Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

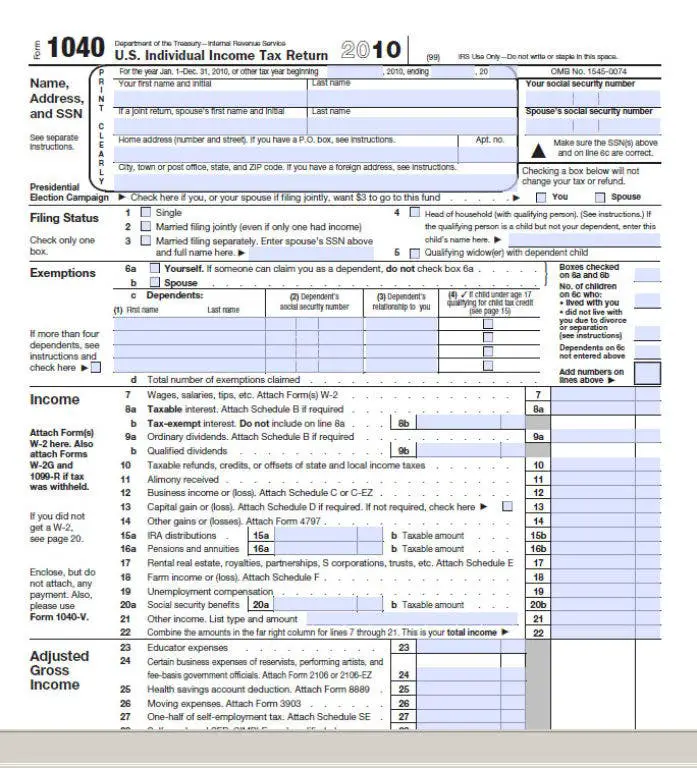

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

How To Dispute Insufficient Interest Paid

If you think we underpaid interest owed to you on refunds or credits you’re eligible for, you can file an informal claim or complete and send Form 843PDF for us to consider allowing additional overpayment interest. Make sure to include your own computation and reason for making the request for additional interest on Line 7 .

Your request must be received within six years of the date of the scheduled overpayment.

Read Also: How To File Taxes Without Social Security Number

Levy Prohibited And The Irss Time To Collect Is Suspended

With certain exceptions, the IRS is generally prohibited from levying and the IRSâs time to collect is suspended or prolonged while an installment agreement is pending. An installment agreement request is often pending until it can be reviewed, and an installment agreement is established, or the request is withdrawn or rejected. If the requested installment agreement is rejected, the running of the collection period is suspended for 30 days. Similarly, if you default on your installment agreement payments and the IRS proposes to terminate the installment agreement, the running of the collection period is suspended for 30 days. Last, if you exercise your right to appeal either an installment agreement rejection or termination, the running of collection period is suspended by the time the appeal is pending to the date the appealed decision becomes final. Refer to Topic No. 160.

With certain exceptions, the IRS is generally prohibited from levying and the IRSâs time to collect is suspended or prolonged while an OIC is pending, for 30 days immediately following rejection of an OIC for the taxpayer to appeal the rejection, and if an appeal is requested within the 30 days, during the period while the rejection is being considered in Appeals. Refer to Topic No. 160 and Topic No. 204.

Example Of Payroll Tax

Mr. A is employed with XYZ International Limited, registered with the federal government of the USA, and is eligible for collecting Payroll tax on behalf of its employees. The company is located in Texas, where State Income Tax is exempted.

Below are the details of the Income of Mr. A based on which applicable Payroll tax deductions have been undertaken:

|

Employee Contribution to working |

Also Check: Can You Submit Taxes Late

Components Of Payroll Tax

It comprises the following components:

- Federal Income Tax: This component of the Payroll tax is withheld and forms a revenue source for the Federal government

- Social Security Tax: This payroll tax component forms part of old age and unemployment benefits extended by the Federal government. It is contributed equally by employer and employee at 6.2% each beyond a threshold income limit which may vary yearly.

- Medicare Tax: This Payroll tax component forms part of federal government schemes comprising health care benefits to senior citizens. It is contributed equally by employer and employee at 1.45% each and applies to employees at all levels without any threshold income limit.

- Additional Medicare Tax for those employees earning more than a stipulated limit varies from year to year.

