Jackson Hewitt Refund Advance Loans

Like its top competitors, Jackson Hewitt promotes no-fee, 0% APR refund-advance loans that are repaid from your federal refund. Loan amounts are offered from $500-$3,500 loans are available through Jan. 15. The loan, called the No Fee Refund Advance, is open to customers who file their taxes through Jackson Hewitt. Like H& R Block, you have to visit a brick-and-mortar office in order to apply.

Jackson Hewitt says those with approved loans may receive their funds, via a Serve American Express Prepaid Card, within a matter of minutes. Loan eligibility is determined by a number of criteria, including your history of IRS payments.

Help With Unemployment Benefits And How To File Your Taxes

We understand that you may have a lot on your plate right now. Where your taxes are concerned, H& R Block is here to help. Be sure to visit our Unemployment Tax Resource Center for help with unemployment related topics.

Free tax filing with unemployment income: You can include your Form 1099-G for free with H& R Block Online Free.

Worried your taxes are too complex for H& R Block Free Online? Check out Blocks other ways to file.

Related Topics

Finding your taxable income is an important part of filing taxes. Learn how to calculate your taxable income with help from the experts at H& R Block.

I Received A Form 1099

If you claimed itemized deductions on your federal return and received a state refund last year, you will receive a postcard size Form 1099-G statement. This form shows the amount of the state refund that you received last year but does not mean that you will receive an additional refund. Generally, your State income tax refund must be included in your federal income for the year in which your check was received if you deducted the State income tax paid as an itemized deduction on your federal income tax return. Please view the Frequently Asked Questions About Form 1099-G and Form 1099-INT page for additional information about Form 1099-G and Form 1099-INT.

Read Also: What Does It Mean To Amend Your Taxes

Payment Options For Corporate Income Tax

Form BIT-V: If your payment is less than $750, you can remit your payment by check or money order. Make check or money order payable to: Alabama Department of Revenue. Include on the check: the corporations federal employer identification number or the Alabama Affiliated Groups federal employer identification number for 20C-C filers, the form type or type of payment , and the tax year end. The check or money order must be remitted along with a complete Form BIT-V, Alabama Business Income Tax Voucher to ensure proper posting of the payment.

Electronic Payments: For payments that are $750 or more, the payment must be made electronically. The payments can be made electronically through the following options:

If I Owe The Irs Or A State Agency Will I Receive My Nc Refund

In some cases debts owed to certain State, local, and county agencies will be collected from an individual income tax refund. If the agency files a claim with the Department for a debt of at least $50.00 and the refund is at least $50.00, the debt will be set off and paid from the refund. The Department will notify the debtor of the set-off and will refund any balance which may be due. The agency receiving the amount set-off will also notify the debtor and give the debtor an opportunity to contest the debt. If an individual has an outstanding federal income tax liability of at least $50.00, the Internal Revenue Service may claim the individual’s North Carolina income tax refund. For more information, see G.S. §105-241.7 and Chapter 105A of the North Carolina General Statutes.

You May Like: Where Can I Find Tax Forms

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

How Do I Get My Refund

One of the ways the IRS tries to convince you to file online is to assure you that you will get your refund faster in less than 21 days, in most cases, although there are exceptions. Once youve filed, you can check the status of your refund online. You can also mobile app, which allows you to check the status of your refund, pay your taxes, and get other information.

Don’t Miss: What To Take To Get Taxes Done

What Banks Are Affiliated With Jp Morgan Chase

We trace our roots to 1799 in New York City, and our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First National Bank of Chicago, National Bank of Detroit, The Bear Stearns Companies Inc., Robert Fleming Holdings,

How Much Interest Does The Irs Owe Me

If you filed a proper return on time and the IRS does not issue your refund within 45 days after accepting it, the agency is required to start paying interest on your refund amount.

As of July 1, the interest rate rose from 4% to 5% as a result of the Federal Reserves recent decision to raise the federal funds rate. If you electronically filed on time, the 45-day period started on April 18. If you filed a paper return, it began the day that the IRS marked your return as accepted.

Of course, any IRS interest you receive with your refund is considered taxable income.

