Dont File 1099s For Contractors Hired Through Freelance Marketplaces

Freelance marketplaces like Upwork or Fiverr donât provide tax documents. Whyâs that? Because theyâre technically payment settlement entities. Businesses do not need to provide 1099-NEC forms to workers they hire on these platforms.

If youâre a freelancer that finds work on these platforms, you will a form 1099-kif you earn more than $20,000 and have 200 transactions. Otherwise you can find all the information you need for tax filing in your account.

Hire A Tax Professional

With so many forms to fill out, we recommend hiring tax professionals and accountants to untangle the complex details of filing taxes. Evading taxes is a felony, and we wouldnt want anyone to accidentally miss anything.

Make sure you hire someone with substantial experience filing taxes. The IRS recommends checking the professionals qualifications and reviewing the entire return before signing your name. There are plenty of able, qualified and helpful tax professionals out there, but choose wisely. Remember that any mistakes will be placed on you, the taxpayer.

Employees With Power Saws Or Tree Trimmers

If you are an employer in the forestry business, you may have employees who, according to their contracts, have to use their own power saws or tree trimmers at their own expense.

In box 14, “Employment income,” include rental payments you made to employees for the use of their own power saws or tree trimmers. You should not reduce the amount in box 14 by the cost or value of saws, trimmers, parts, gasoline, or any other materials the employee supplies.

Also Check: Pay Taxes On Plasma Donation

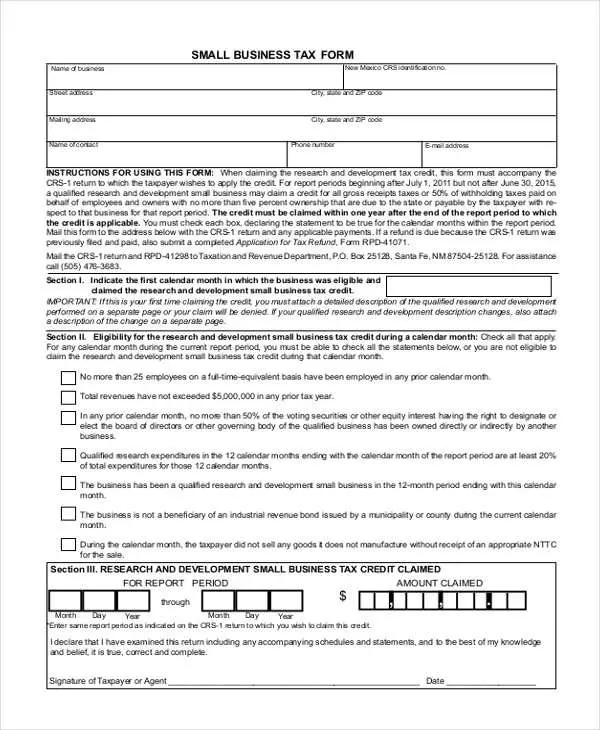

Irs Business Forms: The Basics

When it comes to the IRS, there are many obligations you may have as a business owner. Not only is completing various IRS business forms simply a federal requirement of doing business, but its also important to make sure youre fulfilling your obligations wholly and correctly, to protect your business in the case of an IRS audit. Although not many businesses actually get audited, its better to always be vigilant when it comes to your IRS small-business forms which means knowing the different types and which ones might apply to your business.

Generally, the most prevalent IRS business forms are tax forms. As a business owner, you can be responsible for paying a variety of different taxes: income taxes, excise taxes, taxes for your employees, etc. Ultimately, the taxes you pay and the corresponding IRS business forms you have to complete and file will depend largely on your business entity type. However, in addition to the standard tax forms, there may be other IRS small-business forms you need to complete, ranging from a form specific to employee benefits to one to change your business address.

» MORE: NerdWallet’s best accounting software for small businesses

What Is A Business Tax Return

If you own a business, you need to file a company tax return. A business tax return reports your companys income, tax deductions, and tax payments. All businesses must file tax returns. And, you are responsible for filing your return annually with the IRS to calculate your businesss tax liability.

The specific form you file depends on your type of business entity and which deductions you claim on the return. For example, you may be able to claim the home office tax deduction by attaching Form 8829, Expenses for Business Use of Your Home, depending on your business.

Read Also: Doordash 1099 Form

Dont File 1099s For Employees

The IRS makes strict distinctions between employees and nonemployees. And theyâre often on the lookout for business owners who misclassify workers as independent contractors

Youâll need to file a Form W-2 to report wages, tips, and other compensation you paid to an employee during the tax year.

There are significant penalties for misclassifying employees as independent contractors. Make sure you know how to tell the difference between an independent contractor and an employee before you submit a 1099.

