Read The Disclaimer And Click Proceed

Take note of whats written on the disclaimer. It says that the app can only assist individual taxpayers as of this time. Also, the app can only provide assistance during weekdays, Monday to Friday, from 8 AM to 5 PM. Any queries sent during weekend or holidays will be processed on the next business/working day.

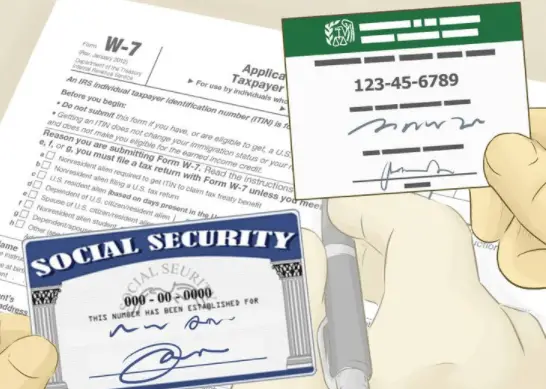

How To Find Your Lost Tax Id Number

Imagine you’re filling out a form when you suddenly realize that you forgot your tax ID number. First of all, don’t panic this kind of situation is more common than you think. Locating a forgotten or misplaced tax ID number is quite simple and should only take a few minutes. Chances are, you can find this information on previously filed tax returns, bank statements or pay stubs.

Tip

First, determine whether you need to find your Social Security Number , Employer Identification Number or Individual Taxpayer ID Number . Any of these numbers will be listed on your tax returns, but you may need to call the IRS or the Social Security Administration to ask for help.

How To Recover Tin Number Online Using The Bir Mobile Tin Verifier App

In early 2021, the Bureau of Internal Revenue launched the Mobile Taxpayer Identification Number Verifier app1 to provide taxpayers with a convenient way to recover or verify their TINs.

Instead of personally going to BIR district offices, taxpayers can get real-time responses to their TIN-related inquiries at the touch of their fingertips. Available in both App Store and Google Play , the tax verifier app can help you complete the following transactions:

- TIN Inquiry to recover your lost or forgotten TIN, the app will ask about your personal details . It will also require you to take a selfie with a valid government-issued ID and upload a copy of the same ID for verification purposes.

- TIN Validation to confirm whether a TIN is an authentic one or not, the app will require you to input your TIN and personal details . Likewise, it will ask you to take a selfie with a valid government-issued ID as well as upload a copy of the said ID.

To recover your TIN number via the new BIR Tax Verifier app, follow these steps:

Don’t Miss: How To Register For Tax Id

Other Ways To Confirm An Ein

There are several other ways of finding Employer Identification Number or EIN verification. Some of the most common ways are:

- Confirmation Letter: If you feel you may have misplaced or lost your employer identification number then you need to search for the confirmation letter. This is a computer-generated notice that was issued to you by the IRS post your application for EIN. The letter is a confirmation of the fact that the IRS has received your application and that they have assigned a nine-digit employer identification number to you. You will be able to find the EIN number on this confirmation letter.

- Bank Documents: If you have opened a bank account using your Employer Identification Number then you can contact the bank directly to find the EIN number used for opening the account.

- Other Documents: If you have used your EIN number on any other official or business documents like state or local business licensing documents or bank loans then you will be able to get your EIN number from such documents. You will have to speak with the right authority in the said agency to get this tax ID number.

Verify A Charitable Companys Ein Number

There are times when you want to make a donation to a charitable organization and the best way to check if it is an authentic non-profit is through EIN verification. It is important to understand that a charitable organization is classified as a non-profit business and hence is required to apply for and obtain a Federal Employer Identification Number or Employer Identification Number . You are probably wondering, isnt a charitable company tax exempt? The fact is that a non-profit organization will enjoy tax-exempt status from the IRS by filing the application Form 1023 or Form 1023-EZ. Even though they can apply for tax exempt status, they are required to provide the 9-digit EIN assigned by the IRS in their application. So how do you verify the EIN of a charitable company?

You May Like: How Much Should I Withhold For Taxes 1099

How To Do An Ein Lookup Online

You can locate a lost or misplaced EIN by the following

If you are trying to find the EIN of business other than yours there are a few options.

Paid Method of Finding an EIN For a Business

Try purchasing a business credit report from any of the major credit agency.

