Be Mindful Of Security

One note on filing your taxes with a mobile device: You need to think about security. The information in your taxes is, by definition, sensitive. All our recommended services take security seriously, but it’s important that you do your part too. While we don’t want to be alarmist, it’s also important to acknowledge that most of us don’t think enough about the security of our Wi-Fi traffic. If at any point in the filing process you’re at all likely to be connected to a public Wi-Fi network you don’t control, you should make sure to use an Android VPN app or an iPhone VPN app, depending on your platform. If the VPN conflicts with your tax service, wait until you can connect to a network you control.

One other important security fact to know is that the IRS will never call you out of the blue and ask for private information. The agency prefers to communicate via written letters sent via US Mail. For more on tax-season dangers, please read our piece on how to avoid tax scams this filing season.

A Guide To Paying Quarterly Taxes

OVERVIEW

Self-employed taxpayers likely need to pay quarterly tax payments and meet key IRS deadlines. Heres a closer look at how quarterly taxes work and what you need to know when filing your tax returns.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Working for yourself presents a host of benefits, such as never having to report to a boss and setting your own hours. It also carries a few added tax requirements, such as paying your taxes quarterly instead of with each paycheck as a W-2 employee would.

Keep reading to learn answers to questions like, “Who has to pay quarterly taxes?” “When are quarterly taxes due?” and “How do I pay quarterly taxes?”

There Are 2 Ways To Prepare And File Your Taxes

Americans have two basic options when it comes to filing their taxes:

1. Do it yourself with tax software or through the IRS website. The IRS does not charge to file taxes. If you’re well-versed in tax law you can or request the paper forms in the mail. However, the IRS encourages online filing and directs taxpayers with incomes under $72,000 to its free filing portal, which lists 10 qualified tax preparers that offer free services .

For people with incomes north of $72,000, you can still find free filing options if you have straightforward income. A more complex situation like self-employment or complicated investments means you’ll likely have to pay an online tax preparer, which can range from $25 to $100 or more for federal and state filing.

2. Hire a tax preparer to do it for you. The only professionals qualified to help you are tax lawyers, CPAs, and enrolled IRS agents. You can search for appropriately credentialed preparers at taxprepareregistry.com.

Preparers generally start at around $100 and vary depending on where you live and how complex your taxes are, and accountants might very well charge at least twice that, with similar variations in price according to location and complexity. According to a survey from the National Association of Tax Professionals, the average charge for preparing and filing a tax return is $216.

You May Like: How To Register For Tax Id

I Am A Day Trader How Exactly Do I Report My Investment Income Into Turbotax So That I Can Capitalize On The Full Range Of Deductions

My losses from the Schedule D then should be included on my Schedule C before transferring over to Line 12 of Form 1040.

That’s not correct. You’re confusing day trading with a Mark to Market election. With day trading your gains and losses still go on Schedule D but your business expenses such as margin interest, computer costs allocatable to the business, etc. go on Schedule C. In effect your losses will be on Schedule D but your day trading expenses will go on Schedule C

It’s too late to make a Mark to Market election for 2014 The last day to make the election for 2015 was on April 15,2015. Consequently, the earliest year you can make it for is next year – 2016.

The Fairmark Press site has an explanation of this:

Gather Tax Filing Information

Youll need to do this whether youre hiring a tax preparer or doing the tax filing yourself. The goal is to gather proof of income, expenses that might be tax-deductible or win you a tax credit, and evidence of taxes you already paid throughout the year. Our tax prep checklist has more guidance, but heres a short version of what to round up:

-

Social Security numbers for yourself, as well as for your spouse and dependents, if any.

-

W-2 form, which tells how much you earned in the past year and how much you already paid in taxes.

-

1099 forms, which are a record that some entity or person not your employer gave or paid you money.

-

Retirement account contributions.

-

State and local taxes you paid.

-

Educational expenses.

You May Like: Do I Need W2 To File Taxes

What Is Irs Free File

The IRS Free File Program is a public-private partnership between the IRS and many tax preparation and filing software industry leaders who provide their brand-name products for free. It provides two ways for taxpayers to prepare and file their federal income tax online for free:

- Traditional IRS Free File provides free online tax preparation and filing options on IRS partner sites. Our partners are online tax preparation companies that develop and deliver this service at no cost to qualifying taxpayers. Please note, only taxpayers whose adjusted gross income is $72,000 or less qualify for any IRS Free File partner offers.

- Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose income is greater than $72,000.

Find what you need to get started, your protections and security, available forms and more about IRS Free File below.

About IRS Free File Partnership with Online Tax Preparation Companies

The IRS does not endorse any individual partner company.

- A copy of last year’s tax return in order to access your Adjusted Gross Income

- Valid Social Security numbers for yourself, your spouse, and any dependent, if applicable

Income and Receipts

Other income

ACA Filers

File Electronically

Contact Information

Round Up Your Tax Documents

To do taxes, collect all your tax documents, including your W-2s, 1099s, investment income statements, bank statements, mortgage interest statements, proof of healthcare form, receipts, and any other documents you may need.

Most forms detailing income and investment interest should be mailed to you by January 31. However, you have until April 15 to file your taxes. If youre missing any forms by the end of January, contact your employers, bank, or brokerage and send a reminder.

You May Like: When Are Alabama State Taxes Due

Can I File My Taxes Online For Free If Im A Non

Yes. TurboTax makes it easy to file your Candian tax return as a non-resident. In fact, if youre a non-resident you can use any of the TurboTax Online products, including TurboTax Free. For more info, read about How Residency Status Impacts Your Tax Return

With more than 20 years experience helping Canadians file their taxes confidently and get all the money they deserve, TurboTax products, including TurboTax Free, are available at www.turbotax.ca.

Hire A Professional If

You don’t have the time and patience to deal with it. If you feel that the significant time you’d need to devote to doing your taxes would be better spent elsewhere, you might want to outsource. It’s probably more prudent than rushing through your filing and making a mistake.

You have a complicated tax situation with dependents, investments, or significant assets or charitable contributions, or you own a business. Nearly every financial transaction comes with some kind of tax consequence, and the more transactions you have, the more things you need to take into consideration. People who own businesses, freelance, or are self-employed in particular might want the help of a professional to iron out their atypical tax situations deductions for home offices, business meals and travel, and vehicles are also audit red flags.

You’re planning to itemize your deductions. Since the Tax Cuts and Jobs Act increased the standard deduction, fewer filers are itemizing deductions. But if you have major medical costs, a mortgage, or make large charitable donations you might save more money itemizing your deductions than taking the standard deduction. But itemizing can be tricky to navigate on your own, especially if it’s your first time.

You’ve had a major life change in the last year. Did you get married? Buy a house? Have a baby? These all impact your tax filing, and, at least the first time you document them on your taxes, you might want someone to show you how best to do it.

You May Like: Who Needs To File Taxes

Why The Government Should Just Do Your Taxes For You

The actual work of doing your taxes mostly involves rifling through various IRS forms you get in the mail. There are W-2s listing your wages, 1099s showing miscellaneous income like from one-off gigs, etc. To fill out your 1040, you gather all these together and copy the numbers in them onto the 1040 form. The main advantage of TurboTax is that it can import these forms automatically and spare you this step.

But here’s the thing about the forms: The IRS gets them too. When Vox Media sent me a W-2 telling me how much it paid me in 2017, it also sent an identical one to the IRS. When my bank sent me a 1099 telling me how much interest I earned on my savings account in 2017, it also sent one to the IRS. If I’m not itemizing deductions , the IRS has all the information it needs to calculate my taxes, send me a filled-out return, and let me either send it in or do my taxes by hand if I prefer.

This isn’t a purely hypothetical proposal. Countries like Denmark, Sweden, Estonia, Chile, and Spain already offer “pre-populated returns” to their citizens. The United Kingdom, Germany, and Japan have exact enough tax withholding procedures that most people don’t have to file income tax returns at all, whether pre-populated or not. California has a voluntary return-free filing program called ReadyReturn for its income taxes.

The Obama administration supported return-free filing, and Ronald Reagan touted the idea in a 1985 speech:

Is It Worth It To Hire An Accountant For Taxes

It may inform you of a mistake on your tax return, an under- or overpayment on your taxes, or tell you about new taxes you owe. Regardless of why the IRS contacts you, its a good idea to hire an accountant. If you handle the situation incorrectly, you may face plenty of fees and headaches in the future.

Recommended Reading: What If I File Taxes Late

You Like The Feeling Of Being In Control

Another reason people like filing with tax software programs such as TurboTax is because they like being involved in every aspect of the numbers that are input on their behalf.

When you use an accountant, you give up a certain amount of control regarding your tax return.

