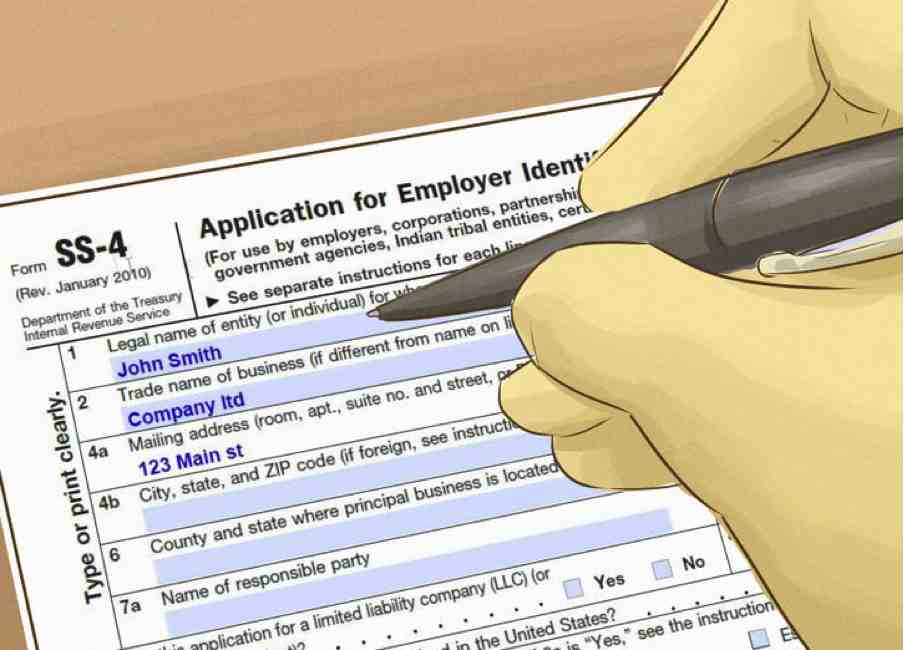

A critical step in forming an LLC is to obtain a tax ID number with the IRS. This ID number is essentially like a businesss social security number. It is used by the IRS to identify the business for federal tax and banking purposes.

It should be noted that before an LLC can obtain a tax ID number, it must be formed and registered in a state. To obtain a tax ID number, the LLC owner can apply directly through the IRS website. Any LLC that has two or more members, or has employees, must obtain a tax ID number. If a single-member LLC adds a new member, or hires its first employee, it must also apply for a tax ID number. An LLC with only a single member can use that members personal social security number instead.

What Is An Llc

An LLC, or limited liability company, is a type of business structure that is a combination between a partnership or sole proprietorship and a corporation. It features the pass-through taxation of a partnership and sole proprietorship, and the personal liability protection of a corporation. These features are what make an LLC so attractive to all types of businesses.

Owners, or members, of an LLC are protected against any personal liability for any of the financial debts or legal liabilities of the company. Limited liability protection shields the members personal assets from any of the LLCs creditors, and is one of the main reasons why LLCs are the most popular type of business structure in the U.S. Members can be individuals or any other type of business entity, such as partnerships or corporations there are also LLCs that are just owned by a single person.

An LLC is considered a pass-through entity. This simply means that the LLCs income and losses will pass through to the individual members personal tax returns. Thus, the members are only paying taxes on their profits from the LLC one time. Members of an LLC also have the flexibility of choosing how they want the LLC to be taxed. For instance, they can elect to be taxed as a sole proprietorship or an S corporation.

Wait For Your Georgia Llc To Be Approved

Wait for your Georgia LLC to be approved by the Secretary of State before applying for your EIN. Otherwise, if your LLC filing is rejected, youll have an EIN attached to a non-existent LLC.

However, if this does happen, you can always cancel your EIN and then apply for a new one. And you dont have to wait for your cancellation to go through before applying for a new EIN.

