Tip #: Dont Miss Your Business Write

Most write-offs are missed because people donât keep track of what they buy for work. In the frenzy to pull everything together before taxes are due, eligible write-offs tend to fall through the cracks.

Do yourself a favor and start keeping up with your expenses now. More of your purchases count as business expenses than you might realize, and they could significantly lower your taxable income. Here are a few examples of business tax deductions you can take:

- ð¶ Your cell phone and internet bill

- ð Work-related parking fees and toll passes

- ð§âð» Software subscriptions

- ð³ Bank and credit card fees on accounts you use for work

- ð Computers and electronic accessories

If youâre wondering where to start with this, youâve come to the right place. The Keeper Tax app is specifically designed for gig and freelance workers.

The app will find and sort all of your business write-offs automatically. When youâre ready to file, all you have to do is upload your 1099s, and weâll handle the rest.

Video: How To Recover A 1099 Tax Form

OVERVIEW

Are you waiting for your 1099 forms to arrive so you can start preparing your tax return? Or do you need to obtain copies of older ones for some other reason? If you answered yes to either, there are easy ways to retrieve the forms. Watch this video to find out more about recovering 1099 forms.

What Is Considered Taxable And Non

In its simplest definition, income is money received and often earned through employment or investing. With that said, when it comes to the IRS definition of income, they have a much broader interpretation. Not only is the government interested in money received as payment but also other forms of compensation.

As such, it is the taxpayers responsibility to pay tax on the fair market value of either the goods or services received. Understanding the difference between taxable and nontaxable income can be confusing during tax season. Most wages, salaries, tips, and other forms of income are taxable.

Nontaxable income tends to come in the form of benefits, rebates, and inheritances. For example, child support income, welfare benefits, health care benefits, and gifts tend to be forms of nontaxable income. If you have received a rebate from the purchase of a car or other product, the rebate may be a form of nontaxable income. Rebates and cash back bonuses arent taxable if it is considered a reduction to the original purchase price, in other words a discount. However, in certain situations rebates are considered to be gifts and in this case, they are taxable.

Taxable income also applies to all gifting, bequests and inheritances of either cash or property. The first $14,000 of a cash gift does not incur any tax at the present time.

To calculate investment income, all you have to do is find the sum of the following:

You May Like: How Do Property Taxes Work In Texas

Read Also: How Much Do I Have To Pay In Taxes

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

We cannot process requests for duplicate 1099-G forms until after February 1 because throughout January we are still mailing the original forms.

You do not need a paper copy of Form 1099-G to file your federal tax return the IRS only needs the total amount of benefits TWC paid you during the previous calendar year and the amount of taxes withheld.

How To Fill Out A 1099

The company you worked for throughout the year will total your earnings on each 1099 MISC form. Throughout the year, you should collect and track your earnings, either in the form of paystubs or invoices from employers.To lower the amount of tax you pay, track your business expenses and hold onto receipts where you can. It’s vital that you enter your business expenditures onto your 1099 MISC form to calculate your exact taxable income.

You May Like: When’s The Last Day To File Taxes 2021

Coronavirus Tax Relief For Self

Coronavirus Aid, Relief, and Economic Security Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020. This means that 50% of the social security tax imposed on net earnings from self-employment earned during the period beginning on March 27, 2020, and ending December 31, 2020, is not used to calculate the installments of estimated tax due. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Managing Your Workers With Square Payroll

When you decide to hire people, one of the first things you do is set up systems to manage how to pay them. Whether you have only employees , only independent contractors , or a mix of the two, Square Payroll can make processing payroll easy.

Square Payroll simplifies your operations and helps you save time with fully integrated timecards, workers comp, sick leave, and PTO for your employees. It also lets you pay both employees and contractors with direct deposit. It also takes care of payroll tax calculations and creation of your W-2s and 1099-MISCs.

Read Also: How To Find Tax Id Number Online

Estimated Taxes For Airbnb Hosts

First, Airbnb hosts should determine if their rental income is taxable. The amount of taxes you owe depends on how many days you rent your place. Do you rent for less than 15 days per year? If so, you dont have to pay any taxes on your rental income.

However, if you rent for 15 or more days per year, then you may need to put aside money for estimated tax payments. As a rule, Airbnb withholds 28% of your income for taxes if you do not provide them with a W-9 form. Although your effective tax rate will likely be lower than 28%, it helps ensure you have enough to cover taxes.

Whether or not you will need to make estimated self-employment tax payments on Airbnb income depends on the treatment of services you provide to guests. More precisely, if you provide substantial services to your guests, the IRS will treat you as a business, meaning youll need to pay self-employment taxes. Alternatively, if you do not provide these services, your Airbnb income will be treated as a normal rental property, meaning you wont need to pay self-employment taxes.

Please review the below sections to determine the appropriate tax treatment for your Airbnb. Of note, determining this tax classification can seem complicated. Wed be happy to help! Contact us to set up a Airbnb tax planning discussion.

What Expenses Can I Deduct

Yes, working for yourself might mean flexibility and freedom. But that freedom comes with a price tag. As a contractor, youâre responsible for most of the expenses that might be paid for in a traditional workplace, including office supplies, printing, mileage expenses and meals with clients.

So before you start putting away money for the IRS, it could be a good idea to take stock of all the money you spend to keep your business running smoothly. Then check the IRSâs guide to deducting business expenses.4 Every dollar you spend on your business is a dollar you can subtract from your income, reducing what you owe to the IRS.

Don’t Miss: How Much Taxes Does Unemployment Take Out

Tax Deductions Available For Self

Despite the additional complications associated with paying self-employment tax, there is some good news. According to NerdWallet, certain tax deductions are available to help self-employed individuals save money. For instance, the home office deduction allows independent contractors who work from home to deduct a portion of their mortgage or rent, property taxes, utilities, and repairs and maintenance. Self-employed individuals can deduct office expenses, wear and tear on their car, phone and internet costs, business travel and meals, and more.3

Whats interesting is that the self-employment tax is itself a self-employment tax deduction. In other words, you can deduct half of your self-employment tax on your income taxes. Although you will need to pay the tax when its due during the year, it will be deductible on your 1040 at tax time, also according to NerdWallet.3

Now theres also the qualified business income deduction which allows self-employed individuals and business owners to deduct a portion of their business income on their taxes. This is for people who have pass-through income, or business income they report on their personal tax return, such as sole proprietorships, partnerships, S corporations and limited liability companies, as explained by NerdWallet.3

Gather Your Income Statements

The first step in computing your AGI is to determine your income for the year. Income can be in the form of money, property, or services you receive in the tax year.

