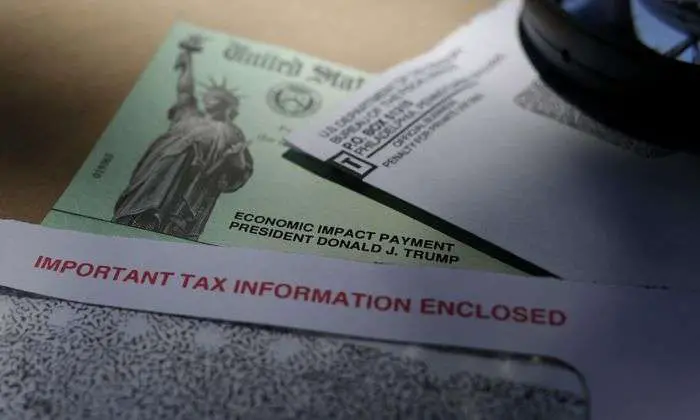

People Who Owed $0 In Taxes Cant Check Their Payment Status

Others complained about a glitch in the tool that wont allow them to move forward because they neither owed any money to the IRS nor received a refund for 2018 or 2019. Typing in zero didnt work.

I could not give an affirmative answer to any of these questions since I owed no tax and did not receive a refund, one reader wrote. Submitting the form returned an error so I tried again and answered yes to owing tax and zero to the amount. Error again.

We are aware of the problem and are checking into it, IRS spokesman Eric Smith said.

Receiving The Wrong Payment Amount Or No Money For Dependent Children

A number of people indicated they received an incorrect payment amount. Five people contacted The Post saying they didnt receive any money for their children or they received only one child payment when they have three kids. Others said the amount for them personally was wrong.

People whose adjusted gross income qualifies them to receive a stimulus check are supposed to receive an additional $500 for every dependent child under 17. But one reader from Kentucky with three children under age 15 said she received only $1,200 on Wednesday. She double-checked her 2019 tax return and verified that all three children were listed as dependents.

Individuals who receive Social Security retirement, survivors or disability benefits or Railroad Retirement benefits will automatically receive the $1,200 stimulus payment if they are eligible. The IRS announced it has added to this group Supplemental Security Income recipients. The automatic payments for SSI recipients will go out no later than early May, according to the agency statement.

However, the IRS says if you fall into one of those categories and have children under 17, you have to use the non-filers tool at IRS.gov to claim the $500 payment per child. Youll need a valid Social Security number or Adoption Taxpayer Identification Number for each of your dependents.

Grizzly Plunge: Bitcoin Nears Bear Market As It Slides Almost 20 Percent

TurboTax and H& R Block customers are reportedly struggling to get their stimulus checks once again but officials say the problems are less widespread this time around.

Dozens of people who filed tax returns through the companies have had their $1,400 coronavirus relief payments sent to the wrong accounts, according to CNBC.

A similar glitch plagued 13 million taxpayers in January, when the Internal Revenue Service initially sent their $600 checks to pass-through bank accounts that tax-prep companies set up to receive the customers previous tax refunds.

The IRS says it worked with the tax industry to fix the glitch and ran tests to make sure the latest checks would land in the right place.

While some money can be sent to closed accounts in any payment process, the IRS believes the volume of payments going to closed accounts will be significantly less than any previous round of Economic Impact Payments, the agency said in a statement.

But many TurboTax customers told CNBC that their money was once again dropped in old pass-through accounts, while others said their checks went to accounts they used to use but had closed.

Several customers aired similar complaints on Twitter, saying their checks had been directed to incorrect accounts even though theyd tried to update their banking information.

Recommended Reading: Where’s My Refund Ga State Taxes

What Happens If You Get A ‘not Available’ Message

Other TurboTax users haven’t been as lucky as Trent.

DeeAnna Kerns, who lives in Winston-Salem, North Carolina, has used TurboTax to file her taxes for the past five years and had no issues receiving her first stimulus check. But she was left scratching her head after she saw a not available” message when checking her account on the IRS website.

I keep getting an error message, which leads me to believe that my stimulus check was redirected to TurboTax’s account, said Kerns, 36, who works at a nonprofit that assists people with intellectual and developmental disabilities.

Anyone who sees this message won’t receive a second Economic Impact Payment by mail or direct deposit and instead needs to “claim the Recovery Rebate Credit on your 2020 Tax Return,” according to the IRS.

But others with that status like Trent still received the money this week.

TurboTax didn’t immediately respond to questions as to why some customers had the “not available” status but still received the money.

Payment Status Not Available

Frustrated taxpayers also about their inability to track when and how they would be getting their money. Some posted an image of the message they received after entering their information: Payment Status Not Available.

There are a number of reasons the tool cant check the status of a stimulus payment, the IRS said.

- You arent eligible for a payment.

- Your payment is based on your status as a Social Security, disability, Veterans Affairs or Railroad Retirement beneficiary. In this case, the IRS will use your SSA or RRB Form 1099 payment information. Your payment information isnt available on the Get My Payment tool.

- You have not filed a 2018 or 2019 federal tax return.