Recommended Reading: Reverse Tax Id Lookup

Wait For Your Pennsylvania Llc To Be Approved

Wait for your Pennsylvania LLC to be approved by the Department of State before applying for your EIN. Otherwise, if your LLC filing is rejected, youll have an EIN attached to a non-existent LLC.

However, if this does happen, you can always cancel your EIN and then apply for a new one. And you dont have to wait for your cancellation to go through before applying for a new EIN.

Basics Of Llc Tax Ids

If a limited liability company has even one employee, the IRS requires the company to have a tax ID number. Similarly, LLCs that have multiple members must have a tax ID.

Tax ID numbers are also commonly known as Employer Identification Numbers . Once you’ve been issued a tax ID number, the IRS will use the number to identify your company, much as the government uses Social Security Numbers to identify individual people.

Entities that are required to obtain tax ID numbers include:

- Corporations

- LLCs

- Partnerships

A sole proprietor of an LLC that is interested in hiring an employee for the first time will need a tax ID number before they can make their hire. However, if an LLC has a sole proprietor and no employees, then the company owner can use his Social Security Number for tax filings instead of getting a tax ID number.

If you choose to use your Social Security Number instead of a tax ID when filling out forms for vendors and clients, you should be aware that you may be at risk for identity theft. Many people choose to acquire their tax ID themselves, although it’s also possible to appoint someone to apply for the number on your behalf.

Recommended Reading: How To Find Employers Ein

How To Apply For A Tax Id In Florida

Have you recently started a new business in Florida? Is your existing business growing and you want to take it to the next step? If you are in either of these situations, you may be thinking about how to obtain EIN for your business. An Employer Identification Number is a tax ID used by many businesses. These organizations typically submit their own tax filings, separate from the owners. However, there are many other situations in which an EIN is helpful.

For example, many financial institutions will only extend credit to businesses that have EINs. The same is sometimes true for opening a business bank account. As the name implies, an Employer Identification Number is very important if you want to employ other people.

Do You Need A Federal Ein For Your Business Entity

In general, unless your business is a sole proprietorship with no employees and no separate legal entity for your business, you need to get an EIN. Sometimes if you own an LLC and it is a single-member LLC with simple accounting, you can get by just using your personal Social Security Number for tax purposes and for receiving payments from clients. But even the simplest businesses can generally benefit from using an EIN the EIN serves as a tax ID for your LLC or other corporate entity.

The following business entities should get an EIN:

- Partnerships: an EIN is required for all general partnerships and limited partnerships.

- Multiple-member LLCs: This type of business entity needs an EIN regardless of whether you have employees.

- Single-member LLCs: If you plan to hire employees within the next 12 months, you will need to get an EIN. And even if your single-member LLC has no employees, and even if you can get by with using your own individual Social Security Number for tax purposes, its still a good idea to get an EIN because many banks and lenders will prefer to use an EIN to do business with you.

- LLC taxed as a Corporation: If your LLC chooses to be taxed as a Corporation , you will need to get an EIN.

- Sole proprietorship with employees: Even if you do not have an LLC or any other legal entity for your business and you run a simple sole proprietorship, you still need to get an EIN if you have employees or plan to hire employees in the next 12 months.

Also Check: 1040paytax Review

State And Federal Online Business Registration

If you need a business registration number from one of the states listed on this page, all you need to do is click on one of the links below. You will leave the IRS website and enter the state website.

If you are from one of these states and you also want to get a federal Employer Identification Number , you may obtain both your state and federal information in one session. Heres how it works!

Words You Have To Use

First, your chosen name must contain the words limited liability company or limited company. You can shorten those words if you like.

Second, the name of your company has to be distinguishable from the names of other people and entities doing business in the state. In other words, your name has to be different enough that people can tell the difference and a search for your entity doesnt turn up anothers records. Most often, this means adding words to a company name.

