Do You Need Help Determining Your Residency Status

If, after reading the preceding information, you are still not sure whether you were a non-resident of Canada for tax purposes in;2020, complete Form;NR74, Determination of Residency Status , or Form NR73, Determination of Residency Status , whichever applies, and send it to the CRA as soon as possible. The CRA will provide you with an opinion on your residency status based on the information you give us.

You Need To Be Honest About Your Second Job

Some people take money under the table so its not taxed. Should the government ever find out that youre doing this, you could face fines, extra money owed, and even jail time.

Even if you dont trust the government or are afraid of a higher tax bracket, you need to be honest about your second job and report it.

Irs Electronic Free File For Federal Returns

You may qualify to electronically file your federal return for free by using IRS Free File Some of the companies participating in the IRS Free File service will file your Maryland return electronically for free as well. No matter what company you select, you can always return to file your Maryland tax return for free online, using our iFile or bFile services. Keep in mind that your Maryland return begins with your federal adjusted gross income, so you must prepare your federal return first before you can prepare your Maryland return.

Generally, you are required to file a Maryland income tax return if:

- You are or were a Maryland resident;

- You are required to file a federal income tax return; and

- Your Maryland gross income equals or exceeds the level listed below for your filing status. The filing levels also apply to nonresident taxpayers who are required to file a Maryland return.

Even if you are not required to file a federal return, you may be required to file a Maryland return if your Maryland addition modifications added to your gross income exceed the filing requirement for your filing status. Dependent taxpayers must take into account both their additions to and subtractions from income to determine their gross income.

For more information, see the instructions in the and nonresident tax booklet.

Filing Requirements for 2020 Tax Year

|

Filing Status |

|

| One spouse 65 or older | $ 24,800 |

| $ 24,800 |

Your income tax return is due July 15, 2021.

Also Check: Will I Get Any Money Back From My Taxes

Determine Your Irs Filing Status

The IRS has five filing statuses:

- Single: Not married or legally separated as outlined in a divorce or maintenance decree.

- Married and filing taxes on combined income.

- Married, but filing incomes separately.

- Head of household: Not married, paying more than half of the cost of maintaining a home, and responsible for a qualified dependent for at least six months of the year.

- Qualifying widow or widower with dependent child: If your spouse died in 2019, you can claim married filing jointly on your return. You are a qualifying widow or widower for up to two years after the death of your spouse if you have a dependent child and you have not remarried.

What Is A Child’s Income Tax Rate

The Tax Cuts and Jobs Act changed the rates for the kiddie taxes. During 2018 through 2025 all net unearned income was to be taxed using the brackets and rates for trusts and estates instead of parent’s individual rates. The new rates were as high as 37% on only $12,070 of income. This change proved so unpopular it was rescinded in 2020 and the old rules put back in place. Starting in 2020, income tax on unearned income over the annual threshold must be paid at the parent’s maximum tax income tax rate, not the rates for trusts and estates. For 2019 and 2018, parents have the option of using either their individual rates or the trust and estates rates. For details, see the article “The Kiddie Tax.”

For federal income tax purposes, the income a child receives for his or her personal services is the child’s, even if, under state law, the parent is entitled to and receives that income. Thus, dependent children pay income tax on their earned income at their own individual tax rates.

For more on tax rules for children, see IRS Publication 929, Tax Rules for Children and Dependents.

Also Check: How Do You Add Sales Tax

Federal Tax And Credits

Complete Step 5 of your return to calculate your federal tax and any credits that apply to you.

Schedule;A, Statement of World Income

You have to complete Schedule;A to report your world income. World income is income from Canadian sources and sources outside Canada. Your net world income, which is shown on Schedule A, is used to determine your allowable amount of non-refundable tax credits on Schedule;B .

Note

Your income from sources outside Canada is reported only on your Schedule;A.

Federal non-refundable tax credits

These credits reduce your federal income tax. However, if the total of these credits is more than your federal income tax, you will not;get a refund for the difference.

The non-refundable tax credits you can claim depend on the portion of net world income ;included in net income .

Schedule;B, Allowable Amount of Non-Refundable Tax Credits

Complete Schedule;B to;calculate the allowable amount of non-refundable tax credits you can claim.

If the result from line;A of Schedule;Bis;90% or more, you can claim all the federal non-refundable tax credits that apply to you. Your allowable amount of non-refundable tax credits is the amount on line;35000 of your return.

If the result from line A of Schedule B is less than 90%, you can claim the following applicable federal non-refundable tax credits if you are reporting Canadian-:

Note

Your tuition, education, and textbook amounts

If you have no Canadian source income, tuition fees paid in 2020 cannotbe claimed.

