An Example Of How Canadas Federal Income Tax Brackets Work

If your taxable income is less than the $48,535 threshold you pay 15 percent federal tax on all of it. For example, if your taxable income is $30,000, the CRA requires you to pay $4,500 in federal income tax.

However, if your income is $200,000, you face several tax rates. This example shows how much federal tax you will pay on your 2020 taxable income. You need to make a separate calculation for your provincial tax due.

- The first tax bracket $0 to $48,535 is taxed at 15%, plus

- The next tax bracket over $48,535 to $97,069 is taxed at 20.5%, plus

- The following tax bracket over$97,069 to $150,473 is taxed at 26%, plus

- At this point, $150,473 of your income has been taxed. The final bracket on your remaining $49,527 is taxed at 29%.

- If you earn more than $214,368 in taxable income in 2020, the portion over $214,368 is taxed at the federal rate of 33%. This is called the top tax bracket and a common misconception is if your taxable income is in this top bracket, you will be taxed at 33% on your entire income.

How Tax Brackets Determine Your Taxes

When you earn an income, you’re required to pay taxes on it. But you can reduce your taxable income â the amount of income you can be taxed on â by claiming certain tax deductions.

Most people claim the standard deduction, which, as of 2020, reduces your taxable income by between $12,400 and $24,800, depending on your filing status. Other taxpayers with a more complicated tax profile may itemize their deductions and potentially deduct even more. In 2021, the standard deduction will increase to $12,550 for single filers and $25,100 for joint filers.

Your taxable income is the amount used to determine which tax brackets you fall into.

For example, if you earned $100,000 and claim $15,000 in deductions, then your taxable income is $85,000. That $85,000 happens to fall into the first four of the seven tax brackets, meaning that portions of it are taxed at different rates.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

Most people already have their taxes withheld from their paychecks by their employer. Other people, such as independent contractors, had to make periodic estimated tax payments based on their income.

When you file your tax return, you’ll figure out if you paid enough tax in the previous year or if you paid too much. The former results in a tax bill for the amount you owe, and the latter results in a tax refund for the amount you overpaid.

Putting It All Together: Calculating Your Tax Bill

To calculate how much you owe in taxes, start with the lowest bracket. Multiply the rate by the maximum amount of income for that bracket. Repeat that step for the next bracket, and continue until you reach your bracket. Add the taxes from each bracket together to get your total tax bill.

For example, the single filer with $80,000 in taxable income would pay the lowest rate on the first $9,875 he makes then 12% on anything earned from $9,786 to $40,125 then 22% on the rest, up to $80,000 for a total tax bill of $13,774.

Effectively, this filer is paying a tax rate of 17.2% , which is less that the 22% tax bracket our taxpayer actually is in.

But, wait. Effective tax rates dont factor in any deductions, so if you wanted get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction , the amount of his AGI that went to the IRS was 14.9% a far cry from 22%.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid and divide your tax bill by that number. The overall rate for our single filer with $80,000 in taxable income might be closer to 12% or even lower.

Also Check: Can Home Improvement Be Tax Deductible

For Married People Who Are Filing Jointly

Tax rate of:

10% for people earning $0 to $19,900

12% for people earning $19,901 to $81,050

22% for people earning $81,051 to $172,750

24% for people earning $172,751 to $329,850

32% for people earning $329,851 to $418,850

35% for people earning $418,851 to $628,300

37% for people earning $628,301 or more

How Canadas Progressive Tax System Works

The Canadian tax system is a progressive system which means low-income earners are taxed at a lower percentage than high-income earners the more money you make, the more taxes you pay.

In Canada, taxpayers pay income tax to the federal government and to the government of the province/territory where they reside. In all provinces/territories, except Québec, the federal government collects the provincial/territorial tax and gives it back to them in the form of various programs. Québec collects and manages its own income tax.

We at TurboTax want to ensure you have all of the information you need to file your taxes, either on your own, or with some help from us.

For a further explanation of tax brackets and rates, see this CRA link.

