Consider Deferment Or Forbearance

If you know you cant make minimum payments on time, you can try deferring your loans. When your loans are deferred, you can generally postpone payments for up to three years.

You also can consider another federal repayment option called forbearance. This is similar to deferment but has different eligibility rules. Forbearance pauses your loan payments for up to one year. Keep in mind that interest continues to add up during the forbearance period.

Depending on your loans, interest also can accrue if youre in deferment, so do your research. Use our student loan deferment calculator to further explore this option.

The Government Wants Their Money Back

If you default on your federal loans, the government will legally try to reclaim the money you owe them. The Federal Government will try to use the Treasury Offset Program.

The U.S. Department of the Treasury uses this to seize federal payments owed to you. They do this to pay off your federal student aid owed to other federal agencies.

So, the U.S. Department of the Treasury can seize up to 100% of your income tax refund. They use this to pay off your defaulted federal student loan. They dont need your permission to seize money owed to them, but they are required to give you notice that these funds will be seized.

Banks And Creditors Might Be Able To Take Your Stimulus Checks In This Circumstance

With the first stimulus check, private banks and creditors were able to seize your payment to cover an outstanding debt. However, some states, such as California, issued orders forbidding banks and creditors from garnishing your stimulus check. With the second stimulus check, your payment was protected from bank garnishment and from private creditors and debt collectors, according to the text of the law. The third check is also supposed to be protected from bank garnishment, though not from private creditors and debt collectors.

However, there’s one major caveat here. Individual banks can decide whether they want to use your stimulus direct deposit payment to cover overdraft fees, according to a New York Times report. This is because, for most people, their stimulus check is deposited into the same bank account where they also receive tax refunds.

Although for the second check large US banks including Bank of America, Citigroup, JPMorgan Chase and Wells Fargo said they would temporarily zero out their customers’ negative balances so that they could access their stimulus money, some regional and community banks still garnished that money to pay overdraft fees, or were considering customer requests on a case-by-case basis, according to the Times. If this has happened to you, you can try contacting your bank to ask for a temporary overdraft waiver, but it may not be granted. This is likely to be the case for a third check as well, Watson said.

You May Like: Do You Have To Do Taxes For Doordash

Your Third Stimulus Check Can Be Seized Here’s What To Know

Bad news: The new stimulus bill doesn’t have the same protections to prevent your third payment from being garnished for a past-due payment as with the second check. We’ll explain what that means for you.

Who can garnish your stimulus check? We’ll tell you.

For millions of people, third stimulus checks have already been delivered. But for others, they may never see all of the money that gets direct-deposited into their bank accounts. Unlike the second stimulus check, the new stimulus bill doesn’t have the same protections against your $1,400 check being seized by debt collectors.

If you’re waiting on your check to arrive, you’re likely wondering many things: Can my third check be garnished to pay overdue child support? Can states, banks, creditors or my landlord take my money to cover an outstanding debt? If I claim missing money from the first or second stimulus checks on my 2020 tax return, can that get taken too? Will my third stimulus check be taxed? What happens if the IRS sends me too much money by accident?

Offsets Of Federal Income Tax Refunds

Private creditors cant garnish your federal tax refund. Your refund can be reduced by an offset. Your federal tax refund will be offset if you owe federal or state income taxes from past years. Your federal tax refund may be offset to pay for child support or a past due federal student loan.

If your refund is offset, the U.S. Department of Treasury’s Bureau of the Fiscal Service will send you notice of it. If you disagree with the debt or the amount, contact the agency that requested the offset. The agencys information will be on the notice.

If you are married filing a joint return and only one of you owes the debt, you can ask that part of your refund not be offset. For example, if you are married and you owe child support from a past relationship, your spouse is not responsible for it. Your spouse can ask to get their part of the tax return.

To request a portion of your refund not be offset, file IRS Form 8379, Injured Spouse Allocation. You can file it with your tax return, or you can send it in separately. If you file it with your return, write INJURED SPOUSE at the top left corner of your 1040 form. If you file it separately, list your social security numbers on Form 8379 in the same order they are on your 1040 form. To learn more about this, read Injured Spouse Relief.