Not Everyone Has To But Be Sure You Know What Your Situation Requires

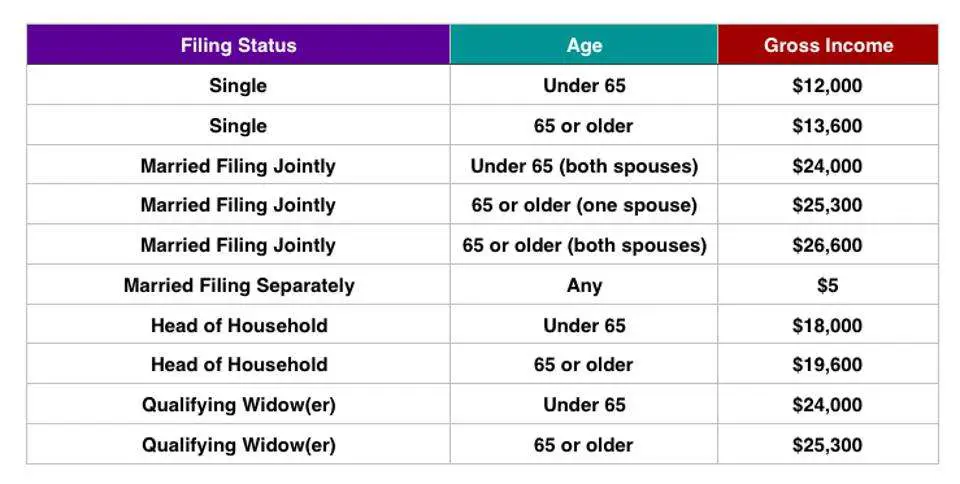

This may come as a surprise to many people, but not everyone needs to file a federal;tax return. The Internal Revenue Service has threshold levels for tax return requirements just like tax brackets. Whether or not you need to file is primarily based on your level of gross income and status for the tax year. However, keep in mind that even if you arent required to file because of your gross income, you may still be eligible for a refund.

Recommended Reading: When Can You File Your Taxes

Does Everyone Need To File An Income Tax Return

OVERVIEW

Not everyone is required to file an income tax return each year. Generally, if your total income for the year doesn’t exceed certain thresholds, then you don’t need to file a federal tax return. The amount of income that you can earn before you are required to file a tax return also depends on the type of income, your age and your filing status.

Apple Podcasts | Spotify | iHeartRadio

Expanded Penalty Waiver Available If 2018 Tax Withholding And Estimated Tax Payments Fell Short; Refund Available For Those Who Already Paid 2018 Underpayment Penalty

The IRS lowered to 80 percent the threshold required for certain taxpayers to qualify for estimated tax penalty relief if their federal income tax withholding and estimated tax payments fell short of their total tax liability in 2018. In general, taxpayers must pay at least 90 percent of their tax bill during the year to avoid an underpayment penalty when they file. On January 16, 2019, the IRS lowered the underpayment threshold to 85 percent and ;on March 22, 2019, the IRS lowered it to 80 percent for tax year 2018.

This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

Taxpayers who have not filed yet should file electronically. The tax;software was updated and uses the new underpayment threshold and will determine the amount of taxes owed and any penalties or waivers that apply. This penalty relief is also included in the revision of the instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

Don’t Miss: What Age Do You Have To File Taxes

Do You Need A Social Insurance Number

A SIN is a nine-digit number issued by Service Canada. You are usually required to have a SIN to work in Canada, and your SIN is used for income tax purposes under section;237 of the Income Tax Act. You must give your SIN to anyone who prepares information slips for you.

For more information, or to get an application for a SIN, visit Service Canada or call;1-800-206-7218 ).

If you are outside Canada and the U.S., you can write to:

Service;Canada CANADA

or call;506-548-7961.

If you are not eligible to get a SIN,;you can apply for an individual tax number by completing;Form T1261, Application for a Canada Revenue Agency Individual Tax Number for Non-Residents. Send it to the CRA as soon as possible. Donot complete this form if you already have a SIN, an individual tax number, or a temporary tax number.

If you have requested but not yet received a SIN or an ITN, and the deadline for filing your return is near, file your return without your SIN or ITN to avoid any possible late-filing penalty and interest charges. Attach a note to your return to let the CRA know.

Know The Standard Deduction

In general, you DONT need to file a tax return if your income was less than the standard deduction.For 2020, the standard deduction was $12,400 for those filing single. The standard deduction reduces taxable income. For someone making less than the standard deduction, their taxable income would be reduced to below $0.00. Obviously, that means there are no taxes due since there is no income to tax. The standard deduction does vary with filing status:

|

Standard Deduction 2020 Tax Year |

|

|---|---|

|

Single |

|

|

Qualifying Widow |

$24,800 |

For those over 65 years of age, the standard deduction increases depending on your filing status:

|

Over 65 Increase in Standard Deduction 2020 Tax Year |

|

|---|---|

|

Single or HoH |

|

|

$1,300 |

|

|

$2,600 |

Because of the higher standard deduction, someone over 65 can make more than someone less than 65 and still end up paying less in taxes or even no taxes.

For those who are legally blind, the standard deductions are:

|

Legally Blind Increase in Standard Deduction 2020 Tax Year |

|

|---|---|

|

Single or HoH |

|

|

$1,300 |

|

|

$2,600 |

With the standard deduction covered, lets look at filing income thresholds.