Also Check: How To Get Less Taxes Taken Out Of Paycheck

How To Track Your State Tax Refund

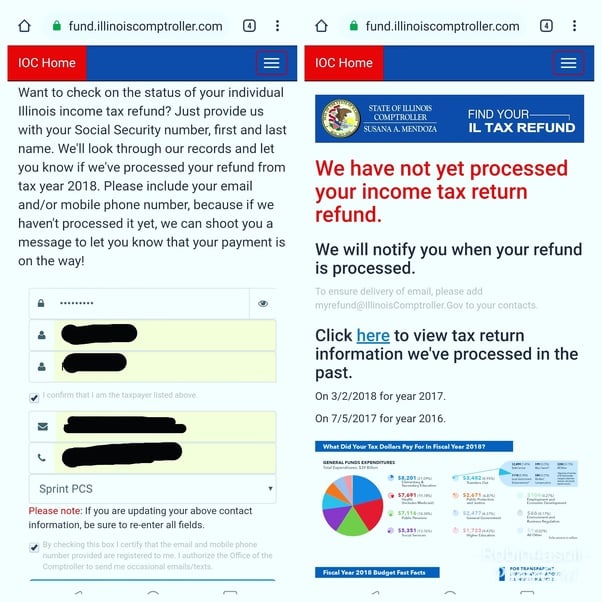

State taxes work a little differently than federal taxes, because each state manages their system a little differently. To check the status of your state tax refund, youll need the same information you need to check your federal tax refund: your Social Security number and your refund amount.

Your states tax website should have an option on the page to track your taxes, similarly to the federal system. Most states pages will say Wheres My Refund? Follow the prompts there to track your state tax refund.

The amount of time it takes to get your refund also varies by state, and some take several weeks. Once youve crossed the amount of expected time it takes, then you potentially have the option to call your state tax office to locate your return, get a status update and an idea of when you might receive your refund. You can find all this information on your states local tax page.

Set Up A Payment Plan

The IRS offers payment plans if you cant pay all or even anything you owe right away. The important thing is that you dont ignore your plight, hoping that it will go away, because it wont.

You can set up a monthly installment agreement with the IRS, allowing you to pay what you owe over time. You can even decide how much you want to pay per month, at least to some extent. The entire balance has to be paid off within 72 months, so your minimum payment would be what you owe divided by 72. Leave some room for interest and penalties when youre making your calculations.

Youre not prohibited from paying more than the amount youve committed to in any month, and you can retire the debt sooner and minimize interest charges by doing so.

The IRS will still charge the late-payment penalty as well as interest, and theres a one-time processing fee to set up the plan$149 as of 2021. But if you apply for the installment agreement online, and if you agree to have the monthly amount taken from your bank account by direct debit, this one-time processing fee drops to $31. Direct debit is required if you owe more than $25,000.

You dont have to qualify for the installment agreement by submitting a collection information statement to prove your assets and income, at least not if you owe less than $50,000. You can apply online using the Online Payment Agreement Application on the IRS website.

Read Also: How To File Previous Years Taxes For Free

How To Know Your Stimulus Check Status

The IRS created a website to track the status of your stimulus payment. It no longer tracks your payment status on either of the three checks as of writing this in 2023. When the status website worked, you could check:

- If your payment had been processed. The IRS specified whether it had sent your check, the date issued, and whether the money would be directly deposited or mailed.

- If your status read Payment Not Available. The IRS indicated whether it hadnt yet processed your payment or you werent eligible for one.

- If it reads Need More Information. The IRS specified whether your check was returned to the IRS after an attempted delivery. You could then provide your bank account information to receive your money.

To get your check, you had to file the specified tax return.

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

You May Like: How Much Taxes Will I Have To Pay

Heres Where You Want To Send Your Forms If You Are Not Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Florida, Louisiana, Mississippi, Texas: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0014

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Department of the Treasury, Internal Revenue Service, Fresno, CA 93888-0014

