What If I Made A Mistake On My Tax Return

If you made a mistake on your tax return, its not the end of the world and it can be corrected. You just need to fix the error so it doesnt become an even larger issue like a tax lien or levy.

- A lien occurs when the IRS assesses a tax debt or liability against you, and your spouse, and sends you a bill. Typically, it gets to a lien situation if you refuse to pay and a levy if you neglect or ignore the notice or simply refuse to enter into an agreement to pay the IRS.

- A levy is a legal seizure of your property to satisfy a tax debt. A levy can take your property or property someone else holds for you such as wages, retirement accounts, bank accounts, etc., and in very rare circumstances, can even seize and sell your vehicle, real estate, and other personal property.

If you amend your tax return and then owe the IRS more money, but dont have the funds to pay the bill, you can enter into an Installment Agreement with the IRS. This is a payment play thats typically divided into short and long-term categories.

Don’t miss out on every credit and deduction you deserve!

When Can You Amend A Tax Return After Filing

Currently, HMRC allow another 12 months to adjust Self Assessment submissions for the previous tax year. In practice, it means that you have until the 31st January 2022 to make any changes to the form declared for 2019/20. This is conditional on hitting the initial deadline i.e. you must send it off when the tax return is due in the first place.

If you missed the Self Assessment tax return deadline, or you want to amend a tax return from a previous tax year, youll have to write a letter to HMRC explaining what you want to do. For example, you would have to obtain written approval for any changes made to your 2017/18 tax return. HMRC needs to know:

- the tax year youre correcting

- how much youve over/underpaid

- why you think this is the case

You can make amendments up to four years after the end of the tax year in question. If the changes entitle you to a refund, youll also have to include:

- that youre claiming overpayment relief, and that you havent previously tried to claim this

- evidence that you paid your initial tax bill

- details on how youd like to be reimbursed

- a signed declaration that the information youve given is correct and complete to the best of your knowledge

What To Do If You Were Sent Too Much Money And Don’t Want To Owe The Irs In 2022

If you’re eligible for the full amount of child tax credit money, you won’t have to pay it back. Child tax credit payments do not count as income. However, if you no longer qualify for the full amount but you receive the full amount anyway, you may need to pay back that extra money.

An overpayment from the IRS may occur if your income went up this year or if your child is aging out of a payment bracket this year . The age brackets for dependents apply to how old your child will be at the end of this calendar year.

The agency is using what it calls “repayment protection,” so if you do receive an overpayment but fall below a set income level, you don’t have to pay the money back. Above that income level, you will have to pay back some or all of the extra funds. Here’s more on taxes and how repayment protection works.

Recommended Reading: Appeal Cook County Taxes

Changing / Amending Your Tax Return

Income Tax Act S. 142

If you’ve filed your return and then determine that you need to make a change, either because you have received another T-slip, or because you didn’t claim an expense and later learned it was deductible, you can request an adjustment to your tax return.

The time limit for filing most adjustments to your tax returns by mail is ten years. For a late or amended pension splitting election the time limit is three years – see our Pension Splitting article.

You can request the change for your most recent return, or your returns for the previous 9 taxyears, either online or by mail. In 2018, you can request a change for the2008 or later taxation years.

If you used a tax professional to file your tax return, they can also filean amendment for you.

How Do I Resubmit A Return Or File An Amended Return

If, after making a successful submission, you need to make changes and file an amended return. Please see the video tutorial for a walk through of the process.

Alternatively, please follow these written steps:

Successful response from HMRC at Date TimeHMRC has received the …..

The process will run the same as when you filed your original return.

You can currently file up to nine amended returns online but all amendments must be made within one year of the submissions deadline. This means that for the 201920 tax return, amendments must be made by 31 January 2022.

You can find further information in our knowledge base article What’s the deadline for my self-assessment tax return?

