Should A Return Be Filed Even If Not Required

Even if your child does not meet any of the filing requirements discussed, he or she should file a tax return if income tax was withheld from his or her income, or he or she qualifies for the earned income credit, additional child tax credit, health coverage tax credit, refundable credit for prior year minimum tax, first-time home buyer credit, adoption credit, or refundable American opportunity education credit. See the tax return instructions to find out who qualifies for these credits. By filing a return, your child can get a refund.

When Can You Start Filing Taxes For 2021

Starting next Monday, Jan. 1, the Internal Revenue Service will begin accepting and processing 2021 tax returns. Due to an early start date of the current tax season, this is 17 days earlier than the late start date for the previous one. In case you still need it, you might need to have certain items together.

The Irs Interactive Tax Assistant

There are a series of questions you should answer to help you determine the minimum income amount that applies to you. Lets start with the IRS questionnaire found on their do you need to file page. This questionnaire is provided through the IRS interactive tax assistant , which is a remarkably easy-to-use program found on the IRS website.

The questions are designed to help you determine whether you need to file a federal tax return and if you need to adjust your Form W-4 to eliminate tax withholding.

The IRS has stated that they want to help eliminate wasted time and money from returns that are filed when they dont need to be. I recommend that you take them up on that offer and work through the questions.

According to the IRS website, answering these questions should take you no longer than 10-15 minutes. This is certainly worth your time, especially if it saves the time it would take you to file or if it saves you from having money withheld unnecessarily.

Also Check: Does Doordash Tax You

Other Situations In Which You’ll Need To File A Tax Return

According to the IRS, you must also file a tax return if, for example:

- You are self-employed and had net earnings of at least $400 in 2020

- You owe any special taxes

- You earned $108.28 or more from a “church or a qualified church-controlled organization that is exempt from employer social security and Medicare taxes”.

When Social Security Benefits May Be Taxable

When determining whether you need to file a return and you receive Social Security benefits, you need to consider tax-exempt income because it can cause your benefits to be taxable even if you don’t have any other taxable income.

Here’s an example of where you may need to file, even with tax-exempt income:

- You are under age 65 and receive $30,000 in Social Security benefits, but also receive another $31,000 in tax-exempt interest. $14,700 of your Social Security benefits will be considered taxable income.

- This is greater than your standard deduction and you would need to file a tax return.

To figure out if your Social Security benefits are taxable:

- Add one-half of the Social Security income to all other income, including tax-exempt interest.

- Then compare that amount to the base amount for your filing status.

- If the total is more than the base amount, some of your benefits may be taxable.

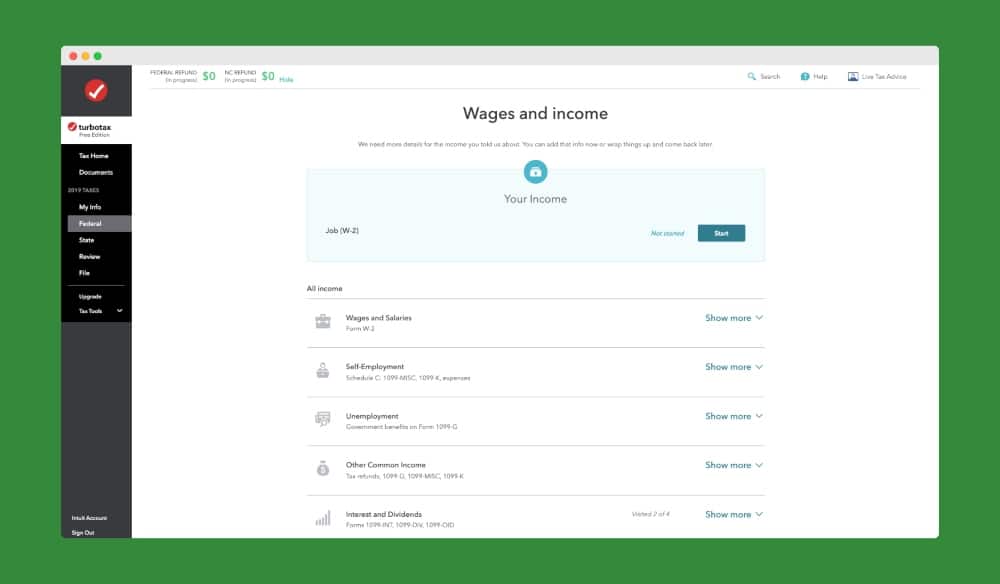

TurboTax can help you estimate if you’ll need to file a tax return and what income will be taxable.

Also Check: Do You Get Taxed For Doordash

Build Up Your Rrsp Contribution Room

Even if you only earned a small amount of employment income, filing your return builds your future RRSP contribution room. Your RRSP contribution room is increased by 18% of the earned income you report on your tax return. For example, if you report $10,000 of employment income on your 2020 return, youll be able to contribute $1,800 more to your RRSP the following year. Even if you dont want to contribute to an RRSP right now, the extra $1,800 you can contribute might be useful in the future.

Unsure which filing option is right for you?