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0014

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0014

Heres How Taxpayers Can Check The Status Of Their Federal Tax Return

IRS Tax Tip 2021-70, May 19, 2021

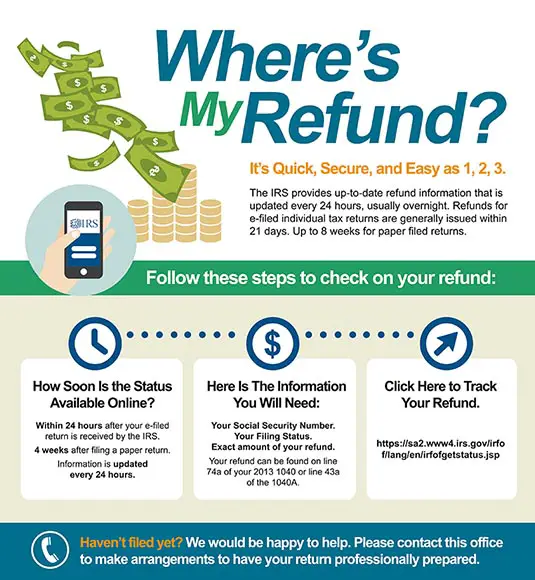

The most convenient way to check on a tax refund is by using the Where’s My Refund? tool. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. The tool also provides a personalized refund date after the return is processed and a refund is approved.

Read Also: Is It Too Late To File Income Tax

Make Irs Payments In Installments

How it works: If you cant pay your tax bill in full when its due, you can get on a payment plan with the IRS. There are two types of plans: short-term and long-term .

Cost: $0 to $225, depending on the plan you select, how you enroll and whether youre a low-income taxpayer

Pros:

-

Sign up online fairly easily on your own .

-

Most taxpayers qualify.

With Electronic Funds Withdrawal

You can usually set up a direct debit from your checking account if you use tax preparation software to e-file your return, either on your own or through a tax professional. This option involves entering your bank account and routing numbers into the program, but its only available to taxpayers who e-file.

IRS Tax Tip 2021-50, April 14, 2021

The May 17 deadline for individuals to file and pay their federal income tax is fast approaching. While paying taxes is not optional, people do have options when it comes to how they pay taxes. The IRS offers a variety of ways to pay taxes.

Some taxpayers must make quarterly estimated tax payments throughout the year. This includes sole proprietors, partners, and S corporation shareholders who expect to owe $1,000 or more when they file. Individuals who participate in the gig economy might also have to make estimated payments. The deadline to pay estimated taxes remains April 15, 2021.

You May Like: What Is The Minimum Amount Of Income To File Taxes

How Long Will You Have To Wait For Your Federal Refund

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,according to its website.

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once its been processed.

Will My Tax Refund Be Delayed

Don’t expect the tax season to sail along smoothly, even though the expectation is that things could be better than last year.

When the IRS processes returns this year, it’s quite likely that fewer complications and mistakes should crop up and delay your refund because we’re no longer looking at some complicated pandemic-related tax breaks, such the enhanced child tax credit and the recovery rebate credit.

The IRS has made progress dealing with its pandemic-related backlog. But the agency still has many unprocessed returns that will clog and challenge the system, triggering potential delays for some refunds on returns filed this year. The IRS said Thursday that its work on the backlog will not impact the timing of tax refunds for people filing in 2023, but the IRS continues to urge people to make sure they submit an error-free tax return this tax season to avoid delays.

The IRS isn’t typically going to correspond with taxpayers in many of these situations, but the agency notes that special handling means it will take the IRS more than 21 days to issue any related refund.

“If we can fix it without contacting you, we will,” the IRS states.

If more information is needed, a letter is sent. Resolution of some issues could take more than 120 days depending on how quickly and accurately the taxpayer responds, and how quickly the IRS can complete processing the return.

