Taxes On Life Insurance: Heres When Proceeds Are Taxable

Typically, beneficiaries on a life insurance policy will not be required to pay income tax when they receive a death benefit, but there are certain exceptions to this rule. Understanding all of the tax implications involving a life insurance policy can help beneficiaries make the best decisions about how to handle proceeds received from a life insurance policy.

Is Life Insurance Tax Deductible

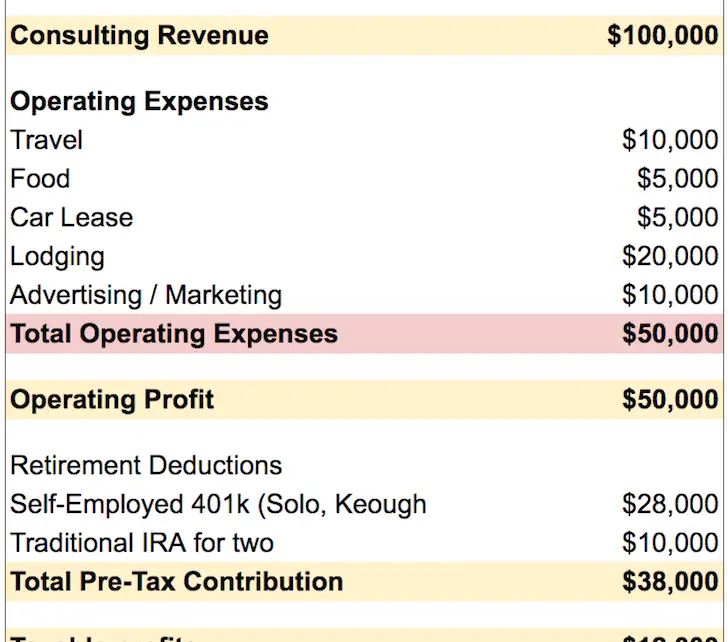

Typically, life insurance premiums are considered a personal expense. Because of this, life insurance premiums are not tax deductible. However, there are a variety of tax benefits to having life insurance.

There are deductions if you are a business owner, and you have business-paid premiums. Also, the tax deferred cash growth of the policy is not subject to taxing through government regulation either.

This means the cash value of your life insurance plan cannot be taxed while it is growing. This allows you to collect higher interest rates and avoid money being taken out.

When You Profit From Surrendering Your Cash Value Policy

After buying a replacement term life policy, getting the payout from your cash value account, and then surrendering your permanent life policy, you may owe taxes. Bummer! If the amount you receive is more than what youve paid in fees and premiums over the life of the policy , youll need to report that amount as extra income. But take heartthis hardly ever happens.

Note: The order here is important. You never want to be even a moment without life insurance coverage. Dont worry if youre double-covered for a few days with both whole and term insurance. Make sure the term is in force before surrendering your whole life and receiving the cash value amount.

Read Also: Is Door Dash 1099

Can I Deduct Aflac Premiums On My Taxes

Supplemental Insurance Premiums Taxpayers cannot deduct the cost of supplemental insurance policies, such as those provided by AFLAC, on their tax returns. According to the IRS, the cost of an insurance policy that pays a specified amount to insured parties who are sick or hurt is not a deductible medical expense.

Medical Claims Aren’t Taxed

Any kind of medical claim you make to insurance, whether it’s part of a settlement you make after an accident or simply a claim for a medical appointment, won’t be taxed.

For example, if you’re in a car accident and incur $500 in medical expenses, your personal injury protection coverage will reimburse you. But since the $500 is only reimbursing you for money you previously spent, you don’t have to pay taxes.

When you’re making a health insurance claim, it’s likely that you won’t touch any money at all because health insurance companies most commonly pay doctors directly. But even if you paid out of pocket for a medical expense and are reimbursed later, you won’t have to pay taxes on the amount you’re paid.

You can actually save even more on your medical bills and taxes by using a flexible spending account, or FSA, to pay the bill. FSAs are most commonly offered as a benefit through your job.

When you sign up for an FSA, you set aside a certain amount of money per year pretax to spend on medical expenses.

- You can use it to pay deductibles and coinsurance for doctor’s visits, filling prescriptions and more.

- But money you put into an FSA generally expires at the end of each year, so you should only put in as much as you think you will spend in a given year.

Recommended Reading: Tax Preparer Licensing

Why Doesnt The Irs Pursue Taxes On Car Insurance Settlements

Though the IRS sometimes pursues taxes on auto insurance settlements as detailed above, the tax collectors generally avoid doing so. Rather, the IRS typically levies taxes on an individuals income. Income is considered a payment that increases wealth. Alternatively, settlements are meant to make the injured individual whole once again. Insurance settlement money is provided to bring the victim back to the state he or she was in prior to the accident. Therefore, even if you are provided with a considerable payout from the insurance company to repair your vehicle, the money will not be taxed if it is meant to make you whole once again.

