Die With Appreciated Stock

The standard calculation for capital gains in your retail brokerage account , IRA, or other tax-qualified retirement plan) after commissions and fees is:

capital gains = sale proceeds cost basis

Should you sell the stock during your lifetime, the net proceeds in this equation are your capital gains . Should you gift the stock, the cost basis carries over to the new owner.

Yet when you die before selling or gifting, this cost basis in most situations is stepped up to the fair market value on the date of death. The stock escapes the capital gains tax on the price increase during your lifetime, regardless of the size of your estate. Thus, no taxable gain is recognized when the inherited shares get sold at no higher than the death-date price.

All the 2020 Democratic presidential candidates seem to be calling for the elimination of this provision. This tax rule, which was not changed when the estate tax income exemption amount increased, is viewed as a tax loophole for super-wealthy people who create sophisticated trusts and estate-planning strategies. However, this tax treatment at death to step up the basis is available for everyone and does eliminate the taxes your heirs and beneficiaries pay.

How To Reduce Your Capital Gains Tax

Though the inclusion rate for the capital gains tax is the same for everyone, there are some ways to lower the amount of tax you pay on your capital gains.

- Choose the right time to sell investments.

- Defer the capital gain if you do not expect to receive the money from the sale right away.

- Donate assets to a registered charity or private foundation.

- Those who own a small business, farm, or fishing property can use the Lifetime Capital Gains Exemption .

What Is The Capital Gains Tax On Property Sales

Again, if you make a profit on the sale of any asset, its considered a capital gain. With real estate, however, you may be able to avoid some of the tax hit, because of special tax rules.

For profits on your main home to be considered long-term capital gains, the IRS says you have to own the home AND live in it for two of the five years leading up to the sale. In this case, you can exempt up to $250,000 in profits from capital gains taxes if you sold the house as an individual, or up to $500,000 in profits if you sold it as a married couple filing jointly.

If youre just flipping a home for a profit, however, you could be subjected to a steep short-term capital gains tax if you buy and sell a house within a year or less.

Also Check: How Can I Make Payments For My Taxes

Make A Donation With Appreciated Stocks

If you plan to make a donation to a charitable organization, dont make it with cash if you have stocks that have appreciated.

Ive made that mistake early on. I wrote donation checks out of my bank account instead of the smarter, tax-advantage way of making a stock donation.

You are able to take a tax deduction on the market value of the stocks donated.

If you donate 100 shares with a market value of $10,000, you can deduct $10,000 from your taxable income.

This is very powerful for me. I have stocks which have gone up over 10 times in 20 years.

Take Apple for instance. I acquired Apple at about $30 a share a decade ago. The stock price has gone up to over $300 today.

If I decide to sell 100 shares of Apple, my proceeds at $300/share come out to $30,000. It would be great if I can pocket the entire $30,000.

But there is this little organization called the Internal Revenue Service which wants its cut.

Since the gain is $27,000 I have to pay about $9,400 in long term capital gains tax .

My net proceeds after taxes are $20,600 .

If I then donate the $20,600 in cash to charity, I can deduct $20,600 from my income. At a marginal tax rate of 50%, I save $10,300 in taxes.

Now, by donating the 100 shares of Apple directly to the charitable organization, I can deduct $30,000 from my income. At a marginal tax rate of 50%, I save $15,000 in taxes.

You can set up a donor-advised fund with a brokerage company to start your donation of appreciated stocks.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

The offers that appear on this site are from companies from which MoneyCrashers.com receives compensation. This compensation may impact how and where products appear on this site . MoneyCrashers.com does not include all companies or offers available in the marketplace.

Besides sales tax, excise tax, property tax, income tax, and payroll taxes, individuals who buy and sell personal and investment assets must also contend with the capital gains tax system. If you sell assets like vehicles, stocks, bonds, collectibles, jewelry, precious metals, or real estate at a gain, youll likely pay a capital gains tax on some of the proceeds.

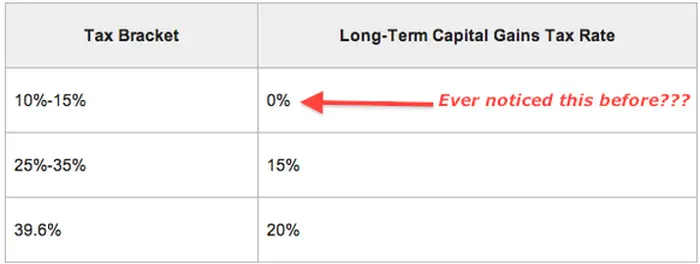

Capital gains rates can be as high as 37%, and as low as 0%. Therefore, its worth exploring strategies to keep these taxes at a minimum.

