How Do I Calculate Closing Costs And What Should I Expect To Pay

On average, most home-buyers will pay between three and six percent of the purchase price of their home in closing costs. This amount varies depending on the amount of the mortgage loan, the loan type and the region in which you are purchasing.

For example, if your home costs $200,000, you may pay between $6,000 and $12,000 in closing fees. Before closing, discuss the details of these costs with your lender and find out if they are willing to offer you a loan with lower fees.

The average total cost of closing fees for home-buyers is about $3,700. The higher the purchase price of your home, the higher your closing costs will be. While the average closing cost amount for a $150,000 house might be between $3,000 and $7,500, the average closing costs for a $600,000 are between $12,000 and $30,000.

If you dont have a real estate agent to estimate the total amount of your closing costs for you, you can calculate the total by adding the fees yourself.

Though the seller does cover certain closing costs, there are closing costs that the buyer should expect to be responsible for paying. But how much will each fee actually cost you? Here is a breakdown of the typical closing costs that home-buyers can expect to pay:

Which Particular Closing Costs Can You Deduct

You cant completely deduct all the costs of closing on your house. Only a few eligible ones make the cut. The IRS denotes the following as deductible costs:

- Sales tax issued at closing

- Real estate taxes charged to you when you closed

- Mortgage interest paid when cost was settled

- Real estate taxes that were paid for by the mortgage lender

- The interest you paid at the houses purchase

- Loan origination fees . These would be written as a percentage of the borrowed money.

Variation exists among these costs, and each house purchase carries different rules. Be sure to double check whether your needs fit with these, and reach out to your lender or advisor if youre not sure.

Are Closing Costs Deductible

Tax deductions for homeowners arent always easy to calculate, but the IRS does break down what types of tax deductions you can take when filing Form 1040. The only way to deduct closing costs, such as property tax or a settlement fee, is by reporting them as itemized deductions. You cant take a standard deduction and also deduct your closing costs, so you have to decide which one offers the most tax advantages when filing your return.

Dont Miss: 50 Tax Write-Offs You Dont Know About

Read Also: Otter Tail County Tax Forfeited Land

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Costs Financed In Your Mortgage

Mortgage default insurance, or CMHC insurance, is not normally considered a traditional closing cost as it is added to the total mortgage you require and amortized over the life of your mortgage. We have chosen to include it here to point out the major difference between it and traditional closing costs: it does not require a cash outlay upon closing.

- Mortgage default insurance. If you purchase a house with less than a 20% down payment, you will be required to buy mortgage default insurance, commonly referred to as CMHC insurance. This protects the lender in the case the borrower, defaults on the loan.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

What Are Closing Documents

One of the key documents you’ll get before the final signing is the closing disclosure, which outlines the details about your loan, including your closing costs. The lender should provide you with that document three business days before the scheduled loan closing.

It’s very important to review this document to make sure all the information is correct and that the terms of the loan are accurate and clear. This closing disclosure explainer might help you as you review the document. Among other advice, it mentions making sure that closing costs match the most recent loan estimate.

Other important closing documents include:

Promissory note: a legal document stating that you will repay your mortgage.

Mortgage, security instrument or deed of trust: gives the lender the right to take your property by foreclosure if you do not pay your mortgage according to the terms you’ve accepted.

Initial escrow disclosure statement: details the charges that you pay into an escrow each month.

Right to cancel form: outlines the rules for when and how you can cancel your loan, usually used as part of the refinancing process.

If you have questions about any of these, ask your lender, broker, or lawyer for help.

Rental Property Closing Costs

At a glance: Closing costs for rental properties can be tax-deductible unlike for a personal residence.

Most rental property closing costs are tax-deductible on Schedule E and dont require filing an itemized return.

Some of the eligible costs include:

- Abstract fees

- Recording fees

- Title insurance

However, some expenses cannot be deducted when you refinance your rental property. One example is mortgage points when the loan amount is larger than the original balance.

For instance, if you took out a cash-out refinance on an investment property that appreciated in value, any portion of the points that exceeds the original loan balance cant be deducted as a rental expense.

Also Check: Can You File Missouri State Taxes Online

Taking Advantage Of All Of Your Potential Tax Deductions

Unfortunately, some new landlords will make the mistake of not including their closing costs in their basis or not deducting some of their closing costs right away. Mistakes like these can cost you thousands of dollars over the useful life of your property.

You can avoid this type of issue by using a tax preparation service that knows the ins and outs of this complicated aspect of being a landlord and can help you determine what rental property closing costs are tax deductible. Learn more about our tax prep services by requesting a free consultation or reviewing our FAQ Section.

Home Equity Loan Interest Deduction

In addition to the mortgage interest deduction, you may be able to write off interest on a home equity loan. However, the TCJA has changed these rules as well.

