Fraud In The Acquisition And Use Of Benefits

Given the vast size of the program, fraud sometimes occurs. The Social Security Administration has its own investigatory unit to combat and prevent fraud, the Cooperative Disability Investigations Unit . The Cooperative Disability Investigations Program continues to be one of the most successful initiatives, contributing to the integrity of SSA’s disability programs. In addition when investigating fraud in other SSA programs, the Social Security Administration may request investigatory assistance from other federal law enforcement agencies including the Office of the Inspector General and the FBI.

History And Rationale For Taxing Social Security Benefits

For more than four decades, Social Security benefits were not subject to income tax. The Treasury Departments rationale for not taxing Social Security benefits was that the benefits under the Act could be considered as gratuities, and since gifts or gratuities were not generally taxable, Social Security benefits were not taxable.

Former Social Security Commissioner Robert M. Ball long argued that, since Social Security is an earned benefit, it should be taxed like other earned benefits, such as employer pensions. Workers pay income tax on private pensions to the full extent that their benefits exceed their contributions, with no income thresholds.

As a leading member of the Greenspan commission on Social Security in 1982-83, Ball had an opportunity to promote this idea. The subsequent Social Security Amendments of 1983 provided that up to 50 percent of benefits would be taxable for beneficiaries with incomes above certain levels. A decade later, the Omnibus Budget Reconciliation Act of 1993 provided for the taxation of up to 85 percent of benefits for individuals with modified AGI above somewhat higher thresholds. The provision has since remained unchanged.

Casualties Disasters And Thefts

A casualty occurs when property is damaged as a result of a disaster such as a hurricane, fire, car accident or similar event. Generally, you may deduct a casualty loss only in the tax year in which the loss occurred. However, if you have a casualty loss from a disaster that occurred in an area declared by the President or the Governor as a disaster area, the loss may be claimed for the year in which the disaster occurred, or the year immediately before the loss.

Recommended Reading: Pastyeartax Com Reviews

Calculating Your Social Security Income Tax

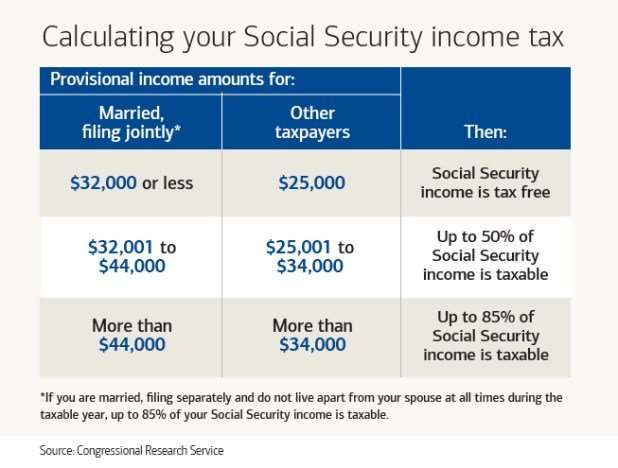

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2021, according to the Social Security Administration.

For the 2021 tax year, single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either a) half of your annual Social Security benefits or b) half of the difference between your combined income and the IRS base amount.

The example above is for someone who is paying taxes on 50% of his or her Social Security benefits. Things get more complicated if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

How Are Social Security Benefits Taxed

Your Social Security benefits are taxed at the Federal level as income just like the income from retirement accounts or a job. You will only pay taxes on, at most, 85% of your benefits. It is possible that you might not be required to pay taxes on any of your benefits if your total income is below the threshold for the year.

