Other Ways To Find Your Account Information

- You can request an Account Transcript. Please note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

General Information About Individual Income Tax Electronic Filing And Paying

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. The Missouri Department of Revenue received more than 238,000 electronic payments in 2020. The Department also received more than 2.6 million electronically filed returns in 2020. Convenience, accuracy, and the ability to direct deposit your refund are just a few of the reasons why electronic filing is becoming one of the Department’s most popular filing methods.

Can I File An Extension For My Business Taxes Online

Yes, you can file for a business tax extension online, and the forms are available on the IRS website. You should still aim to estimate and pay your taxes by the original due date. Extension requests need to be filed by the original deadline. Turn to your states tax authority for information regarding filing for an extension on the state level.

You May Like: How To File Taxes Without W2

Idaho State Tax Commission

Electronic payments are a safe and efficient way to make tax payments.

ACH is a nationwide network used by the Federal Reserve to handle electronic payments.

Payments of $100,000 or more: You must use ACH Debit or ACH Credit. This is required by Idaho law . If you don’t use these methods when required, we can charge you interest and a $500 penalty.Check or cash payments required for: Form 850-U Form 1550-U Form 1350-U

Page last updated July 6, 2021. Last full review of page: February 23, 2018.

TAX REBATE

Making Payments Late Payments And Filing Extensions

To make a payment on individual Arizona income tax owed, taxpayers can either do so electronically or by mail. Taxpayers who file electronically can authorize an electronic funds withdrawal from a checking or savings account.

Individuals who have already filed a tax return and would like to make a payment can do so at www.AZTaxes.gov. Most major credit cards, including Visa or MasterCard branded debit cards, are accepted. Individuals who filed their returns but forgot to enclose payment can also make payments online by e-check or credit card under Make a Payment and 140V.

See the step-by-step guide or tutorial for assistance on making an individual income tax payment.

Individuals can also send the payment, attached to the top portion of the billing notice received, to the address provided. Taxpayers who have not received a billing notice can mail payments to:

Arizona Dept. of RevenuePhoenix, AZ 85038-9085

For correct application of a payment and to avoid processing delays, taxpayers must provide their tax identification numbers and tax periods they want the payments applied to. Additionally, taxpayers who have already filed tax returns and remitted their payments separately must not send a paper copy of a return with their payment.

Read Also: Do I Have To Pay Taxes On Social Security Income

Penalty & Interest Charges

- You will receive penalty on your individual income tax return/payment if not paid within the specified time due per The Revenue Act of 1941.

- Penalty is charged at 5% for the first two months and then 5% for each additional month thereafter up to a maximum of 25%.

- Interest is calculated by multiplying the current interest rate by the amount of tax you owe.

- You may request a waiver of penalty in writing. You are required to explain your reason for late payment of tax. You must submit supporting documentation and meet the reasonable cause criteria outlined in the Revenue Administrative Bulletin 1995-4 before a waiver of penalty will be considered.

How To Prepare Your Taxes

The way your business is structured as well as its location play roles in how your business is taxed. Businesses are required to abide by federal, state, and local tax rules.

Familiarize yourself with your tax requirements in advance, as you may need to pay taxes at different intervals during the year. The types of business taxes generally include:

- Income tax

- Employer tax

- Excise tax

Business obligations, tax requirements, and necessary forms vary depending on the type of business tax. The IRS provides detailed information about the required forms on its website, which also has information about what forms can and cant be e-filed.

Turn to your state and local governments for details regarding your state and local business tax responsibilities, which typically include income and employment taxes.

Recommended Reading: Do Businesses Get Tax Refunds

How To Pay Pay Your Personal Income Tax

Online

Department of Revenue recommends using MassTaxConnect to make tax payment online. You can make your personal income tax payments without logging in. You can use your credit card or Electronic Fund Transfer from either your checking or saving account. Note that there is a fee for credit card payments.

You can send us a check or money order through the mail to make your income tax payment.

When you make a payment by sending a paper check, be sure to enclose your payment voucher with it.

You can find your payment voucher attached to your tax bill.

If you’re making estimated tax payments, be sure to include an estimated tax payment voucher. The correct mailing address will be printed on your payment voucher.

Estimated payments:

Deadline To File And Pay Taxes Was May 17

Find out what to do if you cant pay what you owe. An extension to file is not an extension to pay the taxes you owe.

The estimated tax payment deadline was April 15. Get details on the 2021 tax deadlines.

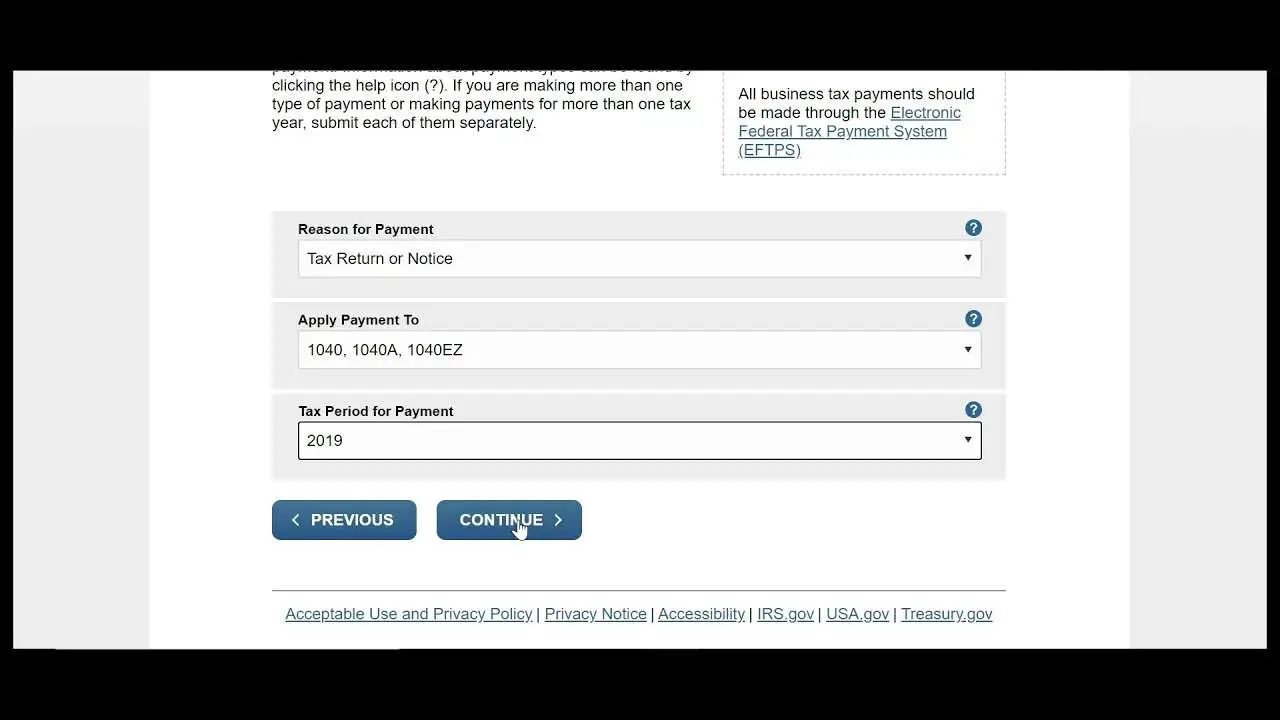

Pay with your bank account for free or choose an approved payment processor to pay by credit or debit card for a fee.

Recommended Reading: What’s The Sales Tax In Florida

Individual Income Tax Return Payment Options

Use these options if you’re paying after you’ve filed your return. You can also pay at the time of filing through approved electronic filing options, and schedule your payment for any day up to the filing deadline.

Online, directly from your bank account

- Log in to your online services account.

- Dont have an account? Create one now.

Not ready to create an account?

You can pay using eForms.

- Individual return payment: 760PMT eForm

- Qualifying farmers, fishermen, and merchant seamen: 760PFF eForm

Make a return payment through Paymentus. A service fee is added to each payment you make with your card.

Check or money order

Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to:

Virginia Department of Taxation

Include your Social Security number and the tax period for the payment on the check.

Qualifying farmers, fishermen, and merchant seamen should use the 760-PFF voucher.

Note: If you filed a paper return with your local Commissioner, mail the voucher and check to the same place you sent your return and make the check payable to the local Treasurer.