Previously, you could borrow against home equity and take a deduction on the interest regardless of whether the proceeds were used to pay off a credit card, take a vacation, or buy a second home. Now, you can deduct interest on home equity debt only if the funds were used to buy, build, or substantially improve the taxpayers home that secures the loan. In addition, as under the old rules, the loan must be secured by your primary or second home and cant exceed the cost of the home.

Under these provisions, if you want to deduct interest on a second home, then you must have a mortgage on it. If you borrowed against equity on your first home to finance the purchase of your second home, then this interest cannot be deducted. Like a mortgage, you can deduct interest on up to $750,000 in home equity debt if you are single or married filing jointly .

The limit applies to all of your mortgage and home equity debt. If you already have $750,000 or more in mortgage debt, then you wouldnt be able to claim an interest deduction on home equity loans exceeding that amount.

Also Check: How Much Does H & R Block Charge For Taxes

Which Ones Are Deductible

Most closing costs for the refinance of an investment property are not deductible. The mortgage interest and property taxes can be deducted, but the rest are added to the cost basis for the asset and are depreciated. Depreciation in this context refers to the investors ability to deduct the cost of an asset over the course of its usable lifetime. The IRS allows residential rental property to be depreciated over a period of 27.5 years. If you are depreciating commercial property, the timeline is 39 years.

For example, if you have a rental property with a cost basis of $100,000, and $10,000 of that value is attributable to the land, the remaining $90,000 is depreciated by dividing it by 27.5. Each year, the property depreciation allowance is $3,272.72.

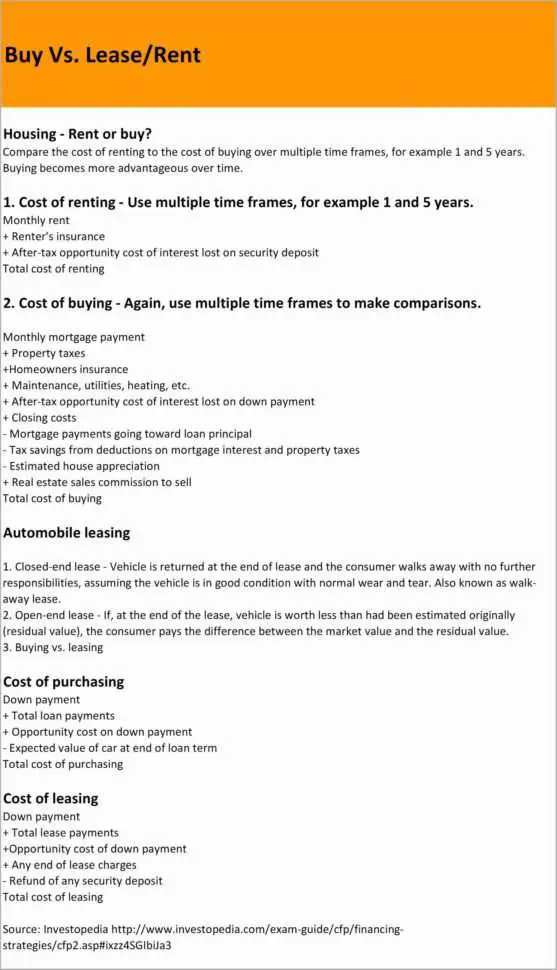

Are Down Payments And Closing Cost Tax Deductible

Your mortgage down payment is a cash payment you make to the mortgage company that reduces the amount of the mortgage loan relative to the purchase price of the home. You cannot deduct any portion of your house payment that reduces the principal amount of the mortgage, so none of your down payment is tax-deductible.

Don’t Miss: What Does Locality Mean On Taxes

How To Claim Closing Cost Deduction On Income Tax Return

Look for real estate deductions on your mortgage closing cost statement.

If youve recently purchased a home, some of your closing costs are tax deductible on your federal income tax return. Its essential to know which of the many expenses incurred during closing are deductible and which are not. Check your mortgage closing cost statement for the amounts you paid.

Capital Gains Tax For Sellers

The capital gains rule isnt technically a deduction , but youre still going to like it.

As a reminder, capital gains are your profits from selling your homewhatever cash is left after paying off your expenses, plus any outstanding mortgage debt. And yes, these profits are taxed as income. But heres the good news: You can exclude up to $250,000 of the capital gains from the sale if youre single, and $500,000 if married. The only big catch is you must have lived in your home at least two of the past five years.

And remember that capitol gains are calculated on the cost basis of your home, not the original purchase price. Whats cost basis? Say you purchase a home for $400,000, then spend $100,000 on improvements, you would have a cost basis of $500,000. A married couple could then sell for the home for $500,000 without having to pay any capital gains taxes.

In other words, the higher your cost basis, the smaller your tax bill once you sell. Just remember to keep track of every single home improvement receipt.

Finally, look for the rules of this exemption to possibly change in a future tax bill.

