Why Do I Owe

Let us help resolve your compliance or collections problem. Learn about reasons why we think you owe us taxes, how we discover the information, what types of notices we send, and what to do about it.

Below you will find links for the most common reasons you may have a Maryland Individual tax liability. You may have received a notice in the mail from us and want more information about it.

If you have not paid your taxes due in full, or have not filed a Maryland return that we believe you should have, you will receive an income tax notice from the Comptroller of Maryland. If you do not respond to the first notice, an assessment notice will be issued.

Once you receive an assessment notice you will be billed for the amount of the assessment in addition to a substantial penalty and interest charge on the tax owed.

Use the links below if youd like to learn more about the notice you received, how we determined that there was a problem, and what you need to do about it.

In all cases, if you have questions about the notice you received, or you cant find your notice defined here, call the phone number on the notice promptly. By calling the number on your notice, you can find out how to resolve the dispute or file an appeal and Dispute It! Failure to respond to the notice may cause us to assess additional penalty and interest charges and result in further collections efforts.

This notice is to advise that a Notice of Lien of Judgment has been satisfied.

How Long Does It Take To Get Into An Irs Collection Agreement

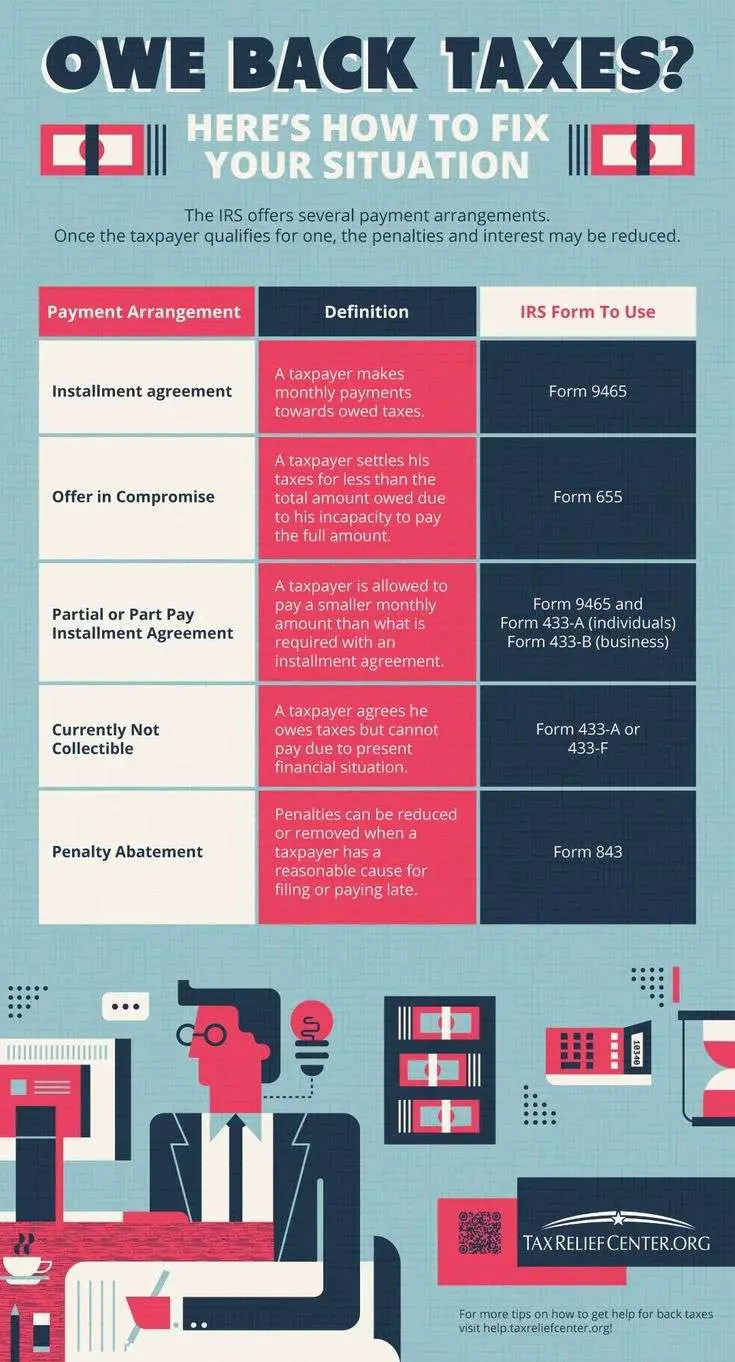

Millions of taxpayers each year cannot pay their taxes. In 2019, there were 16.8 million individual taxpayers who owed the IRS. Each year, between 4-5 million taxpayers have to get an installment agreement, extension to pay, or another more complicated IRS collection alternative to full payment.

How To Pay Back Taxes

Your first step is to file back tax returns if you owe back taxes. Locate the IRS forms for the years you didnt file returns, because tax laws and forms can change from year to year. You can request past years tax documents, like old W-2s and 1099s, by submitting Form 4506-T, Request for Transcript of Tax Return to the IRS.

You can often set up an IRS payment plan when you’ve caught up on tax returns. You can enroll in a short-term plan for free if you can afford to pay your entire balance within 180 days. Otherwise, if you need 180 days or more to pay your debt, you can apply for an IRS installment plan.

Interest and late penalties will continue to accrue under both types of plans, but you’ll incur late fees at a reduced rate of 0.25% per month instead of the typical 0.5%. The IRS wont pursue collection actions like seizing assets or garnishing your wages as long as you make your payments as agreed.

If you cant afford to pay anything toward your tax bill, you may have other options. You can request that your account be reported as currently not collectible, which means that the IRS will temporarily pause collection efforts. Youll still owe the tax debt, plus interest and late payments. Under some circumstances, the IRS might agree to an offer in compromise, where you settle your debt for an amount lower than what you actually owe.

Read Also: Doordash Tax Deduction

Putting Your Property For Sale For Back Taxes

If you are thinking about borrowing against your home, putting your property for sale for back taxes, or obtaining other credit to repay CRA, you should do so before CRA puts a lien on your home as part of their collections action.

However, know that there is a risk to these strategies as well. Any sales or loans should be negotiated through a tax professional who specializes in this area. If you go directly to your existing bank or lender you can damage your relationship with them. Many lenders, especially banks, frown upon back taxes and view them the same as having bad credit. You may not only be declined for the increased financing, but the lender may also cancel existing loan arrangements they have with you.

Debt Incurred Before During And After Marriage

Any tax debt your spouse incurred before you got married belongs to your spouse alone. If the IRS intercepts your tax refund, you can apply for Injured Spouse Status and get it back.

You may be liable for tax debt incurred during your marriage unless you take steps to limit your liability. You can protect yourself by filing separately or applying for Innocent Spouse Status.

Divorce frees you from tax debt your spouse incurs after your marriage. If your divorce has not been finalized, be sure to file separately. You can also assume partial liability by applying for Separation of Liability.

You May Like: How To Get A License To Do Taxes

What To Do If One Spouse Owes Money And The Other Does Not

When it comes time for a couple to prepare their individual tax filings, there are several ways to avoid a one refund, one owing situation. When one spouse owes money to the government while the other does not, consider sharing or transferring credits. It is important to note the Canada Revenue Agency doesnt let one spouses refund offset a balance owing for the other spouse.

What If I’m Looking For Return Info From A Previous Tax Year

The Where’s My Refund tool lists the federal refund information the IRS has from the past two years. If you’re looking for return details from previous years, you’ll need to check your IRS online account.

From there, you’ll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you’ve received from the IRS and your address on file.

Recommended Reading: Doordash State Id Number For Unemployment California

What If I Can’t Pay All Of The Debt At This Time

After you receive your BILL FOR TAXES DUE the Department of Treasury may consider an Installment Agreement if your situation meets certain criteria.

For Installment Agreements lasting for 24 months or less, you must complete, sign and return the INSTALLMENT AGREEMENT . The agreement requires a proposed payment amount that will be reviewed for approval by Treasury. All highlighted areas of the form are required and must be filled in completely before your request for an Installment Agreement will be considered for approval. Failure to complete the required areas will result in a delay of processing and continued collection efforts will continue.

If you are interested in an Installment Agreement for a period longer than 24 months, please call the Collection Services Bureau for more information.

The Collection Services Bureau will file liens on Real and Personal property to protect the State’s interest as a creditor. Liens will be filed even when a taxpayer has made payment arrangements and is current with all payments.

If you have been contacted by the Michigan Accounts Receivable Collection System , please contact them directly for more information about Installment Agreements.

Treasury is providing an Offer-In-Compromise program that began January 1, 2015. This program will allow taxpayers to submit an offer to compromise a tax debt for less than the amount due based on specific criteria. To determine if you qualify visit www.michigan.gov/oic.

Exceptions To Underpayment Of Tax Penalties

If you underpaid your taxes this year but owed considerably less last year, you typically dont pay a penalty for underpayment of tax if you withheld at least as much as you owed last year. That, of course, is only true if you pay by the due date this year.

TaxAct can help determine if the safe harbor rule reduces your penalties and interest. Simply enter last years tax liability and the software will do the calculations for you.

You may also reduce your penalties and interest using the annualized income method if you received more of your income in the latter part of the year.

Also Check: Doordash Quarterly Taxes

Collection Process For Delinquent Taxes

Taxpayers are required to meet certain obligations under Michigan law. You are responsible for filing your tax returns on time with correct payments and ensuring that your returns are correct no matter who prepares them. Remember, you are responsible for the information in your return.

The following information will provide an overview of the Collection Process for Delinquent Taxes.

The Irs Probably Will Not Send A Tax Refund To Individuals Owing Back Taxes

Lets face it, every taxpayer loves to get their IRS tax refund this time of year, and in most cases, those refunds are in your pocket pretty quickly. Long gone are the days of filing a paper return and then waiting

And waiting

And waiting some more

For the most part, today, taxpayers are receiving their refunds in less than three weeks.

But what happens when youve filed, especially when youre waiting for your refund to magically show up in your bank account?

Well, the IRS actually has a web page for that. www.irs.gov/refunds

Its easy to use, fairly reliable, and can give you updates on when the IRS has gotten your return, when theyve begun processing it, and when theyll be sending your refund to your bank account.

But what if you owe back taxes? Chances are , the IRS will take your refund.

However, there is a little trick that works well sometimes.

There is an option to have your refund applied to your next years taxes .

What this does is takes your refund and moves it forward to your account for the next year . That means that you can change your withholdings or estimated taxes for this year to not have as much coming out.

Not as much taxes coming out = getting your refund, albeit throughout the year.

Now, before you go changing your 1040, keep in mind that this has only worked for my clients about half of the time. Why is that? I have no idea. Its the mystery that is the IRS half-century old computer programs.

Also Check: What Type Of Business Is Doordash For Taxes

How To File Back Taxes

Filing back taxes is something you can do on your own but if you have a more complicated return, you may want to enlist the help of a tax professional. In either case, the steps for filing back taxes are the same:

- Organize your information and documents

- Track down any missing documents, if necessary

- Complete your tax return

- Arrange for payment of any taxes due, if applicable

There are some basic things youll need to complete your back tax returns. For example, if you work a regular job youll need W-2s from your employer. If youre self-employed, youll need 1099s from your clients. Youll also need receipts or documentation for any expenses you plan to deduct, including charitable donations, business expenses, mortgage interest and student loan interest.

If youre missing some of these documents, youll need to get copies of them in order to file your back tax return. This usually means reaching out to your current or previous employers or clients if youre self-employed to request copies of W-2s or 1099s. As a last resort, you can also contact the IRS to request a wage and income transcript, which will show W-2 and 1099 income that was reported to the federal government on your behalf.

If The Irs Refuses Your Installment Agreement Proposal

If the IRS won’t agree to installment payments, it is for one of three reasons:

- Your living expenses are not all considered necessary. The IRS may deem your expenses extravagant. For example, if you have hefty credit card payments, make any charitable contributions, or send your kids to private school, expect the IRS to balk. Although reasonable people would disagree on what is necessary and what is extravagant, the IRS is rather stingy here.

