How To Change Your Income Tax Return After You File It

May 20, 2021

Ottawa, Ontario

Canada Revenue Agency

If you think that the income tax and benefit return you filed for the 2020 tax year is missing important details such as the Home office expenses for employees or you made a mistake, you dont need to file a new return. Heres what you can do if you need to change your return.

How To Amend A Tax Return

How you amend your return depends on how you filed it in the first place. As mentioned, you currently have three options for filing: filling out online returns, using third-party software, or submitting paper tax forms by post.

You must use commercial software or paper tax forms to file a return if you:

- Are part of a business partnership

- Are filing for a trust or estate

- Get income from a trust

- Lived abroad

- Are an underwriter for Lloyds

- Are a religious minister

- Wish to report profits from selling more than one asset

Here are the steps for completing each of your tax return options.

Where Do I Mail An Amended Partnership Return

Don’t Miss: Highest Paying Plasma Donation Center Near Me

You Missed Valuable Tax Breaks

This is the time of year when people learn about frequently overlooked tax deductions and credits and they may also realize that they missed some of these breaks in the past, too.

For example, a lot of people miss the retirement saver’s tax credit, which can reduce your tax liability by up to $1,000 if you made any contributions to a retirement savings plan, such as an IRA or 401. To qualify for 2020, your modified adjusted gross income must have been $65,000 or less if married filing jointly, $48,750 for head of household or $32,500 for single and other filers . See the IRS’s Saver’s Credit factsheet for more information.

If you paid for continuing education classes at an eligible educational institution even if you aren’t going to school part time or enrolled in a degree program you could be eligible for the lifetime learning credit, which can be worth up to $2,000 per tax return per year. To qualify for the credit for 2020, your modified AGI must be less than $69,000 if filing as single or head of household, or $138,000 for married filing jointly. See IRS Publication 970 Tax Benefits for Education for more information.

If you missed a deduction or credit, you can go back and amend your federal return to take advantage of the break and get an extra refund. You may get an additional benefit by amending your state income tax return, too.

What Taxpayers Should Know About Amending A Tax Return

IRS Tax Tip 2018-118, August 1, 2018

Taxpayers who discover they made a mistake on their tax returns after filing can file an amended tax return to correct it. This includes things like changing the filing status, and correcting income, credits or deductions.

Here are some tips for taxpayers who need to amend a tax return.

Don’t Miss: How Do I Do Taxes For Doordash

If You Owe Additional Tax With The Amended Return

Calculate the tax, penalty, and interest due, and include both your check and the IA 1040XV amended payment voucher with the amended return. You may make your tax payment online through ePay on our website or with a credit or debit card.

No penalty for additional tax is due if you voluntarily file an amended return and pay all tax due prior to any contact by the Department. However, interest will be due.

Do not send amended returns with the current-year return.

Filing An Amendment With Your Tax Pro

- 1

Make an appointment

We’re still open and we’ve got locations everywhere. With flexible hours, we make it easy to get an appointment when it fits your schedule.

- 2

Review your filed return

Bring your filed return to your appointment. You and your Tax Pro will review and complete your 1040x form. They’ll answer any questions you have.

- 3

Send your amended return

That’s it. Your Tax Pro files your amended return and you receive notifications of any IRS updates.

Also Check: Do I Have To Pay Taxes On Doordash

How To Amend A Tax Return In 2022

Mistakes happeneven on tax returns. If youve made a mistake on your return, theres no reason to panic. You can rectify your miscalculation by filing an amended tax return. If you find yourself in this situation and you need to fix an error, you should first learn what an amended return is and how to amend a tax return.

When You Do Need To File An Amended Return:

- You had a change in filing status.

- You recorded an incorrect income amount.

- Deductions or credits claimed are not correct.

Both state and federal forms may need to be filed including:

- state form IT-40 or IT-40 PNR should be filed.

| Tax Years 2021 and prior |

|

| Tax Years 2022 and forward |

|

When there are changes to your income, exemptions, or credits, filing an amended return may result in a refund or tax due.

To ensure an amended return is complete DOR recommends:

Recommended Reading: Opi Plasma Center

Requesting Changes To Your Tax Return

- Request changes OnlineThe fastest, easiest and most secure way to change a return is to use the Change my return option found in the CRAs My Account or to use ReFILE. If you cannot request changes online because your return is still being processed, you can wait a few days until it has been assessed and then use one of the options in How to change a return.

- Send an adjustment request formIf you prefer, you can complete Form T1-ADJ, T1 Adjustment Request, and mail it to your tax centre, together with all your supporting documents for the change you want to make.

Evaluate The Requirements Of Each Tax Filing Status

The first thing you need to do is determine which tax filing status you are eligible for. The instructions to your federal income tax return lists the requirements for each status, but if you use tax software, such as TurboTax, the program will determine the best status for you based on answers you provide to questions.