Recommended Reading: Where Can I Find My Agi On My Tax Return

Electing Under Section 2183

If you as a non-resident investor have Canadian mutual fund investments with;15% tax withheld from assessable distributions paid or credited to you, both the assessable distributions and the withholding tax will be shown on an NR4;slip, Statement of Amounts Paid or Credited to Non-Residents of Canada. Generally, this;15% tax on the assessable distributions is considered the final tax obligation to Canada on that income.

If you have a loss;on your disposition of a Canadian mutual fund investment, you can apply your loss to offset any assessable distributions paid or credited to you after;2004, as long as;your loss does not exceed your total assessable distributions paid or credited to you on the investment. To apply the loss, you must file a Part;XIII.2 tax return.

At What Income Does A Minor Have To File An Income Tax Return

OVERVIEW

If your kids are young enough to be your dependents, they may have to pay taxes. In some cases, you may be able to include their income on your tax return; in others, they’ll have to file their own tax return or you will have to file a separate return on their behalf. Whether this is required depends on both the amount and source of the minor’s income.

Youngsters are especially ambitious these days, and even if your kids are young enough to be your dependents, they may have to pay taxes. In some cases, you may be able to include their income on your tax return; in others, they’ll have to file their own tax return or you will have to file a separate return on their behalf. Whether this is required depends on both the amount and source of the minors income.

Read Also: Where To Find Real Estate Taxes Paid

The Qualified Business Income Deduction

The IRS has one more gift for small business owners: the Qualified Business Income or QBI deduction. The rules for this one are a little tricky, but in simplest terms, the QBI deduction allows you to slice another 20 percent off your small business income if you qualify to claim it.

This deduction isn’t claimed on Schedule C, either. You can deduct it on line 10 of your Form 1040 tax return, right after you claim the standard deduction or the total of your itemized deductions. Your total business income on Schedule C before this deduction might be $15,000, requiring you to pay taxes on $2,600 the difference between the standard deduction and your income, but the QBI allows you to shave $3,000 or 20 percent off that $15,000. This drops your taxable income to $12,000, less than the standard deduction amount, so you would not owe income taxes.

The first major rule for this deduction is that C corporations don’t qualify. Your small business must be a pass-through tax entity. Income limits apply as well, and some service trades don’t qualify. You must file Form 8995 or Form 8995-A to claim the QBI deduction.

When It Pays To File

For those few who dont legally have to file, it pays sometimes to send in a return anyway.

This is the case for individuals who dont earn much but might be eligible for the earned income tax credit. This benefit is available to qualified individuals even if they owe no tax, meaning they would get money back from the federal government. Many people think the credit is available only to parents. Its not. But the credit amount is greater for eligible low-wage taxpayers with children.

Plus, the IRS says that most individual taxpayers are due a tax refund. But those taxpayers must send in a Form 1040, Form 1040A or Form 1040EZ to get that cash.

You can check out the filing requirements section of IRS Publication 17 for more details.

Once youve determined that you need to file taxes, your next question is likely to be when do I have to file taxes? This year, the deadline for filing your 2020 tax return is Thursday, April 15, 2021. If youre still not sure whether you must file a tax return, ask a tax professional, call the IRS at 829-1040 or make an appointment at your nearest IRS Taxpayer Assistance Center.

You May Like: How To Look Up Employer Tax Id Number

Is There A Minimum Income To File Taxes In California

This can pay anywhere from $243 to $6,728. Additionally, the Golden State Stimulus can only be claimed by filing your 2020 tax return. If you earned less than $30,000 and qualify for the CalEITC, you can get a $600 payment from the Golden State Stimulus along with any other cash from tax credits you are eligible to claim.

Filing Information For Individual Income Tax

Whether you file electronically using our free iFile service, hire a professional preparer, have us prepare it for free, or complete a paper return, filing a Maryland tax return is easy.

For those in a hurry, some quick links to everything you need to know about…

Follow the links to sort out all the details quickly and make filing your tax return painless!

Don’t Miss: How Much Money Is Taken Out Of Paycheck For Taxes

You Must File An Income Tax Return If:

- You owe tax to the CRA.

- Youve participated in the Home Buyers Plan ;or Lifelong Learning Plan and have repayments owing.

- You disposed of capital property. If you sold your home, you must file a tax return even if you dont have to pay capital gains tax on the sale .

- You have received a Canada Workers Benefit advance payments in the tax year.

- The CRA has sent you a Request to File.

- If the CRA has sent you a Demand to File, then that means they are serious about your lack of filing and you had better get to it.

Extended Due Date Of First Estimated Tax Payment

Pursuant toNotice 2020-18, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to , the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

Recommended Reading: How To Reduce Income Tax

How Do I Make My Quarterly Payments

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior years annual tax return in order to fill out Form 1040-ES.

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax.

Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System . If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

See the Estimated Taxes page for more information. The Self-Employment Tax page has more information on Social Security and Medicare taxes.