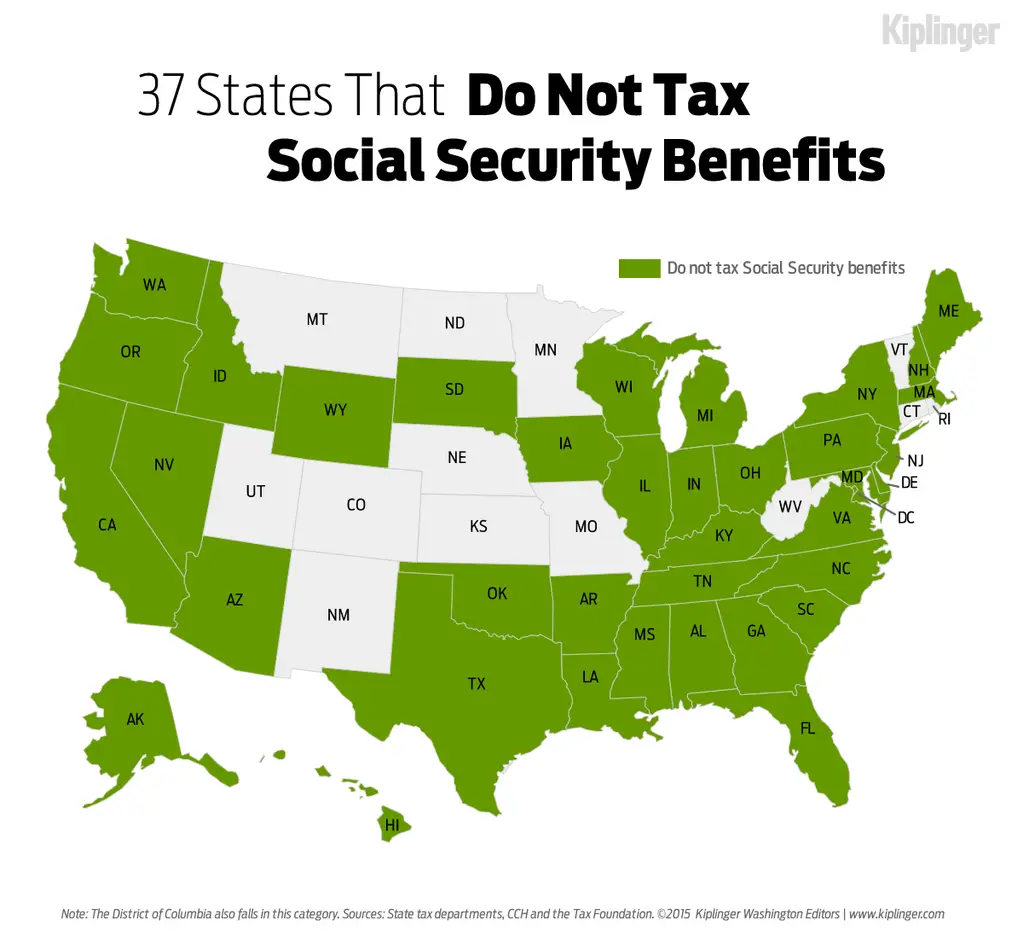

You might also be required to pay state income tax on your benefits if you live in a state that taxes them. The majority of states do not collect taxes on your benefits, but there are a handful of states that do. Some of them follow the same guidelines as the IRS while others have their own rules.

Read Also: Doordash Filing Taxes

Lost Or Stolen Federal Payments

Report your lost, missing, or stolen federal check to the agency that issued the payment. It’s usually one of these paying agencies. If your documentation indicates it’s a different agency, and you need its contact information, look in the A-Z Index of U.S. Government Departments and Agencies.

To get an update on your claim, contact the Treasury Department Philadelphia Financial Center at 1-855-868-0151, option 1.

Are All Kinds Of Social Security Income Taxable

All social security benefits are taxable in the same way. This is true whether theyre retirement, survivors, or disability benefits. Take note that Social Security benefits paid to a child under his or her Social Security number could be potentially taxable to the child, not the parent. Note: Supplemental Security Income, or SSI, is a non-taxable needs-based federal benefit. It is not part of Social Security benefits and does not figure into the taxable benefit formula.

Learn more about capital gains tax on real estate with advice from the tax experts at H& R Block.

Recommended Reading: Pastyeartax Reviews

Social Security And Medicare Tax Deductions

FICA refers to the combined taxes withheld for Social Security and Medicare . On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance. Medicare is shown as Fed Med/EE.

