H& r Block Mobile Accessibility

H& R Block has two different apps : MyBlock and H& R Block Tax Prep.

The MyBlock app lets you upload tax documents ahead of time, keep up with your taxes throughout the year, check out your completed return and e-file status after youve filed your taxes, and estimate your taxes throughout the year. You can also check your H& R Block Emerald Card balance, view transactions, and more.

The H& R Block Tax Prep app lets you actually prepare and file your taxes. It gives you access to all of the above features in a mobile format.

If Youre Getting A Tax Refund

No matter how you file, you can choose to receive your refund in several ways:

A direct deposit to a bank account is the fastest option. You can also have it loaded onto an H& R Block Emerald prepaid debit Mastercard or sent as a paper check.

H& R Block touts that itll add a 3.5% bonus if you put your refund on an Amazon gift card. You can also apply the refund to next years taxes, or direct the IRS to buy U.S. savings bonds with your refund.

You have the option of paying for the software out of your refund. But theres a $39 charge to do that.

Final Thoughts On H& r Block 2021

For those who qualify for free filing, H& R Block Online deserves to be on the short list. It is a premium software, and the free offering is expansive. Additionally, the Premium edition of the software could offer a good value for investors, and gig workers.

However, users considering the Deluxe Tier should think carefully before paying the price. Deluxe users may find a better by considering TaxSlayer Classic or FreeTaxUSA. These tools may also be a good alternative for self-employed people who dont have depreciating assets in their business.

Landlords and others with depreciating assets should also carefully consider whether H& R Block is the right tool to get the job done. TurboTax has a superior user experience for rental property owners which is important given the complexity of depreciation.