- State Income Tax: This payroll tax component is deducted from the employees income and paid to the state authority. The percentage deduction varies from state to state in the USA, with some states not levying this deduction, such as Texas.

- Any other local tax withholding specific to a particular state. Together all these components form the Payroll Tax.

Here Are The Different Ways People Can Pay Their Federal Taxes

IRS Tax Tip 2022-45, March 23, 2022

The April 18 deadline for individuals to file and pay their federal income tax is just around the corner. While paying taxes is not optional, the IRS offers a variety of ways for people to pay their taxes.

Some taxpayers must make quarterly estimated tax payments throughout the year. This includes sole proprietors, partners, and S corporation shareholders who expect to owe $1,000 or more when they file. Individuals who participate in the gig economy might also have to make estimated payments. Taxpayers can pay all of their 2022 estimated taxes by April 18, 2022 or in four quarterly installments due April 18, 2022, June 15, 2022, September 15, 2022 and January 17, 2023.

Here are six ways people who owe taxes can pay it. They can:

Read Also: Does Washington Dc Have Income Tax

Pay With Cash At A Retail Partner

The quickest, easiest way to pay IRS is to make a tax payment online. If you prefer to pay in cash, the IRS offers a way for you to pay your taxes with one of our Cash Processing Companies at a participating retail store.

| ParticipatingStores | Dollar General, Family Dollar, CVS Pharmacy, Walgreens, Pilot Travel Centers, 7-Eleven, Speedway, Kum & Go, Royal Farms, Go Mart, Kwik Trip |

|---|---|

| Locations | Pay cash at participating retail partner locations in all 50 states and Puerto Rico. See map of participating locations. |

| Limits | Up to $500 per payment up to $1,000 per day and 2 payments per day. Monthly, annual and other limits also apply. |

| Support | Contact VanillaDirect customer service if you have any issues making your payment. |

Be sure to plan ahead of your due date to ensure your payment is posted timely.

Extended Due Date Of First Estimated Tax Payment

Pursuant to Notice 2020-18PDF, the due date for your first estimated tax payment was automatically postponed from April 15, 2020, to July 15, 2020. Likewise, pursuant to Notice 2020-23, the due date for your second estimated tax payment was automatically postponed from June 15, 2020, to July 15, 2020. Please refer to Publication 505, Tax Withholding and Estimated TaxPDF, for additional information.

Read Also: How Do You Pay Taxes You Owe

When Are Quarterly Taxes Due For 2022

As mentioned above, estimated taxes are paid during four payment periods over the course of the year. To avoid underpayment, you need to make sure you dont miss the following dates for the 2022 tax year:

- 1st Quarter Deadline: April 18, 2022

- 2nd Quarter Deadline: June 15, 2022

- 3rd Quarter Deadline: Sept. 15, 2022

- 4th Quarter Deadline: Jan. 16, 2023

Notice To Taxpayers Presenting Checks:

When you provide a check as payment, you authorize us either to use information from your check to make a one-time electronic fund transfer from your account or to process the payment as a check transaction. When we use information from your check to make an electronic fund transfer, funds may be withdrawn from your account as soon as the same day we receive your payment, and you will not receive your check back from your financial institution.

Recommended Reading: Where Can I File Taxes For Free

Features And Benefits Of Electronic Funds Withdrawal:

- It’s convenient. Individual and business filers can e-file and e-pay in a single step.

- IRS doesnt charge a fee to use EFW, but check with your financial institution about any fees it may charge.

- Making an electronic payment eliminates the need to submit a voucher.

- Its safe and secure. Payment information is used only for the tax payment authorized.

- Bank account information is safeguarded and wont be disclosed for any reason other than for processing authorized payment transactions.

- All individual and most business payments can be scheduled for a future date, up to the return due date. Payments that qualify for scheduling can be scheduled up to 365 days from the date the electronic return is filed.

- After the due date, the payment date must be the same as the date the return is transmitted, or be within the previous five days of that date.

- The software you use will indicate if a payment can be scheduled or not. If you enter an invalid payment date, you will be prompted to correct the date.

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. You may send estimated tax payments with Form 1040-ES by mail, or you can pay online, by phone or from your mobile device using the IRS2Go app. Visit IRS.gov/payments to view all the options. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

Using the Electronic Federal Tax Payment System is the easiest way for individuals as well as businesses to pay federal taxes. Make ALL of your federal tax payments including federal tax deposits , installment agreement and estimated tax payments using EFTPS. If its easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as youve paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments.