Your FICA withholdings depend on the employee group you belong to:

Court Interpretation Of The Act To Provide Benefits

The United States Court of Appeals for the Seventh Circuit has indicated that the Social Security Act has a moral purpose and should be liberally interpreted in favor of claimants when deciding what counted as covered wages for purposes of meeting the quarters of coverage requirement to make a worker eligible for benefits. That court has also stated: “… he regulations should be liberally applied in favor of beneficiaries” when deciding a case in favor of a felon who had his disability payments retroactively terminated upon incarceration. According to the court, that the Social Security Act “should be liberally construed in favor of those seeking its benefits can not be doubted.” “The hope behind this statute is to save men and women from the rigors of the poor house as well as from the haunting fear that such a lot awaits them when journey’s end is near.”

Also Check: Do I Have To File Taxes For Doordash

Spouse’s Benefit And Government Pension Offsets

The spouse or divorced spouse of a retirement beneficiary is eligible for a Social Security spouse benefit if the spouse or divorced spouse is 62 or older. The benefit amount is equal to 50 percent of the retirement beneficiary’s Primary Insurance Amount if the spouse claims the benefit at the full retirement age or later. If a person is eligible for both a retirement benefit based the person’s own work in Social Security covered employment and a spouse benefit based on a spouse’s work in covered employment, SSA will pay a total amount approximately equal to the higher of the two benefits. For example, if at the full retirement age, a spouse claims a retirement benefit of $300 and a spouse benefit of $450, SSA will pay the person a $300 retirement benefit and a $150 dollar partial spouse benefit for a total benefit of $450.

A spouse is eligible after a one-year duration of marriage requirement is met and a divorced spouse is eligible for spousal benefits if the marriage lasted for at least ten years and the person applying is not currently married. Payment of benefits to a divorced spouse does not reduce the Social Security benefits of the retired worker or family members of the retired worker, such as the worker’s current spouse. A divorced person can claim spousal benefits once the former spouse is eligible for retirement benefits, regardless of whether the former spouse has claimed those retirement benefits.

Withdraw Taxable Income Before Retirement

Another way to minimize your taxable income when drawing Social Security is to maximize, or at least increase, your taxable income in the years before you begin to receive benefits.

You could be in your peak earning years between ages 59½ and retirement age. Take a chunk of money out of your retirement account and pay the taxes on it. You can use it later on without pushing up your taxable income.

For example, you could withdraw funds a little earlyor take distributions, in tax jargonfrom your tax-sheltered retirement accounts, such as IRAs and 401s. You can make penalty-free distributions after age 59½. This means that you avoid being dinged for making these withdrawals too early, but you must still pay income tax on the amount that you withdraw.

Since the withdrawals are taxable , they must be planned carefully with an eye on the other taxes that you will pay that year. The goal is to pay less in tax by making more withdrawals during this preSocial Security period than you would after you begin to draw benefits. That requires considering the total tax bite from withdrawals, Social Security benefits, and any other sources. Be mindful, too, that at age 72, youre required to take RMDs from these accounts, so you need to plan for those mandatory withdrawals.

Don’t Miss: How Much Are Taxes For Doordash

Tips For Saving On Taxes In Retirement

- Finding a qualified financial advisor doesnt have to be hard. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider moving to a state with fewer taxes that affect retirees.

- Another way to save in retirement is to downsize your home. Moving into a smaller home could lower your property taxes and it could also lower your other housing costs.

Claim Of Discrimination Against The Poor And The Middle Class

Workers must pay 12.4 percent, including a 6.2 percent employer contribution, on their wages below the Social Security Wage Base , but no tax on income in excess of this amount. Therefore, high earners pay a lower percentage of their total income because of the income caps because of this, and the fact there is no tax on unearned income, social security taxes are often viewed as being regressive. However, benefits are adjusted to be significantly more progressive, even when accounting for differences in life expectancy. According to the non-partisan Congressional Budget Office, for people in the bottom fifth of the earnings distribution, the ratio of benefits to taxes is almost three times as high as it is for those in the top fifth.

Recommended Reading: Pay Taxes On Plasma Donation

Who Is Exempt From Paying Social Security Tax

First, lets talk about income tax on Social Security benefits. People receiving Supplemental Security Insurance or SSI benefits are exempt from paying taxes on those benefits. In addition, individual filers whose income is below $25,000 or married filing jointly filers whose total combined income is less than $32,000 are not required to pay taxes on any portion of their Social Security income.