Ein Lookup: How To Find Your Tax Id Number

A forgotten or lost EIN is a common issue that small business owners can run into, just as individuals lose their W-2s. Unfortunately, there isnt a convenient, searchable database of EINs or companies you can search for their federal tax ID number. Fortunately, there are some ways you can track down your EIN.

Also Check: How Do You Report Bitcoin On Taxes

What Do I Do If I Lose My Itin Number

If you lose your Individual Taxpayer Identification Number , you may not need to submit another IRS W-7 ITIN application form to apply for a new one. The IRS will mail you a copy of your number after verifying your identity. You will first need to contact the IRS and you will be asked a series of questions which will verify your identity. If youre within the U.S., you can call the IRS toll-free at 1-800-829-1040. Outside the U.S., the number to call is 1-267-941-1000 .

Check Your Tax Documents

You can find the number on the top right corner of your business tax return. If you open the return and discover that the number has been replaced with asterisks for security purposes, contact your CPA and request the number from them.

The business EIN is listed on the top right of a business tax return.

If you file your own taxes with tax software, the software will save the number from year to year. Visit the softwares business section to retrieve your EIN.

Also Check: What Tax Return Does An Llc File

How To Apply For An Ein

Applying for an EIN is very straightforward and easy, and you should do it as early as possible when starting your business. Many early steps when starting a company, like opening business bank accounts or hiring an employee, will require that you have or get an EIN. Here are the ways you can apply for an EIN:

- Apply for EIN Online: Naturally, this is the preferred and most common way to apply for a federal tax ID these days. You can apply for an EIN right at the IRS website on their EIN online application.

- Apply for EIN by Fax: Businesses can fax in their application to the appropriate IRS fax number. Youll use a physical application, Form SS-4, which can be found on the IRS website.

- Apply for EIN by Mail: This is the old-fashion method and takes four weeks to process as a result. You will fill out a physical application, Form SS-4, and mail it to the appropriate address.

There are a few key stipulations about your eligibility to apply for an EIN. Applicants must either have a Social Security number, an Individual Tax Identification or an existing EIN to be eligible for one. Also, the applicant must be an individual, not a business entity, and the true principal officer, owner, general partner, grantor or trustor of the business.

Get your EIN when you form your company with MyCompanyWorks.

How Do You Obtain A Duplicate Copy Of A Lost Federal Tax Id Number

tax defined image by Christopher Walker from Fotolia.com

The IRS issues tax ID numbers to every individual who is subject to federal tax reporting. There are five types of federal tax identification numbers: social security number, employer ID number, individual taxpayer ID number, taxpayer ID number for pending U.S. adoptions and preparer taxpayer ID number.

Go to your local IRS Taxpayer Assistance Center and request a duplicate copy of your Federal Tax ID Number. You can locate your local TAC via the IRS website . Alternatively, you can use your local phone directory.

Request a duplicate Social Security card by filling out an SS-5, Application for a Social Security Card. Fill out the form and take it to your local Social Security office. Bring a form of identification such as your birth certificate or your state issued drivers license. You are limited to three cards a year. There is a lifetime maximum of 10 replacement cards.

Contact the Internal Revenue Service Business and Specialty Tax line at 800-829-4933. Advise the operator that you have misplaced your tax ID number. You need to provide your identifying information: name, address and your taxpayer ID number, if available. Request that the IRS send a duplicate copy of your federal tax ID number via mail to your residence.

Resources

Recommended Reading: How To Calculate Payroll Tax Expense

How To Find State Tax Id Number For A Company

Most businesses must have an employer identification number in order to open a bank account, receive a business license, file taxes, or apply for a loan.3 min read

Need to know how to find a state tax ID number for a company? Most types of business entities must have an employer identification number in order to open a bank account, receive a business license, file taxes, or apply for a loan. This EIN, also known as a business tax ID number or federal tax ID number, is a nine-digit number that the IRS uses to identify a business.

Whether or not your company employs workers, you’ll probably need this number for federal tax filing purposes. However, not every company needs an EIN. In some instances, a sole proprietor without any employees can simply use their own social security number.

Some states may require your business to have an EIN prior to completing state tax forms or registering your company within the state. In addition to tax filing, the EIN is used to identify a business in order to process a business license or satisfy other state requirements. For example, California State requires most businesses to have an EIN prior to registering state payroll taxes.