You May Like: How To Pay Taxes For Free

Recommended Reading: How Do I Protest My Property Taxes In Harris County

How Can I Save Money

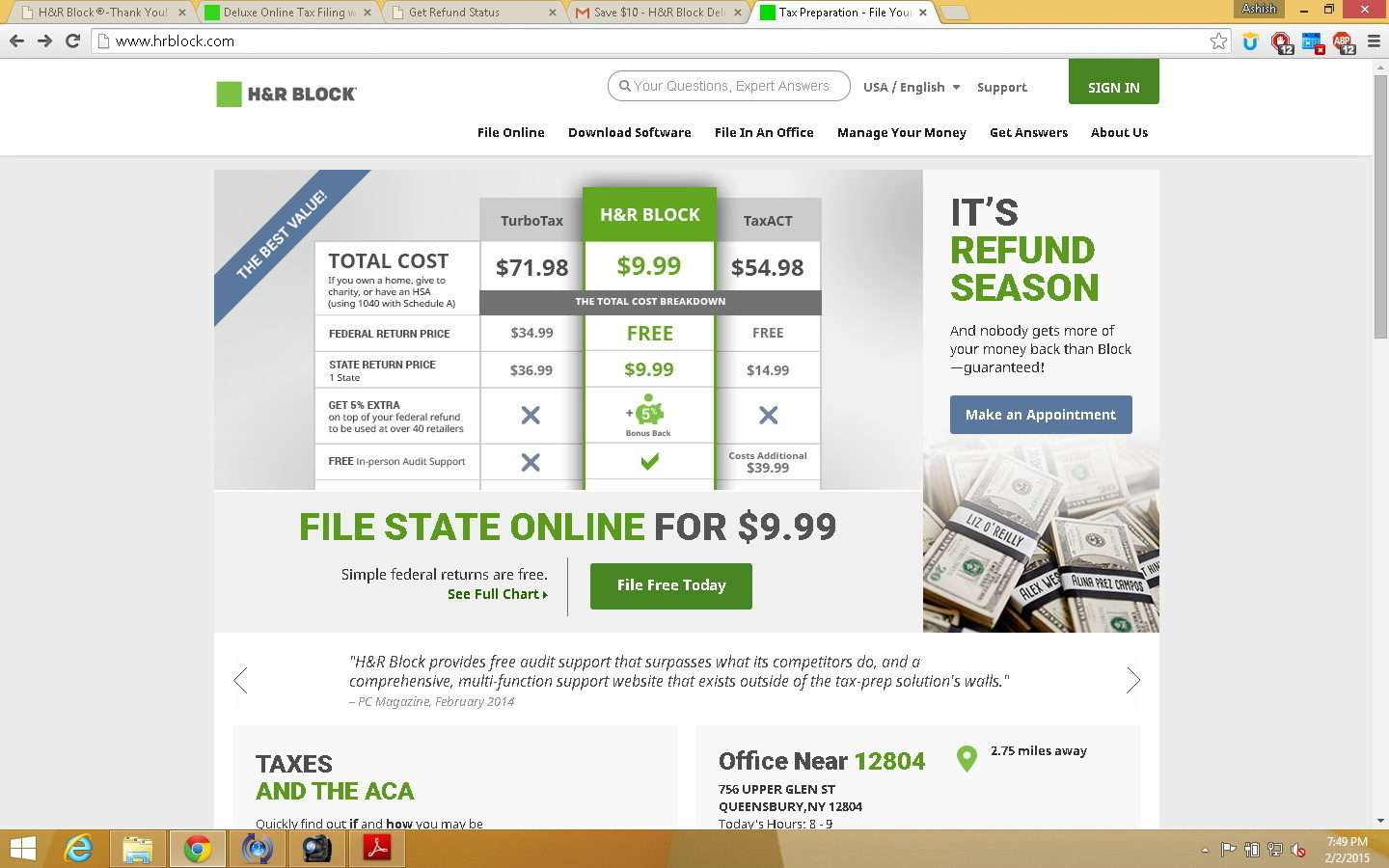

In a crowded market, consider other options such as TurboTax, TaxSlayer, Jackson Hewitt or even TaxAct. All software packages offer its own features and pricing tiers. FitSmallBusiness.com did a comparison of these products, showing us what its best for, the prices and what the free version supports.

If you made less than $60,000 for the year, then you can file you can file for free at MyFreeTaxes.com.

Advertising Disclosure: This content may include referral links. Please read our disclosure policy for more info.

When Are Taxes Due

The IRS began accepting 2020 income tax returns on Feb. 12. The deadline for those returns is on May 17 this year.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Read Also: How Can I Make Payments For My Taxes

Irs Free File Program

Many Americans are eligible to file their taxes for free through the IRS Free File program, which is a public-private partnership between the agency and the Free File Alliance, a group of tax preparation companies with online software such as TurboTax, TaxAct, FreeTaxUSA and more.

In 2020, 4.2 million Americans used the Free File program for their 2019 taxes, according to the IRS. While that was a nearly 50% increase from the previous year, more could still use the program.

If your annual gross income in 2020 was less than $72,000, you can use one of the Free File software programs offered to submit federal taxes free of cost. In addition, some products will also let you file your state taxes for free. The software generally includes step-by-step instructions and help for filers.

“This year it is especially important that people know about the Free File program because it’s a great tool for anyone that didn’t get their first or second economic impact payment or didn’t get the right amount,” said Christopher Miller, a spokesperson for the IRS.

To use the program, you must go through the IRS site not directly to a tax preparer, Miller said.

Free File opened on Jan. 15, meaning that people can now input and submit their tax information. When tax filing opens on Feb. 12, their forms will be automatically filed with the IRS.

How To Contact H& r Block

You can contact H& R Block for help at 1-800-HRBLOCK. You also have the option to connect via live chat while using the software. Screen-sharing is available as well, making it easy to get your questions answered.

If you decide you donât want to handle your filing online, you can also visit a local H& R Block office at one of more than 11,000 locations across the United States but you will have to pay a fee for in-person tax filing.

Recommended Reading: How Much Does H& r Block Charge For Doing Taxes

How To Get The Emerald Advance Loan

When ones taxes are prepared at a participating H& R Block office, they can apply for the early refund advance with an in-store tax preparer.

Those who are eligible can complete an application. If approved, theyll be notified on the amount theyll receive by MetaBank®. Criteria for approval include:

- Being owed a refund by the IRS

- Filing a tax return with H& R Block

- Meeting eligibility requirements

Other Products And Services

Following research on the potential expat market in 2013, H& R Block began its Expat Tax Services program to offer tax advice to U.S. citizens living outside the country.

H& R Block maintains financial services products, including the Emerald Card pre-paid debit card and Emerald Advance line of credit. Additionally, the company’s Tax Identity Shield offers identity theft protection.

Read Also: Is Donating Plasma Taxable Income

H& r Block Review & Guide

Tax time can often be a painful process, as organising and lodging your claim can be a long process, particular if you dont know much about tax. Add into the mix the wide variety of accountants and tax agencies who claim maximum refund guarantees and the whole experience can be confusing, as well as potentially costly.

With more than 470 offices around Australia, H& R Block is one of the nations most well-known tax accountancy companies. With humble beginnings in the US back in the 1940s, H& R Block has expanded to become a global brand, offering a range of financial services for both individuals and businesses. With tax time fast approaching, check out H& R Blocks range of tax services below.

H& r Block Vs Turbotax: User

Both of these services are known for their ease of use but TurboTax is generally the more user-friendly of the two whether youre talking about mobile or desktop.

TurboTaxs interview-style approach will guide you through the filing process with simple and straightforward questions. There is minimal tax jargon. H& R Block is also user-friendly but its questions and explanations are not always as clear as you would hope.

The filing process with TurboTax also includes encouraging phrases throughout. This isnt a necessary feature, but taxes are stressful for many people. Seeing, You can do this, throughout the process may help to reduce some anxiety.

Another important consideration is how easy it is to upload documents. Both services do well on this front. H& R Block and TurboTax both let you upload your W-2 by taking a picture of it. Both services allow you to import your previous returns no matter which tax service you used . They also make it easy to fill out your state return after going through your federal return. Your information quickly transfers so you dont waste time retyping everything.

You May Like: How To Appeal Cook County Property Taxes

Benefits Of H& r Block

H& R Block offers their customers more tax filing options than the competition, with in-person filing, online filing, and a downloadable version available.

In its second year, H& R Block also offers Tax Pro Go, which allows you to have your taxes prepared by trained professionals online.

H& R Block also offers excellent help and support options mentioned earlier, along with the Tax Pro Review option, where a tax pro will review and sign your tax return and file it on your behalf.

How To Negotiate A Fair Price

Call various tax preparation firms and get a feel for their price ranges if you’re searching for the lowest price. The business might not be able to give you an exact price quote, but they should be able to quote you either an average price or a price range for your tax situation.

Some firms might charge higher prices during their busiest days, like the weeks right after W-2 forms are mailed out or just before the April tax filing deadline. You might be able to obtain a lower price quote during a less hectic time of the tax season.

Recommended Reading: Buying Tax Liens In California

Understanding The Value Of The Service

You need to know that the value of tax preparation is more than the fee. Not every single organization is the same. Here are some of the things you should be looking for.

Flexibility in Filing Whether you want to file online or through an office, you should be able to do it. You should be able to get as much help or as little help as you require to file your taxes and claim your deductions.

DIY Choices Look for a tax preparation assistant that provides you with access to cutting edge software and tax experts. It shouldnt take a long time for you to make sense of your taxes.

The Right Professionals Ensure that youre speaking to tax experts who have years worth of experience in their field. They should also offer a friendly and professional service, as well as being easy to work with. You should have confidence in their ability to do the job right.

Guarantee of a Great Experience Doing your own tax preparation shouldnt fill you with nervousness. Many of the leading companies, including H& R Block, offer a guarantee. If your tax return isnt accepted by the IRS, you dont have to pay a thing.

Get the Maximum Refund The value of a great tax preparation company is getting the biggest refund you can. Its now common for tax companies to provide a guarantee that you will get the maximum refund, and nothing will be forgotten. This is where the real value of a tax preparation service comes from.

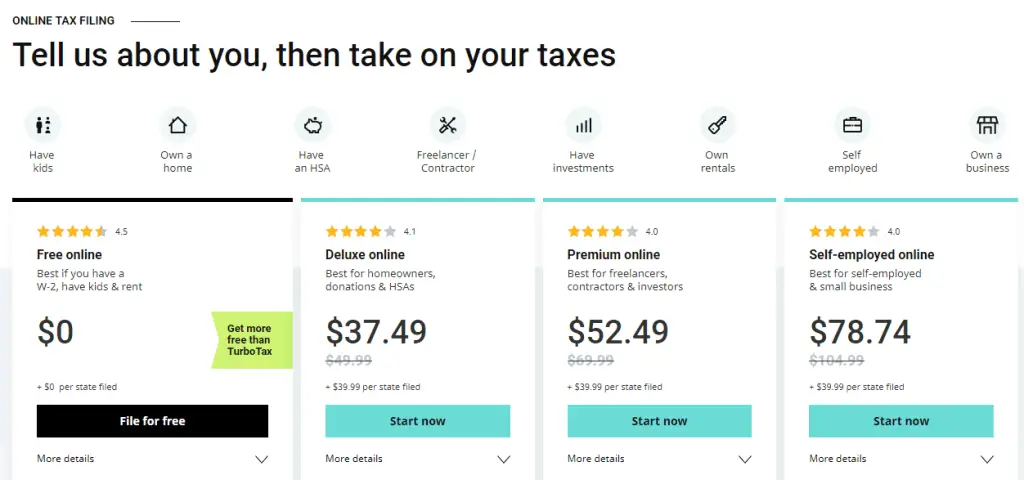

H& r Block Pricing & Packages

H& R Block offers four packages to file your taxes online: Free, Deluxe, Premium, and Self-Employed. There are also add-ons where you can get varying levels of support from the companys tax professionals. Click Help Me Choose to fill out a quick questionnaire that can help you find the right plan for you, or check out the full details on each tier right here.

Recommended Reading: Www.1040paytax.com

What Does The Tax Preparation Fee Include

Be sure to ask what’s included in the fee if you decide to use a professional. Do they charge extra for electronic filing, or for each phone calls and office visits? Some firms, especially franchise chains like H& R Block, charge an extra fee for audit protection. You’re basically prepaying for any costs you’d incur if the Internal Revenue Service decides to shine a spotlight on your tax return.