Don’t Miss: How Much Time To File Taxes

What Are The Tax Brackets

U.S. income tax rates are divided into seven segments commonly known as tax brackets. All taxpayers pay increasing rates as their income rises through these segments. If youre trying to determine your marginal tax rate or your highest federal tax bracket, youll need to know two things:

- your filing status. That means whether you file as single, married or as head of household.

- your taxable income. Your taxable income does not equal your wages rather its the total of your ordinary income sources minus any adjustments and deductions. Need help determining this number? Find out how to calculate your taxable income.

Get More With These Free Tax Calculators

-

See if you qualify for a third stimulus check and how much you can expect

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

See which education credits and deductions you qualify for

* Important offer details and disclosures

Also Check: Where’s My Tax Refund Ga

What Is My Tax Bracket

OVERVIEW

The federal income tax system is progressive, which means that different tax rates apply to different portions of your taxable income. The term “tax bracket” refers to the highest tax rate applied to the top portion of your taxable income and depends on your filing status. Here’s how to calculate your tax bracket.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

Will The Top Tax Rate Be Raised

Will the top income tax rate go up in the near future? It will if President Biden gets his way. As part of his American Families Plan, the president has proposed increasing the highest tax rate from 37% to 39.6%, which is where it was before the Tax Cuts and Jobs Act of 2017. The 39.6% rate would apply to single filers with taxable income over $452,700 and joint filers with taxable income exceeding $509,300.

There’s also a separate proposal coming out of the House Ways and Means Committee that would also raise the top rate to 39.6%. Under this plan, the 39.6% rate would apply to single filers with more than $400,000 of taxable income and married couples filing a joint return with over $450,000 of taxable income. The House plan would also tack on an additional 3% surtax if for anyone with a modified adjusted gross income over $5 million, which would effectively push the tax rate up to 42.6% for the wealthiest Americans.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Where’s My Refund Ga State Taxes

How Do I Know What Tax Bracket Im In

If you calculate your net income after deductions and compare it to the chart about, you will know how much tax you will need to pay. Find the tax bracket where your income falls. If your income falls in the first tax bracket, you will only be taxed on that tax rate. If your income falls in a higher tax bracket, you will be taxed on the lowest tax bracket rate to the maximum for that bracket, on the second tax bracket to the maximum amount for that bracket, and so on progressively until you reach the bracket your income belongs in.

Remember that there are different rates for federal and provincial taxes.

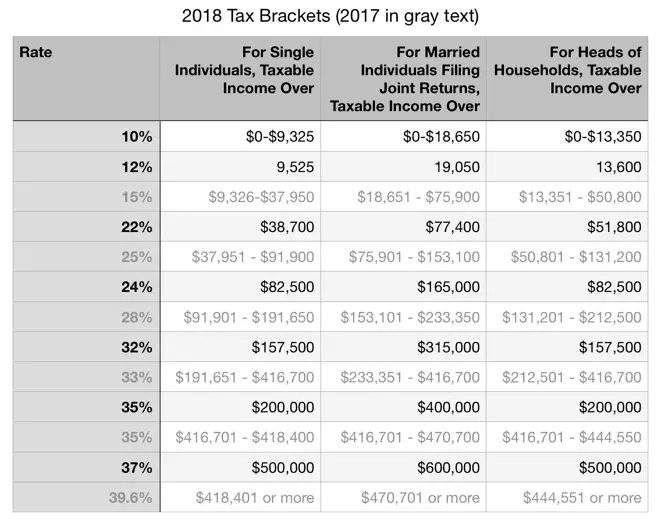

Previous Years Tax Brackets

Taxes were originally due April 15, but as with a lot of things, it changed in 2020. The tax deadline was extended to July 15 in order to let Americans get their finances together without the burden of a due date right around the corner.