How A Negative Tax Bill Could Turn Into A Refund

Consider this example of a woman who doesn’t owe federal income tax and will likely end up with a refund:

Amy is a single mother who earned $20,000 in 2021. The standard deduction for a head of household filer of $18,800 reduces her taxable income to $1,200, which places her in the 10% tax bracket . Her tax bill comes out to $120.

If she qualifies for the earned income tax credit , a subsidy for low-income working families, she can reduce her tax bill by up to $3,618, the maximum for a family with one child in the 2021 tax year. She may also claim the child tax credit , which allows her to apply a credit of up to $1,500 or $1,800 to her tax bill, depending on the age of her child, assuming she collected the six advance payments in 2021.

Amy will end up with a negative final tax bill, and since EITC and CTC are refundable, she’ll receive the credits as cash.

Not “losing” a portion of your paycheck to taxes may sound nice to some, but it’s not a luxury. Millions of Americans don’t owe taxes on their income and aren’t required to file a tax return because they don’t earn enough money.

Those who hold a job are still subject to payroll taxes, which support Social Security, Medicare, and unemployment insurance. And some taxes are certain for everyone, regardless of income, including sales taxes, excise taxes, and property taxes.

Also Check: Is Money From Donating Plasma Taxable

Filing To Report Self

Your child can report income from self-employment using Form 1040 and Schedule C . If your child has a net self-employment income of $400 or more , the child must file a tax return.

To determine if your child owes self-employment taxes , use Schedule SE. Your child may have to pay self-employment taxes of 15.3%, even if no income tax is owed.

Qualifying Rules If You Can Be Claimed As A Dependent

You must file a tax return for 2020 under any of the following circumstances if you’re single, someone else can claim you as a dependent, and you’re not age 65 or older or blind:

- Your unearned income was more than $1,100.

- Your earned income was more than $12,400.

- Your gross income was more than $1,100, or $350 plus your earned income up to $12,050, whichever is greater.

Married dependents who are not age 65 or older or blind are subject to these filing requirements plus one more: They must file if their gross income was at least $5, and their spouse files a separate return and itemizes deductions.

Also Check: Doordash How Much To Save For Taxes

The Canada Employment Amount: Another Tax Credit

You can claim the Canada employment amount if you reported employment income for the year . This amount is designed to help Canadians with some of their work-related expenses such as uniforms, home computers, and supplies they needed to do their job.

In 2020, youll be able to claim $1,245 or the total of the employment income that you reported on your return . If youre a resident of the Yukon and youre eligible for the federal amount, you can also claim an additional $1,245 against your taxes!

Keep in mind, you wont be able to claim this credit if youre only reporting self-employment income. Youll need to report income from a T4 slip to be eligible for the Canada employment amount.

What Determines Who Must File A Tax Return

- You owe tax to the CRA.

- You are self-employed and have to pay your Canada Pension Plan premiums.

- Same for paying Employment Insurance premiums on your self-employment earnings.

- You and your spouse/common-law partner want to split your pension income.

- Youve participated in the Home Buyers Plan or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have to repay any of your Old Age Security or Employment Insurance Benefits

- You have received a Canada Workers Benefit advance payment in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

Age does not affect your requirement to file a tax return. If you meet one of the above requirements, the CRA expects to receive an income tax return from you. The only time age might excuse you from filing a tax return is when youre 65 or older and your income is below certain very low thresholds.

Also Check: Plasma Donation Earnings

Benefits Of Filing A Tax Return

Get money back. In some cases, you may get money back when you file your tax return. For example, if your employer withheld taxes from your paycheck, you may be owed a refund when you file your taxes.

Avoid interest and penalties. You may avoid interest and penalties by filing an accurate tax return on time and paying any tax you owe in the right way before the deadline. Even if you can’t pay, you should file on time or request an extension to avoid owing more money.

Protect your credit. You may avoid having a lien placed against you when you file an accurate tax return on time and pay any tax you owe in the right way before the deadline. Liens can damage your credit score and make it harder for you to get a loan.

Apply for financial aid. An accurate tax return can make it easier to apply for help with education expenses.

Build your Social Security benefit. Claiming your self-employment income on your return ensures that it will be included in your benefit calculation.

Get an accurate picture of your income. When you apply for a loan, lenders will look at your tax return to figure your interest rate and decide if you can repay. If you file accurate tax returns, you may get a loan with a lower interest rate and better repayment terms.

Get peace of mind. When you file an accurate tax return and pay your taxes on time, you’ll know that you’re doing the right thing to follow the law.

Do You Have To File Taxes If You’re A Student

Your parents can claim you as a dependent up to age 19 unless you continue your education in which case they can claim you as a dependent through age 24. If you’re being claimed as a dependent, check the aforementioned requirements of dependents to see if you fit them. If so, you’ll have to file a tax return.

Even if you don’t have to file a tax return, you may still want to look into it. Depending on your situation, you may be able to deduct a limited amount of higher education expenses or claim education-specific tax credits like the American Opportunity Credit.