You can find the IRS guidelines to offsets and a link to Form 8379 on the IRS website.

Recommended Reading: Do You Have To Pay Taxes On Retirement Income

How Do I Know If My Student Loan Will Reduce My Tax Refund

Federal student loan garnishments donât have to go through the courts, so you wonât be receiving a summons. There is a special administrative process that the Department of Education uses to fast-track garnishments without using the courts. The Treasury Offset Program will send you a notice 60 days before your tax return is being garnished. With this notice, youâll have an explanation of some of your rights.

The notice will tell you that you have the right to take the following actions before your tax return is garnished:

-

You can dispute the debt.

-

You can request copies of agency records.

-

You can request an administrative review of your total debt amount.

-

You can make an acceptable repayment plan.

You can call 800-304-3107 to reach the TOP Interactive Voice Response system to learn who you need to contact about your tax offset debt.

Recovery Rebate Credits Under The Coronavirus Response And Relief Supplemental Appropriations Act Of 2021 And The Cares Act:

Generally, a credit increases the amount of your tax refund or decreases the amount of taxes owed. The amount you receive for the Recovery Rebate Credit will be included as part of your refund or applied to any tax owed.

If you owe debts to the United States or certain state agencies, your tax refund may be reduced to pay those debts.

For more information about the recovery rebate credit, please visit IRSâs website at www.irs.gov/newsroom/recovery-rebate-credit-topic-e-receiving-the-credit

For general information about tax refund offset, please visit our TOP webpage at .

Also Check: What Is The Tax In Georgia

Why Does An Irs Tax Refund Offset Happen

Having your tax refund offset can be a substantial financial burden. You may have been counting on your tax refund to pay off your credit cards, pay utility bills, or pay for some necessary repairs.

The TOP is a collection effort used when youâre delinquent or in default on certain federal and state debts, but it certainly isnât the first option for unpaid sums. If an agency reports your debt to the TOP, your tax refund offset is then used to repay your delinquent debt.

The debts the IRS will take your federal tax refund to repay include:

- Past due child support: the state agency where the child support order came from can request your entire tax refund be offset to pay towards unpaid child support debt.

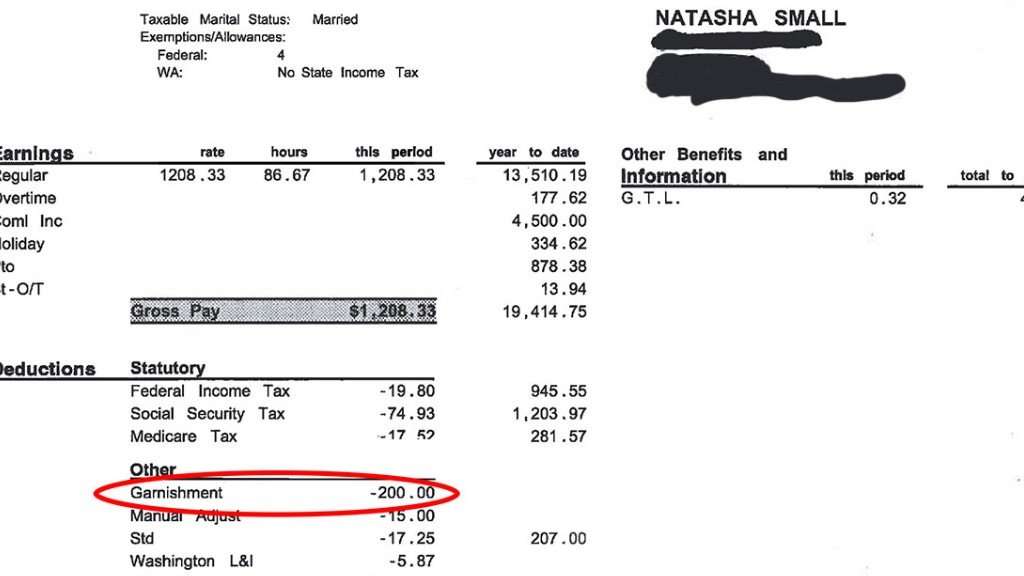

- Defaulted federal student loans: defaulting on federal student loans exposes you to administrative wage garnishment and tax refund offset.