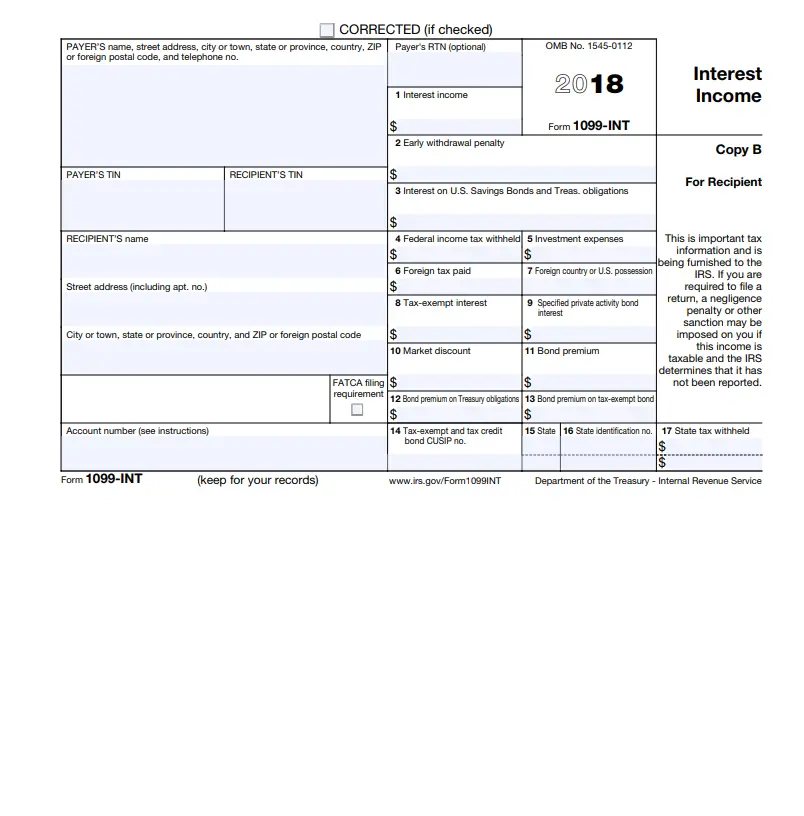

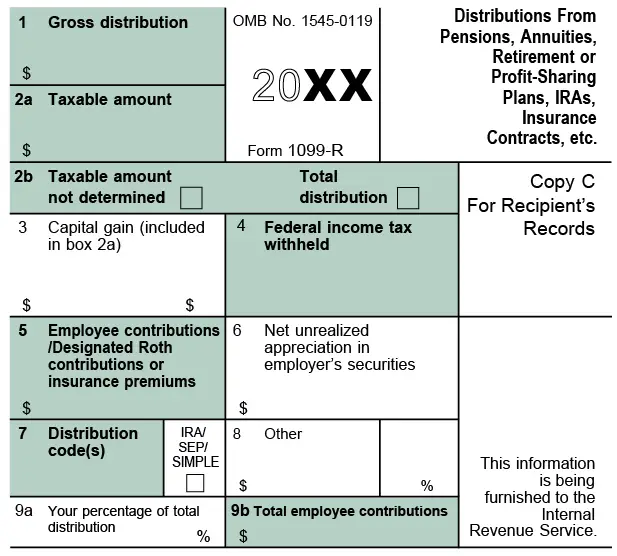

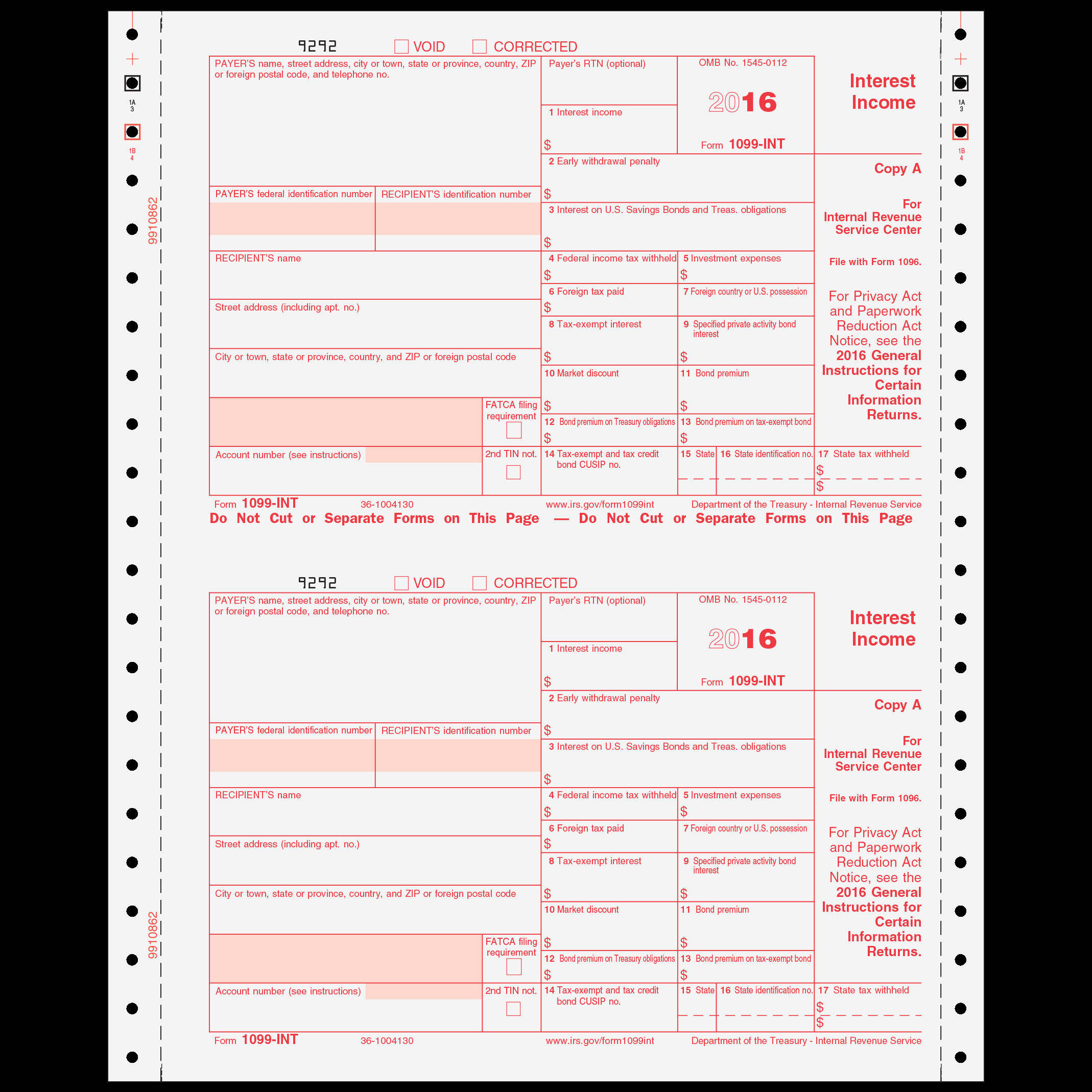

Income includes your traditional salary and wages, which are reported on Form W-2, any earnings from self-employment ventures, and any other income reported on 1099 forms, like investment dividends and retirement income. Proceeds from broker and barter exchange transactions reported on Form 1099-B, proceeds from real estate transactions reported on Form 1099-S, any taxable interest reported on Form 1099-INT, and any investment dividends reported on Form 1099-DIV are all considered part of your taxable income.

In addition, you will also need to include these sources of taxable income:

- Business income

- Capital gains on the sale of your primary home

- Money received as a gift or other inherited assets

- Canceled debts intended as a gift to you

- Scholarships or fellowship grants

- Foster care payments

- Money rolled over from one retirement account to another

Don’t Miss: When Is The Last Day I Can File My Taxes

The Federal Income Tax

The federal personal income tax that is administered by the Internal Revenue Service is the largest source of revenue for the U.S. federal government. Nearly all working Americans are required to file a tax return with the IRS each year. In addition to this, most people pay taxes throughout the year in the form of payroll taxes that are withheld from their paychecks.

Income taxes in the U.S. are calculated based on tax rates that range from 10% to 37%. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

How To Pay 1099 Employees

If you use Square Payroll, you can pay 1099 employees by logging into the Payroll section of your online Square Dashboard or Square Payroll app and clicking Pay Contractors. From there you can record a payment thats already been made or pay by check. While commission-based pay isnt exclusive to 1099 employees, you may want to track commissions. You can do so by automatically importing them through Square Payroll, a third-party timecard application, or manually entering them. Square Payroll will file Form 1099-NEC online for you.

Don’t Miss: Do I Have To Pay Taxes For Babysitting

Who Does Not Have To Pay Estimated Tax

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

If you receive a paycheck, the Tax Withholding Estimator will help you make sure you have the right amount of tax withheld from your paycheck.

You dont have to pay estimated tax for the current year if you meet all three of the following conditions.

- You had no tax liability for the prior year

- You were a U.S. citizen or resident for the whole year

- Your prior tax year covered a 12-month period

You had no tax liability for the prior year if your total tax was zero or you didnt have to file an income tax return. For additional information on how to figure your estimated tax, refer to Publication 505, Tax Withholding and Estimated Tax.

No Matter How You File Block Has Your Back

Also Check: How Much Time To File Taxes

What Is A 1099 Form

A 1099 form is an information filing form that proves some other entity besides your employer paid you money. There are many different types of 1099 forms. For example, you may get one if your bank paid you interest or you earned income as a contract or freelance worker. Generally, the entity that paid you is responsible for sending a copy of your 1099 form to you in the mail.

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: How Do You Paper File Your Taxes

Getting Help With Your 1099 Tax Changes For 2021

Whether its your first tax return as a self-employed worker or youre a seasoned pro, Turbotax®s Self-Employed products can help. Its a simple and easy-to-use program designed especially for self-employed taxpayers.

Need help tracking your expenses throughout the year to make tax time easier? Download the Stride app.

When To Ask For Help

Although taxpayers are responsible for recording their income and filing their taxes, there are times when you don’t know what to do about a situation. In these situations, ask for help from the IRS or a tax advisor.

For example, if a taxpayer does not receive a 1099-R and contacting the payer has not resolved the issue, the IRS suggests you contact them. The IRS will, in turn, contact the payer or employer on your behalf.

Don’t Miss: How Do Tax Write Offs Work For Llc

Self Employment Tax Calculator

Small business owners, contractors, freelancers, gig workers and others whose net profit is greater than $400 are required to pay self-employment tax. Self-employed workers are taxed at 15.3% of the net profit. This percentage is a combination of Social Security and Medicare tax.

Use this Self-Employment Tax Calculator to estimate your tax bill or refund. This tool uses the latest information provided by the IRS including annual changes and those due to tax reform. Gather your 2022 tax documents including 1099s, business receipts, bank records, invoice payments, and related documents to fill in the drop down sections. Explanations for each question are provided below in the chart. If you have questions about your self-employment taxes a Tax Pro can help.

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Do I Have To Pay Taxes On A 1099 Form

Typically, income that has been reported on a 1099 is taxable. However, there are many exceptions and offsets that reduce taxable income. For example, let’s say a taxpayer has a gain from the sale of a home, meaning the selling price was higher than the original cost basis. The taxpayer might not owe taxes on that gain since they may qualify for an exclusion of up to $250,000, depending on their tax situation. It’s best to consult a tax professional if you’re unsure whether you need to pay taxes on your 1099 income.

Also Check: What Is The Easiest Online Tax Service To Use