Don’t Miss: Appeal Property Tax Cook County

When Your Business Needs An Ein

Your business will need an EIN when:

- You have employees

- You are starting a business that is registered with a state, like a partnership, LLC, or corporation

- Your business must pay excise taxes, or you are subject to alcohol, tobacco, or firearms regulations

- You withhold taxes on income, not including wages, paid to a non-resident alien

- You use a Keough Plan or tax-deferred pension plan

- Your business works with certain organizations like nonprofits, trusts, estates, and farm cooperatives

Why Do I Need An Employer Id Number

An Employer Identification Number , also called a Tax ID Number, is a 9-digit code assigned by the IRS to identify your business. You can think of it as the social security number for your company. An EIN is required for a partnership, corporation, or LLC to open a business bank account, gain financing, hire employees, and more.

Without an EIN, you are forced to combine your business and personal funds which opens you up to increased liability and puts your personal assets at much greater risk. It is highly encouraged that you obtain a federal EIN number and open a separate business bank account so you can keep your business and personal transactions separate.

Also Check: Louisiana Payroll Calculator

Llc Tax Ids For Banking

You will need your tax ID number to complete some of your LLC’s most important banking tasks, including securing a line of credit, obtaining permits for your business, and establishing an LLC bank account. All of your LLC’s banking and tax documents will need to include your tax identification number. Your bank can quickly identify your LLC by using your ID number.

Banks also want proof that your LLC and its members are legally separate, which is why they will request that you provide a copy of your Articles of Organization along with your EIN. A tax ID is required to open bank accounts for your business and to hire company employees.

If You Misplace An Ein Number

If your EIN is misplaced, you can call the IRS’s Telephone Assistance for Businesses, Monday through Friday. Once the IRS verifies that the caller is the responsible party, it will provide the caller with the EIN.

An LLC needs a federal tax ID number for business purposes. While there are exceptions, if you open a business bank account or plan to hire employees, you will need an EIN. To simplify your life, and take one less chore off your to-do list when launching your new enterprise, you may want to contact a legal document firm that can handle this for you with no muss, no fuss.

About the Author

Roberta Codemo

Roberta Codemo is a former paralegal. Her areas of specialty include probate and estate law. Read more

Read Also: Is Door Dash 1099

Arizona Business Permits And Licenses

According to the Arizona Commerce Authority, Arizona does not have a statewide business license. However, your city and county governments likely do, so you should check with them to see what their requirements are. Here is a partial list of governments you might need to contact.

Also, keep in mind that many types of businesses will require you to have professional licenses. Check with the government entity that issues those types of licenses for more information.

Special Events And One Time Sales

Special event – Any person or company that is selling goods to a final consumer is required to collect and remit Missouri sales tax and must register for retail sales tax by completing a Missouri Tax Registration Application Form 2643.Examples of a Special Event – craft shows, farmers markets, ComicCon

One time sale – If you already have a sales tax license, file and pay on the preprinted forms and you make a one time sale at a different location, you can add that location on your preprinted form and indicate âone time saleâ.

Read Also: Protest Property Taxes In Harris County

How Is A North Carolina Llc Taxed

Meaning, an LLC is just taxed in the default status set by the IRS and the LLC doesnt elect to be taxed as a Corporation .

The default tax status for a North Carolina Single-Member LLC is a Disregarded Entity, meaning if the LLC is owned by an individual, the LLC is taxed like a Sole Proprietorship. If the LLC is owned by a company, it is taxed as a branch/division of the parent company.

The default tax status for a North Carolina Multi-Member LLC is Partnership, meaning the IRS taxes the LLC like a Partnership.

If instead, you want your North Carolina LLC taxed as a C-Corp, youll first apply for an EIN and then later file Form 8832. If you want your LLC taxed as an S-Corp, youll first apply for an EIN and then later file Form 2553.

If you choose to have your North Carolina LLC taxed as a Corporation, make sure you speak with an accountant as there are a lot of details you need to consider. Having an LLC taxed as an S-Corporation is a much more popular choice than having an LLC taxed as a C-Corporation. S-Corporation taxation usually makes sense once an LLC generates about $70,000 in net income per year.