Ssn Where Can I Get It

In order to get an SSN, youll need to fill out an application form. This form is known as SS-5, and can be found at the SSAs forms page online. As well as this form, you should prepare to submit proof of identity, age, and U.S. citizenship or lawful alien status. If you need further information, you can read this article on applying for a personal taxpayer identification number.

You May Like: Do You Pay State Taxes On Unemployment

Does My Business Need An Ein

Businesses of all types are allowed to apply for an EIN. However, the IRS requires certain businesses to have one. If you answer yes to any of the following, you’ll need an EIN:

- Does your business have employees?

- Does your business file employment or excise taxes?

- Is your business taxed as a partnership or corporation?

- Does your business withhold taxes on non-wage income paid to a nonresident alien?

- Do you have a Keogh plan?

Even if your business is a sole proprietorship or LLC with no employees, its still beneficial to get an EIN. It makes it easier to keep your personal and business taxes separate, and it may be required to open a business bank account or apply for business licenses. If you don’t have an EIN, you’ll need to use your personal SSN for various tax documents.

Keep in mind that those with an SSN, an individual tax identification number , or an existing EIN may apply for an EIN.

No Authorization Needed Access Directly From Irs Website

The search for an employer identification number of your company or another company may require certain authorizations but that is not the case when it comes to charitable companies. You can directly access the online IRS application to find your EIN number. The online database search can be conducted using specific parameters like the company name, state, and city of operations.

You May Like: Can I Use Bank Statements As Receipts For Taxes

How To Find Your Bn

Finding your BN is, fortunately, super easy and relatively straightforward.

To find your BN, use Canadas official Business Registration Online service:

Its used for not only registering for a BN if you dont already have one, but can be used to find your existing BN number.

If for some reason you cant get into the BRO service, contact Canadas official government website here.

How Do I Verify My Ein Number

The employer identification number is one of the most important nine-digit numbers for new and existing businesses. This number is not only used for identifying the tax status of a business entity but also for filing of tax returns, applying for business licenses, and several other business related activities. If you are a business owner and have misplaced your EIN number then it can cause panic but there are ways of EIN verification that can help you in get this highly important business tax number back.

Recommended Reading: What Happens If I Forgot To File Taxes

What Is An Employer Identification Number

An Employer Identification Number is a unique identification number that is assigned to a business entity so that it can easily be identified by the Internal Revenue Service . It is commonly used by employers for the purpose of reporting taxes.

The EIN is also known as a Federal Tax Identification Number. When it is used to identify a corporation for tax purposes, it is commonly referred to as a Tax Identification Number .

What Is My Tin Finding Out Your Own Tax Number

The IRS have to process huge amounts of data from millions of different US citizens. Organizing this is a real challenge, not only because of the sheer volume of data to be processed, but also because identifying people can be quite tricky without the right system. For example, according to the Whitepages name William Smith has over 1,000 entries in the State of Alabama alone. Across the USA this number increases, and the likelihood is that some of these individuals will have the same date of birth, for example, which is often used to identify people. This means that there needs to be another system for keeping track of individuals for tax purposes in the US other than just their names: A taxpayer identification number serves this purpose.

A Taxpayer Identification Number is often abbreviated to TIN and is used by the Internal Revenue Service to identify individuals efficiently. Where you get your TIN, how it is structured, and whether a TIN is the right form of identification for your purposes sometimes seems like it isnt as straightforward as it should be. However, this guide will look at exactly these issues which should show that finding out this information can be as easy as 1,2,3. In this article, we want to concentrate on the tax number that you as an employee will need for your income tax return or the number that you as an employer require for invoicing, and well explain exactly where you can get these numbers.

Contents

You May Like: How To Lower Property Taxes In Florida

Do I Get A P45 When I Leave My Job

A P45 is the document you receive when you leave a job, and it contains all the information a new employer will need about your old salary, your tax code, and how much tax youve paid during your previous employment. Its a legal requirement for employers to send a P45 to all ex-employees after theyve left.

Can Your Businesss Identity Be Stolen With The Ein

It is unlikely that someone could take out a million dollar loan with your EIN because lending institutions have several layers of identity verification.

However, it is possible that someone could apply for business credit lines or business credit cards online using the number and other publicly available information.

To decrease the risk of identity fraud, set up a business account with a credit reporting institution like Dun & Bradstreet, and keep an eye on all tradelines and scores for your business every few months.

Don’t Miss: How Much Do I Need To Make To File Taxes