Note: HMRC will not accept amended returns online for the 201819 tax year and any prior years. If you need to amend returns for these years, you will have to send a paper copy with a covering letter.

| Article ID: 863 |

Read Also: Can Home Improvement Be Tax Deductible

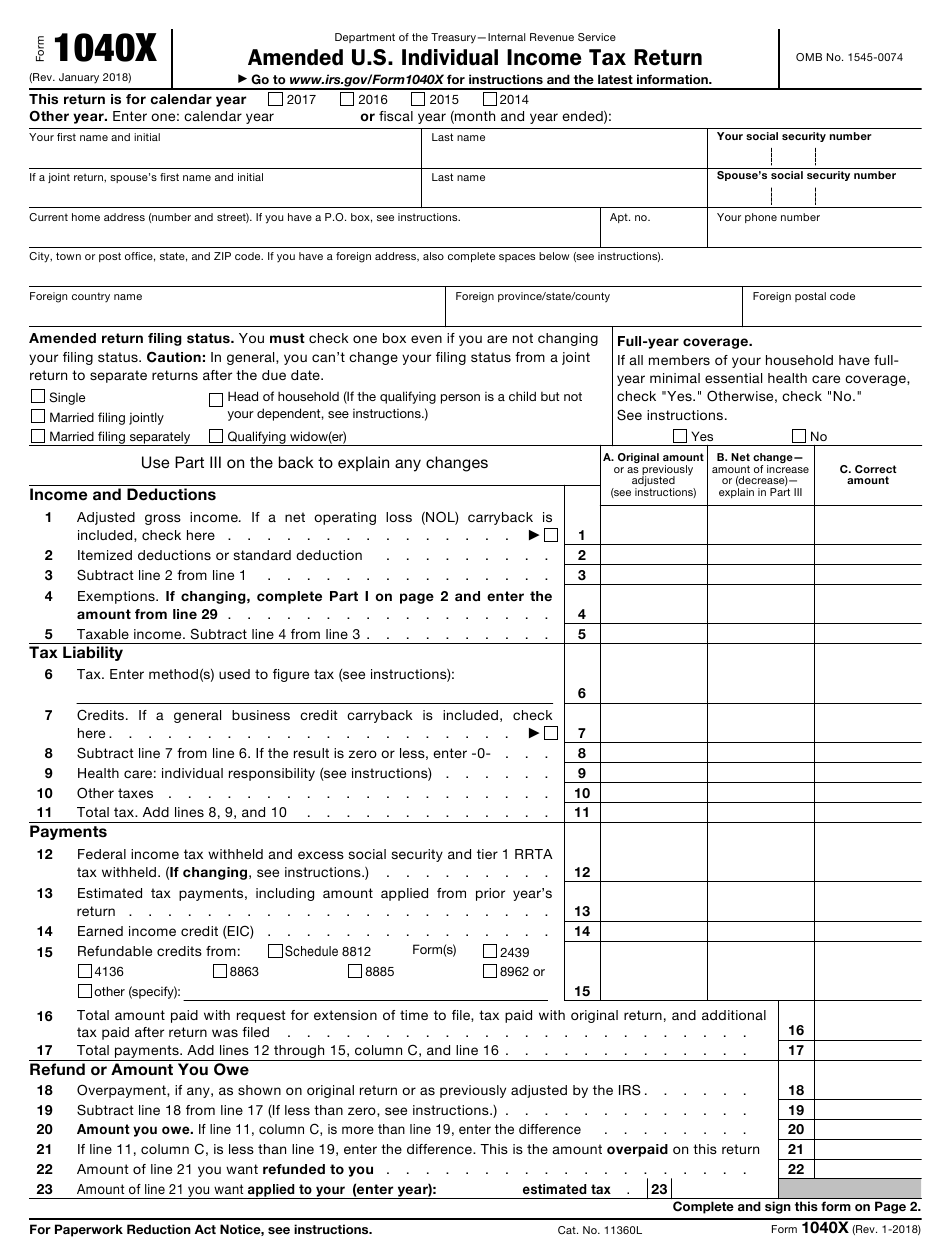

When Electronically Filing Amended Returns If A Field On Form 1040 Amended Return Is Blank Should The Corresponding Field On The Form 1040

For electronically filed Amended Returns: If an amount in a field on the Form 1040 or 1040-SR is blank, then the corresponding field on the Form 1040-X must also be left blank. If there is a zero in a field on the Form 1040 or 1040-SR, then the corresponding field on the Form 1040-X must also contain a zero.

Requesting A Change Online

Requesting a change online is very simple, and is done by logging into youraccount at the Canada Revenue Agency MyAccount page. You can request changes to more than one tax year in onesession, but each tax year is done separately.

There are some changes you cannot make using My Account. See the linkat bottom to the CRA Change my return information for exclusions.