Corporations must deposit the payment using the Electronic Federal Tax Payment System. For additional information, refer to Publication 542, Corporations.

You May Like: Can You Claim Private School Tuition On Taxes

Penalty For Underpayment Of Estimated Tax

If you didnt pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller. There are special rules for farmers, fishermen, and certain higher income taxpayers. Please refer to Publication 505, Tax Withholding and Estimated Tax, for additional information.

However, if your income is received unevenly during the year, you may be able to avoid or lower the penalty by annualizing your income and making unequal payments. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , to see if you owe a penalty for underpaying your estimated tax. Please refer to the Form 1040 and 1040-SR Instructions or Form 1120 Instructions PDF, for where to report the estimated tax penalty on your return.

The penalty may also be waived if:

What Are You Paying For

If voters approve the tax increase, the money generated will enter a dedicated trust fund maintained by the countys Clerk of the Circuit Court and divided three ways:

- General Purpose Portion: 54.5% of the proceeds would be split among Tampa, Temple Terrace, Plant City and unincorporated Hillsborough County, based on relative populations.

- Transit Restricted Portion: 45% of the proceeds would be earmarked for the Hillsborough Area Regional Transit Authority.

- Planning and Development Portion: 0.5% would be set aside for the Hillsborough Transportation Planning Organization for purposes such as data collection and analysis.

The proceeds are not allowed to fund the expansion of right of way or the width of the interstate highway system.

In practice, only Hillsborough County and Tampa likely would need to follow these additional funding priorities. Plant City and Temple Terrace have discretion to spend their shares, as long as funds are spent on transportation.

The county and the three cities will be able to collaborate, pursuing funding partnerships with each other or with the Hillsborough Area Regional Transit Authority, known commonly by the acronym HART.

The proceeds HART receives are subject to a proposed funding formula, too.

You May Like: Does New Mexico Have State Income Tax

How To Pay Quarterly Taxes: 2022 Tax Guide

From flexible work hours to not reporting to a boss, being self-employed comes with a lot of perks. However, with the freedom of working for yourself also comes responsibilities such as paying quarterly taxes. Heres a checklist and basic steps to pay quarterly taxes in 2022. If you need more help with taxes, consider working with a financial advisor.

The Hillsborough County Transportation Tax Explained

When Hillsborough voters enter the polling booth in November, they will be asked whether the county should implement a 1% sales tax for 30 years to fund transportation needs.

But how, when and if Hillsborough Countys potholed roads, dangerous intersections and skeletal bus routes will be improved is ensnared in a legal challenge yet again.

Last month, Karen Jaroch a 58-year-old Northdale resident, licensed professional engineer and among the most prolific anti-rail organizers the county has ever seen filed a lawsuit challenging the ballot language of the transportation surtax referendum due to be posed to Hillsborough voters Nov. 8.

Advocates of the surtax say the referendum offers Hillsborough constituents a solution to the countys multi-billion-dollar backlog in road and transit projects. Adversaries say its a money grab, particularly ill-advised at a time of high inflation.

Both agree the stakes are high. Heres a primer on the proposed surtax, and the recent lawsuit.

Recommended Reading: How To Claim Gas On Taxes

Why You Should Change Your Withholding Or Make Estimated Tax Payments

If you want to avoid a large tax bill, you may need to change your withholding. Changes in your life, such as marriage, divorce, working a second job, running a side business or receiving any other income without withholding can affect the amount of tax you owe. And if you work as an employee, you don’t have to make estimated tax payments if you have more tax withheld from your paycheck. This may be a convenient option if you also have a side job or a part-time business.

Some income is not subject to withholding. This includes some income from self-employment, the sharing economy or some rental activities. Be sure to make estimated tax payments on those sources of income throughout the year. You may also make estimated tax payments if the withholding from your salary, pension or other income doesn’t cover your income tax for the year.

You make your estimated payments based on the income you expect to earn and any credits you expect to receive in the year. You can use your prior year tax return as a guide and Form 1040-ES, Estimated Tax for Individuals has a worksheet to help you figure your estimated payments.

You can use estimated tax payments to pay both income tax and self-employment tax .