- Unpaid federal income taxes: your tax refund can be offset to pay any outstanding federal tax debt.

- Unpaid state income taxes: your state can offset your federal tax refund for outstanding state tax debts.

- Unpaid unemployment compensation debts: your state can also offset your refund for unemployment compensation paid due to fraud or contributions due to a state fund that wasn’t paid.

Yes Your Third Check Might Be Seized To Pay Certain Debts Here’s Why

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks or private creditors. However, part of this rule changed with the third check.

The bill authorizing the third payout was pushed through using a process called budget reconciliation. Congressional Democrats used this legislative tool to more quickly pass the new COVID-19 relief bill and the third stimulus check that comes with it, since it allowed them to pass it with fewer votes. But because this process was used, the third checks aren’t protected from all garnishment, although lawmakers are moving to fix this now.

There are three types of unpaid debt that could be paid through garnishment: unpaid IRS tax debt, other government debt like child support payments or private debt, according to Garrett Watson, a senior policy analyst at the Tax Foundation. Your third stimulus payment will be protected from outstanding tax debt and child support, but not from private debts, such as debt accrued due to a civil judgment, ranging from civil damages to consumer debt in default, Watson said.

Several banking groups sent a letter to Congress on March 9 asking lawmakers to pass stand-alone legislation to prevent the third check from being garnished for private debts.

Recommended Reading: Do I Have To Pay Taxes On Social Security Income

Will I Get A Stimulus Check If I Owe Back Taxes

The answer is no. The IRS explains the payment is not income, and a stimulus check recipient wont owe tax on it. It wont decrease the refund amount or increase the amount owed on the 2020 tax return. It also will not affect taxes currently owed to the IRS.

Garnishment Of State Tax Refund By State Agencies

If you owe past income taxes or money to a state agency, the Department can take all or part of your income tax refund to pay the debt. If this happens, you will get a Notice of Adjustment to Income Tax Refund. It has detailed information about the refund. If there is any money left in your refund after that debt is paid, you will get it.

You will not get a notice that your refund is being held to pay a debt to the state until you file your state income tax return.

Don’t Miss: How To File Federal Taxes Electronically

When Will Student Loan Debt Garnish My Tax Return

If youâve defaulted on a federal student loan, your tax return refund can be garnished, but garnishment wonât start until after youâve missed nine months of payments. If youâve defaulted on a private school loan, your wages wonât be garnished until after a court process grants your lender the authority to garnish your wages.

The time it takes to enter default status on a student loan is different for federal and private student loans. A federal student loan wonât go into default status until after nine months of missed student loan payments, but federal agencies are required to notify TOP if a federal debt has gone unpaid for 120 days. A private student loan could go into default after only one or two missed payments. This classification will depend on the terms of your loan agreement.

The agency managing your debt must send you a letter before your tax refund is garnished. That letter will tell you that the collector plans to take your money from a federal payment. It will also include the following information:

-

The reason for your debt

-

The amount you owe

-

Your rights to review information about your debt and

-

The arrangements you can make to pay off your debt.

After you receive a notice from your lender , then youâll receive a notice from the Treasury Offset Program.

How To Stop Student Loans From Taking Your Taxes

October 28, 2020 by Katie Bentley

How to stop student loans from taking your taxes? Everyones asking this question.

When you are struggling to pay back your student loans and make ends meet at the same time, there is a good chance your taxes will be affected.

So today, learn how to keep your debt from getting worse by managing your money better and looking at the different repayment options available to you.