Also Check: How Do I Get My Doordash 1099

One Big Mistake Taxpayers Make When Filing An Amended Return

The most common mistake many taxpayers make when they need to file an amended return is failing to file an amended state income tax return also, Curtis says.

Many states rely on the federal return, so if the federal return is amended often the state return needs to be amended as well, she says. Additionally, when filing an amended return, the IRS is looking for documentation to support the amendment, so failing to include the appropriate documentation as to why the taxpayer is amending the return is a common mistake as well.

You usually dont need to file an amended return if you discover math or clerical errors on a recently filed tax return, Gibson says.

The IRS will often correct those types of mistakes on its own, he says.

If the IRS does not fix the math mistake, you should file an amendment to make the correction.

Get Instant Access To Your Cra Records Sign Up For Online Mail

You can have instant access to your tax records anytime, anywhere. Register for online mail and you’ll receive an email notification that your notice of assessment or reassessment is available online. Provide us with an email address on your T1 return or register directly online at www.cra.gc.ca/myaccount.

-30-

Read Also: What Is The Sales Tax In Philadelphia

Filing For An Amended Return

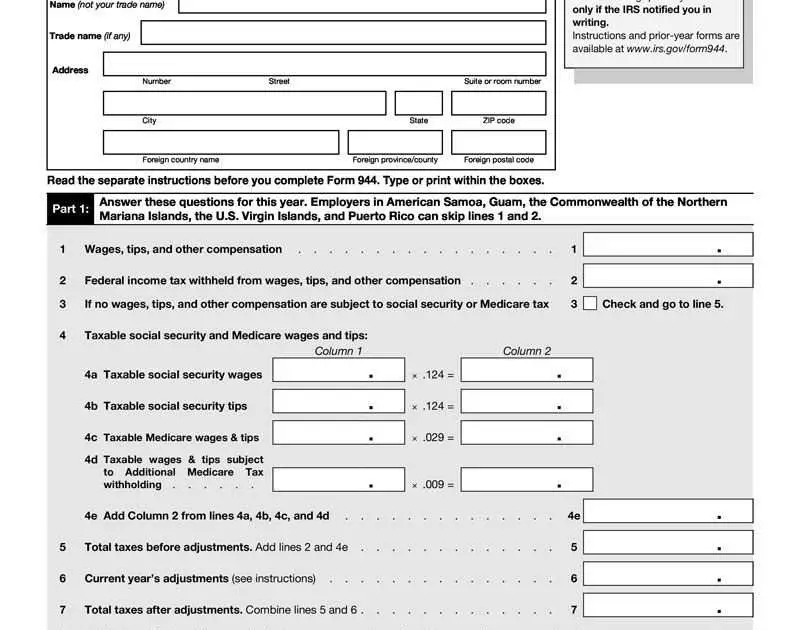

To file an amended return, you must follow several steps. Starting with using the current form 1040X, which covers changes to the forms 1040 and 1040SR. This can be done electronically.

On this form, youll need to:

- Enter the amount from the original return or as adjusted by the IRS

- Enter the NEW correct amount

- Show the difference between the two amounts

- Explain each change by line: This may seem complicated, just like fixing any mistake at work or at home — so be careful

When you send your amended tax return to the IRS, you also need to include copies of all other schedules or forms that have changes, any new forms created, and any W-2s or 1099s received after the original tax return was filed. Do NOT include a new form 1040 with the return. If a form was changed between the original or amended returns, write AMENDED at the top of the changed form. Make sure you include any NEW W-2s or 1099s reported on the amended return, but DO NOT include W-2s or 1099s that you sent in with your prior return.

Its also important to know that if you amend your federal return, you must amend your state return. If you forget this step, it could cause unnecessary issues for future tax returns.

The statute of limitations for filing an amended return is three years from the due date of the originally filed tax return or two years from the date the taxes were paid. This is why it is important to keep good tax records.

Deserve more of a refund? Get a FREE Refund Recheck!

Common Reasons Why You Need To Amend A Return

| Reason | |

|---|---|

|

|

| Update credits |

|

| Update deductions |

|

| Report federal income tax adjustments | You amended your federal tax return or recently audited by the IRS |

Also Check: Www Michigan Gov Collectionseservice

How Long Do You Have To File An Amended Return

- If you or the IRS changes your federal return, you must file an amended Virginia return within one year of the final IRS determination.

- If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Interest on any amount due will still accrue from the original due date, so file the corrected return as soon as you can.