Also Check: Www Aztaxes Net

How Can I Reduce Capital Gains Tax

You can minimise the CGT you pay by:

Work Your Tax Bracket

While long-term capital gains are taxed at a lower rate, realizing these capital gains can push you into a higher overall tax bracket as the capital gains will count as a part of your AGI. If you are close to the upper end of your regular income tax bracket, it might behoove you to defer selling stocks until a later time or to consider bunching some deductions into the current year. This would keep those earnings from being taxed at a higher rate.

Also Check: How To Get Tax Preparer License

Apply Rule #1 Value Investing Strategy

Now, the above only applies if you have actually done the work and researched the companies you are investing in to ensure they are indeed wonderful.

You can feel confident in buying and holding your investments for the long-term when you know the value of the company. This means checking off all of the 4Ms before you hit buy.

Anytime you consider selling your ownership in the company, revisit the 4Ms to see if the stock price is still below the value, or if it is overvalued.

There are some instances where it will make sense to sell . For one, if the stock price jumps above what you think the companys intrinsic value is, its time to sell.

Second, if the companys story changed for the worse such as they hired a terrible new CEO or they were bought by a company you know nothing about then it may also be time to sell.

Finally, if you need the money from an extremely profitable investment for a better investment where you can get better returns, you may also want to sell.

The rule in these cases is that you could easily lose more than youd save on capital gains tax by holding onto the company a little longer. Apart from these three instances though, you never want to let a wonderful company go.

Your investment could continue to grow and you dont want to make the mistake of selling a wonderful company for the wrong reason, or just because you got a little greedy.

Do I Pay Taxes On Stocks I Dont Sell

Capital gains taxes only come into play when you sell your shares. Therefore, a good way to save on capital gains taxes is to not sell your shares.

Seriously, if you hold onto your shares until your death, you may be able to give your inheritors a tax break, too. This happens with a vehicle called a cost basis step-up.

The cost basis of any investment is how much the investor paid to obtain it. After you die, the cost basis is adjusted to the investments value at the time of your death.

This can wipe out most or all of the capital gains taxes that investment would have incurred if youd sold it. When your heirs choose to sell these shares, theyll save money lots of money if its a highly valuable stock. Its a great gift to give, especially from someone whos dead.

Also Check: Where’s My Tax Refund Ga

Do You Pay Capital Gains On Tfsa

Generally, interest, dividends, or capital gains earned on investments in a TFSA are not taxable, both when theyre in the account or when theyre withdrawn. But if you exceed your contribution room for the year, then youll have to pay tax on the excess TFSA amount.

Tax Capital Gains At Death

A somewhat more aggressive reform would be to tax capital gains at death. Under this regime, death would be treated as if the holder sold the asset. The decedent would owe capital gains tax on unrealized capital gains accrued during his or her lifetime. The heir would then inherit the asset at its current value through basis step-up.

For example, if an investor with an asset basis of $100 were to die when the assets marketable value was $300, his estate would pay capital gains tax on the $200 gain. The heir to this asset would have the basis stepped up to $300 the value of the asset at the time of inheritance.

Relative to basis carryover, taxing unrealized gains raises more revenue, reduces sheltering opportunities, and reduces the lock-in effect. Lily Batchelder and David Kamin , using JCT projections , estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would bring in $290 billion between 2021 and 2030.

Read Also: Mcl 206.707

How Much Will I Be Taxed On My Shares

Dividends from shares held in a stocks and shares ISA or pension are tax-free. The tax rate you pay on dividends that exceed the allowance depends on your income tax band, which you can work out by adding your total dividend income to your other income: Basic rate taxpayers pay 7.5% Higher rate taxpayers pay 32.5%

Capital Gains Rates For 2021

Long-term capital gains tax rates are based on adjusted gross income . The basic capital gains rates are 0%, 15%, and 20%, depending on your taxable income. The income thresholds for the capital gains tax rates are adjusted each year for inflation.

| Capital Gains | |

| Over $473,750 | Over $501,600 |

Capital gains on a primary dwelling are taxed differently from other real estate, due to a special exclusion. The first $250,000 of your gain on the home sale is excluded from your income for that year, as long as you owned and lived in the home for two years or more out of the last five years. For , the exclusion is $500,000.

You May Like: Do You Have To Pay Taxes On Plasma Donations

Alternative : Constructive Realization

In his budget proposal to Congress, President Joe Biden proposed replacing stepped-up basis with constructive realization. Under that system, wealthy households would pay capital gains taxes when they gift or bequeath assets to their heirs. The gains would be realized for tax purposes as though a sale to a third party had occurredhence the term constructive realization.

The Biden proposal is limited in two key ways that protect ordinary Americans and owners of family farms and businesses. First, under the presidents plan, couples can still use the stepped-up basis provision for up to $2 million of gains . This means that, in effect, only a small number of families with substantial untaxed gains would be affected by the Biden proposal.

Second, the Biden plan allows those inheriting family-run farms and businesses to defer any tax on the original owners gains so long as the farms or businesses continue to be owned and operated by members of the family. As tax expert Bob Lord and this pieces author noted in a previous publication, these protections ensure that no one inheriting and operating a family farm or business would be forced to sell it for the purpose of paying new taxes under the Biden plan.

How Could Changing Capital Gains Taxes Raise More Revenue

Over the past 40 years, the distributions of income and wealth have grown increasingly unequal. In addition, there has been growing understanding that the United States faces a long-term fiscal shortfall that must be addressed, at least in part, by raising revenues. For these and other reasons, proposals to raise taxes on wealthy households have received increased attention in recent years. One approach to both reduce inequality and raise revenue is to reform the taxation of capital gains. One prominent proposal would be to tax capital gains as they accrue instead of waiting until an asset is sold, an approach sometimes known as mark-to-market.

Also Check: Amended Tax Return Online Free

Monitor Your Holding Periods

When selling stocks or other assets in your taxable investment accounts, remember to consider potential tax liabilities.

With tax rates on long-term gains likely being more favorable than short-term gains, monitoring how long youve held a position in an asset could be beneficial to lowering your tax bill.

Holding securities for a minimum of a year ensures any profits are treated as long-term gains. On the contrary, the IRS will tax short-term gains as ordinary income. Depending on your tax bracket, any significant profits from short-term gains could bump you to a higher tax rate.

These timing strategies are important considerations, particularly when making large transactions. For the do-it-yourself investor, its never been easier to monitor holding periods. Most brokerage firms have online management tools that provide real-time updates.

How Do We Tax Capital Gains Now

The federal income tax does not tax all capital gains. Rather, gains are taxed in the year an asset is sold, regardless of when the gains accrued. Unrealized, accrued capital gains are generally not considered taxable income. For example, if you bought an asset for $100 ten years ago, and its worth $300 now and you sell it, your taxable capital gain would be $200 in the current year, and zero in the previous years.

This taxation upon realization approach has two advantages: relative ease of valuation and likelihood of investor liquidity. For the purpose of determining the capital gain, and then assessing tax liability, the value of the asset is simply the sale price. After realizing the gain, the selling investor should be able to use the money received for the asset to pay the capital gains tax.

Two other features of current capital gains taxation are noteworthy.

First, the tax rate on realized capital gains is lower than the tax rate on wages, if the asset was held for at least a year before selling. The top marginal tax rate on long-term capital gains is 23.8 percent, compared to a top marginal tax rate of 40.8 percent on wage income.

Read Also: Do You Have To Pay Taxes On Plasma Donations

Carry Over Your Losses

Its possible that your capital losses exceed your capital gains. In this case, you can deduct the difference as a loss on your tax return. However, the IRS places a limit on the number of losses you can deduct each year. As of right now, a married couple filing taxes jointly can deduct up to $3,000 of capital gains losses. But what if you have more than $3,000 worth of capital gains losses one year? If this is the case, the IRS allows you to carry over the excess loss to later years.

Sometimes, planners capture significant losses for certain strategies to work. However, due to the cap, those losses cant all be written off in a single year. Thats where we use the carryover rule to claim losses for several years in a row. Yet, not all losses qualify for multi-year carryover deductions. This is another area where youll need to have a conversation with your tax and financial advisers to determine exactly which strategy is right for your individual situation.

Financial strategies to minimize your taxes can get complicated very quickly. If youre truly trying to maximize your net worth, its not always as easy as getting a booklet that tells you what to do and then filling out the booklet. Some financial planners want you to believe that. Theres a difference between working with a Wall Street broker who just wants to sell you an asset to gain a commission and working with a registered investment adviser who has a fiduciary responsibility to act in your best interest.

Exclusion For Sale Of Primary Residence

Special rules apply to the capital gains when you sell your primary residence. If you meet the ownership and use tests, you can exclude up to $250,000 if you are unmarried, or $500,000 if you are married and filing a joint return. The tests mentioned are met if you own and use your house as your primary residence for two out of the five years immediately preceding the date of sale.

You can meet the ownership and use tests for different two-year periods, but both tests must be met within the five years immediately preceding the date of sale. This exclusion of capital gains is sometimes referred to as a Section 121 exclusion.

Don’t Miss: Is Plasma Donation Taxable Income