- Information you provided on your Collection Information Statement, Form 433-A, is incomplete or untruthful. The IRS may think you are hiding property or income. For example, if public records show your name on real estate or motor vehicles that you didn’t list, or the IRS received W-2 or 1099 forms showing more income than you listed, be prepared to explain.

- You defaulted on a prior IA. While this doesn’t automatically disqualify you from a new IA, it can cause your new proposal to be met with skepticism.

Recommended Reading: Filing Taxes For Doordash

Pursue A Currently Not Collectible Status

While the IRS is not statistically likely to accept your offer in compromise, its still worth a shot. But depending on your situation, you may have far better odds at requesting to be placed in a currently not collectible status.

What this status means is that you are simply not financially capable of paying your taxes at this time due to hardship. When you apply, the IRS will want to examine your financial records to verify your inability to pay. And if you are approved, you will need to periodically provide more financial records to indicate that you are still incapable of paying the taxes back.

The most important thing you should know about this status is that it is temporary. It will not make your tax debt go away, and its still entirely possible for the government to put liens on you. So even if your status is approved, its important to develop a game plan for eventually paying off your back taxes.

One of the most annoying things about pursuing this status is that the IRS retains the right to examine your Collection Information Statement and determine if your finances are as bad as you claim. Rather than risk them rejecting your claims altogether, you should work with a tax specialist who can help you make the strongest possible case to the IRs about your collectible status.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

You May Like: Www..1040paytax.com

Owing The Irs Mistake #: Ignoring The Consequences

Aside from the penalties and the interest, there are other things the IRS can do to make you regret skipping out on paying your taxes. Your passport could be canceled, for example, which can throw a wrench in your travel plans. In the worst case scenario, the IRS could place a lien against your property or garnish your wages. Knowing whats at stake can motivate you to pay up.

What Is A Time To Pay Arrangement

This is a special arrangement that can be made with HMRC in certain circumstances where an individual is having difficulty paying a tax bill or anticipates having difficulty in paying a bill that will become due in the near future.

If your Time to Pay arrangement includes Class 2 National Insurance contributions , then this could affect entitlement to certain welfare benefits such as Maternity Allowance and new style Employment Support Allowance. This is because eligibility for certain benefits relies on having paid Class 2 NIC for a certain tax year but you may not have settled this with HMRC by the time you make your claim. See our news article Self-employed with an HMRC payment plan? Watch out if you claim certain benefits for more information.

Recommended Reading: Prontotaxclass

Work With The Cra If You Can

If you owe the CRA money, its best to contact them as soon as possible so you can explain your financial situation and find a solution that works best for you. The faster you do this, the more likely it is that the CRA will be able to work with you to create a fair payment plan that takes your needs into account.

The Effect That Irs Tax Debt Has On Your Ability To Refinance

As we previously mentioned, IRS tax liens extend from the time period when the tax was due and owing. The problem with refinancing is that you are essentially re-doing a loan and creating a new debt obligation on a piece of property. So with your prior loan, if you had a mortgage before the IRS filed a tax lien, theres no risk to the existing lender because their security interest was put into place before the IRS got involved.

However, the refinance of an existing obligation changes things quite a bit. With a refinance, the old loan obligation is cancelled and whomever owns the loan would be in a subordinate position to the IRS. The lender is not going to like having their loan subordinate to a tax obligation.

In these cases, you have a couple of options. The preferred option, at least to the lender, is for you to pull cash out of your home refinance and use it to satisfy the IRS and put the lender back into a first position.

As a secondary option, the IRS may consider subordinating its interest to the lender in certain circumstances. Under the Internal Revenue Code, the IRS is able to accept a subordination when it would facilitate the payment of tax.

Keep in mind, however, if the plan is to pull cash out of the refinance and not give it to the IRS or to not otherwise confer some benefit to them, they have no incentive to agree to let you refinance your property. Ultimately, the IRS just wants to get paid.

You May Like: How Do You Pay Taxes For Doordash