Should I Be Making Quarterly Tax Payments To The Irs

If you expect to owe more than $1,000 on taxes, then you should be making quarterly estimated tax payments. This basically means you need to pay a portion of your expected tax bill four times per year, instead of all at the end of the tax year.

Feel free to use our free quarterly tax calculator to calculate exactly how much you should be paying . You’ll also find detailed instructions for how to pay quarterly taxes on the same page.

Earned Income Tax Credit

As a self-employed worker, you may qualify for the earned income tax credit if you have a low to moderate income. The credit increases based on the number of children you claim. For example, if youre single and claim three qualified children, your adjusted gross income has to be $50,949 or lower.

Heres the maximum credit amounts for 2020:

- $6,600 if you claim three qualified children

- $5,290 if you claim two qualified children

- $3,584 if you claim one qualified child

- $538 if you dont claim any child

The IRS has certain rules for a child to qualify.

To qualify for this credit, be sure to see whether you can use one of the optional methods mentioned above. By doing so, you can potentially reduce your adjusted gross income, making it easier to qualify.

Consequences Of Not Making Or Being Late On Employment Tax Payments

If employers fail to remit payroll tax payments or send them in late, it could have the following impact:

- Employers may face criminal and civil sanctions

- Employees may lose access to future Social Security or Medicare benefits

- Employees may lose access to future unemployment benefits

If youre late making deposits for FICA or federal income taxes, youll be charged penalties.

Also Check: How Much H And R Block Charge For Taxes

Tax Deductions And Lowering Your Self

Using a self employment expense tracker and finding tax deductions are critical to reducing your tax bill. From car expenses, to home office and software — there’s a good chance you can knock a few thousand bucks off your tax bill if you’re smart about claiming write-offs.

Check out our self-employment tax deductions explorer for a complete list of all the different kinds of write-offs you might be eligible for, based on the type of work you do.

Note: The calculation above doesn’t take tax deductions into account – if you want to see your tax bill after deductions, just subtract your annual business expenses from your 1099 income input field.

How To Determine Your Tax Rate

To determine your tax rate you will need to calculate your taxable income and determine the best way to file. To determine taxable income, calculating your gross income for the year and subtract any above-the-line deductions. An example of an above the line deduction would be contributions you make to your IRA. The IRS allows you to deduct up to the maximum contribution limit. Currently, the limit is $6,000. From here you can take your deductions, either standard or itemized. The result, after adjustments and deductions, is your net income, or your taxable income.

Read Also: Where Is My State Refund Ga

States That Have A State Income Tax

Not all states have a state income tax. However, in states that do, the employee must be asked what amount to withhold from the paycheck. That amount is to be withheld by the employer and paid to the state. The income tax rate varies by state and also varies by person based on factors such as their marital status and the number of exemptions they claim.

Employees provide this information on the equivalent of a federal W-4 form, which may be called by a different name in each state. For example, South Dakota has no state income taxes, while North Dakota does and uses the Federal W-4 to track withholdings. New Jersey also has state tax withholdings and tracks them on a Form NJ-W4.

Family Caregivers And Self

Special rules apply to workers who perform in-home services for elderly or disabled individuals . Caregivers are typically employees of the individuals for whom they provide services because they work in the homes of the elderly or disabled individuals and these individuals have the right to tell the caregivers what needs to be done. See the Family Caregivers and Self-Employment Tax page and Publication 926 for more details.

Don’t Miss: How Does H& r Block Charge

Differences Between Paying Llc Taxes And Paying S Corporation Taxes

If you’re not taxed as an S corporation and you’re taxed as an LLC instead, you’ll have to pay employment tax on your full salary.

In the event that you’re taxed as an S corporation, there are two ways to remove money from the business:

The differences between these two are considerable. If you have a standard LLC and you remove $70,000 from the business, your employment taxes will total $10,710. In comparison, if your salary was $45,000 and you paid $25,000 in distributions, your employment taxes would amount to $6,885.

Estimating Your Income Tax

When you’re an employee, your employer withholds money for federal taxes out of your paychecks and sends the money to the IRS, so that by the end of the year, your anticipated tax bill should already be substantially paid. If you’re self-employed, however, this is another task you have to take care of yourself.