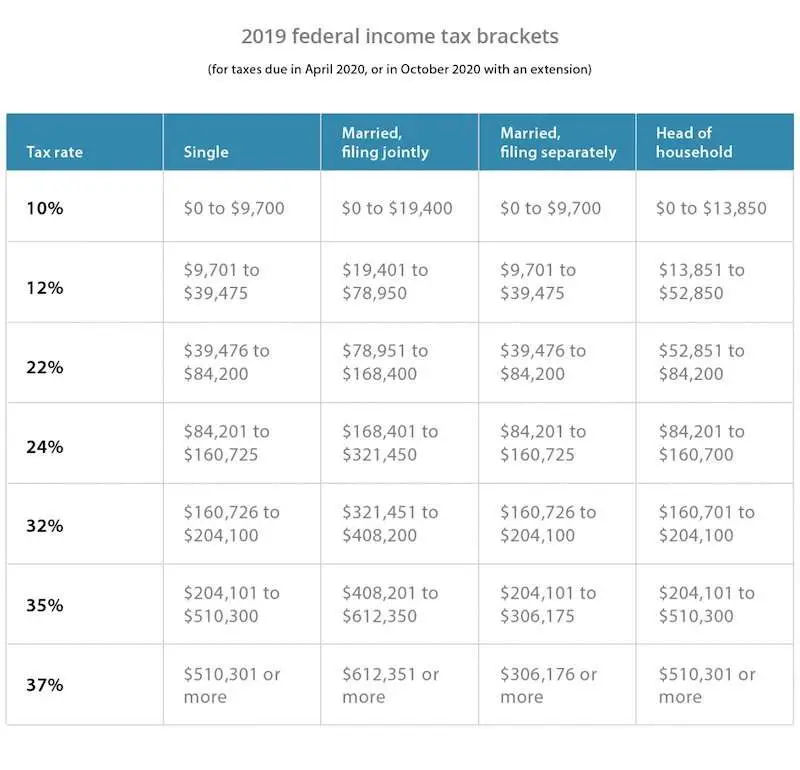

Here is a look at what the brackets and tax rates were for 2019:

2019 Tax Brackets| Tax rate |

|---|

You May Like: Efstatus Taxactcom

Alternative Minimum Tax Rate

Many wealthier individuals are able to take advantage of tax deductions that simply don’t apply to individuals with lower incomes. That means many wealthy people could pay a much lower tax rate as a proportion of their income than less-wealthy people.

For that reason, the IRS uses a special rule called the alternative minimum tax for people who earn above a certain income. The effect of the AMT is to oblige people who claim a lot of personal allowances to pay at least a minimum amount of tax.

In effect, two income calculations are run: one with all your usual deductions applied, and another that removes most deductions from the calculation and applies an exemption — the AMT exemption — instead. If your tax rate under the second calculation is higher, then you have to pay the AMT on the amount of income in excess of the first calculation.

If you’re subject to the AMT, you have to pay it in addition to your regular tax. Because of this, the AMT rate is usually lower than your marginal tax rate at similar levels of income.

How To Determine Your Federal Tax Bracket

This article was co-authored by Cassandra Lenfert, CPA, CFP®. Cassandra Lenfert is a Certified Public Accountant and a Certified Financial Planner in Colorado. She has over 13 years of tax, accounting, and personal finance experience. She received her BA in Accounting from the University of Southern Indiana in 2006.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status. This article has been viewed 115,105 times.

Taxpayers in the United States pay federal income tax according to how much taxable money they make each year. The tax bracket, listed in a tax table or tax schedule, tells you approximately how much tax you will pay. It is important to note that your tax bracket is not the percentage of your income that you will pay in taxes. The actual amount you will pay in taxes is found through a formula when you complete your annual tax filing. However, by finding your taxable income and tax bracket, you will be able to ballpark your taxes and properly evaluate certain financial decisions.

Don’t Miss: Where Can I File An Amended Tax Return For Free

Other Changes: Higher Fsa Limit 401 Totals

The IRS said some other limits are also going higher for the next tax year.

Employees will be able to sock away up to $2,850 in their flexible spending accounts for health expenses, or an increase of $100 from the 2021 maximum. But because the IRS announced the expanded amount on November 10, some companies may have already closed their open-enrollment periods for 2022 employee benefits, which means some workers may not have been able to tap into the higher limit.

The maximum Earned Income Tax Credit will also get a boost next year, rising to $6,935 for qualifying taxpayers with at least three children, an increase of more than $200 from the current tax year.

The changes come after the IRS earlier this month said workers can stash an extra $1,000 in their 401s. Next year, the contribution limit for 401s, 403s and most 457 plans will increase to $20,500 from $19,500 in 2021.

