How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

What If I Dont Receive My 1099 Or 1098 Forms

Remember: you can expect to receive a 1099-INT form if you earn at least $10 in aggregated interest on your account.

Typically, TD Bank mails 1099 and 1098 tax forms to customers in late January. If this applies to you, then you should receive your tax information within the first two weeks of February.

If you did not receive a 1099 or 1098 from us and you think you should have, please contact us by secure message using the instructions below. Remember, never send your account information or any other personal information by unsecured e-mail.

To send a secure message through the Online Banking Message Center:

- Select the Customer Service tab

- Under Secure Message and Inquiries, select Send a Message

- Under the New Message to TD Bank Customer Service, select General Customer Service

- In the Subject Line, enter 1099 or 1098 Request

- To expedite your request, please include the following information in the comments section of your message:

- Primary account number

- Go to the message center

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Also Check: Why Raising Taxes On The Rich Is Bad

Five Things People Can Find On Irsgov Besides Tax Filing Info

IRS Tax Tip 2022-147, September 26, 2022

Many people know IRS.gov has the latest filing info and tax forms, but they may not be aware that it also has a wide range of other tax-related topics. Here are five things people can find on IRS.gov besides filing info.

Locations To Pickup Tax Forms

OTR Customer Service Center1101 4th Street, SW, Suite W2708:15 am to 5:30 pm

John A. Wilson Building1350 Pennsylvania Avenue, NW, lobby8 am to 6 pm

Judiciary Square441 4th Street, NW, lobby7 am – 7 pm

901 G Street, NWNote: MLK Library is closed for renovations but can be obtained from libraries across the city

Municipal Center6:30 am to 8 pm

Reeves Center7 am to 7 pm

Read Also: How To Take Taxes Out Of Check

The Irs Free File And Tax Map

This IRS Tax Map program assists taxpayers in understanding their tax issues and determining which form they must complete. It divides tax issues by topics and provides a list of -and live link to- forms applicable for each topic. It also provides live links to publications concerning the searched-for topic.

The IRS also offers taxpayers the IRS Free File program, which assists medium to low-income individuals earning less than $58,000 per year with free tax preparation services. The program is the result of an alliance between the IRS and tax software companies. Free File allows users to complete their taxes online, then print and mail the completed form. This format ensures that the completed form will be legible. However, the service requires users to calculate their annual income independently.

Also Check: Tax Lien Investing California

When Getting Ready To Fill Out Your Tax Forms

Even before you start doing your 1040 tax forms, you need to have the following material ready:

- Valid identification

- Statements of interest/dividends from finance institutions, brokerages, etc.

- Evidence of any tax credits, tax deductions, or tax exemption

- Your checking account number and routing number

Keep in mind that IRS Tax Form 1040, with the payment amount, is owed by April 15th. A 6-month tax continuance may be allowed for overdue submitting. However, payments still have to be made by April 15th. You can file Form 1040 by paper mail, via IRS e-file, or by way of a certified tax preparer.

Also Check: How To Get A Pin To File Taxes

Also Check: Where Is My Income Tax Return

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Where Can I Get Tax Forms

- Obtaining tax forms is one of the first steps in completing returns for many people. Find out where you can get tax forms and where you probably can’t.

Older adults may remember when tax forms were readily available in locations such as public libraries and post offices. The IRS also used to automatically mail forms to tax payers. But it’s not as easy to get your hands on a physical copy of these forms today. Find out where you can get tax forms below.

Read Also: How Much Taxes Deducted From Paycheck Md

Mailing Addresses For Massachusetts Tax Forms Including Amended Returns

- Form 1 or a Form 1-NR/PY:

- Refund: Mass. DOR, PO Box 7000, Boston, MA 02204

- Payment: Mass. DOR, PO Box 7003, Boston, MA 02204

Visit Mailing addresses for Massachusetts tax forms for other form addresses.

