I Owed State Income Taxes Last Year

Are you wondering, Can I deduct state income tax on federal return? In that case, you need to learn what your options are.

The IRS allows for multiple types of non-business tax deductions, and state, local as well as foreign income tax deductions are among them. If you paid state income taxes, the IRS allows you to deduct state taxes from federal returns, given certain criteria are met. However, if you live in one of nine states where residents do not pay income tax, then you might be able to deduct state sales tax instead.

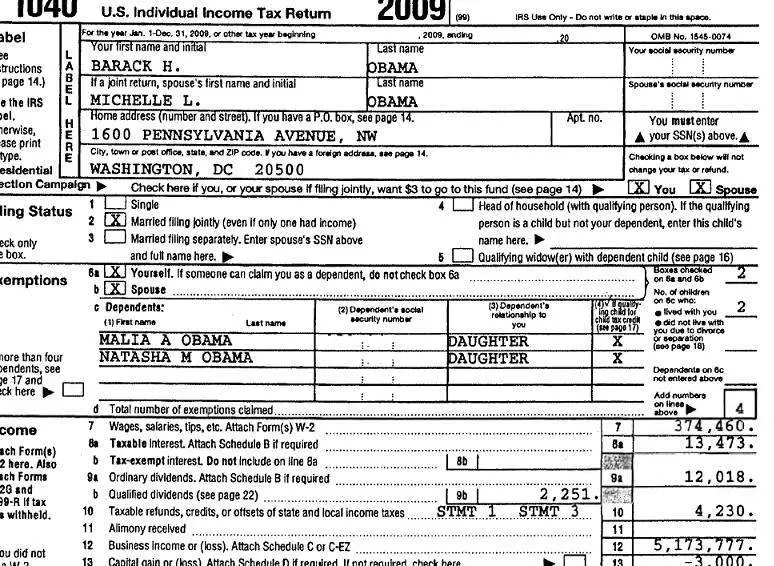

Either way, in order to deduct these state taxes, you must itemize your deductions on IRS Form 1040, Schedule A. Its also worth noting that the IRS does not allow you to claim both state income and sales or local taxes on the same return.

Read More:Form 1040: What You Need to Know

Liability For The Elective Tax

The Qualified Entity pays the Elective Tax on the sum of the allocable share of income of all Qualified Owners that have consented to the Election. Given that the Qualified Entity is liable for the Elective Tax, the non-consenting owners of the Qualified Entity will want to make sure that the Elective Tax is borne solely by the consenting Qualified Owners, either through one or both an offset of distributions to them or an indemnity from them in case the Elective Tax exceeds such distributions, as often occurs with so-called phantom income.

What Do State And Local Taxes Pay For

As long as the taxes don’t directly contradict the Constitution, such as by imposing a poll tax to provide election services, then states can provide public services and impose taxes as they see fit to provide for them. Schools, police, firefighters, roads, and public parks are all examples of things that taxes pay for. Check with your state treasury or local authorities for more information about how your tax dollars are spent.

You May Like: Csl Plasma Taxes

Why Federal Charitable Deductions Are No Longer Available To Most Taxpayers

The charitable deduction is not gone from the federal tax code, but it has been rendered mostly useless for all but the wealthiest or most generous taxpayers. The reason is the doubling of the standard deduction that Congress included in its 2018 overhaul of the U.S. Tax Code .

The standard deduction is now set at $12,000 for people who file an income tax returns as singles and $24,000 for married couples who file jointly. That dollar amount is high enough that the vast majority of U.S. taxpayers have no reason to keep track of and itemize their deductions.

No itemization, no sense tallying up one’s gifts to charitycharitable donations are, after all, on the list of potential itemized deductions.

The one exception is found in theCoronavirus Aid Relief and Economic Security Act of 2020. It was passed by Congress in response to the COVID-19 pandemic, and includes a new universal deduction for charitable contributions. Taxpayers who do not itemize may now deduct up to $300 per year in charitable contributions, on the condition that these donations are made in cash , and to a 501 public charity. Contributions to nonoperating private foundations, support organizations, and donor advised funds also don’t count.

How To Deduct Sales Taxes On Business Purchases

Sales taxes you pay for items you purchase for business are deductible if the purchase itself was a deductible business expense. You don’t need to be separated out these taxes are considered as part of the cost of the item. Just include the total amount you paid, including the tax. For a large item purchase, like a car, the sales tax is determined separately check with your tax professional to see how to handle this.

You May Like: How To File Doordash Taxes

Rules For The Salt Deduction

All income taxes that are imposed by a state or local jurisdiction can be deducted, subject to a few rules. First, you must itemize your deductions on Schedule A to claim them. This means foregoing the standard deduction, which is often more than the total of a taxpayer’s itemized deductions for the tax year.

Make sure that your itemized deductions, including all other deductions you’re qualified to claim in addition to state and local tax deductions, exceed the standard deduction for your filing status, or itemizing can actually cost you tax dollars.

The Tax Cuts and Jobs Act virtually doubled standard deductions for every filing status when it went into effect in 2018, so it might be less likely that the total of all your itemized deductions will exceed these amounts for tax year 2021, the tax return you’ll file in 2022:

- $12,550 for single filers and those who are married filing separately

- $18,800 for heads of household

- $25,100 for married taxpayers who file jointly

In tax year 2022, filed in 2023, the deductions will increase to:

- $12,950 for single filers and those who are married filing separately

- $19,400 for heads of household

- $25,900 for single fliers and those who are married filing separately

The tax must be imposed on you personally. You can’t claim a deduction for income taxes paid on behalf of one of your dependentsand in some cases, even by your spouse. You must have paid them during the tax year for which you’re filing.

Federal Income Taxes Are Not Deductible

The IRS is very clear on this: You cannot deductfederal income taxes These are the taxes you pay on your business income, and you can’t deduct the taxes you paid the IRS.

In general, the IRS says,

“You can deduct various federal, state, local and foreign taxes directly attributable to your trade or business as a business expense.”

Your state income taxes may be deductible, depending on your business type and your state. Corporations, S corporations, and partnerships deduct state income taxes on the business return. If you are filing a Schedule C for your business, you can’t deduct state income taxes on this form, but you can deduct sales taxes on your personal tax return .

Don’t Miss: What Can I Write Off On My Taxes For Instacart

Pay Nothing Out Of Pocket Use Your Federal Refund To Pay For Turbotax Learn More

TurboTax CD/download also available

- Earned Income Tax Credit

- Child tax credits

- Student Loan Interest deduction

States Offering Tax Incentives For Charitable Giving

This federal tax change created a good deal of concern within the nonprofit sector. Early predictions were that charitable giving could be reduced by an estimated $17.2 billion in total per year .

In response, various states have been looking into legislation to create a state-tax based incentive for making gifts to charity. It also happens that some states have separate charitable deduction laws on their books, or basically track the federal code and don’t have any disincentives to claim the deduction. Let’s look, for example, at California, Minnesota, and Colorado.

See a tax professional for more detailed information.

Also Check: Doordash Pay Taxes

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

What Is The State And Local Tax Deduction

First off, remember that a tax deduction is basically any expense that can be used to lower your taxable income. Specifically, the state and local tax deduction allows you to deduct up to $10,000 of your state and local property taxes, as well as your state income or sales taxes.1

The state and local tax deduction allows you to deduct up to $10,000 of your state and local property taxes, as well as your state income or sales taxes.

Wait, wait, hold upstate income or sales taxes? Yep. Unfortunately, you cant deduct both state income and sales tax . You can combine property and sales taxes or you can combine property and income taxes, but not all three. Deciding which combination works best for your tax return is a part of the fun of taking this tax deduction .

Recommended Reading: Doordash Write Offs

Effective Income Tax Rates

Effective tax rates are typically lower than marginal rates due to various deductions, with some people actually having a negative liability. The individual income tax rates in the following chart include capital gains taxes, which have different marginal rates than regular income. Only the first $118,500 of someone’s income is subject to social insurance taxes in 2016. The table below also does not reflect changes, effective with 2013 law, which increased the average tax paid by the top 1% to the highest levels since 1979, at an effective rate of 33%, while most other taxpayers have remained near the lowest levels since 1979.

| Effective federal tax rates and average incomes for 2010 |

|---|

| Quintile |

Trouble In Paradise For S Corporations

S corporations have a number of problems with AB 150, as outlined below.

Will the S Corporation be Respected?

Given the massive tax benefit of the Election, there will be a mad rush for every service provider that can afford it and is willing to risk it to form an S corporation and attempt to run their income through the S corporation. This, in turn, will put enormous pressure on the boundary of the appropriate use of loan-out corporations, and it can be expected that federal and state tax authorities will not respect the use of such loan-out corporations when the substance of the relationship to the payor is that of employer-employee. This is particularly true in California, where prior legislation treats almost all service providers as employees if they render services in the regular course of business of the payor, which has the net effect of disregarding certain loan-out corporations. There will be a mountain of tax-related litigation on this issue as executives attempt this strategy.

