How Much Does It Cost To Get Your Taxes Done

7 Minute Read | September 17, 2021

You cant run from them. You cant hide from them. But you can get someone else to do them.

Yep, were talking about taxes.

For those of us who would like to spend our weekends at the park with the kids or, honestly, anywhere else but at a desk with tax forms and schedules, finding a tax advisor may be our only hope this tax season.

How much does it cost to have a professional do your taxes? Lets take a closer look and find out.

Is H& r Block Or Turbotax Better

When it comes to costs, H& R Block‘s pricing is slightly lower than TurboTax‘s. Both offer solid customer service, an easy-to-use interface, and clear instructions and guidance, though there are some variations between packages.

Beyond the free version, here’s how they stack up on cost for the DIY online filing option, not considering discounts:

| $50 |

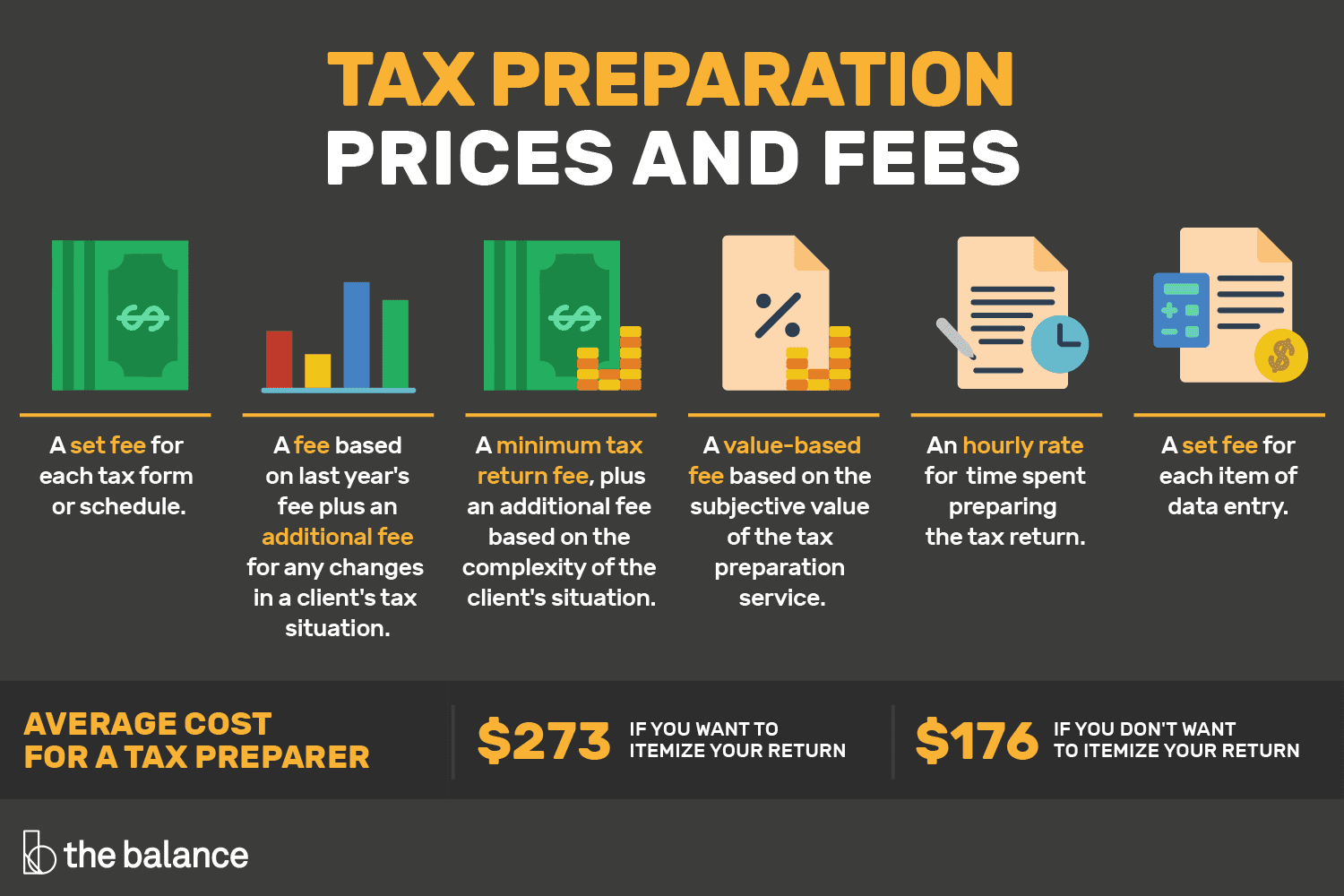

Pricing Methods Used By Tax Preparers

You can ask up front how the firm determines its prices if you’re comparing tax professionals or accountants. Ask for an estimate of what their services might cost you, although you probably won’t get an answerat least not a firm, definitive oneuntil you’ve met with the professional and they have a firm grasp of your tax issues.

Some accountants offer free consultations, so you might get an answer at the end of this initial meeting.

Otherwise, the firm would have to base its number on your personal summary of your situation, and this might or might not provide an accurate picture of your tax situation. After all, you probably wouldn’t be seeking a professional’s services if you were exceptionally savvy about tax matters.

Some of the methods used by tax professionals to set prices include:

- A set fee for each tax form or schedule

- A fee based on last year’s fee plus an additional fee for any changes in a client’s tax situation

- A minimum tax return fee, plus an additional fee based on the complexity of the client’s situation

- A value-based fee based on the subjective value of the tax preparation service

- An hourly rate for time spent preparing the tax return and accompanying forms and schedules

- A set fee for each item of data entry

Read Also: How Do I Find My Lost Tax Id Number

When Should I Consider Hiring A Tax Professional

As a CPA and former IRS agent, there are certain filing situations that I believe should be left to the professionals. I have seen many âdo it yourselfâ tax returns that landed in the hands of an IRS auditor. Here are some scenarios where you should consider hiring a tax pro:

- You just started a business in the 2020 tax year or have a complex business structure, such as an S-corporation, partnership or corporation

- You have employees or youâre self-employed

- You experienced a recent change in your tax situation

- You sold a property in the 2020 tax year

- You worked in multiple states

Can You Get A Refund On Vat

Foreigners must pay VAT in Russian on all purchases. This cannot be returned if living in Russia, but it is possible for visitors. To be eligible, you must hold a passport issued by a foreign country outside the Eurasian Economic Union and shop at selected retailers officially communicated by the Ministry of Industry and Trade .

The minimum purchase amount is 10,000 p. per retailer per day at a differential refund rate as follows:

- Up to 20% on a wide variety of goods including fashion, technology, watches, and jewelry

- Up to 10% on other goods including food, medicine, and books

Youll need to ask the store for a VAT check or refund form. A customs officer must then stamp this at the airport or port you depart through. The officer will ask to see your ticket, purchase receipts, and may want to inspect the goods youve bought. These should ideally have their original tags or labels intact.

You can take your validated form to a VAT refund office or agency to get your money. Refunds come either in cash or via a refund to your credit card. Several agencies have the authority to refund VAT taxes in Russia, including Premier Tax Free, Global Blue, National Operator Tax-Free, and Hi Sky.

If youre leaving Russia but traveling within the EEU, you wont be able to claim a refund.

Don’t Miss: How Do I Protest My Property Taxes In Harris County

Multiply The Number Of Dependents By The Exemption Rate

How do you figure how much you get back in taxes. Those amending their income to remove unemployment payments, for instance, would focus on lines 1 through 23. The calculator will amortize your loan and show you how much interest you pay each month and year for the duration of the loan. Fortunately, you may be able to recoup some of those costs by claiming tax deductions on your federal taxes.

Once you find out what your approximate tax refund is, you can make your financial plans based on that. Whats left is taxable income. To use the calculator, you will need your marital and filing status and some basic information about your income.

How much you owe the irs. Each of your tax returns will report the amount of tax you owe, but never paid. suppose you earn enough to be in the 28 percent bracket, but only by $300.

In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. There are several factors that can impact how much income tax you pay and how much you get back as a refund. When you file your tax return, you’ll figure out if you paid enough tax in the previous year or if you paid too much.

Calculate any tax credits you have. For example, if you fall in the 34 percent tax bracket and have a $10,000 mortgage interest deduction, multiply $10,000 by 0.34 to find. Then we apply the appropriate tax bracket (based on income and filing.

Determining back taxes may be as simple as filing or amending a previous year’s tax return.

Tax Tips For Independent Contractors

- Consider working with a financial advisor to better manage your independent contractor income. SmartAssets free tool matches you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now

- Develop a good record-keeping system for your business. Make sure you have accurate records of both your income and expenses for the year. Consider using an expense app to keep tabs on receipts, charitable donations and other deductible expenses. When you receive your 1099 forms, be sure to check them for accuracy.

- A financial advisor who specializes in tax planning can help lower your 1099 income taxes by harvesting your losses. This means that you will be able to use your investment losses to reduce taxes on 1099 income.

- Figuring out your taxes can be overwhelming. SmartAssets income tax calculators will help you calculate federal, state, and local taxes.

Recommended Reading: What Are The Different Tax Forms

Russian Income Tax Deductions

Official residents can reduce their Russian income tax bills via deductions and allowances. These are typically not available to non-residents. Therefore, deductions only apply to earnings subject to the progressive Russian tax rate. They are not applicable to taxes you pay at any other rate. You can file declarations for tax deductions at any time throughout the year.

Some examples of when deductible expenses are available include buying property in Russia, paying tuition fees, medical treatment, or making payments to charity.

The main deduction from income taxes in Russia applies to children. The exemption starts from 1,400 p. for the first two children and goes up to 3,000 p. for a third and each subsequent child. It does not matter where the children live when applying for this tax deduction. However, to qualify for a deduction of child tax, you must be earning a cumulative annual income of less than 350,000 p.

Individuals may also deduct the costs of their own education in licensed institutions and for their childrens education .

Donations to certain non-commercial organizations and charities are deductible from taxable income .

When buying property in Russia, foreign tax residents can apply for a once-in-a-lifetime tax deduction of up to 2,000,000 p. plus the amount of interest of up to 3,000,000 p.

Better Than A Franchise

Here are just some of the reasons why starting your own tax preparation business makes better sense than buying into a tax business franchise. Having your own tax business means:

Also Check: How To Track E File Tax Return

Advice On Tax Rates In Russia

Although taxes in Russia appear straightforward, there are a number of exceptions and deductions available to resident and non-resident taxpayers alike. The tax system is fluid, and many legal requirements may not be applicable in practice thanks to additional exceptions.

There is also wide scope for interpretation. As such, it is advisable for expatriates to seek expert advice before determining the likely tax consequences and finalizing their returns.

American expats living in Russia can get help meeting their US tax obligations through Taxes For Expats.

Where Can You Find A Trustworthy Tax Advisor

Think of the cost of tax preparation like the cost of getting a haircutyou can get a simple haircut for a very low price. Sure, it may not be the best haircut youve ever had, but for $10, you cant complain.

Now, if you want to use a skillful stylistsomeone who puts a warm towel on the back of your neck, massages your scalp, gives you a great haircut and fully styles it before you walk outyou have to pay more.

The same goes for tax advisors. If you pay around $220, youll probably get an average tax preparer who may or may not help you get all the deductions you deserve. But for a little bit more, you can get a trustworthy tax advisor who cares about your situation, helps you understand tax changes, and ensures you get the maximum refund back this year.

If youd like to find a tax advisor, we can put you in touch with a professional in your area whos earned our seal of trust. Find a tax pro now!

Interested in becoming an Endorsed Local Provider? Let us know.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

You May Like: How To File Taxes At H& r Block

Tax Filing Assistance Options

If you fall within a certain income bracket or are a senior citizen, you may qualify for tax filing assistance. As of 2021, the Volunteer Income Tax Assistance provides free tax preparation services to people who earn $57,000 or less per year. In addition, if you are age 60 or older, you may qualify for free tax preparation services through Tax Counseling for the Elderly and the AARP Foundation’s Tax-Aide programs.

How Do Tax Preparers Set Their Prices

Some professionals have hourly fees, set fees or minimum fees based on how complex your income tax return is.

Whether you will be charged hourly or pay a set fee depends on your preparer. Some professionals will charge you a flat fee for each specific form they must file for you, and they should give you the rates for those forms ahead of time. Other preparers will talk to you and get an idea of what they think filing your taxes will require and provide you with a set fee upfront.

Finally, some tax preparers will give you an hourly rate and charge you for each hour they used in preparing, calculating and filing your taxes. Here are the average hourly rates for individual tax preparation services:

You May Like: When Is The Final Day For Taxes

Should You Pay Someone To Do Your Taxes

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

It’s tax season – which means money is on most peoples’ minds. Getting a tax refund is a big part of that driver. Most people hope for a refund and look forward to getting their direct deposits ?

As with most things, the answer is: it depends.

Here’s what you need to know.

The Tax System In Russia

In Russia, incometax is managed by the countrys tax authority , which is governed by the Ministry of Finance.

The Russian tax year runs from 1 January to 31 December. You should submit tax returns to the Federal Tax Service using a form called Tax Declaration . Returns must be submitted before 30 April and the final date to pay your taxes in Russia is 15 July.

English information can be found on the Federal Tax Services website, though more information is available in Russian. Large corporations can apply electronically through special software that is not yet accessible for wider public use.

For a company, it is mandatory to register at the Russian tax office if it intends to do business for more than 30 days a year. On the other hand, an employee must notify the tax office via their employer within 10 days of starting employment.

In 2021, Russia implemented a progressive tax with rates of 13% or 15% for tax residents. Overall, in recent years taxpayers have benefited from streamlined procedures and more favorable tax rates in Russia with a smaller tax burden. In particular, collection rates doubled since 2011 thanks to better collection processes and closer tax monitoring at the highest levels, particularly for business. It is generally thought that these will expand to cover a greater number of businesses and eventually, consumers over time.

Read Also: When Is Tax Time 2021

How About A Tax

Sellers are always looking for a way to pay as little taxes as possible. But, what if you could avoid paying taxes altogether? You wont necessarily be able to do this with most business selling deals, but there are a few which can be made tax free. One kind of tax-free deal you can make is with stock exchanges. For example, lets say your buyer has their own corporation and they want to give you stock in their company in exchange for you giving them stock in your company. As long as certain IRS provisions are met which pertain to a reorganization, you can conduct a stock exchange like this and not have to pay any taxes. The IRS states that the seller must receive between 50 to 100% of the buyers stock in order for it to be tax-free. As for asset transfers, you can make these tax-free as well if you receive 100% of the buyers stock. The only time you will be taxed is if the buyer gave you actual cash for your stock or assets. Otherwise, you can get away with a tax-free transaction by simply keeping it as an exchange of non-cash assets.

Corporate Tax Rates In Russia

The benchmark rate of Russian corporate tax on profits is 20%. Companies are also taxed 13% on dividend profits. However, corporate taxes in Russia and allowable expenses vary depending on the company structure.

In the case of self-employed persons, note that individual entrepreneurs do not pay profit tax and are subject to personal income tax on their business profit.

Read more in our guide to Russian corporate tax.

Also Check: How Can I Make Payments For My Taxes

State Of Your Tax Records

How well do you keep track of your financial documents? Are they stored in well-maintained files and folders, or are they thrown haphazardly into a cardboard box in a dark corner of your office? The price will likely rise if the tax professional will have to sort through unorganized files. It is best to present them with well-organized records to increase your chance of getting fair rates.

Another issue concerns what your tax details entail. You can get away with the bare minimum rate if all you need the tax preparer to do is place figures where they belong. The more complicated the calculations and tax knowledge required for your return, the more youll end up paying. All of this means that the better prepared you are before meeting with a tax advisor, the more affordable tax preparation services will be.