Easy Ways To Pay Taxes

IRS Tax Tip 2018-87, June 6, 2018

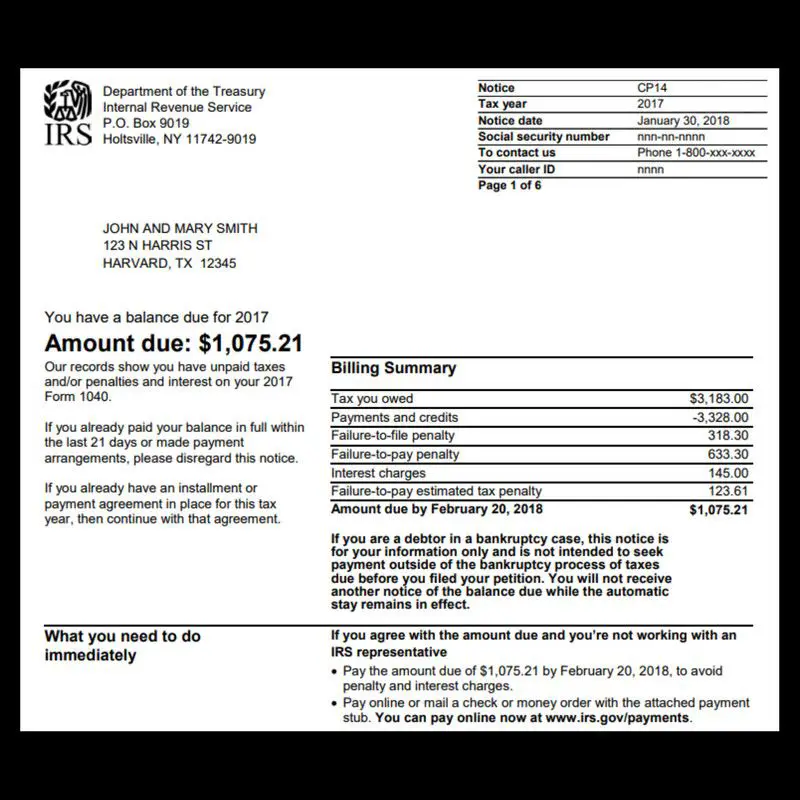

The IRS offers several payment options where taxpayers can pay immediately or arrange to pay in installments. Taxpayers should not ignore a bill from the IRS because as more time passes, interest and penalties accumulate.

Here are some ways to make payments:

- Direct Pay. Taxpayers can pay tax bills directly from a checking or savings account free with IRS Direct Pay. Taxpayers receive instant confirmation once theyve made a payment. With Direct Pay, taxpayers can schedule payments up to 30 days in advance. They can change or cancel a payment two business days before the scheduled payment date.

- Taxpayers can also pay their taxes by debit or credit card online, by phone or with a mobile device. The IRS does not charge a fee, but convenience fees apply and vary depending on the card used.

- Installment agreement. Taxpayers who are unable to pay their tax debt immediately may be able to make monthly payments. Before applying for any payment agreement, taxpayers must file all required tax returns. They can apply for an installment agreement with the Online Payment Agreement tool, which also has more information about whos eligible to apply for a monthly installment agreement.

You May Like: When Is Nc State Taxes Due

Collection Rate Must Improve To Pay For Added Costs

How much money is spent to collect taxes for one year? Salaries and benefits for 100,000 IRS employees annually is over $10 billion. IRS facilities across the country must be maintained. Equipment must be upgraded. Fuel for IRS vehicles and aircraft must be provided along with the usual maintenance. Retirement benefits for those retiring now must be provided along with the millions who retired years ago. This is all paid by taxpayers. And an expense hardly ever mentioned is the amount that businesses and individuals pay simply to comply with the tax code. It is over $200 billion.

Attorneys are hired to help with tax audits. Businesses spend thousands to keep and maintain tax records. Farmers and other property owners often hire tax planners so their heirs can be kept safe from the death tax. Millions of ordinary citizens spend hundreds to have professionals do their taxes. And in a time of historically high inflation, the Administration plans to almost double the size of the IRS. The payroll will be pushed toward $20 billion. To house, equip and train 87,000 new agents, we will need a carbon copy of everything the IRS has now. The spending for IRS II is sure to cause further inflation and dont forget the cost of all those new weapons.

Meanwhile, the Administration wants to double the IRS payroll. Will that doubling be for a year or two or will it continue forever? It sounds like we could be on the hook for retirement benefits far into the future.

Joseph Ryan