Calculate Your Tax Deductions

Paying taxes is painful, but tax deductions can soften the blow. What you can deduct depends on the type of business you run, though there are a few deductions nearly every business owner can claim every year. For more information, read through IRS Publication 535. It details business deductions and explains how to calculate them.

You May Like: H& r Block Early Access W2

Running Your Business In Bellevue

At the core of any successful business is a focus on creating value, effectively leading people to do quality work and managing the work to optimize costs. Because small business is closer to the customer, they are more sensitive and responsive to market changes. Because they tend to solve value problems, not cost problems they tend to be more innovative.

-

Taxes

Businesses pay several different kinds of taxes, including income tax and property tax. Taxes for businesses can be federal, state, and local. There are also different types of taxes depending on various business activities, like selling taxable products or services, using equipment, owning business property, being self-employed versus having employees.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: How To Find Employers Ein

Gather The Required Information

Before you can complete and submit a 1099, youâll need to have the following information on hand for each independent contractor:

- The total amount you paid them during the tax year

- Their legal name

- Their address

- Their taxpayer identification number

The standard method for acquiring this information is to have each contractor fill out a Form W-9. As a best practice, you should have a W-9 on file for each of your independent contractors. Having contractors fill out a W-9 should be one of the first administrative tasks you complete after engaging their services.

Check your bookkeeping records to confirm the total amounts you paid to each contractor during the tax year.

Once you have all of the required information, use it to fill out Form 1099-NEC.

Small Business Tax Myths

My business didnt make any money so I dont have to report anything right? False.

Many businesses dont see a profit in the first year . You are still required to include details of your business on your tax return and if your business actually lost money, you can apply the loss to your other income.

I made less than $5000 so I dont have to file: False.

Although you may not owe any taxes on your business income, you may be responsible for Canada Pension Plan contributions. As a small business owner, you pay both your share of CPP and the employers share. The amount due is calculated by TurboTax Self-Employed on your tax return.

I am a student so the money I make is tax-free: False.

The CRA doesnt have special rules for small business owners who are still in school. The details of your self-employment must be included when you file your return.

Also Check: What Does It Mean To Grieve Taxes

Business Policies Forms And Company Rules

You know this. Every time you subscribe to something new you have to agree with its terms. The same goes for your company.

Even a small business requires a policy and your employees must know and agree with it. It is a legal matter.

These are the company rules, including privacy policy, if it requires a dress code or not, behavior, check-in time, hours of work per day or week, use of the mobile phone during work hours, computer and internet use, legal aspects in general.

Your small business can have a Terms of Use and Privacy Policy form or add it to existent forms where all personnel can check the business policy and agreed with it.

Overview: What Is The Irs Form 941

There are three key small business taxes that must be paid each pay period: Social Security, Medicare, and withholding. For Social Security and Medicare, the employer and employee portions must be paid. For withholding, you pay only the employee portion.

The IRS Form 941 is a quarterly report that shows the sum of each of the three payments for the quarter, as well as payroll data for employees. For unique businesses, it also includes reports of items such as tips earned by employees that may change the total amount due.

You May Like: How To Calculate Doordash Miles

Pay Attention To Deadlines

Be aware of different filing deadlines. When you use a Schedule C, it becomes part of your Form 1040 and therefore, no separate filing deadlines apply. It is generally subject to the same April 15 deadline.

If you are taxed as a C-Corp, you need to file a Form 1120, you must file it by the 15th day of the forth month following the close of the tax year, which for most taxpayers is April 15 or the next business day if it falls on a weekend or holiday. If you are taxed as an S-Corp, you need to file a Form 1120S, you must file it by the 15th day of the third month following the close of the tax year, which for most taxpayers is March 15. You cannot send this form to the IRS with your personal income tax return.

TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms. Perfect for independent contractors and small businesses. Well search over 500 tax deductions to get you every dollar you deserve and help you uncover industry-specific deductions.

Prepare For The Unexpected

- The Department of Health provides a wide range of resources to help you prepare for public health emergencies including bioterrorism events, disease outbreaks and natural disasters. You can find fact sheets, links and additional information at the Department of Health website.

- Being part of an industry or business association can provide you a network of colleagues and opportunities for specialized training to help you deal with the unexpected.

- Unexpected events, such as fires, floods, storms and earthquakes, could damage or destroy your records, damage critical equipment, or close your business for a period of time. Establishing a business continuity plan in advance will help you get your business up and running more quickly.

Don’t Miss: Is A Raffle Ticket Tax Deductible

Mandatory Electronic Filing Of T4 Returns

Budget 2021 announces that the threshold for mandatory electronic filing of income tax information returns for a calendar year would be lowered from 50 to 5 information returns.