If Changes to Your Return Result in a Refund

We can only issue a refund if the amended return is filed within:

If You Moved In December The Letter Could Have Incorrect Information

Did you move at the end of 2021? If so, that could be why your letter from the IRS has inaccurate figures. The IRS says those who moved in December could be among those with erroneous information because their final child tax credit check may have been returned as undeliverable.

We recommend updating the IRS and USPS with your new address when you move. Doing so could help prevent any money owed to you from being delayed — for instance, the rest of your child tax credit money, your tax refund and any stimulus money you haven’t received.

Read Also: Does Doordash Do Taxes

What If I Miss The Deadline

If you miss the deadline for filing an amendment for your most recent return, or if you want to amend a return from a previous year, youll need to reach out to HMRC by mail and make the request. You can still request to make changes for four years from the end of a given tax year.

So, for example, the 2018-2019 tax year ended on 5th April 2019. If you find you need to change information on the return for that year, you have until 5th April 2023 to do so.

When you contact HMRC about a change, be sure to include the following information:

- The tax year for the return you wish to amend

- An explanation of the change youre requesting

- The amount you believe youve over or underpaid

If youre claiming overpayment and requesting a tax refund, youll also need to include:

- A statement that youre claiming overpayment relief

- Documentation of your Self Assessment tax paid for the relevant period

- How you would prefer to receive payment

- A statement that you havent already tried to claim this refund

- Your signature, indicating that the information youve included is correct and complete to the best of your knowledge

For additional information on how to file an amendment for any tax years for which the deadline has passed, visit GOV.UK.

How Long Will It Take For The Changes To Be Made

- If you submitted your request online, your change request will take about two weeks to be processed.

- If you submitted your request by mail, your change request will take longer. Due to COVID-19, the CRA may take 10 to 12 weeks to process paper adjustments.

Keep in mind that some adjustment requests are considered complex and may take longer to process. Complex requests include situations where additional information or review is required.

For more information on processing times, go to Service Standards in the CRA.

Online or by mail, you can request anadjustment for any of the 10 previous calendar years. For example, a request made in 2021 must relate to 2011 or a later tax year. Adjustment requests for different years should be on different forms but they can be mailed in together or submitted to the CRA at the same time.

You May Like: Taxes Taken Out Of Paycheck Mn

Amending An Individual Income Tax Return

Individual income tax returns from 2009 and forward may be amended electronically through Revenue Online. Filing and amending returns in Revenue Online is a free service. You may amend online even if the original return was filed on paper. Revenue Online has all the information from your original return. You will not need to re-enter everything.

If you cannot amend online, you may file the DR 0104X. Make sure you use the appropriate form version for the year you are amending. If you are changing your Colorado return because the IRS made changes to your federal return, you must file the DR 0104X within 30 days of being notified by the IRS. You must amend your Colorado return in this case, even if there is no net change to your tax liability. It is very important that you submit all schedules and supporting documentation for any changes with your amended return. You must submit all schedules, even if you are not changing those values.

Printable/downloadable forms can be found on the Individual Income Tax Forms web page.

Return Filed Via Third Party Software

Third-party software can help guide you through filling out your tax return. Some programs can even track your records throughout the year so you have a clear idea of what your return will look like as you go. Third-party software often offers you the chance to talk with an accountant who can review your return for accuracy before you file. HMRC has provided a list of approved commercial software suppliers on their website for your convenience.

Please note that by the start of the 2024-2025 tax year, self-employed individuals and landlords making over £10,000 will need to comply with HMRCs Making Tax Digital for Income Tax initiative. So if you havent already, now is a good time to get familiar with filing online.

Top Tip: Making Tax Digital is a plan HMRC put in place to make filing taxes more efficient and reduce errors. Learn everything you need to know about MTD as a small business in our guide to Making Tax Digital

You May Like: Doordash Deductions

How To File An Amended Return

Complete your amended return as if you are filing the return for the first time.

Submit all the forms relevant to the information in your amended return , such as:

- forms for any credits you are claiming or amending,

- forms you submitted as attachments to your original return that are still applicable , and

- all your wage and tax statements, such as Form IT-2.

Do not submit a copy of your original Form IT-201, IT-203, or IT-195.

See the instructions for Form IT-201-X or IT-203-X for additional information about what to submit with your amended return.

See the instructions for the form you originally filed to determine which form to file when amending your return .

Qualify For Head Of Household

If you are unmarried, see if you qualify as head of household. Filing as head of household rather than single allows you to claim a much larger standard deduction. However, this tax filing status requires that you pay more than half the costs to maintain your home and to have a dependent who lives with you for more than half the tax year.

Married taxpayers are generally ineligible to claim this filing status. If you are married, you must determine whether to file jointly or separately. Unless you have extenuating circumstances, you should file a joint return with your spouse to take advantage of the larger standard deduction and lower tax rates.

Don’t Miss: Doordash Self Employment Tax