However, the amount that people can contribute to IRAs is remaining the same next year, at $6,000. The tax agency also said that the catch-up contribution for people over 50 years old is also remaining at $1,000, since it’s not subject to an annual cost-of-living increase.

But more higher-income earners may be able to contribute to a Roth IRA in 2022, since the IRS said the income phase-out range for taxpayers making contributions to a Roth IRA will be higher, ranging from $129,00 to $144,000 for single taxpayers in 2022.

What Are The Federal Tax Brackets For Tax Year 2020

The top tax rate remains 37% for individual single taxpayers with incomes greater than $518,400 . Below are the other brackets:

- 35%, for incomes over $207,350

- 32%, for incomes over $163,300

- 24%, for incomes over $85,525

- 22%, for incomes over $40,125

- 12%, for incomes over $9,875

The lowest rate is 10% for incomes of single individuals with incomes of $9,875 or less .

You May Like: Where Do I File My Illinois Tax Return

For Married People Who Are Filing Separately

Tax rate of:

10% for people earning $0 to $9,950

12% for people earning $9,951 to $40,525

22% for people earning $40,526 to $86,375

24% for people earning $86,376 to $164,925

32% for people earning $164,926 to $209,425

35% for people earning $209,426 to $314,150

37% for people earning $314,151 or more

A Simplified Example Of Brackets

For a simple example of how progressive taxation works, say the government has three , set up like this:

- 10%: $0 to $20,000

- 20%: $20,001 to $50,000

- 30%: $50,001 and above

Now, let’s say your taxable income is $75,000. This would put you in the 30% bracket.

- The first $20,000 of that would be taxed at 10%, or $2,000.

- The next $30,000 would be taxed at 20%, or $6,000.

- The final $25,000 of your income would be taxed at 30%, or $7,500.

- Your total tax would be: $2,000 + $6,000 + $7,500 = $15,500.

In this scenario, even though you’re in the 30% bracket, you would actually pay only about 20.7% of your income in taxes.

You May Like: How To Buy Tax Liens In California

Popular Tax Deductions And Tax Credits For Individuals

There are hundreds of deductions and credits out there. Here’s a drop-down list of some common ones, as well as links to our other content that will help you learn more.

Deduct up to $2,500 from your taxable income if you paid interest on your student loans.

This lets you claim all of the first $2,000 you spent on tuition, books, equipment and school fees but not living expenses or transportation plus 25% of the next $2,000, for a total of $2,500.

You can claim 20% of the first $10,000 you paid toward tuition and fees, for a maximum of $2,000. Like the American Opportunity Tax Credit, the Lifetime Learning Credit doesnt count living expenses or transportation as eligible expenses. You can claim books or supplies needed for coursework.

Generally, its up to 35% of up to $3,000 of day care and similar costs for a child under 13, a spouse or parent unable to care for themselves, or another dependent so you can work and up to $6,000 of expenses for two or more dependents. In 2021, it’s up to 50% of $8,000 of expenses for one dependent or $16,000 for two or more dependents.

This could get you up to $2,000 per child and $500 for a non-child dependent in 2020 and up to $3,600 per child in 2021.

For the 2020 tax year, this item covers up to $14,300 in adoption costs per child. In 2021, it’s $14,440.

In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income for the tax year.

Understanding Canadas Personal Income Tax Brackets

Tax rates apply to personal income earned between predetermined minimum and maximum amounts, also referred to as tax brackets.

Knowing where your income falls within the tax brackets can help you make decisions about when and how to claim certain deductions and credits. By understanding which tax bracket you are currently in, it can also help you understand changes in your income taxes if, for example, you start a side-gig or have other extra income that pushes you into the next bracket.

When youre preparing your income taxes this year, this could explain why you have taxes owing or your refund amount is different than what it was last year.

It is important to note that these rates apply to taxable income, which is your Total Income from Line 15000 less any deductions you may be entitled to.

Remember, all provinces and territories also have their own tax brackets. When using the tax brackets and your annual earnings to make contribution decisions, make sure to also consider the tax rates for the province where you reside.

Also Check: How To Get A Pin To File Taxes