How Much Is The Tax Credit Worth

Again, it depends on the number of qualifying children you can claim and whether your adjusted gross income or earned income is below the maximum set by the state.

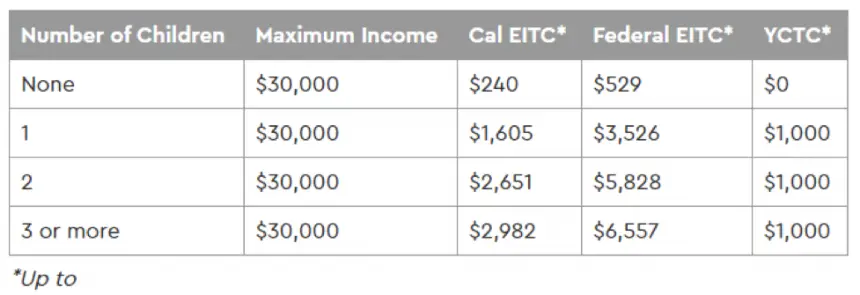

Referring the table above showing the maximum income and number of qualifying children claimed, you can expect the following state earned income tax credit for the tax year 2016:

- If you claim no children and earn up to $6,717, you may receive up to $217.

- If you claim one child and earn up to $10,087, you may receive up to $1,452.

- If you claim two children and earn up to $14,161, you may receive up to $2,406.

- If you claim three or more children and earn up to $14,161, you may receive up to $2,706.

In each case, your federal earned income tax credit will be higher.

You May Qualify For The Caleitc If:

- Youre at least 18 years old or have a qualifying child

- You have earned income of $30,000 or less

The amount of CalEITC you get depends on your household status, income, and family size.

No Social Security number? No problem! For the first time, taxpayers with an ITIN Individual Taxpayer Identification Number are eligible for the CalEITC and the YCTC when paying their 2020 taxes.

Number of qualifying children

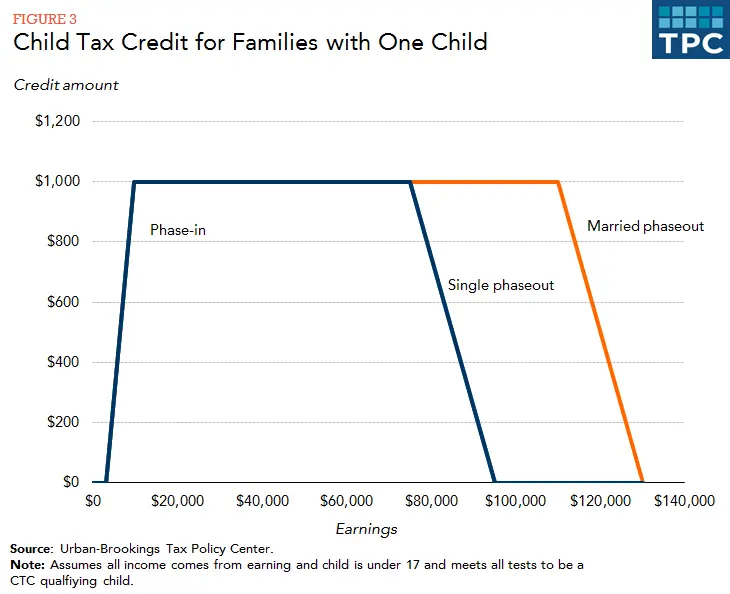

As a parent, you may qualify for other credits, too, such as the federal Child Tax Credit .

Note: ITIN holders only qualify for the CalEITC and the state YCTC, not the federal EITC or CTC.

Good to know: It does not work to add up the maximum CalEITC, YCTC and federal EITC to get the maximum amount you can get between all three credits in total, because the credits phase in and out at different income levels. Use our CalEITC calculator to see if you qualify and estimate the amount of your credit.

Was I eligible last year? Did you know you can amend tax returns up to three years back if you find out you are eligible for tax credits you didnt originally claim? Good news you can still get this refundable credit. Review the chart below to see if you may be eligible and how much you may have qualified for in 2019.

Number of qualifying children

Are You Eligible For Federal Eitc

To receive the credit, you must have income from work for your employer or someone else, work for yourself, a business or farm you own or operate, or some disability plans. And, you must either meet additional rules for workers without a qualifying child or have a child that meets all the qualifying child rules for you.

Use the EITC Assistant on www. irs.gov/EITC to see if you qualify by answering a few questions and to find out your filing status.

To claim EITC You Must Meet Certain Criteria:

- Must Work and Have Earned Income

- Must Have a Social Security Number

- Must File a Federal Tax Return:

Resources

- For answers to any questions regarding the EITC tax credit please go to the IRS website at www.irs.gov or call 1-800-829-1040.

- Volunteer Income Tax Assistance : The VITA program offers free tax preparation help to people who generally make $54,000 or less, persons with disabilities, the elderly and limited English-speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals. For more information, please visit the website at www.irs. gov or call 1-800-906-9887.

CALIFORNIA STATE QUALIFICATIONS:

Read Also: How To Appeal Cook County Property Taxes

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify forGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Do I Qualify For The California Earned Income Tax Credit

You may qualify for the California Earned Income Tax Credit if all of the following apply:

- You earned wages or business income taxable to California.

- Your federal adjusted gross income and California wages are less than $30,001.

- You, and your spouse/RDP if filing a joint return, have a valid Social Security Number that allows you to work in the United States.

- You are NOT using the filing status.

- You and your spouse/RDP were NOT nonresident aliens for any part of 2021.

- If you’re filing as a part-year or nonresident, you and your spouse/RDP lived in California for at least 183 days during the tax year.

- Your investment income taxable to California is no more than $4,053.

- If you don’t have a qualifying child, you are at least 18 at the end of the tax year.

- If you aren’t filing a joint return, you cannot be claimed as a dependent on another person’s return and cannot be a qualifying child of another person.

- Your main home was in California for more than half of 2021.

You May Like: Doordash How Much To Save For Taxes

Es Usted Elegible Para El Eitc De California

Este crédito tributario es aplicable si usted tiene ingresos laborales puede solicitar sus reembolsos de EITC aunque no tenga ninguna deuda del impuesto sobre sus ingresos. Solicitar su EITC es muy fácil. Tan solo debe presentar su declaración de impuestos del estado.

El EITC requiere que presente sus impuestos estatales y que haya recibido ingresos informados en un formulario W-2 , sujetos a las retenciones de California. Los ingresos como trabajador independiente no se pueden usar para calificar para el crédito del estado.

$1200 Income Tax Credit In California: Who Qualifies

People who receive assistance from state programs benefiting low-income families as well as people who are blind and disabled are also eligible.

California taxpayers who qualify for Californias state earned income tax credit and have an individual identification number would receive a total of $1,200 in state stimulus.

Recommended Reading: Do You Have To Pay Taxes On Donating Plasma

Check If You Qualify For Caleitc

You may qualify for CalEITC if:

- Youre at least 18 years old or have a qualifying child

- You have earned income within certain limits

The amount of CalEITC you may get depends on your income and family size.

You must:

- Have taxable earned income

- Have a valid social security number or individual taxpayer identification number for you, your spouse, and any qualifying children

- Not use married/RDP filing separate if married

- Live in California for more than half the year

Earned income can be from:

- W-2 wages

- Other employee wages subject to California withholding

Qualifying Widow Or Widower

To file as a qualifying widow or widower, all the following must apply to you:

- You could have filed a joint return with your spouse for the tax year they died. It does not matter if you filed a joint return.

- Your spouse died less than 2 years before the tax year youre claiming the EITC and you did not remarry before the end of that year

- You paid more than half the cost of for the year

- You have a child or stepchild you can claim as a relative. This does not include a foster child.

- This child lived in your home all year, except for temporary absences. Note: There are exceptions for a child who was born or died during the year and for a kidnapped child. For more information, see Qualifying Child Rules, Residency.

Related:

You May Like: Does Doordash Provide W2

The California Earned Income Tax Credit

The California Earned Income Tax Credit is now available for more families this year. This cash-back credit is designed to put money in the pockets of low-income working families and individuals.

If you qualify for the CalEITC and the amount of the credit is greater than the tax you owe, you will receive a refund.

Qualifications

- You must file a state tax return, even if you do not owe any tax or are not otherwise required to file.

- You must have earned income from W-2 wages, salaries, tips, or other employee compensation subject to California withholding.

- You, your spouse, and any qualifying children must each have a social security number issued by the Social Security Administration that is valid for employment.

- You must file using the single, married/registered domestic partner filing jointly, or head of household filing status. The “married/RDP filing separately” status may not be used.

- You must either:

- Meet the rules for those without a qualifying child or

- Have an individual that meets all of the qualifying child rules for you or your spouse if you file a joint return.

How To Claim The California Earned Income Tax Credit

The first few months of every new year seems to be dragged down by the necessity of preparing tax returns and the feeling of becoming poorer by the minute. To ease some of the federal burden, the IRS created an earned income tax credit that was implemented in 2013. California taxpayers, who are in a state where the tax burden is higher than average, were provided a state earned income tax credit starting with the 2015 tax year.

Read Also: Restaurant Tax In Philadelphia

Who Qualifies For California Earned Income Tax Credit

4.8/5California

Also question is, do I qualify for California Earned Income Tax Credit?

To qualify, you must have income from employment, self-employment, or employer-paid disability benefits received prior to retirement. There is no limit to the number of times you can claim an EITC you can claim one every year that you qualify.

One may also ask, how much do you get back in taxes for a child 2019 in California? The Young Child Tax Credit was introduced in tax year 2019. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year, you may qualify for up to $1,000 through this credit.

Keeping this in view, how do you qualify for the Earned Income Tax Credit?

To qualify for and claim the Earned Income Credit you must:

What does FTB EITC mean?

Eligibility. The Earned Income Tax Credit is designed to assist people with limited incomes by reducing the amount of federal income tax they owe. The credit can be claimed when filing your annual federal tax return.

California Earned Income Credit

If you made less than $13,870 last year, then you may be eligible for the California Earned Income Tax Credit , Californias new cash back tax credit.

Made more than $13,870? If you made up to $53,267, you may qualify for the federal Earned Income Tax Credit.

CalEITC4Me is here to help you learn how to get more cash back in your pocket this tax season. The website CalEITC4Me.org has all the information you need to find out if you are eligible and how to claim the tax credits for free.

All you have to do is: Find out if you are eligible and for how much with the CalEITC4Me Calculator at: CalEITC4Me.org/Earn-It/ If you made $54,000 or less last year, search by city or zip code to find free help to file for free with the free tax prep finder at: CalEITC4Me.org/Get-It/ Watch the latest videos about CalEITC and the free tax prep finder:

File your tax returns by April 18, 2016. Dont let this money go unclaimed you can only get your cash back tax credits if you file!

Like CalEITC4Me on and follow on to get new information this tax season.

Recommended Reading: How Does Taxes Work For Doordash

Who Will Get The $600 Relief Payments

The bulk of the $600 payments are directed to those who were hardest hit by the pandemic. These were people with low to moderate incomes who qualify for the California earned income tax credit on their tax returns. In general, those are people who make $30,000 per year or less.

The money will also go to people who earn under $75,000 per year and use an individual taxpayer identification number to file their income taxes, including immigrants. This group was left out of the stimulus checks from the federal government in the CARES Act and the December covid-19 relief bill because they dont Social Security numbers.

Invest In Caleitc Outreach And Free Tax Preparation Services

Promoting the CalEITC is critical to its success. The CalEITC targets very poor households, a hard to reach population who are struggling to make ends meet every day and are mostly not required to file state taxes unless they want to claim their credit. A survey conducted by the California Budget and Policy Center found that fewer than 1 in 5 people who were likely eligible for the CalEITC had even heard of the credit. The Franchise Tax Board acknowledged that households will churn on and off the income eligibility threshold for CalEITC, thereby making ongoing outreach efforts particularly important. Efforts to raise awareness of the CalEITC are critical to ensuring as many eligible families as possible benefit from the credit. Promoting the state EITC also provides a great opportunity to increase participation in the federal EITC, which would draw millions of dollars into the state, help low-income working families better support themselves, and boost local economies.

California should fund robust outreach and increased capacity in free tax-preparation services throughout the state by continuing the CalEITC Education and Outreach Grant Program administered by the Department of Community Services and Development at a funding level of $9 million to ensure outreach resources are sufficient to meet the needs and that free tax prep assistance is there for those who want to access it.

Recommended Reading: Doordash File Taxes

Earned Income Tax Credit

El Crédito Tributario por Ingreso de Trabajo es un beneficio monetario para personas que trabajan y tienen ingresos bajos a moderados. Si usted es elegible para este crédito tributario, podrá conservar el dinero que le corresponde. Si califica para el EITC federal, también puede calificar para el mismo crédito tributario que se ofrece en California. Estos están diseñados para devolver dinero a las personas de bajos ingresos que son la columna vertebral de nuestro país y nuestro estado.

REQUISITOS A NIVEL FEDERAL:

Why Consider An Eitc

Many working families with children struggle to make ends meet on low wages. A full-time job at the federal minimum wage yields about $15,000 often insufficient income for a family to afford basic necessities. The EITC, a federal tax credit for people earning low and moderate pay, boosts income and improves the outlook for children in low-income households. It also helps women and communities of color two groups that disproportionately work in low-wage jobs see more of the fruits of their labor and share more fully in the benefits of economic growth. State lawmakers can build on the proven effectiveness of the federal EITC to help address low wages with a state-level credit. Like the federal EITC, state EITCs:

| Follows a separate schedule, credit between $300-$2,000 based on family sizem | Yes |

a Californias credit is available to working families and individuals with wage income below $30,000 depending on family size. The credit is worth 85 percent of a households federal EITC until household income reaches half of the level at which the federal credit is fully phased in it then begins phasing out at varying rates, depending on family size. In 2019, the maximum credit ranges from $240 for workers without dependent children to about $3,000 for workers with three or more children, plus a new $1,000 Young Child Tax Credit for families with children under 6. The value of the credit is set each year by the legislature.

Read Also: Doordash Tips Taxable

Are You Eligible For Californias Eitc

This cash-back credit is applicable if you have work income, you can file and claim your EITC refunds, even if you dont owe any income tax. Claiming your EITC is easy. Just file your state tax returns.

California EITC requires filing of your state return and having earned income reported on a W-2 form subject to California withholding. Self-employment income cannot be used to qualify for state credit.

You qualify for Cal EITC for the 2017 tax year if:

- You have wages, self-employment income and adjusted gross income within certain limits

- You, your spouse, and any qualifying children each have a Social Security Number issued by the Social Security Administration that is valid for employment

- You do not use the married/RDP filing separately filing status

- You lived in California for more than half the tax year.

This year the California EITC is bigger and better. Starting with the 2017 tax year, families earning up to $22,300 may qualify for CalEITC, which is a dramatic increase of the upper income limit over past years. Also those who earned self-employment income in 2017 may qualify. For the 2017 tax year, this credit is available to California households with adjusted gross incomes of up to $15,008 if there are no qualifying children, up to $22,322 if there is one qualifying child, up to $22,309 if there are two qualifying children, and up to $22,302 if there are three or more qualifying children. See below the chart for specific EITC credit information.

Resources