Find out what’s included with your initial fee if your return is audited, and what happens if the mistakes were made by the preparer and were no fault of your own.

How Qualified Do You Want Your Professional To Be

The average tax preparer will charge less than a high-quality advisor with loads of experience. But when it comes to the IRS and your money, the stakes can be high, depending on your specific situation.

Now, dont get us wrong. We want you to save money just as much as you do. But when hiring expertslike tax pros, doctors and mechanicswere all for spending more cash to get the job done right. Paying an extra $100300 on the front end may be worth it in the long run if the expert is thorough, accurate and ends up saving you a ton. Remember, were talking about estimates here, so adjust your professional expectations accordingly.

Recommended Reading: Where Is My State Refund Ga

How Much Does It Cost To Get Your Taxes Done

If youâve never hired a tax preparer before, youâre probably wondering, âHow much does it cost to get your taxes done by a professional?â And the answer is, it depends.

It all comes down to the amount of time spent preparing your tax returns. Average tax preparation fees depend on three factors:

How organized are your taxes?

Where do you live?

Donât Miss: Did The Tax Deadline Get Extended

Fulfill Your Business Accounting Needs

One can rely upon them to fulfill their accounting needs. Their services are of the very highest class and professional as well as affordable. To begin, a business needs the services of tax accountants or hires trained accountants who can integrate with the business like other employees of the organization.

A professional and successful accountant has years of financial education behind him as well as experience working with major concerns. An accountant from firms is well equipped to handle any situation effectively and easily. They are fully equipped or trained to deliver the best results under any circumstances. The tax return service in Canada never out of gear or let their high standards down or fall. For example, accountants from a tax accountants company are highly qualified and well-trained to take responsibility for ones business and taxation needs and requirements.

A professional and expert tax accountant is well-versed with the latest tax laws as well as the local laws and uses them in the best possible way to the benefit of the organization. They are fully capable of producing the desired or accurate and best solutions for the firms business needs. As the accountants have set high standards for themselves, they are able to deliver the most productive results in a smart and effective manner.

Also Check: Mcl 206.707

H& r Block Plans Pricing And Features

H& R Block uses an interview-style tax preparation process that methodically guides you through your federal and state returns, making sure youve entered all sources of income and checked for all appropriate credits and deductions, including commonly missed deductions, along the way.

Whether you have only the barest familiarity with online tax filing or boast years of complex self-prep, you can find a plan or package that fits your needs. Thats the case even if you need to file a Schedule C for self-employment income from freelancing or solopreneurship.

H& R Block has four DIY pricing plans, one hybrid plan with expert assistance at predefined checkpoints throughout the prep process, and a customizable CPA- or EA-aided plan thats a remote version of in-office prep.

Like many tax prep software providers, H& R Block raises its fees as Tax Day approaches. The step-up date varies from year to year and generally isnt revealed well in advance. It pays to begin your return as early in the season as possible, even if you dont yet have all the documentation necessary to complete your return.

On the bright side, H& R Blocks pricing is transparent you know your final price as soon as you select a plan .

What To Do In The Event Of Dispute

Inevitably, clients and tax accountants might disagree over the appropriate price of tax preparation services. Treasury Department regulations protect you in fee disputes. You’re entitled to receive your original tax documents back from the accountant even if you haven’t paid the fee.

Accountants can keep any forms, schedules, and documents that they’ve preparedthey don’t have to turn these over to you without compensation.

Read Also: Protesting Harris County Property Tax

Online Vs Cd/download Vs In

All tax preparation platforms discussed in this article are online. H& R Block and TurboTax also have CDs as well as downloadable software. Only Jackson Hewitt and H& R Block offer in-person filing, though TurboTax has added a new feature, TurboTax Live Full Service, that allows you to meet one-on-one with a tax expert via a live video call. Generally speaking, CD/download versions are the least expensive and in-person filing is the most expensive. As features and services offered vary, direct comparison is difficult.

Is H& r Block Or Turbotax Better

When it comes to costs, H& R Block‘s pricing is slightly lower than TurboTax‘s. Both offer solid customer service, an easy-to-use interface, and clear instructions and guidance, though there are some variations between packages.

Beyond the free version, here’s how they stack up on cost for the DIY online filing option, not considering discounts:

| $50 |

Read Also: How Can I Make Payments For My Taxes

They Charge A Set Fee For Each Tax Form Or Schedule

No ifs, ands or buts about it! They have one flat fee per form or schedule. If youre wondering what the average costs for filing common forms are, heres the breakdown:

- $323 for a Form 1040 with a Schedule A and state return

- $220 for a Form 1040 and state return

- $192 for Schedule C

- $118 for Schedule D

- $145 for Schedule E

- $200 for Schedule F 5