When you log into My Account, if it shows a link to your most recentassessment on the Overview page, you can select the Change my return icon inorder to make a change. For a prior year, click on

Go to Tax returns details, then Once at the assessment page, go to the bottom of the page and click on theChange this return icon. You will be prompted for the line number that you wish to change on your tax return.

If you are trying to correct a prior return because youdidn’t enter all your RRSP contributions, see our article RRSPContribution Not Recorded Last Year.

You can also use the online request if you forgot to apply for the GST/HST tax credit when you filed your tax return.

Read Also: Protest Property Taxes In Harris County

Where’s My Amended Return

Track the progress of your amended tax return using the IRS’s online tracking tool.

You can also the progress of your amended tax return by calling the IRS.

-

It can take three weeks for an amended return to show up in the IRSs system and up to 16 weeks to process an amended return.

-

If nothing has happened after 16 weeks, call the IRS again or ask someone at a local IRS office to research your amended return.

How Do I Fix A Mistake On My Taxes After The Irs Accepts My Return

If youve found a mistake after the IRS officially accepts your return, you may wonder if theres anything actually wrong with it. After all, if the IRS approved it, doesnt that mean your tax return was fine?

That depends on the error on the return. You normally dont need to correct math errorsthe IRS will catch and make those changes for you.

On the other hand, mistakes having to do with personally identifiable information , filing status, dependents, total income, or tax breaks should be fixed, which is done by using Form 1040X.

You May Like: Claiming Home Improvement On Taxes

How Long Do You Have To File An Amended Return

- If you or the IRS changes your federal return, you must file an amended Virginia return within one year of the final IRS determination.

- If you file an amended return with any other state that affects your Virginia income tax, you must file an amended Virginia return within one year.

Interest on any amount due will still accrue from the original due date, so file the corrected return as soon as you can.

If Changes to Your Return Result in a Refund

We can only issue a refund if the amended return is filed within:

