Tax Brackets & The Tax Cuts And Jobs Act Of 2017

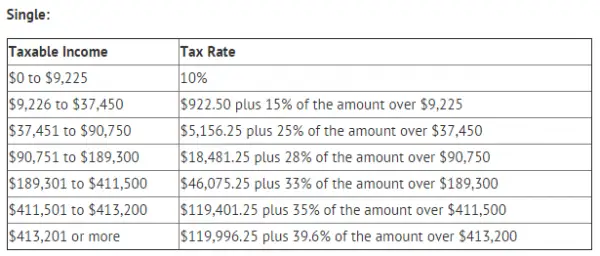

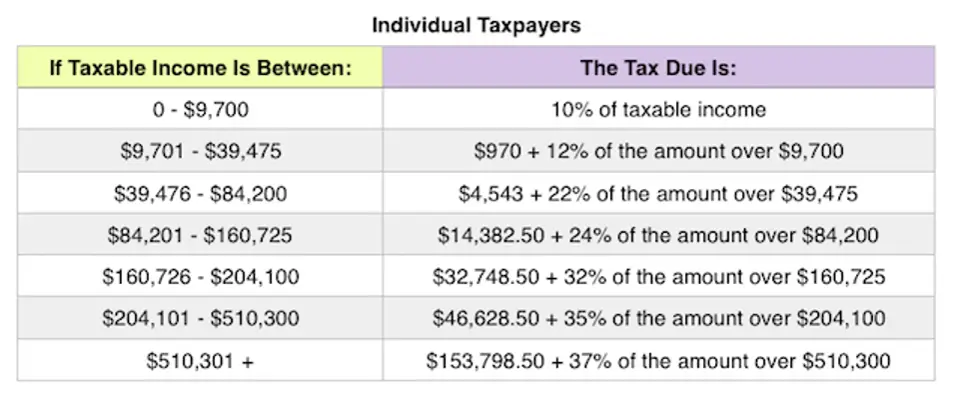

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Capital Gains Tax Canada

There is no special capital gains tax in Canada. Instead, capital gains are taxed at your personal income tax rate. Only 50% of your capital gains are taxable. This means that only half of your capital gains amount will be added to your taxable income.

If you have incurred both capital gains and losses, you can use your capital losses to offset the amount of your capital gains. For example, if you have capital gains of $10,000 and losses of $4,000, your net capital gain would be only $6,000.

You can rollover your capital losses to offset capital gains in the future, or you can retroactively apply them to capital gains that you have realized in the past three years. For example, if you have capital gains of $10,000 and losses of $14,000, your capital gains for that year would be $0. You can then roll over the leftover capital loss of $4,000 to apply to future years, or the previous three years.

What Is An Income Tax Bracket

Federal income tax brackets are one of the key pieces for determining income tax rates for independent individuals in the United States. They are categories for assessing individual incomes and the proportionate taxes due. They apply to all individual income, whether earned as an employee or a small business owner.

Each bracket covers an income range and applies a given tax rate for income in that range. When your income goes up, you may find yourself going from one tax bracket into the next.

Finding the appropriate bracket that your income falls under is the first step to calculating your income taxes.

Also Check: Are Property Taxes Paid In Advance

How To Find Your Tax Bracket

There are numerous online sources to find your specific federal income tax bracket. The IRS makes available a variety of information, including annual tax tables that provide highly detailed tax filing statuses in increments of $50 of taxable income up to $100,000.

Other websites provide tax bracket calculators that do the math for you, as long as you know your filing status and taxable income. Your tax bracket can shift from year to year, depending on inflation adjustments and changes in your income and status, so its worth checking on an annual basis.

How State Income Tax Rates Work

In general, states take one of three approaches to taxing residents and/or workers:

No tax income at all.

Flat tax. That means they tax all income, or dividends and interest only in some cases, at the same rate.

Progressive tax. That means people with higher taxable incomes pay higher state income tax rates.

If, like most people, you live and work in the same state, you probably need to file only one state return each year. But if you moved to another state during the year, lived in one state but worked in another or have, say, income-producing rental properties in multiple states, you might need to file more than one. And because the price of most tax software packages includes preparation and filing for only one state. Filing multiple state income tax returns often means paying extra.

Also Check: Where Can I Find My Property Tax Bill

What Is Federal Income Tax

Federal income tax is taxes on income, both earned and unearned , according to the IRS. In the U.S., both individuals and businesses must pay federal income tax.

Federal taxes are the U.S. governments main source of funding. In 2019, individual income taxes accounted for approximately 50% of the federal governments nearly $3.5 trillion in total revenue, according to the Congressional Budget Office.

Taxes help keep the federal government running and providing essential services, such as benefits for senior citizens, veterans, the disabled and low-income families. Tax revenue also supports other important government operations and departments, like defense, transportation, health, justice and international affairs.

You May Like: How To Get My Income Tax Return Copy Online

Calculate Your Effective Federal Income Tax Rate

The marginal income tax bracket you fall into is useful so you can know exactly how much tax youll have to pay on each additional dollar of income you earn.

But theres another tax rate you should know.

Your effective federal income tax rate is a better indicator of how much income tax you pay each year.

To find this number, take the total tax calculated on line 15 of Form 1040. Then, divide it by your total income.

This gives you the amount of tax you paid as a percent of your total income or your effective tax rate.

Heres a quick example. John Smith made $38,800 of taxable income and filed single. His federal income tax ended up being $4,475.50 because he had no other taxes to pay or tax credits to claim.

To figure out his total income, John would add back the standard deduction of $12,400 for single people.

He didnt have any pre-tax benefits or have any other tax deductions, so his total income was $51,200.

He divides his tax of $4,475.50 by his total income of $51,200 to get an effective tax rate of 11.44%.

This is less than his marginal income tax bracket of 12% due to his standard deduction and the way the marginal tax bracket system works.

Don’t Miss: Where Do I Pay My Federal Taxes

Taxable Iras Pensions And Annuities

Taxable income from IRA distributions, IRA withdrawals, pensions, and annuities all impact your tax bracket calculations.

Not all IRA distributions are taxable. For instance, Roth IRA distributions are usually tax-free.

Pensions and annuities may or may not be taxable depending on your situation and the particular pension or annuity.

How To Calculate Your Tax Bracket In Retirement

The easiest way to calculate your tax bracket in retirement is to look at last years tax return.

For 2020, look at line 10 of your Form 1040 to find your taxable income. Next, compare your taxable income to the tax brackets and rates for the year which can be found in Table 1 on this page of the Tax Foundations website.

Based on your taxable income and filing status, such as single filer or married filing jointly, youll find out if your marginal tax bracket was 10%, 12%, 22%, 24%, 32%, 35% or 37% for the year 2018.

Its important to note:

this wont tell you your current years tax bracket. It will only tell you the top tax bracket you fell in last year.

Each year, the amount of taxable income subject to each tax bracket changes due to inflation and potential tax law changes. You can find the 2020 tax brackets here in Table 1, as well.

That said:

You can use last years tax return to figure out how you ended up in the tax bracket you fell in. Then, you can use that information to plan how to you might be able to change that for this year or next year.

You May Like: How To Read My Tax Return

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

How Do I Work Out My Tax

You can work out your tax by following these four stages:

1. Work out whether your income is taxable or notSome income is taxable and some is tax free. You start by adding up all amounts of income on which you are charged to income tax for the tax year.You can then take certain deductions from this figure, such as trade losses.

2. Work out the allowances you can deduct from your taxable income There are several different tax allowances to which you might be entitled. However, at this stage of the tax calculation there are only two which are relevant: the personal allowance and the blind persons allowance.Every man, woman and child resident in the UK has a personal allowance. For most people, the personal allowance for the tax year starting on 6 April 2021 and finishing on 5 April 2022 is £12,570.Despite its name, you do not have to be completely without sight to claim the blind persons allowance. So if you have very poor eyesight, check if you are entitled.You can find out more information on these allowances on What tax allowances am I entitled to?. Note, however, that some so-called allowances are in fact nil rates of tax that are applied at step 3 below, and some are given as a tax credit or tax reduction at step 4 below.

Similarly, if you live in Wales and are a Welsh taxpayer, there are Welsh rates of income tax set by the Welsh Assembly that apply to your non-savings and non-dividend income. The UK rates apply to your savings and dividend income.

Read Also: Do Your Own Taxes Online

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes then 12% on anything earned from $9,786 to $40,125 then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Other Types Of Income

ALQURUMRESORT.COM” alt=”How much will i pay in taxes in 2018 > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How much will i pay in taxes in 2018 > ALQURUMRESORT.COM”> If youre retired, you may still have other types of income.

If you are still earning royalties or own rental real estate, businesses or farms, that income is usually included in taxable income, as well.

Other sources of income may also be included in taxable income depending on your situation. Consult your tax advisor if youre unsure.

You May Like: Where Can I Find My Agi On My Tax Return

Ways To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions such as charitable donations or deducting property taxes and the mortgage interest paid on a home loan and property taxes. Deductions can lower how much of your income is ultimately taxed.

Tax credits, such as the earned income tax credit, or child tax credit, can also put you into a lower tax bracket. They allow for a dollar-for-dollar reduction on the amount of taxes you owe.

How To Calculate Your Adjusted Gross Income

Your adjusted gross income is an important part of your tax calculation. To get your AGI, you can subtract certain deductions from your income to reduce the amount of income that will be taxed.

Some examples of deductions that help determine your AGI:

- Deductible IRA contributions

- Contributions to a Keogh retirement plan

- Penalty on early withdrawal of savings

- Teacher’s education expenses up to $250

Also Check: What’s The Sales Tax In Florida

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The credit can be up to $6,660 per year for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $3,000 or $6,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Earned Vs Unearned Income

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Earned income is what you make from your job. Whether you own your own business or work part-time at the coffee shop down the street, the money you make is earned income.

Unearned income comes from interest, dividends and capital gains. It’s money that you make from other money. Even if you’re actively day trading on your laptop, the income you make from your investments is considered passive. So in this case, “unearned” doesn’t mean you don’t deserve that money. It simply denotes that you earned it in a different way than through a typical salary.

The question of how to tax unearned income has become a political issue. Some say it should be taxed at a rate higher than the earned income tax rate, because it is money that people make without working, not from the sweat of their brow. Others think the rate should be even lower than it is, so as to encourage the investment that helps drive the economy.

Recommended Reading: What Can I Write Off On My Taxes For Instacart

What Is A Tax Bracket

A tax bracket refers to a range of incomes subject to a certain income tax rate. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individuals income grows. Low incomes fall into tax brackets with relatively low income tax rates, while higher earnings fall into brackets with higher rates.

What Is A Federal Allowance

A federal withholding allowance refers to information that is on the W-4 form for tax years before 2020. You generally fill out a W-4 when you start a new job or experience a life change, like having a child. Your W-4 helps your employer understand how much tax to withhold from your paycheck. Before 2020, the number of personal allowances you took helped determine the amount your employer withheld the more allowances you claimed, the less tax your employer would withhold. But the IRS changed the W-4 starting with the 2020 tax year. The new form eliminates personal allowances.Learn more about the new W-4.

Also Check: Can I Use Bank Statements As Receipts For Taxes

You May Like: How To Get Stimulus Check 2021 Without Filing Taxes

Explained: Tax Calculator Components

1. Assessment Year: This means a period of 12 months immediately succeeding the year of which income is being taxed/ assessed.

2. Salary:

a. HRA: House Rent Allowance is an allowance provided by an employer to an employee to cover the house rent expenditure. HRA is exempt subject to conditions and limits specified in the tax laws.

b. Leave Travel Assistance: LTA is an allowance provided by an employer to an employee for expenses incurred on travel within the country but does not include expenses incurred on boarding lodging etc. Exemption is available twice in a block of 4 calendar years. The quantum of expenditure allowed is subject to conditions specified under tax laws.

c. National Pension System: NPS is a defined contribution based pension scheme regulated by Pension Fund Regulatory and Development Authority . The NPS Corporate model allows employers and employees to contribute a certain portion of employees salary to NPS. The employer contribution is added to the salary income of the employee. However, the employee is eligible to claim deduction of the employer contribution under section 80CCD to an extent of 10% of the salary. The employee is eligible to claim his contribution as deduction under section 80C and is also eligible to an additional deduction under section 80CCD amounting to Rs 50,000/-. However, the additional deduction can only be availed if the overall limit of Rs 1,50,000/- specified under section 80CCE is exhausted.

3. House Property