How Is A Connecticut Llc Taxed

Meaning, an LLC is just taxed in the default status set by the IRS and the LLC doesnt elect to be taxed as a Corporation .

The default tax status for a Connecticut Single-Member LLC is a Disregarded Entity, meaning if the LLC is owned by an individual, the LLC is taxed like a Sole Proprietorship. If the LLC is owned by a company, it is taxed as a branch/division of the parent company.

The default tax status for a Connecticut Multi-Member LLC is Partnership, meaning the IRS taxes the LLC like a Partnership.

If instead, you want your Connecticut LLC taxed as a C-Corp, youll first apply for an EIN and then later file Form 8832. If you want your LLC taxed as an S-Corp, youll first apply for an EIN and then later file Form 2553.

If you choose to have your Connecticut LLC taxed as a Corporation, make sure you speak with an accountant as there are a lot of details you need to consider. Having an LLC taxed as an S-Corporation is a much more popular choice than having an LLC taxed as a C-Corporation. S-Corporation taxation usually makes sense once an LLC generates about $70,000 in net income per year.

Read Also: Is Selling Plasma Taxable

Federal Tax Id Obtainment Ordering Details

The following requirements apply for ordering an EIN:

- To get the Federal Tax ID Number for your business, you must provide your SSN or Individual Tax Identification Number .

- BizFilings does not assist with form preparation or the obtainment of the ITIN, but you can download Form W-7 to complete and provide to the IRS.

- The individual applying for the Federal Tax ID Number is also required to provide a physical US address-P.O. Boxes are not acceptable.

Fulfill Arizonas Llc Publication Requirement

Within 60 days of the filing of your LLCs articles of organization, Arizona requires you to take an unusual step: publication of your LLCs formation.

Arizona Revised Statutes section 29-3201 provides two ways this can happen:

- You can file a notice in the newspaper of the county where your statutory agent is located. The notice has to have the same information that the state required in your articles. It must be published in the paper three times in a row. Once this is done, you should file an affidavit with the ACC saying you did it.

- If your agent is located in a county with a population greater than 800,000 , then this requirement is fulfilled by the ACC. In this case, it will put the information about your LLC formation into its electronic database.

If you have to publish in a newspaper, the cost can run between $30 and $300. There is no cost if you live in one of the larger counties because you don’t need to print a notice of publication.

This rule may seem a bit odd. Its a throwback to a pre-Internet age when the only way the public could learn about new companies was through the local newspaper.

This law also prevents you from forming companies in secret to hide assets from a spouse or creditor. In any case, its an ancient rule that does not have a lot of use today, but Arizona is one of the few states that use it.

Recommended Reading: Doordash Mileage Calculator

Draft Your Arizona Llc Operating Agreement

Operating agreements are contracts between you and the other members of your LLC.

Arizona doesnt force you to have a written operating agreement, but we strongly recommend you make one. An operating agreement states your companys rules and can help settle disputes. It also tells you how to let in new members, let existing members exit, and manage a variety of other unexpected events.

Every companys needs are different, so every operating agreement should be different. This is your chance to set down the rules that will govern your livelihood for a long time.

Keep in mind that if you dont make your own rules with an agreement, Arizona statutes will determine the rules. You might not like those results, so its best to think about them now.

Arizona Revised Statutes section 29-3105 sets down a broad range of things that your agreement can cover:

- Relations among the members as members and between the members and the LLC

- Rights and duties of an LLC manager

- What the LLC can do, and how it does it

- How the operating agreement can be amended

A good operating agreement should have all up-to-date facts about your LLC. If you are forming your company with other people , you likely each have your own job at the company. The agreement outlines all the jobs and sets standards to make sure everyone is doing their best.

When LLCs draft their operating agreements, those contracts typically perform some or all of these functions: