What If I Cant Pay The Tax Owed On Unemployment

Paying taxes on unemployment insurance payments can seem counterintuitive, since most recipients either are out of work or recently have been. This could lead to a situation where you have a tax bill that you cant afford to pay.

In such a case, its important that you still file a return. If youre unable to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. Theres also a penalty for failure to file a tax return. So try to file on time, whether or not you can afford to pay the full balance due.

If your tax bill is too much for you to pay right now, pay as much as you can to reduce the amount of interest that will accrue. You can also apply to pay the balance in installments, allowing you to make monthly payments. You can request an installment agreement online through the IRS website, by filling out Form 9465, or for help.

How To File 1099 Manually

Who must file.

How do you file 1099 with the IRS?

and IRS.gov/Form1099NEC. You can complete these copies online for furnishing statements to recipients and for retaining in your own files. Filing dates. Section 6071 requires you to file Form 1099-NEC on or before January 31, 2022, using either paper or electronic filing procedures. File Form 1099-MISC by

Who needs to file 1099?

The company must send your Form 1099-MISC if they pay you more than $600 as an independent contractor. The IRS deadline for the employer to submit a 1099-MISC for income for the year begins in mid- or end-February, so, again, you will need a tax return to report the income. what if a company does not issue a 1099? do you issue a 1099 for services?

Dont Activate The Debit Card

The goal with all of these strategies is to limit your access to your tax money. To that end, itâs best to not even activate the new debit card or store it in your wallet.

Think of it this way: The second the money gets transferred into your tax account, it no longer belongs to you, it belongs to Uncle Sam. Cutting off access points will remove the temptation to spend whatâs not yours.

You May Like: What Age Can You File Taxes

How To Budget For Self

The United States operates on a âpay-as-you-goâ tax system. Meaning, taxes are due when the money is earned, not when your tax return is filed. If you expect to owe more than $1,000 in taxes, you should probably be making estimated tax payments. Not making payments throughout the year could result in penalties and interest when you finally file your tax return.

But making periodic tax payments is easier said than done. Between rent, groceries, and the occasional Starbucks latte, there never seems to be money leftover. If you relate to that, youâve come to the right place. Weâve compiled some tried and true methods to effectively manage yourself â and some common financial pitfalls to avoid.

What Is A 1099 Form And How Does It Work

9 Minute Read | September 27, 2021

Are you one of the 56.7 million freelance workers in the U.S.?1 Congratulations! Technically that means you are self-employed. Whether youre designing websites or selling cupcakes, you are your own businessthe CEO of You, Inc. At least thats how Uncle Sam sees you.

Working for yourself definitely has its perks, but it also comes with its own challengesespecially when tax season comes around. One of those challenges is figuring out what to do with those 1099 tax forms that start coming in from all those clients who paid you for a job well done.

Dont worry, well walk you through what a 1099 tax form is, why you got one , and what youre supposed to do with them.

Recommended Reading: Can You File Missouri State Taxes Online

Recommended Reading: How To File Tax Return For Free

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

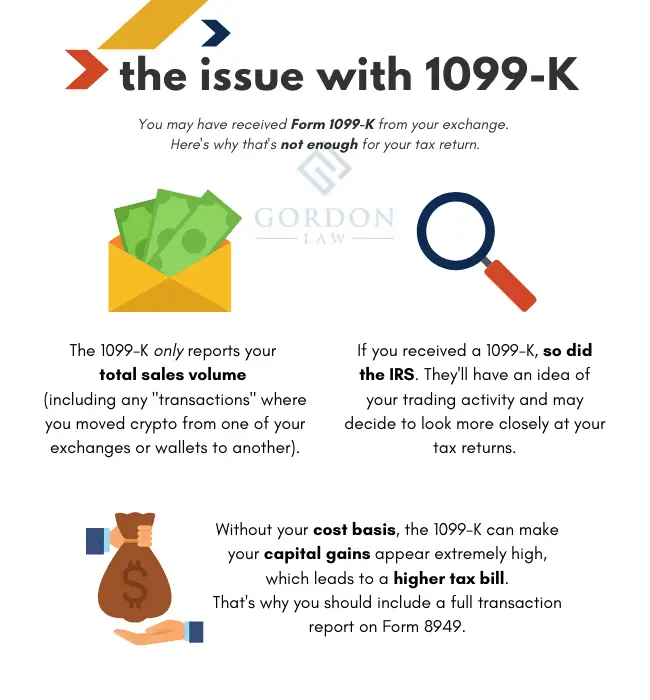

Why Would There Be Withholding On A 1099

The IRS determines if a person or business paying compensation to another person or business has an employee or contractor relationship. Generally, the type of income statement form issued depends on the relationship . As it relates to income tax, an employee relationship requires an employer to withhold on wages in a contractor relationship, the worker is responsible for their own income tax. Michigan follows these federal guidelines. For guidance on determining of you have an employee or contractor relationship with someone who works for you, refer to IRS Publication 15, Employers Tax Guide and the Michigan Unemployment Insurance Agency Fact Sheet 155.

Generally, a contractor can request withholding from their pay. The business receiving contractor services could agree to withhold on the contractors behalf.

Read Also: What Is Form 8995 For Taxes

Submit Copy B To The Independent Contractor

Once your Form 1099-NEC is complete, send Copy B to all of your independent contractors no later than January 31, 2021.

You can download and print a version of Copy B from the IRS website and send it to your independent contractor. This process is explained in further detail on the first page of Form 1099-NEC.

Withdrawals From A Retirement Account

When you withdraw money from your traditional IRA, in most cases it is taxable. You will receive a Form 1099-R that reports your total withdrawals for the year. The form also covers other types of distributions you receive from pension plans, annuities and profit-sharing plans. Usually the 1099-R will show the taxable amount of the distribution on the form itself and will report the amount of federal tax that was withheld.

Also Check: Www.1040paytax.com

Recommended Reading: When Will The Irs Open For 2021 Tax Returns

Record All Business Deductions

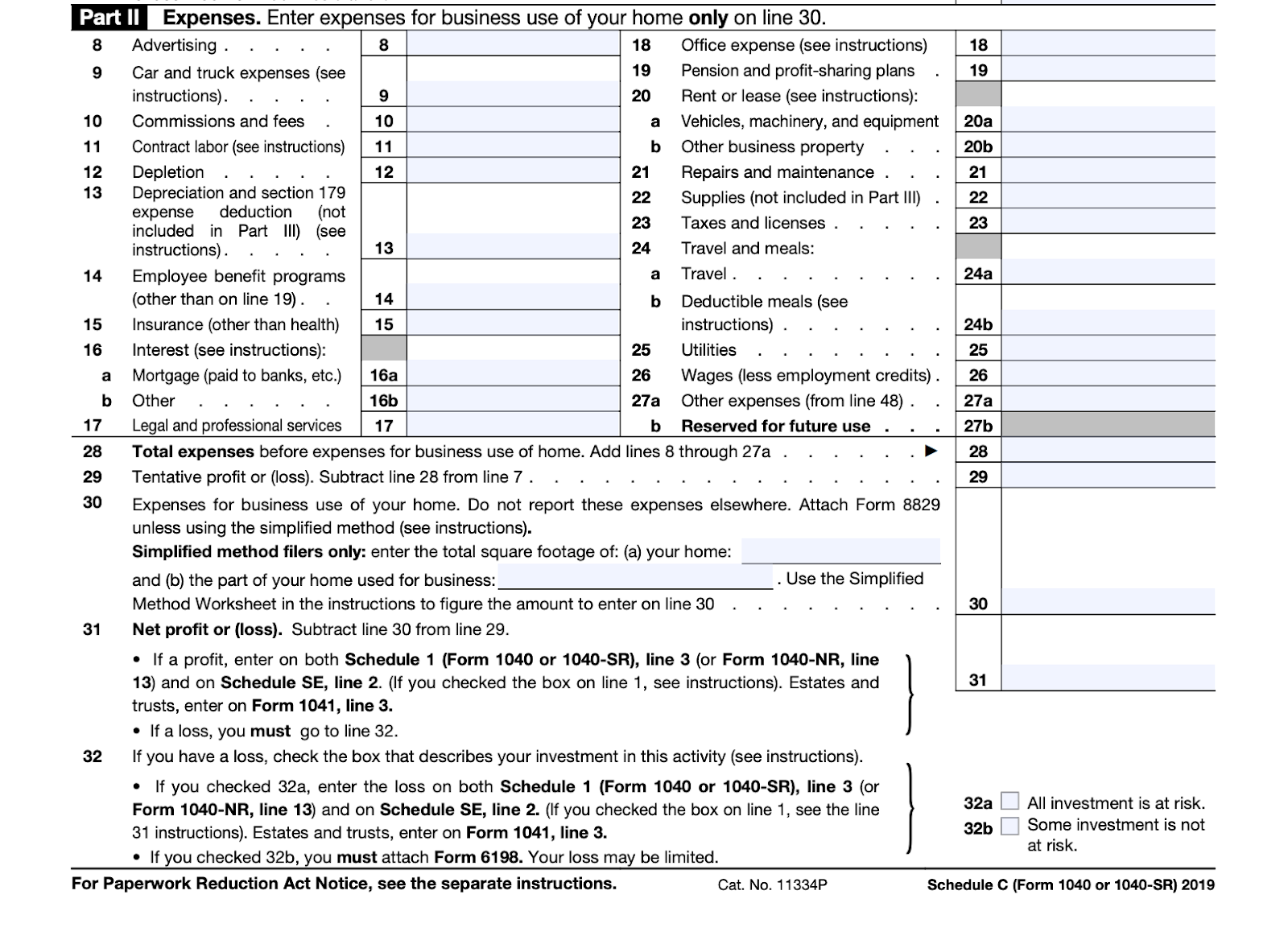

The more you track tax deductions and the more organized you are, the better youâll be during tax season. Remember, you are responsible for paying “both sides” of the self-employment tax. When you know your expenses and accurately track them, you will understand what tax deductions you can get and can maximize them. Simply follow the Schedule C instructions to claim your tax deductions.

Note: Itâs critical to separate business expenses from personal ones, as you donât want to merge the two accidentally. If you want to do all of that automatically, try Bonsai’s freelancer 1099 expense tracking software. Our tax software can help you organize all of your expenses and save you money on your tax bill at the push of a button.

What Is Irs Form 1099 And Form 1099

Form 1099 is an informational form that shows how much money you have received during a calendar year from a financial institution. It serves many purposes. It is not only used to report dividends but also retirement distributions, lottery winnings, interest payments, lawsuits, divorce settlements and real estate transactions, as well as dividend payments.

The official name for the Form 1099-DIV, on which dividends are reported to taxpayers each tax year, is Internal Revenue Service Form 1099-DIV: Dividends and Distributions. This form is used by banks, credit unions, mutual funds and other financial institutions to report the dividends paid to a taxpayer each calendar year. For 2021, if you received more than $10 in dividends from one of these institutions, you will receive a Form 1099-DIV. If you received dividends from more than one entity, you will receive a Form 1099-DIV from each of them. The businesses also submit a copy of each Form 1099-DIV you receive to the IRS.

You do not file this form with your taxes. Instead, you take the information from the form and use it in several locations on your tax return.

Don’t Miss: Can I Pay My State Taxes Online

How Do Tax Brackets Work

Tax brackets are based on your taxable income, which is what you get when you take all of the money youâve earned and subtract all of the tax deductions youâre eligible for.

Once youâve calculated your taxable income, itâs time to look at the IRSâs tax rate scheduleâa fancy term for âbig list of tax system bracketsââfor the year youâre doing your taxes for.

Letâs take the IRS tax brackets for individual single filers in 2022:

| Tax rate | |

|---|---|

| 37% | $539,901+ |

Unless you made $10,275 or less in taxable income in 2022, itâs likely you fall into at least two brackets. This means different parts of your income is taxed at a different rate.

For example, letâs say that your taxable income ends up being $20,000. That means youâll fall into two different tax brackets and get taxed at two different rates:

-

the $0 – $10,275 bracket, which taxes you at 10%

-

the $19,276 – $41,775 bracket, which taxes you at 12%

So youâll pay two different tax rates: 10% on the first $10,275 âchunkâ of your income, and 12% on every dollar you made above $10,275.

In equation form, weâd write this out as:

Total tax = +

Total tax = $1027.50 + $1,167.00

Total tax bill = $2,194.50

We call the highest tax rate that you pay your . In this example, your marginal tax rate is 12%.

Tax Deductions For Self

You can deduct half of your self-employment tax on your income taxes. So, for example, if your Schedule SE says you owe $2,000 in self-employment tax for the year, you’ll need to pay that money when it’s due during the year, but at tax time $1,000 would be deductible on your 1040.

Self-employment can score you a bunch of sweet tax deductions, too. One is the qualified business income deduction, which lets you take an income tax deduction for as much as 20% of your self-employment net income. Plus, there are other deductions available for your home office, health insurance and more. Heres a primer.

» MORE:Compare online loan options for funding and eventually growing your small business.

About the author:Tina Orem is NerdWallet’s authority on taxes and small business. Her work has appeared in a variety of local and national outlets.Read more

You May Like: Can I Deduct State Income Tax On Federal Return

What Happens If I Dont Amend My Tax Return

The IRS gets a Form 1099-G from the state unemployment office showing what they paid you. If you dont include that income on your tax return, the IRS computers will automatically flag your return.

The IRS will calculate the additional amount you owe and send you a bill. It will usually take several weeks or months to do so. In addition to the extra taxes, you will owe interest and penalties from when your tax return was due until you pay in full.