You hand your stuff to the tax specialist, and he or she hands it back to you with a note telling you what your refund will be or how big of a check you need to write.

You have little to no idea what numbers were entered into your return.

Unless you scrutinize your return with a fine-toothed comb youre going to have to take your accountant at his word that there were no mistakes made or deductions missed.

However, if youd rather see first-hand exactly what numbers are being used and which deductions are being included, you might prefer using TurboTax.

Programs like these will walk you through every line item of your return so that you can make sure youre considering every potential deduction.

This process gives you complete control over the numbers that are entered and the expenses and deductions that are included.

How Much Does Each Version Cost

When we looked up prices on Amazon, here were the prices for the digital download :

Now the packages are only available with state if you dont have to file a state return, you may want to go with TurboTax online.

Sometimes, its possible to do the Federal return with software and to file your state return on paper. This can save you money and state returns are often less complex.

You May Like: What Am I Getting Back In Taxes

Open The Wine Its Ok To Make It Fun

Im not going to fault you for not lovvving doing your own taxes, starting them 48 hours before the filing deadline, or opening the wine and doing your first draft slightly buzzed. Taxes are a lot of data entry. I manually entered 47 different stock transactions this year, and have two words to make that less painful: pinot noir.

Do what you need to do to make them fun. Think of them as selfcare. Do them with a friend. Make it a personal challenge. Give yourself a little treat when youre done. But remember, you CAN do them. Feel free to reach out to us with questions.

Join our AskFlossie community where all women are empowered with community and knowledge to build stronger financial lives. Were here to be your financial wingwoman!

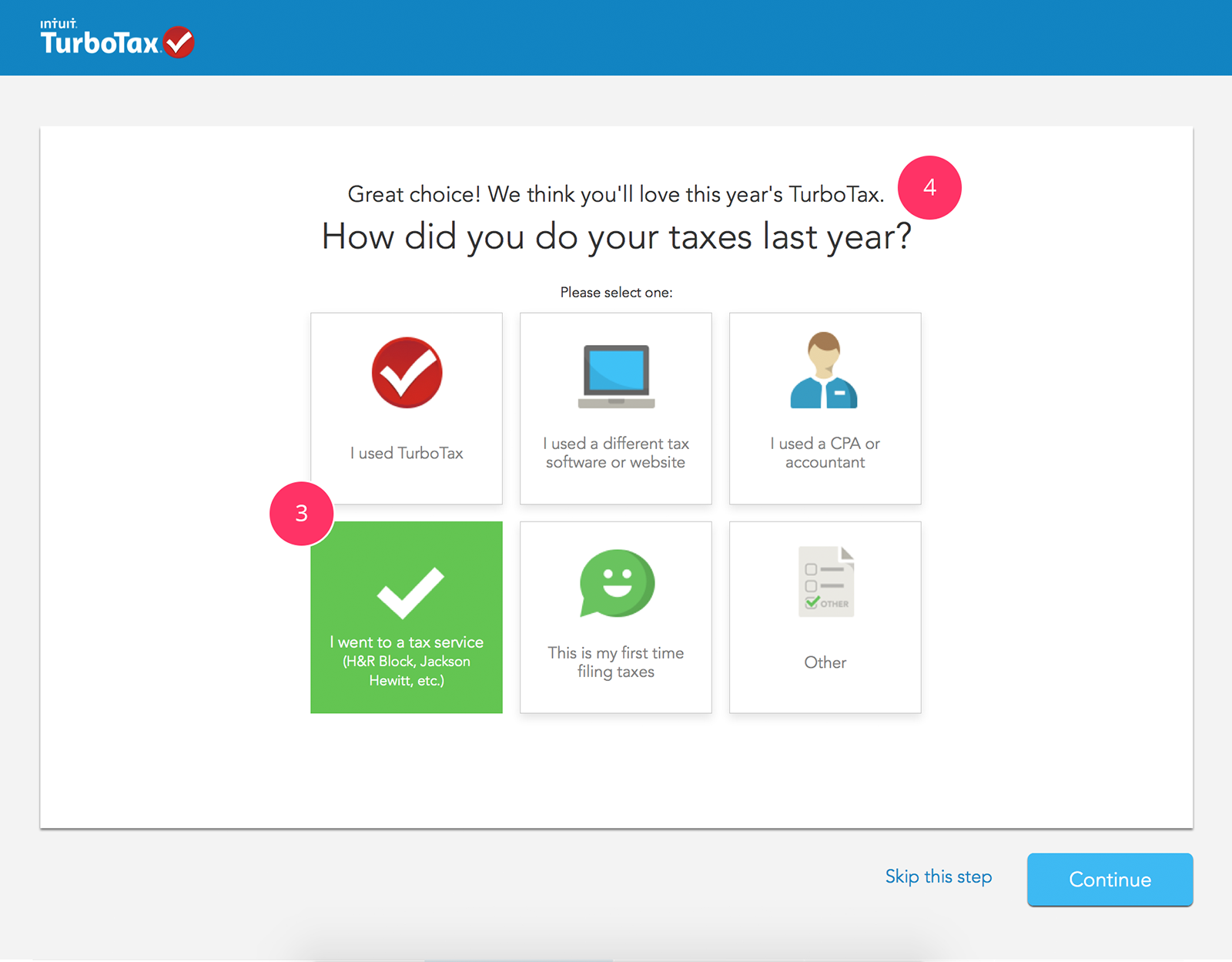

The Tutorial: Doing Your Taxes With Turbotax Free Software

INSIDE: Filing your taxes online doesnt have to be overly complicated, especially with the TurboTax free version online. Heres a Turbo Tax step by step guide!

Oh, hi tax season. Even though I cover personal finance topics for a living, tax season still sneaks up on me every year. Even ifyou dont run your own business or have complicated taxes, filing online can be intimidating. While more of a hassle than say, returning a package, filing your income tax online doesnt have to be overly complicated, if you plan properly and leverage great technology, such asTurboTax free filing online.

You May Like: Do You Have To Report Roth Ira On Taxes

Is Turbotax Reliable And Safe

TurboTax keeps your information secure with data encryption. It also requires multi-factor authentication every time you log in to verify your identity.

One of the biggest complaints about TurboTax is the ease with which it attempts to upgrade users to the next-tier product. A 2019 investigation by ProPublica found that Intuit, TurboTax’s parent company, was deliberately hiding its free filing services from Google and other search engines. As of this writing, TurboTax’s free file options are clearly advertised.

TurboTax may not have the best reputation, but it’s a leader in tax preparation services for a reason. Millions of people come back to TurboTax year after year because they can easily and successfully file their tax return. If you follow the directions provided and enter the numbers on your income forms correctly, you should end up with accurate taxes just as if you went to a more expensive professional tax preparer.

Small Business Tax Myths

My business didnt make any money so I dont have to report anything right? False.

Many businesses dont see a profit in the first year . You are still required to include details of your business on your tax return and if your business actually lost money, you can apply the loss to your other income.

I made less than $5000 so I dont have to file: False.

Although you may not owe any taxes on your business income, you may be responsible for Canada Pension Plan contributions. As a small business owner, you pay both your share of CPP and the employers share. The amount due is calculated by TurboTax Self-Employed on your tax return.

I am a student so the money I make is tax-free: False.

The CRA doesnt have special rules for small business owners who are still in school. The details of your self-employment must be included when you file your return.

You May Like: Where Is My California State Tax Refund

The Best Tax Software For Filing Your Own Taxes

Once you have made the decision to file your own taxes and have all of your documents ready its time to choose a tax filing software. For me, the key to filing my taxes correctly and with full confidence in getting my best refund was relying on TurboTax. I love that TurboTax has many different options to fit everyones needs and budget. From filing your taxes for free if you have simple tax returns with TurboTax Free Edition to having the option to get all of your questions answered by a live tax expert when you use TurboTax Live, theres something for everyone.

Can I Share Turbotax With A Friend

Yes, you can share it with a friend, with some conditions.

When you purchase the TurboTax software , it says that it comes with 5 free federal e-files. This is actually an IRS rule, not a TurboTax one. The IRS only allows you to prepare and electronically file up to five federal and state tax returns.

You can, however, prepare an unlimited number of returns and print them out to mail in.

When you buy TurboTax, youre allowed to install it on any computer you own. When you do, you can prepare the returns of you and your immediate family. Ive seen families do this a lot where a parent does their returns as well as their children, often when theyre in college.

In that way, you can share TurboTax with someone else when you buy the software but you are limited to five e-files. E-filing is the fastest way to get a tax refund.

If youre using the online version, you can only do one return.

You May Like: When Do We Get Our Taxes Back 2021