Rather than paying weekly, you must make four estimated tax payments during the year. Because you’re doing this while the tax year is in progress, all you can do is provide your best estimate based on the income you earn and recent tax rates.

Also Check: How Much Does H& r Block Charge To Do Taxes

What Should You Do If Your Self

The first thing you should know is that no matter if you are able to pay your taxes you should always, still file on time. Anytime you are unable to pay your taxes or even unable to pay in full, The Internal Revenue Service does have several avenues which are helpful to the taxpayer. You can do a few things:

- Request an extension of up to days to pay in full by applying with the online payment agreement or by calling 800-829-1040

- If you just simply need more time to pay you can request an installment agreement.

- Lastly, you may also qualify for an offer in compromise, which means the IRS may settle for a lesser amount than what you actually owe.

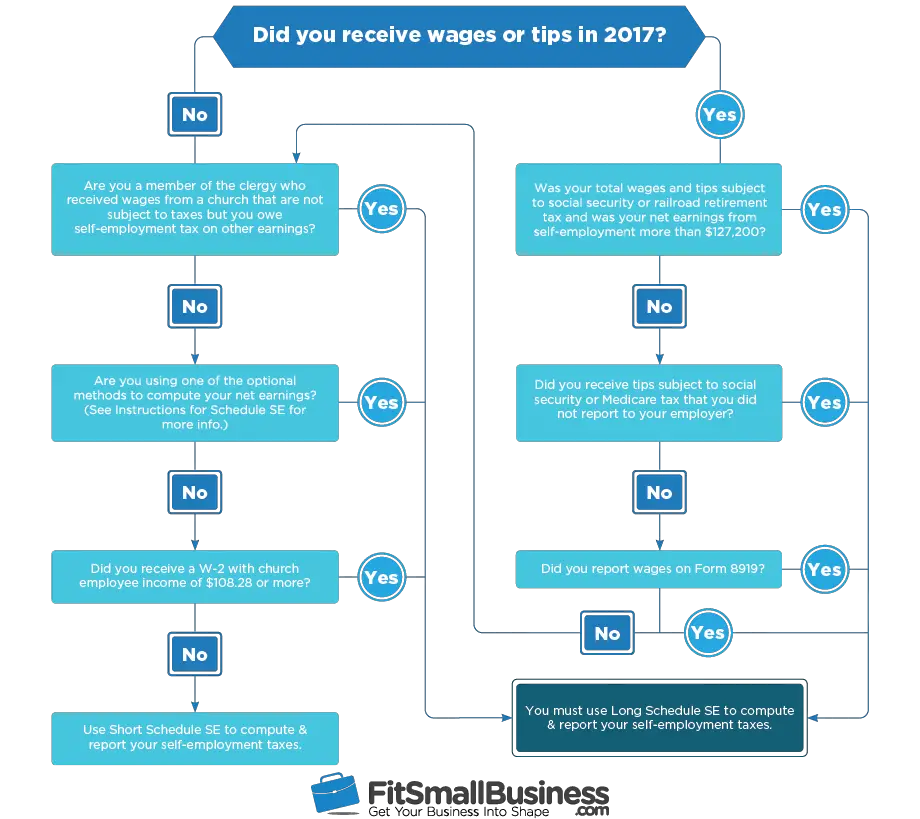

Now, for those of you who just wanted to know how to calculate your estimated self-employment tax, you can certainly do so by following the guidelines and instructions on the Long Schedule SE form or you can follow the steps below:

To summarize in short:

Remember that the rules of self-employment tax can be involved and sometimes difficult to understand. Do not let the fear of owing or paying taxes yearly or quarterly scare you away from working for yourself. If you are newly self-employed and you are not sure, be sure to keep detailed records and please consult with a CPA for advice. If you plan properly and have financial discipline, paying taxes should be easy and less painful for you.

What Are The Limits On Self

There is currently no maximum limit for the Medicare portion, which totals . The IRS self-employment limits for the Social Security portion for 2020 is $137,700, which is subject to of the self-employment tax. High income individuals may be assessed an additional Medicare tax equal to 0.9% of any income above the threashold amount.

| Filing Status |

|---|

Also Check: What Does Agi Mean In Taxes

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How Much Do I Owe In Self Employment Tax To The Government

Texas self employment tax is calculated based on your earnings. A base amount is established each year, against which the 12.4% of Social Security is applied. In 2020, the base amount will be the first $137,000 of your earnings. The second payment towards Medicare is 2.9% applied against all your combined net earnings. Then there may be variations if you have a married couples business, or your spouse is an employee.