Ralph DiBugnara, vice president at Cardinal Financial, says lawmakers might push to change this so that homeowners would have to live in the property for five of the past eight years, instead of two out of five.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

About Deductible Closing Costs

As per IRS publication 530, homebuyers may deduct certain closing costs when they file federal tax returns. These include the points, or loan origination fees, you paid, as well as property taxes and mortgage interest. The IRS considers points as prepaid interest, thereby permitting deductibility. You can deduct all the points you paid in the year you paid them, rather than over the life of the loan, if the mortgage is for your primary residence and you didnât pay more in points than the usual amount in your area.

Points are worth 1 percent of the entire mortgage loan, so if you have $350,000 mortgage, each point is worth $3,500. Typically, homebuyers pay two to three points at closing, not higher amounts which limit deductibility.

Selling Your Second Home

If you sell your primary residence, then the law allows single taxpayers to exclude up to $250,000 in capital gains from your income. Couples who are married and filing jointly can exclude up to $500,000 in capital gains. However, this is for sales of primary residences only. When you sell your second home, you must pay a capital gains tax on your entire profit.

Read Also: Michigan.gov/collectionseservice

What Are Closing Costs

When home buyers take out a mortgage loan, they must pay closing costs. These costs are how lenders and other third parties such as title insurance providers make their money. Buyers can expect to pay 3% 6% of their loan amount on closing costs. Buyers, then, will pay $6,000 $12,000 in closing costs on a $200,000 mortgage. Home buyers will receive a Closing Disclosure at least 3 business days before closing that will itemize their closing costs.

Can You Deduct Closing Costs When Selling A Rental Property

In addition to deducting closing costs when you buy the property, there are also closing costs you can deduct when you sell a rental property:

1. Reduce selling price by closing costs paid

Sellers can deduct closing costs such as real estate commissions, legal fees, transfer taxes, title policy fees, and deed recording fees to lower the profit and lower the potential taxes owed.

Assuming seller closing costs run 8% of the sales price , deductible closing costs on the rental property sold for $164,000 would be $13,120, leaving you with a net sales price of $150,880.

2. Recapture depreciation

Recall that the annual depreciation deduction on the rental property was $5,218 per year.

Over the three years you owned the property you used a total depreciation deduction of $15,654 to reduce taxable net income. The depreciation deduction also lowered the property cost basis to $128,096, which is the original cost basis of $143,750 less the total depreciation expense of $15,654.

When the rental property is sold, you have to recapture the depreciation and pay a depreciation recapture tax based on your ordinary income tax rate, capped at 25%. Assuming you are in the 24% tax bracket, your depreciation recapture tax due would be $15,654 x 24% = $3,757 .

3. Capital gains tax

4. Defer capital gains tax with a 1031 exchange

There are three general rules to follow when conducting a 1031 tax-deferred exchange:

Don’t Miss: Where Is My Federal Tax Refund Ga

Discount Fee Or Points

When you pay points toward your mortgage loan, it is also known as buying down the loan. These fees, paid to your lender, lower the interest rate of your loan. One point equals 1% of the loan amount. In our example of a $250,000 loan, you would pay $2,500 to buy the loan down one point. The amount the one percent buy down would impact your interest rate varies by lender, type of loan, and current mortgage rates.

Is There A Tax Credit For Buying A House In 2019

Though the first-time homebuyer tax credit is no longer an option, there are other deductions you can still claim if youre a homeowner. The biggest is the mortgage interest deduction, which allows you to deduct interest from mortgages up to $750,000. Mortgage interest is the interest fee that comes with a home loan.

Read Also: 1040paytax.com Safe

Deducting Closing Costs On Taxes

To deduct home closing costs of property taxes, home mortgage interest and points, you must itemize on your Form 1040 return, reporting deductions on Schedule A. Enter eligible property taxes on Line 5c, home mortgage interest and points from Form 1098 on Line 8a, home mortgage interest not on Form 1098 on Line 8b, and points not on Form 1098 on Line 8c.

Complete Schedule A according to its directions by adding these amounts together and entering the total on Line 17. It’s this Line 17 amount that you’ll transfer to Line 8 of your 1040.

You should file Form 1098 with your tax return to report mortgage interest and points.

How To Report Taxable Gains

Should you elect not to claim the exclusion for some reason, or if you don’t meet the various requirements, you should report any gain as income on IRS Schedule D and submit it with your Form 1040 tax return. Otherwise, there’s no need to report the sale.

An exception exists if you have a capital loss rather than a gain, and you receive a Form 1099-S from the transaction. In that case, you might want to consult with a tax professional, because the IRS does not allow deductions for capital losses from selling your main home.

Also Check: How Much Does H And R Block Charge To Do Your Taxes

Property Rented Fewer Than 15 Days A Year

You can rent your home for fewer than 15 days during the tax year without having to report the income to the Internal Revenue Service. The house is considered a personal residence, which means you cannot take deductions for rental expenses. But you can deduct mortgage interest and property taxes as you would with any home.

This special rule applies even if you rent your home for $10,000 per night. Section 280A of the Internal Revenue Code says the money doesnt need to be included in your gross income, provided that the home was rented for fewer than 15 days per year.