- You filed your 2019 return, but it hasnt been fully processed.

- You used the non-filers tool, but the information you entered is still being processed.

- Theres a problem verifying your identity when answering the security questions.

Others say they are getting that message even though they do not fall into any of these categories. Information on the site is updated only once a day, so checking more than once in a 24-hour period wont yield a different result. The IRS says people who qualify for a payment will receive it by mail if they do not get it from direct deposit.

Also Check: How Much Does H& r Block Charge To Do Taxes

If You See Payment Went To A Different Account Here’s Why

Those who opted into receiving tax refund payments on a debit card are more likely to see an account number they don’t recognize on the IRS Get My Payment portal, according to the IRS.

“But dont worry we have sent these payments on to the method you chose for Refund Transfer: direct deposit, check or Emerald Card,” H& R Block said Monday night. “The money should be there by the end of the day.”

The Irs Started Sending The Third Stimulus Payments In March 2021 And Will Continue To Send Them On A Weekly Basis As 2020 Tax Returns Are Processed Payments Will Be Sent To Eligible People For Whom The Irs Did Not Have Information To Send A Payment But Who Recently Filed A 2020 Tax Return

Here are some helpful answers for you

How much is the third stimulus check?

Each eligible taxpayer can receive up to $1,400, plus an additional $1,400 per dependent. That means that a family of four with two children could receive $5,600. Remember, just because you are eligible doesnt mean you are eligible for the full $1,400.

Who is eligible to receive a third stimulus check?

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should have received the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year were eligible to receive stimulus checks for a smaller amount. Unlike the previous two rounds, you should have received stimulus payments for all your dependents, including adult dependents and college students.

When will I get my stimulus check?

The IRS started sending the third stimulus payments in March 2021 and will continue to send them on a weekly basis as 2020 tax returns are processed. Payments will be sent to eligible people for whom the IRS did not have information to send a payment but who recently filed a 2020 tax return.

How will I receive my stimulus payment?

What if someone claimed me as a dependent?

If you are claimed as a dependent on someone elses return you are not eligible for a stimulus payment.

Where can I find more information on stimulus payments?

You can learn more at the IRS Economic Impact Payment Information Center.

Read Also: How To Buy Tax Lien Properties In California

H& r Block Turbotax Confirm Mix

PORTLAND, Maine If you’re a customer with H& R Block or TurboTax, you may experience a delay in receiving your second stimulus check.

While the IRS and the U.S. Treasury Department began issuing the second round of stimulus checks last week, customers of both companies are taking to the internet to air out their frustration about their payments not ending up in their bank accounts.

According to H& R Block, customers who have used the IRS Get My Payment tracking tool may see an account number their payment was issued to that is not theirs.

People that have their tax refund checks sent directly to their bank account automatically get their stimulus check from the government to that account number. However, H& R Block customers that used the Refund Transfer option in 2019 may have had their stimulus sent to that temporary account.

H& R Block posted online saying in part, “If you took a Refund Transfer, it may be reflecting that account number. Check your 2019 return to confirm. But dont worry we have sent these payments on to the method you chose for Refund Transfer: direct deposit, check, or Emerald Card. The money should be there by the end of the day.”

However, many are saying they still didn’t receive their payment at the end of the day when this started on Monday, or they only received a part of their payment.

Following H& R Block’s announcement of the issue Tuesday, TurboTax announced the same issue later in the day.

How To Track The Third Stimulus Check And Find Your Payments Status

We have confirmed with the IRS that they have the accurate banking information from the tax filing for all TurboTax filers, McMahon said in an email. If the taxpayer closed their personal bank account where they received a recent tax refund, the IRS may still try to deposit their stimulus payment there if it is the latest banking information that the IRS has on file for them.

Some H& R Block users, meanwhile, griped that their checks were incorrectly deposited onto Emerald Cards, prepaid debit cards that customers can use to receive their tax refunds, CNBC reported.

But the company says those problems were isolated incidents in a distribution process thats been much smoother than the last one. H& R Block said on Tuesday that all stimulus payments headed to Emerald Cards have been processed.

While there were individuals who had questions or needed a replacement Emerald Card, the systemic issue seen during the second stimulus disbursement was solved and was not an issue this time, an H& R Block spokesperson said.

Those affected by the glitches may have to wait a bit longer to receive the money.

The IRS said any payments sent to closed bank accounts will be returned to the feds and reissued in less than two weeks. Some reissued payments are already on the way, according to the agency.

You May Like: What Does Agi Mean In Taxes

Turbotax Payments Were Delayed But Now They’re On The Way

TurboTax users are experiencing similar issues. However, one user on Twitter said she avoided the issue by setting up her bank account to receive the tax refund instead of having TurboTax receiving it.

According to TurboTax, “If you selected a refund transfer or a debit card when you filed your taxes and a stimulus payment is sent from the IRS to that account, you will receive your stimulus payment without delay or fees into the account you received your tax refund.”

Johnson sent out an email to TurboTax customers on Wednesday night saying he expects the issue to be corrected “within days” after the IRS sent millions of payments to the wrong bank accounts.