Also Check: Do You Have To Report Roth Ira On Taxes

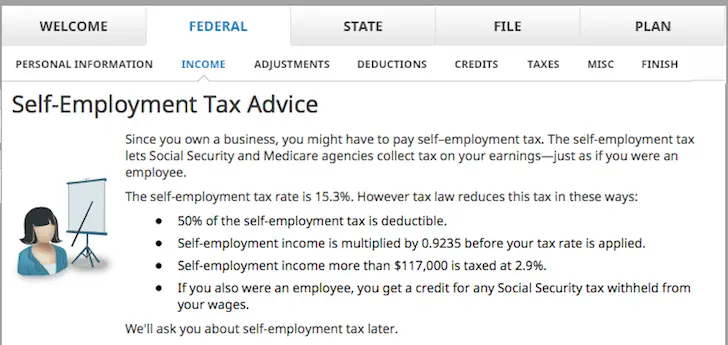

Paying Taxes On Your Self

The biggest reason why filing a 1099-MISC can catch people off guard is because of the 15.3% self-employment tax. The 1099 tax rate consists of two parts: 12.4% for social security tax and 2.9% for Medicare. The self-employment tax applies evenly to everyone, regardless of your income bracket. For W-2 employees, most of this is covered by your employer, but not for the self-employed!

Don’t feel so intimidated by your tax liability after using our free 1099 taxes calculator. In the next section, we’ll show you how you can reduce your tax bill with deductible expenses.

How To Pay Federal And State Payroll Taxes

Its best to set aside money for employment taxes each pay period, even if youre only required to send payment monthly. You should definitely need to withhold money from your employees paychecks each period.

You will either need to deposit payroll taxes on a monthly or semi-weekly basis. If you owed $50,000 or less in taxes for the prior year, you can pay monthly anything more than that puts you on a semi-weekly pay schedule. If youre a new employer, youre automatically placed on a monthly deposit schedule. For employers with very little payroll tax obligation , deposits can be made quarterly with the 941 tax return.

Also Check: How Much Time To File Taxes

How Do I Make My Quarterly Payments

Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. You will need your prior years annual tax return in order to fill out Form 1040-ES.

Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax.

Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System . If this is your first year being self-employed, you will need to estimate the amount of income you expect to earn for the year. If you estimated your earnings too high, simply complete another Form 1040-ES worksheet to refigure your estimated tax for the next quarter. If you estimated your earnings too low, again complete another Form 1040-ES worksheet to recalculate your estimated taxes for the next quarter.

See the Estimated Taxes page for more information. The Self-Employment Tax page has more information on Social Security and Medicare taxes.

How To Claim Self Employed Tax Deductions And Credits

When you file your taxes online, you can claim your tax deductions and credits and get tips on how to increase your tax refund. The answers you provide will enable them to see which deductions and credits you qualify for.

You can also speak to an online tax expert when doing your tax returns. Theyll be able to offer you expert advice to ensure that you claim every self-employment tax credit possible and pay the least amount of taxes.

Recommended Reading: Can You File Missouri State Taxes Online

Don’t Pay More Than You Have To

Also, bear in mind that the self-employment tax is charged against net income from your self-employment. If you have deductible expenses that you can take against the revenue you bring in from your business, then they will reduce the amount of income for purposes of calculating the self-employment tax. That makes it all the more valuable to take whatever deductions you’re entitled to use in your self-employment activities.

That said, if you do owe substantial self-employment tax, remember to make estimated tax payments on a quarterly basis. Otherwise, the IRS can hit you with penalties on your annual tax return if you didn’t pay as much as you were supposed to throughout the year.

Self-employment tax can be a big burden, and the tax bill can be larger than you expect. By knowing what the amount is beforehand, you can plan for self-employment tax and avoid any nasty surprises at tax time.

What Is The Deduction For Self Employed Insurance

Self-employed insurance is the general term for the deduction you can make for health insurance when youre self-employed.