The 2 Types Of Life Insurance

Life insurance is a contract between you and the life insurance company where you pay premiums for a payout that your living relatives will receive, known as the death benefit. Should you die, the insurance company pays the death benefit to your chosen beneficiary.

There are two types of life insurance: permanent life and term life. The difference between term life insurance and permanent life insurance is similar to the difference between renting an apartment and owning a home .

When you rent, you have a lease for a certain term. When that lease is over, you can renew but most likely with a rent increase. Term life insurance lasts for a specified period. When it’s up you can reapply for coverage, but the premiums most likely will go up as you age.

Permanent life insurance never expires, has a death benefit for your beneficiaries, and a cash value that you can use during your lifetime. It’s like owning a home, where you gain equity that can be used as collateral and your home can be left to your heirs leaving a legacy.

Although the term “whole life insurance” is often used synonymously with permanent life insurance, whole life, universal life, and variable life are actually types of permanent life insurance. Other permanent life insurance policies are a variation of these three products.

| Types of term life insurance | Types of permanent life insurance |

| Level premium |

Read Also: Doordash 1099 Nec

Estate And Inheritance Taxes

One poor decision that investors seem to frequently make is to name “payable to my estate” as the beneficiary of a contractual agreement, such as an individual retirement account , an annuity, or a life insurance policy. However, when you name the estate as your beneficiary, you take away the contractual advantage of naming a real person and subject the financial product to the probate process. Leaving items to your estate also increases the estate’s value, and it could subject your heirs to exceptionally high estate taxes.

Section 2042 of the Internal Revenue Code states that the value of life insurance proceeds insuring your life is included in your gross estate if the proceeds are payable: to your estate, either directly or indirectly or to named beneficiaries if you possessed any “incidents of ownership” in the policy at the time of your death.

Tax Filing And Insurance

At tax time people are looking to find every possible deduction they canso what about writing off your home or auto insurance premiums? The answer mostly comes down to one easy question: personal or business?

If youre buying personal coverage for your home, car or another purpose, the Internal Revenue Service considers it a regular living expense, which isnt any more deductible than buying toothpaste or kitty litter.

If youre in business for yourselfeven if its just moonlightingthe answer may be different. And if you participate in the gig economy you also can deduct some part of those costs against your business incomeas long as youre also willing to declare the money youre earning as income.

Also Check: How To Calculate Mileage For Doordash

The Irs Rule On Taxability Of Settlements And Judgments

The applicable language of the Internal Revenue Service regulation addressing the question of taxability of settlements and judgments is found at 26 C.F.R section 1.104-1:

Damages received on account of personal physical injuries or physical sickness In general. Section 104 excludes from gross income the amount of any damages received on account of personal physical injuries or physical sickness. Emotional distress is not considered a physical injury or physical sickness. However, damages for emotional distress attributable to a physical injury or physical sickness are excluded from income under section 104. Section 104 also excludes damages not in excess of the amount paid for medical care or ) for emotional distress.

Remember that there are federal and state income tax laws and regulations. Most states have adopted rules that are the same or similar to the above-referenced CFR section when it comes to the taxability of personal injury settlements and judgments.

When Do I Pay Tax On Life Insurance

Tax can be payable on the full or partial surrender of permanent life insurance that has a cash value, says Wouters. You might also have to pay taxes if you borrow directly from the life insurance policy, and the amount that you borrow exceeds a certain amount called the adjusted cost basis of the policy. The longer you own a policy, the higher the cash value will be and, over time, the lower the adjusted cost basis will be. The excess of the cash value over the adjusted cost basis is taxable when borrowed or withdrawn from the policy.

Wouters adds that the life insurance illustration you used to help with your buying decision, as well as a calculation from the insurance company, can tell you if the amount you withdraw or borrow at any time is subject to tax. If it is, then the insurance company will issue a T5, showing how much you need to report.

Also Check: How To Calculate Taxes For Doordash

You Sell The Life Insurance Policy

Theres a market for existing life insurance policies, especially cash value life insurance policies that insure people who are terminally ill or have short life expectancies. Transactions involving terminally ill policy owners are called viatical settlements. These involve an investor, such as a company specializing in buying policies, paying you money for the policy, becoming the policy owner, and then making the life insurance claim when you pass away.

Viatical settlements are typically used as a way for patients to get money for medical bills, especially when selling a life insurance policy will mean getting more money than simply surrendering it for the cash value.

Fortunately, the IRS doesnt treat any portion of what you receive for a viatical settlement as taxable. Under IRS code 101, an amount paid by a viatical settlement provider is treated like a payment of the death benefit and death benefit payouts are not taxable.

A life settlement is a similar transaction but involves a policy owner who is not terminally ill. In these cases the IRS does not see the proceeds as a payment of death benefit. A portion of what you receive can be taxable.

Taxes And Life Insurance

Most people think of lump-sum death benefits when using the term “life insurance.”