Around 1:30 a.m. Friday, Johnson sent this follow up email to its customers:

Great news, your stimulus payment is on the way! We are happy to share that stimulus payments will begin to be deposited starting January 8th. We expect most payments to be available that day, but your bank could take a few business days to process. Your payment will be deposited into the same bank account that you received your 2019 tax refund. We have been working tirelessly with the Treasury and IRS to get your stimulus payment to you. We know how important these funds are for so many Americans and we regret that an IRS error caused a delay in you receiving your stimulus payment.

Other taxpayers took to Twitter earlier this week to express their frustrations with the way the IRS, H& R Block and TurboTax are handling stimulus check payments.

Turbotax Explains Issues With Stimulus Payments

The e-mail to users says millions of payments were sent to wrong accounts due to an IRS issue

GREENVILLE, N.C. – Tax preparation company TurboTax has sent an e-mail to users to update them on issues with stimulus checks.

According to the e-mail obtained by WITN, it says an IRS issue caused millions of payments to be sent to the wrong accounts. The company says they are working on a solution with the Treasury and the IRS to get the issue resolved.

TurboTax says they expect the issue will be fixed within days and payments will be deposited into the correct bank accounts. They are also working with the IRS to make sure they have the correct banking information.

Most Read

Read Also: How Can I Make Payments For My Taxes

Recommended By Our Editors

No action is necessary for taxpayers as this work continues they do not need to call the IRS, their tax provider or their financial institution, the IRS added.

The agency says it has direct-deposited over 100 million stimulus checks thus far.

Get Our Best Stories!

Sign up for What’s New Now to get our top stories delivered to your inbox every morning.

This newsletter may contain advertising, deals, or affiliate links. Subscribing to a newsletter indicates your consent to our Terms of Use and Privacy Policy. You may unsubscribe from the newsletters at any time.

Several Million People Who Filed Their Taxes Via H& r Block Turbotax And Other Popular Services Were Unable To Get Their Payments Some Parents Reported They Didnt Get The $500 Promised For Their Dependent Children

Many Americans woke up Wednesday expecting to find a payment of $1,200 or more from the U.S. government in their bank account, but instead they realized nothing had arrived yet or the wrong amount was deposited. Parents of young children complained they did not receive the promised $500 check for their dependent children.

U.S. Treasury Secretary Steven Mnuchin has instructed the Internal Revenue Service to get payments out as fast as possible to help offset the pain of losing jobs and shutting down businesses, but numerous glitches affecting filers who used tax preparers, parents of dependent children and people with 2019 tax returns still to be processed are delaying payments and causing confusion.

Several million people who filed their taxes via H& R Block, TurboTax and other services were unable to get their payments because the IRS did not have their direct deposit information on file, according to the Treasury, companies and experts.

The IRS launched a Get My Payment tool Wednesday for people to track the status of their payment and enter direct deposit information, but many who used it said they received a message saying Payment Status Not Available, a frustration that left them without answers.

Some parents told The Washington Post that they received a $1,200 payment for a single head of household or a $2,400 check for a married couple but that the IRS left out the $500-per-child-under-17 payments.

Don’t Miss: Buying Tax Liens California

Millions Of People Who Use Tax Preparation Services Didnt Get Their Payments

Customers who use tax preparation services such as H& R Block, TurboTax and Jackson Hewitt complained on Twitter and to The Post that they didnt get their stimulus payments Wednesday.

Up to 21 million tax filers could be affected, said consumer law expert Vijay Raghavan, because the IRS does not have these peoples direct deposit information on file if they received an advance on their tax refund from these companies or had the fee for tax preparation taken out of their tax refund.

The reason is that tax preparation companies received these peoples tax refunds first, deducted their fees and then distributed the remaining refunds to the customers. Because of that, the IRS had a temporary bank account on file that the tax preparer created for the 2019 tax season, Raghavan said.

The IRS is aware of the problem and urges people to input their bank information on the Get My Payment portal, a spokesman said.

Chi Chi Wu of the National Consumer Law Center said the IRS told her that it found a way to work around this problem and a significant percentage of these people will ultimately get a direct deposit. So far, many are still waiting.

Im not happy with H& R Block. I probably wont be doing business with them ever again, Sielen said.

A TurboTax spokesperson said the IRS does have all of the necessary information for its users, but customers were still reporting issues on and to The Post.

What Should You Do

The IRS told taxpayers not to call the agency or their banks with questions about payment timing and should instead visit the IRS.gov website.

Those who dont receive a direct deposit should monitor their mail for either a paper check or a prepaid debit card, the agency said.

Payments must be sent by the government by Jan. 15, according to the IRS. Customers who qualify for the $600 but don’t receive their payment via direct deposit or in the mail can still get it this tax season by claiming a special rebate credit when they file their 2020 taxes, the IRS said.

But some Americans arent keen on that method.

For me, a credit would get eaten up in taxes and would be no benefit at all,” says Kerns, who was hoping to stash the money away in her savings because shes uncertain about her job security. “It would absolutely break my heart.”

Recommended Reading: How To Buy Tax Lien Properties In California