The cost of the premiums on medical, dental, and long-term care insurance are all deductible in full. These can be policies that also cover your spouse and any dependents, along with adult children up to the age of 27.

Supplemental Medicare premiums are also deductible. They dont have to be in your name. They can be in the name of the business.

Recommended Reading: How To Buy Tax Lien Certificates In California

Contact Skilled Social Security Disability Lawyers

For your convenience, we answer our phones 24 hours a day, 7 days a week. Evening and weekend meetings can be arranged upon request. To set up a free initial consultation, email us or call us at . Se habla Español.

At Bailey & Galyen, we provide comprehensive legal counsel to individuals across Texas including Arlington, Bedford, Burleson, Carrollton, Dallas, Fort Worth, Grapevine, Houston, Mansfield, Mesquite, Midland/Odessa, Plano, Texarkana and Weatherford.

Talk To A Lawyer Today

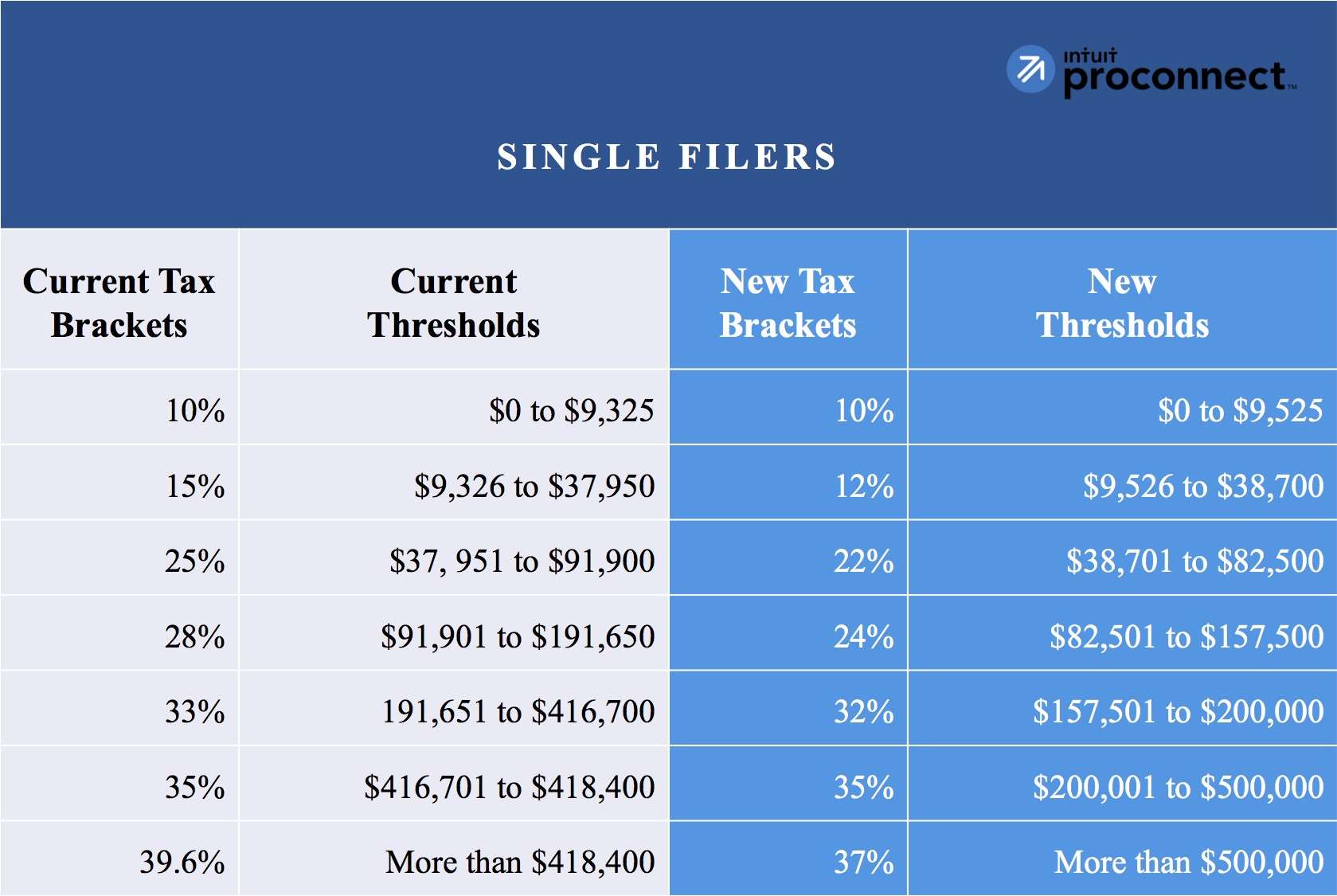

How Do Tax Brackets Work

Tax brackets determine your annual tax rate. Tax brackets vary depending on the taxable income. The tax bracket you are in will depend on your taxable income and filing status you are choosing to file under. You can file as single, married, or head of household. To qualify as head of household you must meet the following criteria:

- Pay for more than half of all household expenses

- Be considered unmarried for the year

- Have at least one qualifying child or dependent

Tax brackets charge higher-income earners higher tax rates than lower-income taxpayers. All tax brackets are graduated, so all earned income isn�t taxed at the same percentage. This means that your income up to the bracket maximum is assessed at that bracketâs tax rate and so on. Income earned over the previous bracketâs threshold is taxed at the next bracketâs rate. That is why someone who makes above half a million dollars is paying so much on every additional dollar earned.

Don’t Miss: How To Look Up Employer Tax Id Number

Taxes On Larger Businesses

The state taxes businesses that do not file the E-Z Computation form at a rate of 0.75% on their taxable margins . It defines this as the lowest of the following three figures: 70% of total revenue, 100% of revenue minus cost of goods sold , or 100% of revenue minus total compensation.

Nearly all business types in the state are subject to the franchise tax. The only exceptions are sole proprietorships and certain types of general partnerships.

Small businesses with gross receipts below $1,180,000 pay zero franchise tax for tax year 2020.