Also Check: How Much Should I Save For 1099 Taxes

You Owe Child Support

When a parent is delinquent in paying court-ordered child support, the states child-support agency can request that the Treasury Department withhold money from the person’s tax refund to cover the back payments.

A person in this situation should receive a pre-offset notice explaining how much is owed, how the offset process works, and how to contest the debt. Once the money has been withheld from the refund, the taxpayer also should receive an offset notice from the Bureau of the Fiscal Service showing how much money was withheld.

Anyone in this situation should contact the state child support agency for further information.

Protecting Your Spouses Refund

If youre married and file a joint return, you may still be able to protect your spouses share of the tax refund even if youre subject to a tax offset. To do so, you must fill out Form 8379-Injured Spouse Allocation and either submit it with your tax return or mail it in by itself after you file your return.

Read Also: Is Nursing Home Care Tax Deductible

Learn About Your Tax Refund Options If You File For Chapter 7 Bankruptcy

By Cara O’Neill, Attorney

The coronavirus pandemic has financially impacted millions. If bankruptcy might be inevitable, think twice before using retirement funds to pay bills. Most people can keep their retirement account in bankruptcy. Learn about your options in Laid Off Due to the Coronavirus ? Bankruptcy Can Help.

COVID-19 Update: Courts are holding 341 creditor meetings telephonically or by video appearance unless an in-person meeting is necessary and local public health guidelines can be followed. On August 28, 2020, the U.S. Trustee stated that this order will end 60 days after the termination of the President’s Proclamation on Declaring a National Emergency Concerning the Novel Coronavirus Disease Outbreak. Visit the U.S. Trustee’s 341 meeting status webpage or your court’s website for details.

If you’re considering filing for Chapter 7 bankruptcy and you’re expecting to receive a tax refund, you probably want to know what will happen to that refund. The answer will depend on several factors, including when you receive it, the timing of your bankruptcy, and whether you can protect the funds with a bankruptcy exemption. In this article, you’ll learn more about keeping your tax refund in bankruptcy.

Want step-by-step bankruptcy guidance? Read What You Need to Know to File for Bankruptcy in 2021.

Which Debts Will The Amounts Be Applied To

The Registrar cannot obtain and hold a refund amount in order to apply it to a debt that may become due and payable in the future. However, section 72 does apply to debts that are due but not yet payable.

If the person’s relevant debt equals or exceeds the amount of the tax refund owing to the person, the Registrar can apply the full amount to the debt. Where the relevant debt is less than the amount owing, the Registrar can apply an amount equal to the amount of the debt. The Commissioner will refund the balance to the person ).

Also Check: How To File 2 Different State Taxes

An Extension May Help

If you think your tax refund might be subject to offset, check before you file your tax returns.

If you are in the TOP database to have your tax refund offset, you can file an extension to file your taxes. This will give you more time to work out what to do next to have your account removed from the programâmore on that in a bit.

If A Creditor Garnishes Your Wages Can You Settle With Them

Just because a creditor is garnishing your wages doesn’t mean they are automatically entitled to your tax refund. In fact, very few creditors have permission to pluck your refund from IRS coffers. If you think you might have to give up your refund to pay outstanding debt, find out before your refund is seized. Knowing in advance can help you prepare your finances for the blow, and you might even be able to hang onto your refund if you play your cards right.

TL DR

Only government agencies can directly intercept your tax refund. Examples of such debt might include back child support, student loans and prior tax debts. However, other creditors may place a bank account levy.

Don’t Miss: Can I Pay Quarterly Taxes Online

A Skilled Ohio Debt Lawyer Can Help You

At Luftman, Heck & Associates, our debt management lawyers we take pride in our ability to help Ohioans overcome their debt issues. Proper planning, knowledge of your rights, and in some cases, legal action, can remove the cloud of debt over your life. Dont wait for your loans to go into default before taking action. If you are worried that you cannot meet your debt obligations, Ohio debt lawyer Jeremiah Heck can help. Contact our office today at for your free consultation.