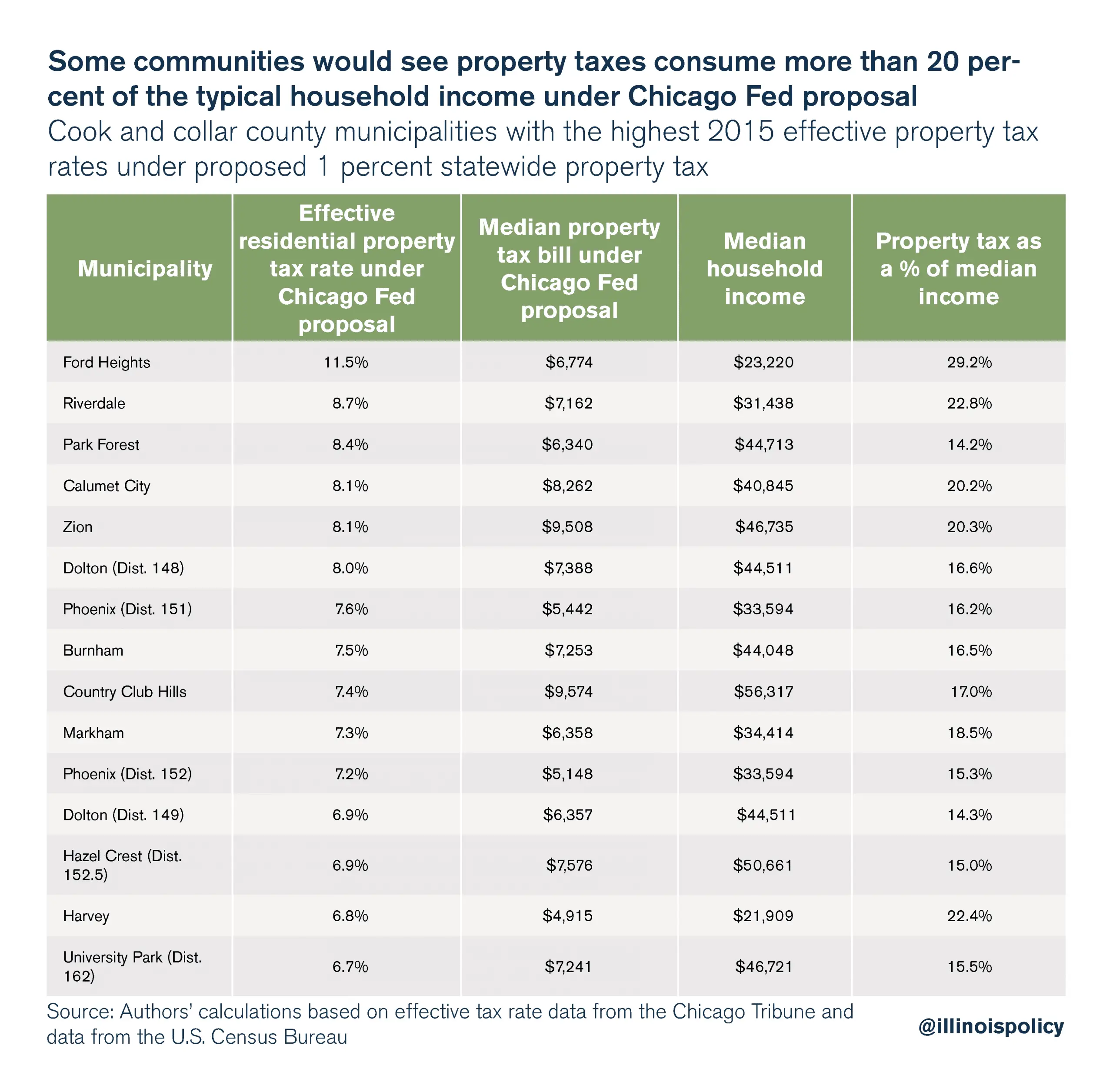

Read Also: How To Calculate Property Tax

Electronic Federal Tax Payment System

You can also pay your tax bill using the governments Electronic Federal Tax Payment System . Youll use your Social Security number or Individual Taxpayer Identification Number , a personal identification number , an internet password, and a secure browser to make a payment through this system. It can take up to five days to process your enrollment in this service, and you can complete the initial paperwork online or over the phone. With EFTPS, you can schedule payments up to 365 days in advance, and youll receive an immediate confirmation upon payment.

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include Surviving Spouse and Deceased next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Also Check: Do I Have To Pay Taxes On My Unemployment

Policy Basics: Where Do Our Federal Tax Dollars Go

The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is important to examine what the government does with the money it collects.

In fiscal year 2022, the federal government is estimated to spend $5.8 trillion, amounting to 23.5 percent of the nations gross domestic product . Of that $5.8 trillion, over $4.8 trillion is estimated to be financed by federal revenues. The remaining amount will be financed by net borrowing. As the chart below shows, three major areas of spending make up the majority of the budget:

Three other categories together account for one-quarter of spending:

As the chart above shows, the remaining federal spending supports a variety of other public services. A very small slice 1 percent of the budget goes to programs that operate internationally, including programs providing humanitarian aid and maintaining U.S. embassies and consulates. The rest includes investing in education, investing in basic infrastructure such as roads, bridges, and airports maintaining natural resources, farms, and the environment investing in scientific and medical research enforcing the nations laws to promote justice, and other basic duties of the federal government.