The legislation for this measure was not finalized when the guides and forms were published. For the latest information about the penalty for not filing information returns over the Internet, go to Penalty for failure to file information returns over the Internet. You can also subscribe to our email distribution list about the electronic filing of information returns at Canada Revenue Agency electronic mailing lists.

Business Income Tax Forms And Instructions

We offer several ways for you to obtain Maryland tax forms, booklets and instructions:

You can also file your Maryland return online using our free bFile service.

Also Check: Doordash And Taxes

Penalties Interest And Other Consequences

Late filing and failing to file the T4 information return

You have to give your employee their T4 slip and file your T4 information return with the CRA on or before the last day of February following the calendar year to which the information return applies. If the last day of February falls on a Saturday, or a Sunday, your information return is due the next business day.

We consider your return to be filed on time if we receive it or if it is postmarked on or before the due date.

We may assess a penalty if you file your information return late. For T4 information returns, we have an administrative policy that reduces the penalty that we assess so it is fair and reasonable for small businesses. Each slip is an information return, and the penalty we assess is based on the number of information returns you filed late. The penalty is $100 or the amount calculated according to the chart below, whichever is more:

Penalties for failure to file returns on time| Number of information |

|---|

| $7,500 |

Mandatory electronic filing

You can file information returns electronically, as well as amend, cancel or add slips by using the “File a return” service in My Business Account or Represent a client. If you have a Web access code, you can file up to 100 slips electronically in a single submission by using our Web Forms service.

For more information about filing information returns electronically, go to Filing Information Returns Electronically – Overview.

Failure to deduct

The penalty is:

What Should I Put On My W

If you got a huge tax bill when you filed your tax return last year and dont want another, you can use Form W-4 to increase your withholding. Thatll help you owe less next time you file. If you got a huge refund last year, youre giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.

Here are some steps you might take toward a specific outcome:

Don’t Miss: Ct Tsc Ind

Irs Business Forms For Partnerships

If your business is a partnership, youll be responsible for paying taxes for the partnership as a whole, as well as the individuals that make up the partnership. As a partnership, youll have to complete Form 1065, which is an annual information return to report the income, gains, losses, deductions and credits for your business. To determine each partners share of the business income and losses, youll each complete a Schedule K-1. You’ll then use the calculations from Schedule K-1 to complete Form 1065.

As a partnership, however, your business does not pay income tax. Instead, this tax burden is passed on to the individual partners. In this case then, as a member of a partnership, you may be responsible for many of the forms discussed previously, including Form 1040, Form 1040-ES and Form 1040-SE. Depending on your business, you might also have to complete Form 1040 Schedule E, which reports supplemental income and loss from your partnership.

Check Numbers And Send To Irs

If you were able to generate the form with your software, compare Schedule B with your collected worksheets to ensure the correct amount was paid each week. If it was, you are not required to pay more taxes.

You can then send the completed form to the IRS, or you can file Form 941 online. The mailing address depends on your business location. Visit this page on the IRS website to find the correct address.

You can e-file the return as long as you use the IRSs list of approved providers.

Read Also: Laurie Kazenoff

Online Order Forms For Small Businesses

If you are selling something on your website or offering some kind of service, it is imperative that you have an Order Form, even if youâre still a small company or one-person business. These kinds of forms can guide you during your sales, by keeping track of your product stock, manage your time and income.

Why use order forms?

An order form is something like a contract between a company and its client. It has all the terms agreed on, like price and date of the expedition and delivery, and address to deliver the product. It is a legal bonding among the two parts. It is advantageous for your business to have this legal support.

Another benefit of using the order form is that it improves your fiscal control, building a mechanism more efficient for your IRS income tax.

What are must-have fields in an Order Form?

There are important things you need to make a good order form, and a clean design can make it more efficient. It must have your branding design, just as your contact form.

Some form fields that your order form can include:

- Company name

- Payment information and terms

- Agreement space

You can add more information if your product or service requires so. Remember that every form you use in your company has to match with your business stands and image. That is the company identity.

Finish With Form 1065 Schedule M

This area shows a partners beginning and ending capital account. It also derives from the fundamental balance sheet equation which is assets = liabilities + equity and the partners capital account can be seen as the equity portion. It also shows any capital and distributions which could be cash or property made throughout the year.

Schedule M-2 is especially important as the IRS uses this to verify the equity section in schedule L . It also needs to match the total of the amounts reported in Part II, Item L of every partners schedules K-1s. Therefore, its important to ensure each of the three schedules are filled out accurately as they are deeply interrelated.

Recommended Reading: How To Get Doordash Tax Form