Getting Help With Your 1099 Tax Changes For 2021

Whether its your first tax return as a self-employed worker or youre a seasoned pro, Turbotax®s Self-Employed products can help. Its a simple and easy-to-use program designed especially for self-employed taxpayers.

Need help tracking your expenses throughout the year to make tax time easier? Download the Stride app.

Recommended Reading: Do You Pay Taxes On Bitcoin

Estimate How Much Youll Need To Pay

With these two new shifts in your tax obligations, you might be wondering, How do you estimate your income and self-employment tax payments?

If its your first year as a 1099 worker and you dont have a CPA doing your taxes, Chelsea Krause, an accounting expert at business financial site Merchant Maverick, says the IRS Self-Employed Individuals Tax Center is your home for understanding how much you might have to pay.

The page has a link to the 1040-ES, which is a worksheet that will tell you, based on your income for the past three months, how much you need to pay for the quarter. The worksheet takes about 10-15 minutes to complete.

In the event that youve filed as a 1099 worker the previous year, then Dave Du Val, an Enrolled Agent with TaxAudit.com, says the following percentages are the governments guide for how much you should save:

- 90 percent of what youll owe for the year

- 100 percent of what you paid the previous year

- 110 percent of what you paid the previous year if your income was above $150,000

If possible, make up any shortfall in the taxes you owe by estimated tax payments as soon as you are making more than you expected, Du Val said.

Forms That Independent Contractors File

The main form that all of your numbers will go on is a regular 1040. Regardless of your background and type of earnings, everyone in the U.S. submits this form. Where the paperwork veers off a little, however, is the point when you start working with the supporting schedules.

The income that you report for your independent contracting must come from a Schedule C. Furthermore, to account for the self-employment tax, you need to include a Schedule SE. If you made any estimated tax payments, which will be discussed shortly, you need to ensure that those accompany your return as well.

The best starting point is Schedule C. You begin by adding all of your earnings in Part I on lines one through seven. After that, you go through lines eight through 28 to derive the total expenses. Finally, you will get your net profit or loss on line 31. That number will go directly on line 12 of your form 1040. Also, do not forget to calculate your qualified business deduction from section 199A of the new tax law from 2017, which will amount to 20% of the net income that you made. That is, of course, as long as you satisfy certain requirements that most independent contractors do. To find out more about them, review the overview provided by the IRS.

Read Also: What Is Hawaii State Tax

Home Office Or Office Space Rental

Self-employed people often work remotely at home or rent out an office space for themselves. If you rent space, you can deduct your monthly rent payment and any equipment you rent.

If you work out of a home office, you can potentially write it off. However, this is a bit more complicated and involves a few requirements. But it can be done.

The standard method and the simplified method both require exclusive business use. In the standard method, youâll need to determine your home office expenses, making sure to track everything in great detail.

With the simplified method, office space shouldn’t exceed 300 square feet. Youâll need to multiply the square footage of your home office space by the IRS rate. The IRS uses $5 per square foot to calculate your deduction.

No Withholding On 1099 Income

You may be wondering why there was no tax withholding on your 1099-NEC form. That’s because the payer didn’t withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances. Employers also do not withhold Social Security and Medicare taxes from non-employees.

Because no taxes are withheld on 1099 income during the year, you may have to pay quarterly estimated taxes on this income. Failing to pay taxes during the year can result in fines and penalties for underpayment.

Recommended Reading: How To Jointly File Taxes

Can I File 1099 Myself

You cannot designate a worker, including yourself, as an employee or independent contractor solely by the issuance of Form W-2 or Form 1099-MISC. It does not matter whether the person works full time or part time. You use Form 1099-MISC, Miscellaneous IncomePDF to report payments to others who are not your employees.

How do I file a 1099 with the IRS?

Use Form 1096 To Send Paper Forms to the IRS You must send Copies A of all paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the IRS with Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

How To Lower Your Self

If you are self-employed or a small business owner, you understand first-hand how awful your tax bill can be, especially with the giant 15.3% self-employment tax added on .

When youâre not an employee, you donât have anySocial Security and Medicare taxes withheld from your income.

And since thereâs no state and federal income taxes, health insurance, or social security and medicare taxes, are taken out of your paycheck, you are the one who is solely responsible to pay self-employment tax. Most individuals working a full-time job would expect a tax refund, but you’ll need to pay taxes on 1099 income.

Thankfully, there are plenty of things you can do to avoid outrageous quarterly tax payments and yearly tax payments.

Here are a few ways you can keep some extra money in your pocket when you receive a 1099.

Don’t Miss: How Do You Find Property Taxes By Address