Read Also: Where Can I Amend My Taxes For Free

The American Opportunity Tax Credit

This credit covers up to $2,500 for qualified college expenses and is partially refundable. If the credit brings the amount of tax you owe to zero, you can have 40% of any remaining amount of the credit, up to $1,000, refunded to you.To be eligible for the AOTC, students must be within their first four years of higher education and be enrolled at least half time at some point during the tax year.

To claim the AOTC, you must file a federal tax return with a completed Form 8863 attached to your Form 1040 or Form 1040A.

You Can Claim Refundable Tax Credits

Refundable tax credits are particularly valuable for low-income taxpayers because they can provide a refund beyond what you paid for the year via withholding or estimated tax payments.

In other words, if its worth more than the tax you owe, the IRS will issue you a refund for the difference. Refundable credits include:

Don’t Miss: How Much Tax Do You Pay On Doordash

How Can I Reduce My Taxable Income

One way to reduce taxable income is by topping up your retirement savings with traditional IRAs and 401s, up to the maximum allowable contribution.

Contributions to Health Savings Accounts and Flexible Spending Accounts are another way to shrink your taxable income.

You could potentially earn thousands of dollars before paying taxes. However, even when your income falls below the cut-off level and you do not have to pay taxes, you need to file to taxes to get a refund check.

RELATED ARTICLES

What Is The Minimum Income To File Taxes

If your gross income for a tax year is low enough, you dont have to file a federal income tax return. But the exact threshold depends on a few factors.

- Your filing status For example, the threshold for single filers is much lower than for married couples filing jointly.

- Age Filing thresholds are generally higher for people 65 and older across all filing statuses.

- Dependency status Children and other dependents have different filing thresholds that are also based on the type of income they have .

- Employment status If youre self-employed, other rules may apply.

Here are the basic filing requirement thresholds for 2020 taxes.

Don’t Miss: How Do You Report Plasma Donations On Taxes

Making Money In Canada

Your Canadian residency status doesnt affect whether or not you have to file a Canadian income tax return, however, it does affect how you file your taxes, what income you need to report, and the availability of certain credits or deductions. If you meet any of the CRAs criteria listed above, for example, you have to file a tax return regardless of your residency status.

If you live in another country but receive income from a business you own in Canada, or from investments you have in Canada or if you have property in Canada, then you will need to file an income tax return.

Income Requirements For Dependents

If you are claimed as a dependent on someone else’s tax return, a different set of income requirements apply to you. Dependents whose earnings are over the following minimums must file a 2020 return:

| Single | ||||||

| Age at end of 2020: | Under 65 | 65 or over and blind | Under 65 | 65 or over and blind | ||

| Unearned income above: | ||||||

| Gross income above larger of: | $1,100 or earned income + $350 | $2,750 or earned income + $2,000 | $4,400 or earned income + $3,650 | $1,100 or earned income + $350 | $2,400 or earned income + $1,650 | $3,700 or earned income + $2,950 |

*Married dependents must file a tax return if their income was at least $5 and their spouse files a separate return and itemizes deductions.

Also Check: Paying Taxes On Doordash

Do Working Children Pay Taxes

As with any Canadian citizen, your child isnt generally required to file a tax return if they have no tax owing. Usually, the amount earned by a minor child doesnt hit the basic personal credit amount meaning they wont owe tax on their earnings. There are some exceptions.

Regarding tax returns for a child, how much the child earned from what activities will determine if your child needs to file taxes. Dont worry well help you figure out what you and your child need to do.

Filing To Earn Social Security Work Credits

Children can begin earning work credits toward future Social Security and Medicare benefits when they earn a sufficient amount of money, file the appropriate tax returns, and pay Federal Insurance Contribution Act or self-employment tax. For the tax year 2021, your child must earn $1,470 to obtain a single credit . They can earn a maximum of four credits per year.

If the earnings come from a covered job, your child’s employer will automatically take the FICA tax out of their paycheck. If the earnings come from self-employment, your child pays self-employment taxes quarterly or when filing.

Read Also: Do You Pay Taxes For Doordash

How Much Do You Have To Make To File Taxes In The Us

Tax season is upon us, with the deadline only a couple of months away. And that deadline will be here before you know it.

Getting all of your tax information prepared as early as possible is important. But depending on the money you make and how you plan on filing your taxes, there’s another important thing to figure out: do you even make enough money to require filing taxes?

It can be a worthwhile question if you’re not making that much money. If you’re below a certain threshold of annual income, you may not need to file them. However, often even in these cases, there are other circumstances that will necessitate a tax return, such as the health insurance you have, whether you’re self-employed or whether you’re eligible for an earned income tax credit.

If these don’t apply to you, though, do you need to file taxes?

Filing To Recover Taxes Withheld

Some employers automatically withhold part of pay for income taxes. By filing Form W-4 in advance, children who do not expect to owe any income tax can request an exemption. If the employer already has withheld taxes, your child should file a return to receive a refund of all taxes withheld from the IRS.

To receive a refund, your child must file IRS Form 1040.

Read Also: Payable.com Doordash