Payment Fee – Returned Payments

If your financial institution does not honor your payment to us, we may impose a $35 fee . This fee is in addition to any other penalties and interest you may owe.

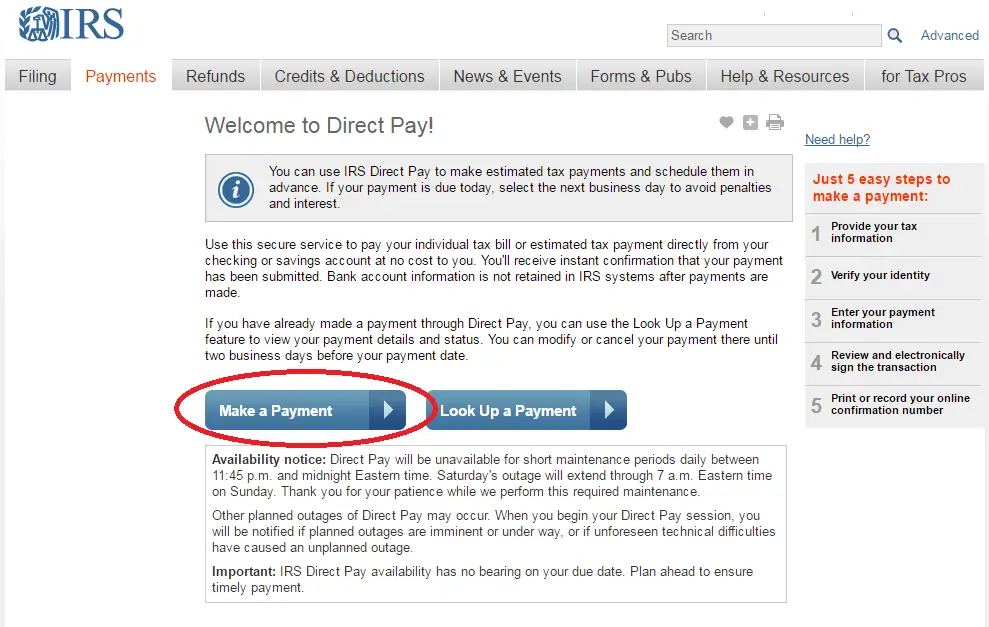

How To Pay Your Taxes

If you owe taxes, the IRS offers several options where you can pay immediately or arrange to pay in installments:

- Electronic Funds Withdrawal. Pay using your bank account when you e-file your return.

- Direct Pay. Pay directly from a checking or savings account for free.

- . Pay your taxes by debit or credit card online, by phone, or with a mobile device.

- Pay with cash. You can make a cash payment at a participating retail partner. Visit IRS.gov/paywithcash for instructions.

- Installment agreement. You may be able to make monthly payments, but you must file all required tax returns first. Apply for an installment agreement through the Online Payment Agreement tool.

Also Check: Can You Claim Rent On Your Taxes

Dont Neglect Your Business Taxes

If youre a business owner, you have numerous responsibilities. Among your top priorities should be filing your business taxes accurately and on time.

Failing to file and pay taxes on time with the IRS can result in you owing back taxes, which often have severe consequences, such as penalties, interest, and seized business assets. You could also face challenges securing loans or other financing as lenders typically require copies of your tax returns before they approve funding.

If your business owes back taxes, dont ignore the problem. You can get guidance from a tax professional who can help you create a plan for paying your tax bill.

What You Need For Pay Your Personal Income Tax

You can choose from several different payment options:

- Electronic Funds Transfer

You will need the following:

- Your legal name

- Your Social Security Number or Individual Taxpayer Identification Number

- Your payment voucher if you are making a bill payment.

You can find your payment voucher attached to your tax bill. If you’re making estimated tax payments by mail, be sure to include an estimated tax payment voucher.

Please read the following carefully and choose the best payment option.

Estimated tax payments can also be made electronically.

Also Check: How To Avoid Capital Gains Tax On Land Sale

Estimated Tax Payment Options

Use the following options to make estimated tax payments. For more information about filing requirements and how to estimate your taxes, see Individual Estimated Tax Payments.

Online, directly from your bank account

- Log in to your online services account to schedule all 4 quarterly payments in advance.

- Dont have an account? Create one now.

Not ready to create an account? Use eForms – make sure to choose the correct voucher number for the payment you’re making.

- Individual estimated payment: 760ES eForm

ACH credit

Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax’s bank account. See our Electronic Payment Guide for details on requirements and set-up with financial institutions, which may include fees.

Pay using a credit or debit card through Paymentus . A service fee is added to each payment you make with your card.

Check or money order

Mail the correct 760ES voucher for the tax period to:

Virginia Department of Taxation

When Are Business Taxes Due

Due dates for business taxes vary depending on the necessary taxes your business owes. Some taxes need to be paid on a regular basis throughout the year, such as quarterly, while others are due on the annual tax-filing deadline, which is usually in mid-April unless you file for an extension, which moves the annual deadline to October.

Read Also: When Will Tax Refunds Be Issued

Pay Individual Income Taxes Online

If you are a registered MyTax Missouri user please log on to make payments for your Individual Income Taxes.

Note: You will only need to provide your contact information once by signing up for a MyTax Missouri account and you have the option to save your payment information. To register for MyTax Missouri, proceed to Register for MyTax Missouri.

If you are not a registered MyTax Missouri user you can use the links below to make estimated, balance due, or bill payments for your Individual Income Tax debts by electronic check, if you would like to pay by credit card please click here.

This system is available to all personal income tax users and does not require a separate registration. There are, however, additional charges or convenience fees that may apply. Additional technical notes are available.

Payments submitted on this site are made to the Missouri Department of Revenue for state taxes only. Submitting a transaction from this site does not generate a payment for any city, local, or county property or other taxes.

Payments By Electronic Check Or Credit/debit Card

Several options are available for paying your Ohio and/or school district income tax. For general payment questions call us toll-free at 1-800-282-1780 or adaptive telephone equipment).

If you are remitting for both Ohio and school district income taxes, you must remit each payment as a separate transaction.

Note: Payments made online may not immediately reflect on your Online Services dashboard. Please allow 2-3 business days for the payment made to be applied to your outstanding liability.

Pay via Guest Payment Service Register & Pay via Online Services

The Department is not authorized to set up payment plans. However, you may submit partial payments toward any outstanding liability including interest and penalties. Such payments will not stop the Department’s billing process, or collection attempts by the Ohio Attorney General’s Office.

Note: This page is only for making payments toward individual state and school district income taxes. To make a payment for a business tax, visit our online services for business page.

See the FAQs under the “Income – Online Services ” for more information on using Online Services.

You can pay using a debit or credit card online by visiting ACI Payments, Inc.or calling 1-800-272-9829. You may also use the Online Services portal to pay using a credit\debit card. You will be redirected to the ACI Payments, Inc. website. This payment method charges your credit card .

You will then be prompted to enter your payment information.

Also Check: Are Goodwill Donations Tax Deductible

What You Need To Know About E

Familiarizing yourself with necessary tax-filing requirements is a crucial part of being a small business owner. While all of the rules and documentation can seem overwhelming, well break down the basics of how to file business taxes online.

In this article, youll learn how to prepare business taxes, what forms you can file online, and details regarding business tax e-filing and payments.

Payment For A Tax Due Return

You may choose a from a checking or savings account when the return is e-filed and supported by the software. A direct debit is a tax payment electronically withdrawn from the taxpayer’s bank account through the tax software used to electronically file the individual income tax return. Submitting the electronic return with the direct debit information provided, acts as the taxpayer’s authorization to withdraw the funds from their bank account. Requesting the direct payment is voluntary and only applies to the electronic return that is being filed.

Payments can be made by using the Michigan Individual Income Tax e-Payments system.

- If you have received an assessment from the Michigan Department of Treasury’s Collection Services Bureau, use the Collections e-Service payment system.

- Payments for 2020 tax due returns can be made using this system. Prior year payments are currently not accepted electronically.

- Any payment received after April 15th will be considered late and subject to penalty and interest charges. However, you may submit late or partial payments electronically.

- Estimate penalty and interest for a tax due return.

Payment can also be made by check or money order with your return. Make checks payable to “State of Michigan,” print your complete Social Security number and appropriate tax year on the front of your check or money order.

Read Also: How To File Taxes With No Income

What Receipts Should I Keep For Business Taxes

Keep receipts from business purchases for three years so that if youre audited by the IRS, you can show that the purchases were for business use. The IRS recommends keeping supporting business documents such as gross receipts, documentation for purchases, proof of expenses , and records to accompany assets.

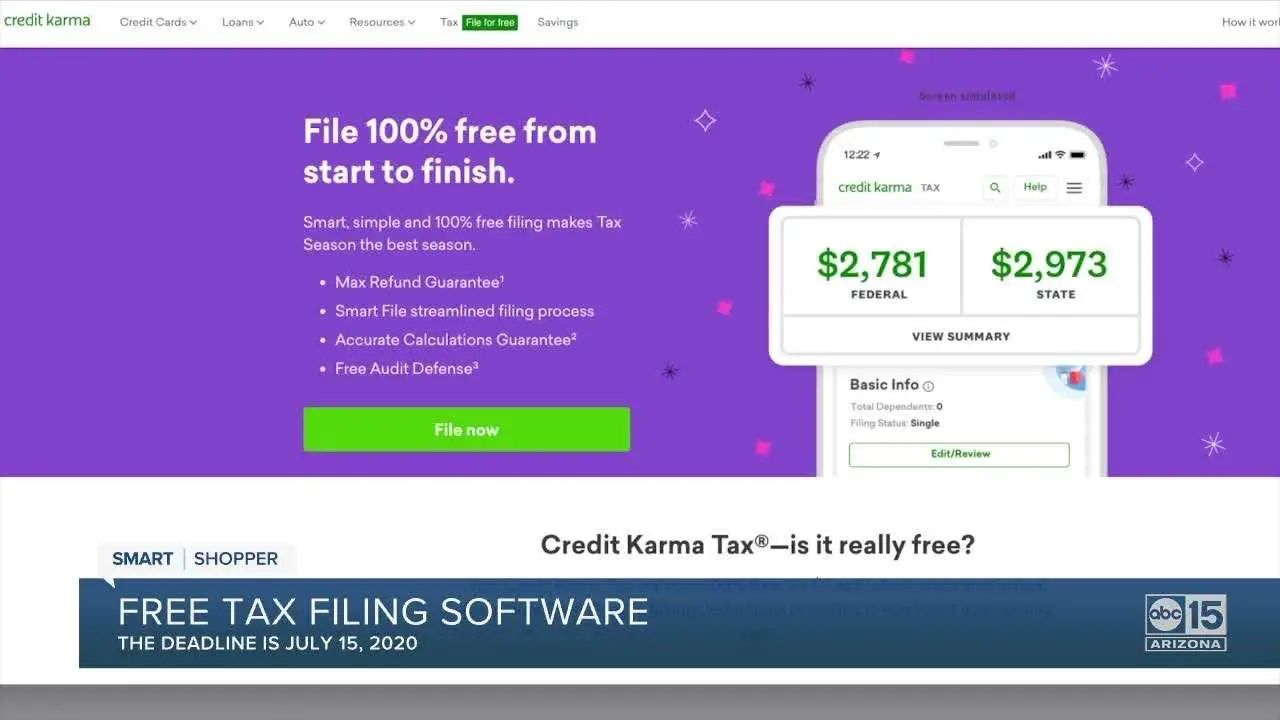

How To E

The IRS allows businesses the option to file federal tax returns online. If you have an income of $72,000 and less, you can file taxes electronically using IRS Free File, no matter if you are drawing a paycheck, are self-employed, or have a small business. If your business income is above $72,000, you can use IRS Free File Fillable Forms.

If you choose to utilize IRS Free File Fillable Forms, make sure you feel confident doing taxes, because youll receive little guidance using this method, and the system does not check for errors. However, its the only free option for taxpayers with income above $72,000.

You can use the IRS Modernized e-File system for filing business income tax returns as well as employment tax returns. The IRS provides a list of approved Modernized e-File business providers to choose from, depending on your filing needs.

Filing your tax paperwork then paying the IRS are two separate steps, so make sure to complete both transactions. You can pay your taxes directly through linking a bank account, or you can choose to pay with a debit or credit card.

You can also enroll in the Electronic Federal Tax Payment System, which is a free service from the U.S. Treasury.

There are various options available for filing your business taxes online beyond using the IRS system directly. You can work with a tax preparerthe IRS provides a list of authorized e-file providersor use a tax preparation software.

Also Check: When To File Quarterly Taxes