Requirement of Paying Reasonable Compensation

The second problem is that S corporations, unlike partnerships, are required to pay reasonable compensation to their shareholders, and such compensation does not qualify for the Election. Thus, there will be enormous pressure for S corporations to reduce the amount of compensation they pay their shareholders, and this will be another fertile area for litigation by tax authorities.

The 1.5% California Tax on S Corporations

Associated People

Read Also: Doordash Tax Percentage

Example Of A Tax Computation

Income tax for year 2017:

Single taxpayer making $40,000 gross income, no children, under 65 and not blind, taking standard deduction

- $40,000 gross income â $6,350 standard deduction â $4,050 personal exemption = $29,600 taxable income

- amount in the first income bracket = $9,325 taxation of the amount in the first income bracket = $9,325 Ã 10% = $932.50

- amount in the second income bracket = $29,600 â $9,325 = $20,275.00 taxation of the amount in the second income bracket = $20,275.00 Ã 15% = $3,041.25

Note, however, that taxpayers with taxable income of less than $100,000 must use IRS provided tax tables. Under that table for 2016, the income tax in the above example would be $3,980.00.

In addition to income tax, a wage earner would also have to pay Federal Insurance Contributions Act tax :

- $40,000

- $40,000 Ã 6.2% = $2,480

- $40,000 Ã 1.45% = $580

Total federal tax including employer’s contribution:

- Total FICA tax contributed by employer = $3,060

- Total federal tax of individual including employer’s contribution = $3,973.75 + $3,060.00 + $3,060.00 = $10,093.75

Missouri’s Federal Income Tax Deduction

Missouri allows a deduction for your federal income tax liability resulting from your federal tax return, but any alternative minimum tax you’re liable for must be subtracted. You must also subtract the amount of certain refundable credits you received.

The deduction you can take is the amount of federal tax you actually paid according to your federal Form 1040. You must file a federal tax return to find this amount, rather than using the amount of federal tax withheld by your employer on your W-2.

Don’t Miss: Does Doordash Withhold Taxes

Documents You’ll Need For Filing

Payments of state and local income taxes can show up on a variety of different documents. Keep copies of your checks or your bank statements showing the debits from your account when you pay estimated taxes to your state or municipality.

State taxes can also show up on various documents related to tax withholding. Keeping a record of all this paperwork will help you maintain a tally of how much you can deduct, up to the TCJA limit. These documents should show how much state or local tax you paid during the year:

All Turbotax Products Include

- 100% accuracy guaranteed

Our calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

- Maximum refund guaranteed

We search over 350 deductions & credits to find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

- Get the green light to file

CompleteCheck will run a comprehensive review of your return before you file so nothing gets missed.

You May Like: Florida Transfer Tax Refinance

Should You Take The Salt Deduction

Heres the deal. As we talked about above, the SALT deduction limit for 2020 is capped at $10,000. Since the standard deduction is higher than that, you have to find additional deductions, beyond the SALT deduction, to make itemizing your tax deductions even worth it.

That doesnt mean it cant be doneyou can still deduct donations to charity, medical expenses and mortgage interestbut it does mean you have to do some math.

Video: How To Claim State Taxes On A Federal Tax Return

OVERVIEW

Do you live in a state that imposes an income, sales, real estate or personal property tax? If you make payments for any of these taxes, you should know that the IRS may let you deduct them on your federal tax return. Watch this tax tips video from TurboTax for more information on how to claim state taxes on your federal tax return.

You May Like: Reverse Ein Lookup Irs

Still Feeling Unsure Talk To A Tax Pro

If youre confident you can handle your own taxes and just want easy-to-use tax software , check out Ramsey SmartTaxwe make filing your taxes easy and affordable.

But if youre still considering itemizing your deductions, or youve got a morewell, saltytax situation, you shouldnt let any eligible tax deduction go unclaimed. Thats why we recommend working with a reliable tax pro. Truth is, missing out on deductions could end up costing you more than it would to work with a pro.

Our tax Endorsed Local Providers will make sure you get every tax deduction and credit you deserve. Theyve got years of experience and can walk you through your tax filing with confidence.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Here’s Some Help On How To Choose Whether To Deduct The State And Local Income Taxes You Paid For The Year Or The State And Local Sales Taxes You Paid

If you itemize your deductions and live in one of the 43 states with income taxes, you have the option of deducting either the state and local income taxes you paid for the year or the state and local sales taxes you paid, up to a $10,000 annual cap. You can’t deduct both: You must choose between income tax and sales tax. As a general rule, you should deduct whichever is more. However, because of the annual cap, in some cases it won’t make any difference which tax you choose to deduct. First, you have to figure out how much state income tax and sales tax you paid.

Don’t Miss: Where To Mail New York State Tax Return