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

You May Like: Where Do I Send My Taxes

Prior Year Forms & Instructions

Make your estimated tax payment online through MassTaxConnect. Its fast, easy and secure.

- Form 1-ES, 2022 Estimated Income Tax Payment Vouchers, Instructions and Worksheets

- Form 2-ES, 2022 Estimated Tax Payment Vouchers, Instructions and Worksheets for Filers of Forms 2 or 2G

- Form UBI-ES, 2022 Non-Profit Entities Corporation Estimated Tax Payment Vouchers and Instructions

Income and Fiduciary Vouchers these estimated tax payment vouchers provide a means for paying any taxes due on income which is not subject to withholding. This is to ensure that taxpayers are able to meet the statutory requirement that taxes due are paid periodically as income is received during the year. Generally, you must make estimated tax payments if you expect to owe more than $400 in taxes on income not subject to withholding. Learn more.

Get Your Refund Faster By Filing Online

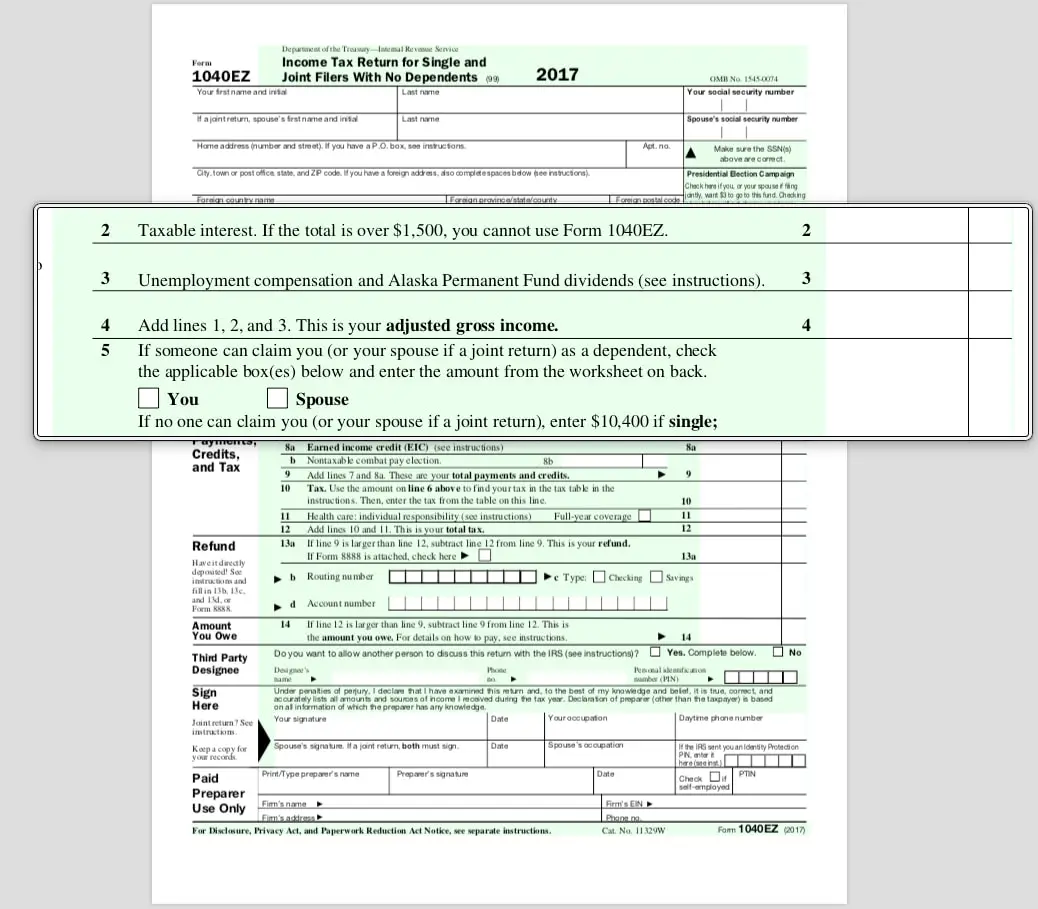

Filing income taxes online is usually safer, quicker, and more straight forward. Also, you can get your tax refund a lot faster should you opt for the Direct Deposit method. While there are a few income tax forms to pick from when preparing your federal income taxes, a reliable option is to use IRS Form 1040 when you are not sure if you will be eligible for the 1040A or 1040EZ.

- The standard guideline is: If uncertain, submit Tax Form 1040.

- You have to submit Form 1040 once any of the following apply:

- You have taxable earnings of $100,000 or higher

- You have self-employment earnings of $400 and up

- You had income tax being taken from paychecks

- You made anticipated income tax payments, or have overpayment that applies to the current tax year

- You have listed deductions

- You generate revenue from a company, S-corporation, partnership, trust, rental, or farm

- You have sold real estate, stocks, bonds, or mutual funds

- You are claiming revenue alterations

- You got an advance payment for Earned Income Tax Credit from a company

- You have a W-2 that indicates uncollected tax , or a W-2 that demonstrates a code Z

- You owe excise tax on insider stock payment

- You are a person in debt in a Chapter 11 personal bankruptcy case

- You make foreign income, paid foreign income taxes, or are claiming tax treaty benefits

- You are obligated to repay any further special taxes

Also Check: What Happens If You Cannot Pay Your Property Taxes

Should You File Early

Many American taxpayers wait until the April 15 deadline to complete and file their taxes. However, if procrastination stresses you outor if youre expecting a refund and you want it as soon as possibleyou can file your 2020 return as early as Feb. 12, 2021.

Thats a little later than usual, and the reason is important: If you didnt receive the economic stimulus check approved by Congress by the end of 2020, you can claim it on your 2020 return.

Another reason to file early is to reduce the risk of someone stealing your identity to file a false return using your Social Security Number and claim a fraudulent refund.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

You May Like: Can You File Taxes Without Your W2

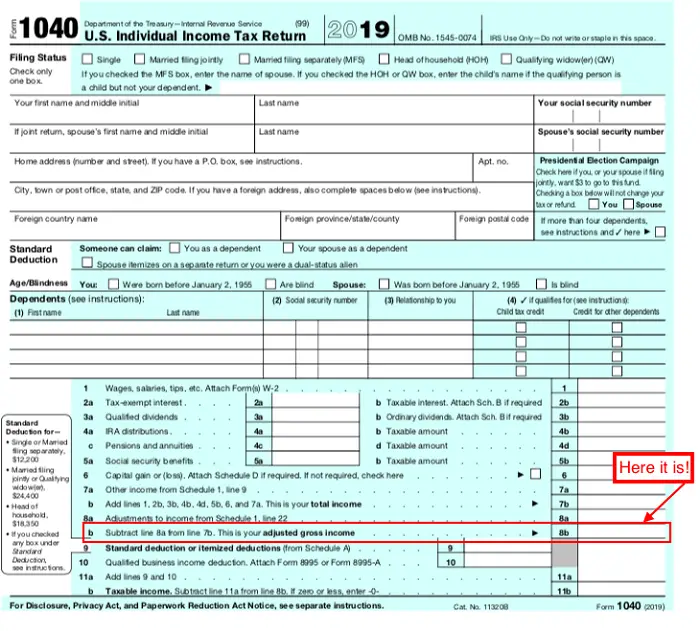

Federal Income Tax Forms

Printable 2019 federal tax forms are listed below along with their most commonly filed supporting IRS schedules, worksheets, 2019 tax tables, and instructions for easy one page access. For most US individual tax payers, your 2019 federal income tax forms were due on July 15, 2020 for income earned January 1, 2019 through December 31, 2019.

Recommended Reading: How To Buy Tax Liens In California

Access Payroll Tax Forms And Tax Payments

Learn how to view payroll tax payments and forms in QuickBooks Online Payroll and QuickBooks Desktop Payroll.

Do you want to view your past forms and payments? With QuickBooks Payroll, youre free to access your filed tax forms and paid tax payments.

Heres how you can access your tax forms and payments in your payroll service:

| Note: Not sure which payroll service you have? Here’s how to find your payroll service. |

Don’t Miss: How Can I Find My Tax Id Number

Filing Your Tax Return

What you need to know about filing your personal income tax and benefit return.

Get help this tax season with the Ontario Child Care Tax Credit and the Low-Income Workers Tax Credit.

Save your receipts for the new Seniors Home Safety Tax Credit in 2021, which you can apply for during the 2022 tax season.

You may be eligible for tax credits and benefits to help you with living costs.

The Best Way To Fill Out Form 1040

Form 1040 can be managed in a far superior way by using online tax preparation software. Online tax filing will enable you to enter your information into the system, and the software will do all the calculations.

It will take the information you enter and populate the relevant parts of your 1040 for you. You dont need to use a professional tax preparer or an accountant if your tax affairs are relatively simple.

Don’t Miss: When Do Tax Returns Come 2021

Can I Still File My 2019 Taxes

Yes, you can still file a 2019 tax return. You generally have up to three years to claim a federal income tax refund. After three years the IRS simply wont pay you the refund. If you are owed a refund, you will not be charged a late filing penalty.

If you cant afford to pay the back taxes you owe, ask the IRS for a reduction due to a hardship and create a payment schedule. See the 2019 Form 1040 instructions booklet below for more information about late filing penalties and how to request a payment schedule.

What Phone Number Is 800 829 0922

If you want to call the IRS, make sure you call the right number: 800-829-0922. The letter says you have 60 days from the date of the letter to appeal or you can sue in federal court. You may want to hire a tax professional and you may qualify for low-income taxpayer clinics.

Read Also: Where To File Past Year Tax Returns

What Are The Requirements For Td Bank To Send Me A Form 1099

$10 minimum requirementForm 1099-INT is produced if the aggregated interest earned for a particular Tax ID number is $10 or more. For individuals, the Tax ID number is typically your Social Security number.

Primary owner requirementOnly the primary owner will receive a Form 1099-INT. If you are listed first on an account, you are considered the primary owner. You may co-own an account with another person spouse, partner, child, etc. If they are listed second on the account, they would be considered the secondary owner.

Typically, TD Bank mails 1099 tax forms to applicable customers in late January. If this applies to you, then you can expect to receive your tax information within the first two weeks of February.

To issue you a Form 1099-INT, TD Bank reviews all of your account relationships and sends one Form 1099-INT to cover all of your accounts in which you are the primary owner.

Special note about Individual Retirement Accounts IRAs do not receive a Form 1099-INT. Interest postings to IRAs are not reportable. However, distributions from an IRA are reported to you and the IRS on a Form 1099-R. This form is mailed out in late January for the prior tax year.

Changes For Tax Year 2020 And Forward Individual Income Tax Forms:

Please Note: The Department is no longer printing and mailing the following tax forms:

- Form MO-1040 Missouri Individual Income Tax Long Form

- Form MO-1040A Missouri Individual Income Tax Short Form

- Form MO-1040P Property Tax Credit and Pension Exemption Short Form

- Form MO-PTC Property Tax Credit Claim

The Department encourages you to electronically file, or e-file, your tax forms online. E-filing is a fast and safe alternative to mailing a paper return. For more information about e-filing, visit our website at dor.mo.gov/personal/electronic.php.

If you choose not to e-file, you may print any Missouri tax form from our website at dor.mo.gov/forms.

Questions? Contact us at or .

Also Check: How Much Can You Make Before Social Security Is Taxed

Heres How People Can Request A Copy Of Their Previous Tax Return

IRS Tax Tip 2021-33, March 11, 2021

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it: