How To Get Copies Of Old Tax Returns

To view copies of your old tax returns, follow these steps:

And thats it! You should now be able to view your tax yearoverviews for every year youve previously submitted a tax return.

Heres How To Get Prior

IRS Tax Tip 2018-43, March 21, 2018

As people are filing their taxes, the IRS reminds taxpayers to hang onto their tax records. Generally, the IRS recommends keeping copies of tax returns and supporting documents at least three years. Taxpayers should keep some documents such as those related to real estate sales for three years after filing the return on which they reported the transaction.

To Obtain A Copy Of Your W

If you are looking for information that was on your W-2s from previous tax years, you will be able to get the information by utilizing form 4506-T and selecting option eight. Just follow the previously listed steps to get your copy. If, however, you want a copy of your W-2 the only way to get it is to order a copy of your full tax return or request it from your employer/previous employer. It again can be accomplished by filling out from 4506 and mailing it to the IRS with a $57.00 payment for each year you select.

Recommended Reading: How Much Taxes Do You Pay For Doordash

How Can I Obtain Copies Of Previously Filed Returns

You may obtain copies of previously filed returns using self-service.

Include your full name, complete current mailing address and the tax year with your request.

- Primary filers Social Security number

- Primary filers last name

- Tax year

- Adjusted Gross Income /Total Household Resources

- If your AGI is a negative number, enter – after the number. Example: 1045-

Note: If you are unable to authenticate using your current tax year information, select the previous tax year forauthentication. When you submit your question, explain that you selected a previous tax year forauthentication. Include the AGI/THR and tax year for which you are inquiring.

Before Reaching Out To The Irs

Before reaching out to the IRS, which is not necessarily a quick process, first look in all the usual places. For example, if you filed your tax return online, you should be able to get a copy of previously filed returns. Tax preparation software plans typically allow you to access returns prepared for at least the past three years.

If you used a paid preparer, you should be able to get a copy just by requesting one. Tax preparers usually maintain copies of tax returns for up to seven years, even if you are no longer a client.

But if youve already tried those routes and have come up empty, its time to reach out to the IRS. It wont be as simple as getting a copy from the preparation services, but you will be able to access your old returns.

Lets look at whats involved in obtaining either a tax transcript or a full copy of a tax return.

Read Also: Is Doordash 1099

What Tax Documents Do I Need To File Back Taxes

When was the last year you filed? Do you have a copy of that tax return? Do you still have W-2s and other tax documents for the years you didnt file?

You can request copies of your tax documents from the IRS if youre missing anything by filing Form 4506-T, or you can contact your employer or the institution that would have sent them to you.

Keep in mind that current or former employers or other establishments might not still have these documents on file, or at least they may not be easily accessible. There might also be a fee if you choose this option.

At a minimum, youll need Forms W-2 and 1099 for any income you brought in during the year in question, as well as specific tax returns and forms for that tax year. For example, you cant file a 2020 Form 1040 to report 2019 income. You should also gather supporting documentation of anything you spent that year that might be tax deductible or that will qualify you for tax credits, such as bank statements and credit card statements for that period of time.

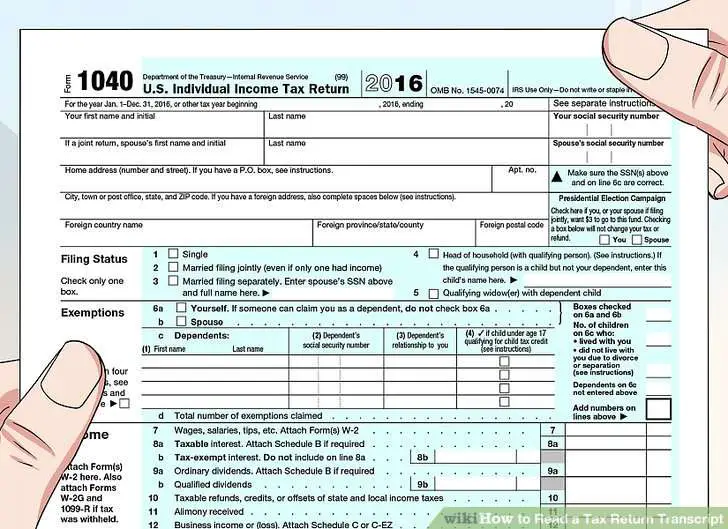

Provide Complete And Accurate Information On Form 4506

The top portion of the form requires you to enter your personal details as it appears on the original tax return you are requesting. At a minimum, the name and Social Security number you provide must match the original return. If you filed your original return jointly, you must include your spouses full name and Social Security number as well.

If you are no longer married, its not necessary for your former spouse to sign Form 4506 or even provide consent. If youve moved since filing the return, you must also provide your current address. The IRS gives you the option of having the return sent directly to a third party if you provide their name, phone number and address.

You May Like: Irs Forgot Ein

How To Obtain A Prior Year Tax Return

When you file your taxes, keeping a copy of the final return is highly recommended but sometimes not possible, or forgotten. Having that copy, though, is often required for many financial decisions. Reasons include answering questions related to an IRS audit or investigation, or on a student loan or mortgage application. If you cannot find or did not save a copy of a prior year tax return, we can help you.

Optima Tax Relief has compiled a guide to help you obtain your tax returns quickly and easily:

What Is A Sa302 Calculation

This is a much more detailed breakdown of your tax return. Itspecifies the tax rate youre on, the total income on which youve been chargedtax, the amount of income tax you owe, along with any Class2 and Class4 National Insurance contributions. It will also tell you about deductions,balancing payments, and any other income you may have received from othersources.

Self-employed workers can use SA302 documents to provideevidence of their income. So if youre applying for a mortgage, for example,and the bank or building society asks you to prove your income for a givenperiod, you can follow the steps above to access your SA302 documents.

If you didnt submit your tax return online, or if yourestruggling to locate certain older paper documents, then you can try contactingHMRC. Youll need your Unique Taxpayer Reference number to hand, aswell as your National Insurance Number. You should also ensure that all of yourpersonal details are up to date in your personal tax account, sothat HMRC can properly identify you with their screening questions.

You May Like: Does Doordash Take Taxes Out

Here Are The Three Ways To Get Transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- . Taxpayers can call to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- . Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

Here’s How To Request A Copy Of Your Tax Return

IRS tax transcripts are not photocopies of your actual tax return with all the forms and attachments.

-

If you want an actual copy of an old tax return, youll need to complete IRS Form 4506 and mail it to the IRS.

-

Theres a $43 fee for copies of tax returns , and requests can take up to 75 days to process.

Recommended Reading: How Much Do You Pay In Taxes Doordash

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents youll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Dont Miss: How To File 2 Different State Taxes

How About Checking The Status Of An Amended Tax Return

You can use the Wheres My Amended Return IRS tool. This tool shows updates for amended returns for current years and up to three prior years. However, it is recommended that you wait three weeks after mailing your return to retrieve the most accurate status update. Before opening the tool, youll want to make sure you have a few bits of information on hand:

- tax year

- zip code

Don’t Miss: Does Doordash Take Taxes

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Filing Past Years Income Tax Returns

Individuals can file returns for the previous years. This can only be done for the two years preceding the current financial year for which the returns have to be filed. Taxpayers are provided a two year period during which returns can be filed.

Individuals who are looking to file their income tax returns for the previous years can do so only for the two years prior to the current financial year for which he or she has to file returns. If an individual is looking to file his or her tax returns for the financial year 2017-18 then the time frame by which the returns can be filed will be up to the end of the financial year 2019-2020. This means that the individual has a two year period during which the returns must be filed. In this case the returns for the financial year 2017-18 will have to be filed by the 31st of March 2020.

Also Check: Taxes Taken Out Of Paycheck Mn

An Offer In Compromise

An offer in compromise is a bit more complex. It involves reaching an agreement with the IRS to pay less than your full balance due. An offer in compromise is typically only approved if youre unable to pay through an installment plan and comes with an application fee. Youll probably need the help of a professional for this option.

You must establish that you cannot pay your balance through an installment agreement or by any other means. All your past due tax returns must be filed before the IRS can grant you this relief, and you must have made some payment toward taxes in the current year, either through withholding from your paychecks or by sending in quarterly estimated payments, even though you havent filed a tax return for the year yet.

Also Check: How To File Taxes From Doordash

What If I Need The Actual Copy Of The Tax Return I Filed

If you regularly use an online preparation software like TaxACT or TurboTax, retrieving old returns should be relatively easy. If not, taxpayers can request and receive the actual paperwork they filed directly from the IRS. The current years paperwork and up to the past six years are available.

Individuals requesting this information must mail $57 per tax year and IRS Form 4506, Request for Copy of Tax Return. Turn-around time generally takes up to 60 calendar days.

Don’t Miss: Is Plasma Donation Income Taxable

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

Signature Section:

Dont Miss: Can You File Taxes For Unemployment

Filing Back Taxes In Canada

You should file your taxes on time. This is the best way to avoid interest charges, penalties, and additional hassle from the Canada Revenue Agency . However, for many reasons, people sometimes do not file their taxes when they should. Maybe you forgot or maybe you didnt realize that you needed to file. Maybe you did not file on purpose. Sometimes, people believe that its in their best interest to not file their taxes if they dont have the money to pay their tax debt. This isnt true, but its a common belief and it happens.

For whatever reason, if you didnt file your taxes when you should have, and now youre wondering how far back you can file taxes in Canada, the good news is that it is possible to file prior year returns.

You May Like: Irs Business Look Up

Get A Copy Of A Tax Return

Mail the following items to get an exact copy of a prior year tax return and attachments:

- A completed Form 4506.

- $43 fee for each tax return requested. Make the check or money order payable to the United States Treasury.

Send them to the address listed in the form’s instructions. The IRS will process your request within 75 calendar days

Benefits Of Filing Past Years Income Tax Returns

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”>

ALQURUMRESORT.COM” alt=”How do i get my tax return from last year > ALQURUMRESORT.COM”> There are a number of benefits that come with filing tax returns for the previous years:

- Loans Individuals who have filed their returns for past years will find it easier to get their loans approved by banks and financial institutions. The loan process becomes faster and less complicated.

- Proof Filing past years tax returns also act as a proof of an individuals income. Tax returns are valid documents that can be submitted whenever there is a requirement to validate an individuals income.

- Investments Individuals who have filed their tax returns for past years will also find it easier to make investments or conduct stock or share trading, since financial institutions look favourably on individuals who have their returns in order.

- Refunds In case an individual has been taxed beyond what his or her taxable liability is for the previous years, that individual can claim for a refund on the excess tax that he or she has paid for the past years.

- Travel Individuals who have filed their tax returns will also find it easier to obtain visas to travel abroad. Tax returns serve as a proof of financial abidance, which is a mandatory check when it comes to applying for a visa.

Read Also: Appeal Property Tax Cook County

Recommended Reading: Do You Claim Plasma Donation On Taxes

Filing Multiple Year Tax Returns In Canada

If youre behind filing your returns, you shouldnt simply walk into your nearest popular income tax chain with your collection of returns. Once you are behind on filing your taxes, you should deal with professionals who have a high level of experience that can negotiate with the CRA for you to achieve compliance.

Late tax-filing should be approached carefully. When filing past tax returns, the Canada Revenue Agency has a process that you should follow and helpful programs that may make it easier to follow their process.

The Voluntary Disclosure Program was designed to be used as a second chance for people who did not file taxes accurately or when they should have.

If your application is accepted to the VDP, the CRA could grant you relief from prosecution and even reduce the interest or eliminate the penalties that you will be required to pay. This can be a great incentive for taxpayers who are interested in filing past tax returns in Canada.

Its important to note that your disclosure must be voluntary, which means that you will need to come forward before the CRA contacts you about filing taxes late.

You will also need to provide complete and accurate information during your disclosure.

Finally, you must also include the full payment of the tax debt owing, including any interest not waived by the VDP.

Whatever your solution, its crucial to act quickly and file your back taxes so that you receive your tax benefits and arent faced with any future penalties.