Generally, the answer to, “do I have to pay taxes on life insurance?” is no, you do not.

This answer is assuming that the death benefit goes to your financial dependents.

Your spouse and children, for instance, usually won’t have to pay taxes if they receive a lump-sum life insurance payout.

The answer changes when the payout goes to non-financial dependants, however.

Your beneficiaries can be taxed up to 35% on the payout in this case.

Adult children, business partners, and anyone else who doesn’t rely on you for financial stability will have to face this tax.

Don’t Miss: How To Look Up Employer Tax Id Number

Do You Have To Pay Tax On Insurance Payouts

Payouts from a personally-held life insurance policy are generally tax-free when paid to your nominated beneficiaries. However, the lump sum benefit is almost always taxed if life insurance is for a key person, for example, the policy is owned by a business and the insured is a director.

If you receive a personal injury compensation payment, you may not have to pay tax on it. Payments you are exempt from tax on include: payments made under Part IVB of the Civil Liability Act 2017.

Cash Value Life Insurance Policies

Mark Williams, CEO of Brokers International, told Insider that one instance where life insurance beneficiaries may have to pay taxes is if the death benefit includes a pay out of cash value.

Cash value is a feature unique to permanent life insurance policies. All permanent life insurance policies have death benefits as well as a cash value that grows on a tax-deferred basis. The big difference between the types of permanent life insurance policies is how they manage the cash value in the insurance company’s portfolio, stock market, or annuities.

Williams warned that because the money inside the policy has been growing on a tax-deferred basis, you will pay taxes on the cash value upon surrendering the policy or if it’s paid out to a beneficiary.

You May Like: Tax Write Off Doordash

Taxation Depends On What A Beneficiary Does With The Money

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Life insurance is a critical part of ensuring that beneficiaries have a measure of financial stability after their loved one dies. A death benefit can help you replace your loved ones income and pay for their end-of-life expenses. In most cases, you wont have to pay taxes on the life insurance payout but there are certain situations in which you may be responsible for tax payments.

When There Are More Than Two Parties Involved

The main parties involved in determining if your life insurance premium is taxable are the policy owner, the beneficiary, and the insured person. Usually, the policy owner and the insured person are one and the same. If this is the case, the policy is not taxable.

However, if a third person is involved, the beneficiary on the life insurance policy may be taxed. For example, say a mother buys her daughter a life insurance policy but names the father the beneficiary. In this instance, the father would be taxed.

Read Also: How To Get Doordash 1099

Set Money Aside For Your Children’s Education

Create a college fund for your kids by putting some money into a 529 college savings plan. The funds can be withdrawn tax-free to pay for qualified school expenses. If possible, when paying for education, use any available tax credits first. After this, consider using 529 funds on remaining expenses, while watching out for penalties. You need to withdraw 529 funds during the year they will be used for school expenses.

You Took Out A Policy Loan And The Life Insurance Ends

If you have a policy with cash value and take out a loan against it, the loan isnt taxable as long as the policy is in-force. But if the policy terminates before youve paid the loan back, you could get a tax bill. For example, if you surrender the policy or it lapses, the coverage terminates.

The taxable amount is based on the amount of the loan that exceeds your policy basis. Remember, policy basis is the portion youve paid in as premiums. Amounts above basis are based on interest or investment gains on cash value.

One way to access all your cash value and avoid taxes is to withdraw the amount thats your policy basis this is not taxable. Then access the rest of the cash value with a loan also not taxable.

Don’t Miss: How Do Taxes Work With Doordash

Next Steps: Ways To Protect Life Insurance Proceeds

Life insurance is a way for you to help protect your loved ones financially after youre gone. The simplest way to help them avoid paying tax on the payout from your life insurance is to name them as beneficiaries, rather than naming your estate.

But if your financial situation is complex, or your estate may be subject to estate taxes, its probably a good idea to consult a financial adviser or tax professional who can counsel you on ways to minimize tax impact, such as an irrevocable life insurance trust. And a life insurance specialist may be able to help you understand what life insurance products are best for your specific situation.

Relevant sources:IRS: Life Insurance & Disability Insurance Proceeds | IRS Publication 525: Taxable and Nontaxable Income | IRS: Estate Tax | IRS Publication 559: Survivors, Executors and Administrators

Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She co-developed an online DIY tax-preparation product, serving as chief operating officer for seven years. She is an Enrolled Agent, the current treasurer of the National Association of Computerized Tax Processors and holds a bachelors in business administration/accounting from Baker College and an MBA from Meredith College. You can find her on .

About the author:

Why Do I Have To Pay Taxes When I Sell My Insurance Agency

There are two main reasons for that: acquiring the corporations stock opens the buyer up to hidden past liabilities such as for taxes, E& O claims and employment disputes even if the seller agrees to indemnify the buyer, and the buyer in most cases loses the ability of taking a step-up in the tax basis of the assets.

Recommended Reading: How Much Taxes Do You Pay For Doordash