How To File An Amended Return

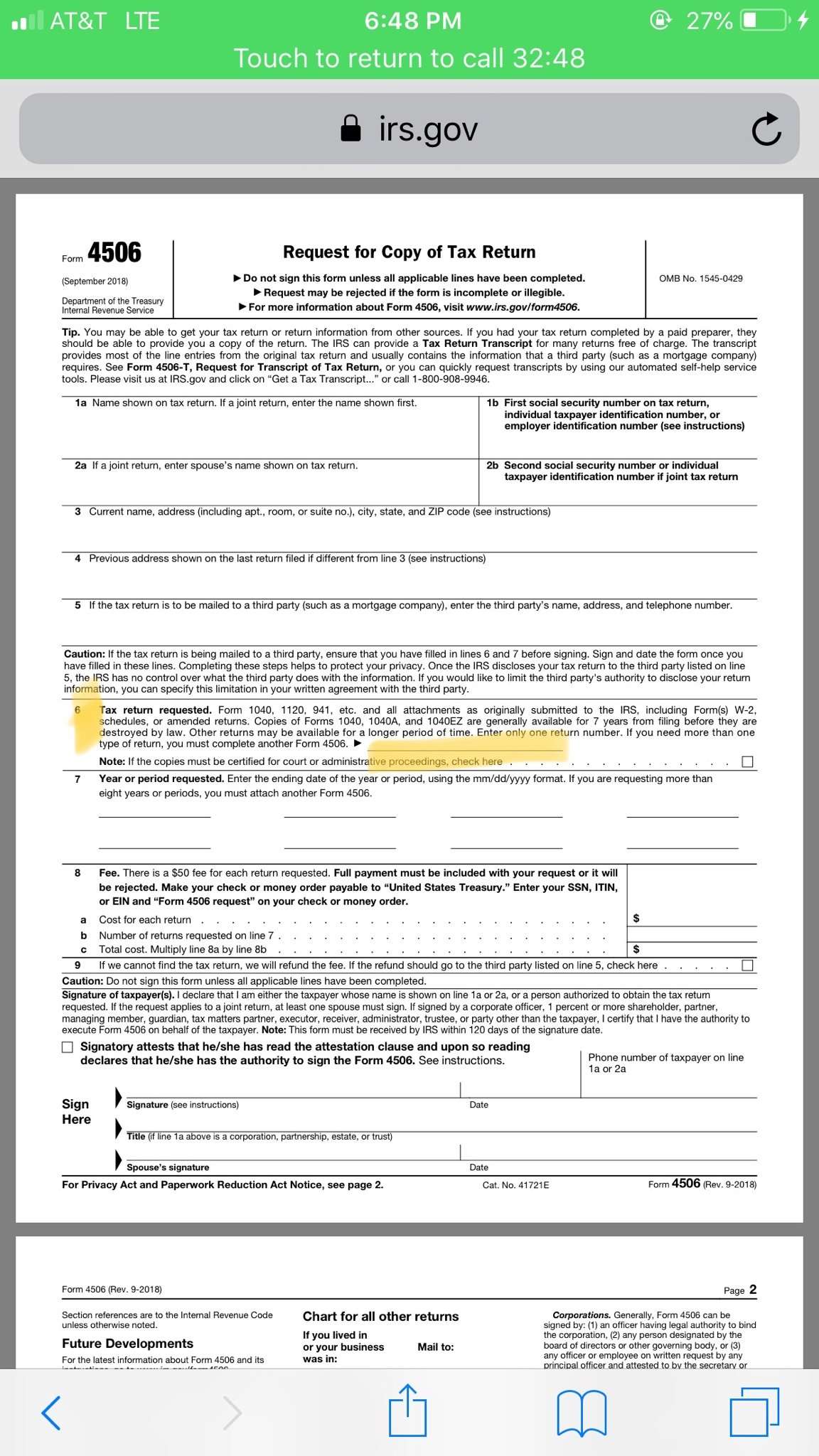

Taxpayers should use Form 1040-X, Amended U.S. Individual Income Tax Return, to file an amendment. You can check the status of your amended return three weeks after it was filed by going to the Wheres My Amended Return? online tool or by calling 866-464-2050.

You can track the status of amended returns for the current year and up to three prior years. When you check online or call, youll need to prove your identity by entering information, including your taxpayer identification number along with your date of birth and zip code.

There are three processing stages of your return: received, adjusted and completed.

Some common reasons to file include changing the number of dependents you claim, a changed total amount of income from when you originally filed, or that you can now claim tax deductions or credits.

You can amend your return by going online for Form 1040X, Amended U.S. Individual Income Tax Returnyou can correct forms 1040, 1040-A, 1040-EZ, 1040-NR, or 1040-NR EZ. The online form lets you input your data and download it for submission to the IRS.

You May Like: Irs Federal Returns

But Wait What If I Owe Money Will I Have To Pay A Penalty

If its after the tax deadline, and you discover you underpaid your taxes, you may owe a penalty plus interest. Pay the tax due immediately to minimize interest and penalties.

However, if you have a good cause, such as erroneous information sent to you, be sure to attach a statement with your amended return and ask for an abatement of the penalty.

The IRS often grants abatements when taxpayers attempt to correct problems on their own and as soon as possible. In fact, the IRS can be quite reasonable.

Note: Amending your tax return does not increase the risk of being audited.

Amending Your Most Recent Self Assessment

Assuming that you need to adjust your most recent Self Assessment, there are three ways to do so:

- For online tax returns, simply log into your HMRC account, select Self Assessment account and click the More Self Assessment details button. From there, go to the At a glance menu, and scroll down to Tax return options. Once chosen, you can pick the relevant tax year, look through the document and file it again.

- Paper tax returns are slightly more complicated. To amend them, you must obtain the latest tax return forms, complete them a second time, and note the word amendment on each page.

- If youve used GoSimpleTax, you need to login to your account and make any necessary changes. Then click validate your tax return and select yes on the question Are you submitting an amended tax return for 2019/20 to HMRC?. In the additional information box, you will need to provide a message to HMRC stating the reason for the amended tax return submission.

Once youve adjusted your Self Assessment tax return, HMRC should give you an updated bill within a couple of weeks. This will include either a new deadline for tax you owe, or instructions about your pay-out.

Of course, the risk of an inaccurate tax return is much lower when you have Self Assessment software to hand, so you wont need to ask questions like: can a tax return be amended after filing? GoSimpleTax makes it easy to complete on time, in full, with enough evidence to bear scrutiny from HMRC.

You May Like: Plasma Donation Taxable Income

When I Called Ldr About A Bill I Was Told That I Needed To Amend My Tax Return To Resolve The Bill How Do I File An Amended Tax Return

Amended returns can be filed by re-filing a corrected tax period return with an X marked in the Amended Return box and attaching an explanation of the changes. The amended return should be mailed to the address on the tax return.

Amended individual income tax returns can be file electronically using the Louisiana File Online application. If you filed your original tax return electronically, you may log in to your account and amend your original return. If you filed your original tax return on paper or via another electronic filing option, you can still file your amended return electronically using the Louisiana File Online application. You must register and create a User ID and password and then select the amended tax return option.

Amended business tax returns can be filed electronically using the Louisiana Taxpayer Access Point system. Once registered for the LaTAP system, you can file and pay your taxes electronically and review your tax filing and payment history for all taxes.

You Can File An Amended Tax Return On Your Own

People with simple tax situations and small changes might be able to file an amended tax return on their own. Many major tax software packages include modules that will file an amended tax return. Many tax preparers are happy to file amended returns as well.

And note: Amending your federal tax return could mean having to amend your state tax return, too.

Read Also: Wheres My Refund Ga.state

Cras My Account Change My Return

Change my return is a secure My Account service that allows you to make an online adjustment for the 10 previous calendar years. In order to use the Change My Return service, taxpayers must have My Account setup with the CRA. My Account allows you to track your refund, view or change your return, check your benefit and credit payments, view your RRSP limit, set up direct deposit, receive online mail, and so much more.

For more information on how to set-up My Account, visit the CRA website.

Taxpayers should wait until they receive their Notice of Assessment before requesting to make any changes to their tax return. Furthermore, this request to make changes to a tax return can only be made within 10 years from filing the actual tax return. For example, a request to make changes to 2008s tax return can only be made until 2018.

CRAs Change My Return CANNOT be used to make changes in a tax return that:

- has not been assessed

- was a return filed prior to the year of bankruptcy

- has nine or more reassessments existing for a particular tax year

- has carryback amounts such as capital or non-capital losses

- was filed by an international or non-resident client

- changes the elected split-pension amount

- has income from a business with a permanent establishment outside your province or territory of residence

- was arbitrarily filed by CRA

Why File An Amended Tax Return

You found an error on your original return. Did you enter your Social Security number incorrectly? Did you check the wrong box for your filing status? Did you simply make a typo when entering your Form W-2 wages? Did you forget to record a charitable contribution or other tax deduction?

Not all errors are created equally. Some errors are worthy of an amendment while others are not.

Errors worthy of amendment include:

- A substantial noncash contribution

- Income, such as unemployment benefits, that you didnt know you should report

- A corrected form from your employer, financial institution, or a partnership

- An incorrect social security number for yourself, your spouse, or a dependent

Other inconsequential errors are not worthy of amending a tax return. For example, if you found a small $20 receipt for a charitable contribution or additional mileage for a business trip, its not worth your time to amend your return.

If you calculated your return by hand, didnt use tax software, and made a math error, generally, the IRS will find these errors and make the corrections for you. The IRS will send you a letter letting you know they found an error and corrected it. If you agree with the corrections, you do not need to file an amended return.

Read Also: Do I Have To File Taxes For Doordash If I Made Less Than $600

Can I Amend My Tax Return Online Electronically

The simple answer is no, but there is more to know about the no. Lets walk through the basics of amending a tax return.

If you discover an error after filing your taxes, you may need to amend your tax return. You should file an amended return if there’s a change in filing status, income, deductions or credits. This is a reality as receipts are lost, records jumbled or the exclamation of: I thought you kept that record. It is more common than you might think to experience errors on a tax return since humans can easily misinterpret definitions of terms and expectations.

You can and should file an amended return if there is a change in filing status, income, deductions or credits.

Please note that the IRS may have already corrected mathematical or clerical errors on a return. They also may accept returns without certain required forms or schedules. In these instances, there is no need to file an amended return, but you can contact us, and we can help you amend your return.

If you need to amend a tax return, here are some important tips:

- Dont file an amended return after an audit starts. If you have been selected to be audited, you find it better to not file an amended return after the audit starts. It is not likely the auditor will get your amended return quickly enough, filing it may create confusion. Discuss any proposed change with the revenue agent conducting the audit.