Social Security tax may also refer to your withholdings from your paycheck that you pay into the system while you are working. This tax is part of the FICA taxes. Very few people are exempt from paying these taxes. There are a few exceptions though. State and local government employees who are included in a public retirement plan are not required to pay the tax because that would essentially be double dipping. In addition, foreign government officials working in the U.S. are not required to pay into the system. In rare cases, individuals may claim a religious exemption to paying the tax, although strict requirements must be met to qualify for this exemption.

How Do I Determine If My Social Security Is Taxable

Add up your gross income for the year, including Social Security. If you have little or no income in addition to your Social Security, then you wont owe taxes on it. If youre an individual filer and had at least $25,000 in gross income including Social Security for the year, then up to 50% of your Social Security benefits may be taxable. For a couple filing jointly, the minimum is $32,000. If your gross income is $34,000 or more , then up to 85% may be taxable.

Recommended Reading: Plasma Donation Taxes

Three Ways To Reduce The Taxes That You Pay On Benefits

Is Social Security taxable? For most Americans, it is. That is, a majority of those who receive Social Security benefits pay income tax on up to half or even 85% of that money, because their combined income from Social Security and other sources pushes them above the very low thresholds for taxes to kick in.

But you can use some strategies, before and after you retire, to limit the amount of tax that you pay on Social Security benefits. Keep reading to find out what you can do, starting today, to minimize the amount of income tax that you pay after retiring.

How Social Security Benefits Are Taxed

Social Security beneficiaries must pay federal income tax on a portion of their benefits if their income exceeds certain thresholds the portion of benefits that is taxable rises with income. Income for this purpose equals a taxpayers adjusted gross income plus tax-exempt interest, certain other tax-exempt income, and half of Social Security benefits this is referred to as modified AGI. A three-part formula applies:

- For individuals with modified AGI below $25,000 and couples with modified AGI below $32,000, no Social Security benefits are taxable.

- For individuals with modified AGI between $25,000 and $34,000 and couples with modified AGI between $32,000 and $44,000, up to 50 percent of benefits are taxable.

- For individuals with modified AGI over $34,000 and couples with modified AGI over $44,000, up to 85 percent of benefits are taxable.

For a detailed explanation of the tax calculation, see Appendix Table 1.

You May Like: Efstatus.taxact 2015

How To File Social Security Income On Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099. Then, on Form 1040, you will write the total amount of your Social Security benefits on line 5a and the taxable amount on line 5b.

Note that if you are filing or amending a tax return for the 2017 tax year or earlier, you will need to file with either Form 1040-A or 1040. The 2017 1040-EZ did not allow you to report Social Security income.

Social Security And Railroad Retirement Benefits

If your social security or railroad retirement benefits were taxed on your federal return, you may take a deduction for those benefits on your North Carolina individual income tax return. You may take this deduction because this income has already been included as part of your federal adjusted gross income and North Carolina does not tax this income. This deduction will increase your refund or decrease the amount you must pay.

Any social security benefits you received that are not included in your federal adjusted gross income cannot be deducted on your North Carolina return. If your federal adjusted gross income includes social security benefits, enter the taxable amount of social security benefits on Form D-400 Schedule S, Part B Deductions from Federal Adjusted Gross Income, Line 18. The total deductions from federal adjusted gross income entered on Form D-400 Schedule S, Line 38, also needs to be entered on Form D-400, Line 9.

Recommended Reading: Is Freetaxusa A Legitimate Site

Can You Live On Social Security Alone

Surviving on Social Security alone in retirement would be difficult for most. The average person received just $17,040 per year in 2019. The maximum Social Security benefit for 2020 is expected to be $2861 at full retirement age. . For sure this is a good amount of money, dont get me wrong, but not exactly living rich.

How much of your Social Security benefits will be taxed will ultimately depend on your other income sources. This will be a combination of all other earnings in a given year, plus some portion of your Social Security benefits. These other sources will include everything from distributions from your 401 or IRA, wages from work, royalties or rental income.

Most people know to have a strategy to get the largest Social Security Benefits throughout their retirements. Having a plan to pay the least amount of taxes on your Social Security benefits it much less common.

Keep reading to learn more about Social Security taxation.

Living off of Social Security alone will be a stretch for most retirees.

Getty