For many businesses, the actual tax rates are much lower than the stated rates. For example, the franchise tax for retail and wholesale companies, regardless of the size of the business, is 0.375%. Businesses that earn less than $20 million in annual revenues and file taxes using the state’s E-Z Computation form pay 0.331% in franchise tax.

However, the E-Z Computation form does not allow a business to deduct COGS or compensation, or to take any economic development or temporary credits.

Where Do Your Self

Given that you, as a self-employed person, do not report to an employer, there is a different break-down of where your taxes are allocated.

While typical employees pay half the Social Security and Medicaid taxes , self-employment taxes take out the full lot altogether – or, 12.4% for Social Security and 2.9% for Medicaid, for a grand total of 15.3% in taxes for self-employed filings.

But, given that the tax burden is a lot heavier on those who are self-employed, what deductions are self-employed filers eligible for?

Also Check: Do I Need W2 To File Taxes

Alternatives To Estimated Tax Payments

If you have a “regular job” in addition to your self-employment, you may be able to increase your federal tax withholding at that job to cover the taxes on your self-employment income. If you can do so, you won’t have to pay estimated taxes. However, if you still owe at least $1,000 even after increasing your withholding, then you must make some estimated tax payments. By year’s end, your estimated payments must equal at least 90 percent of your tax liability for the current year or 100 percent of your tax liability from last year. If it doesnt, you may be subject to an estimated tax penalty.

Dont worry about knowing which tax forms to fill out when you are self-employed, TurboTax Self-Employed will ask you simple questions about you and your business and give you the business deductions you deserve based on your answers. TurboTax Self-Employed uncovers industry-specific deductions. Some you may not even be aware of.

Federal Payroll Tax Rates

At the federal level, in addition to income tax, there are two categories of employment taxes: FUTA and FICA. Well cover each briefly as youll process these as tax deductions on employees paychecks. You must also pay these taxes on your employees behalf, regardless of the state in which you operate.

- Income tax: The tax rate is based on withholdings chosen on the employees W-4 form.

- FUTA: This 6% federal tax is to cover unemployment in most cases, youll be credited back 5.4% of this amount for paying your state taxes on time, resulting in a net tax of 0.6%.

- FICA: This 15.3% federal tax is made up of two parts: 12.4% to cover Social Security and 2.9% to cover Medicare. For employees earning more than $200,000, the Medicare tax rate goes up by an additional 0.9% therefore, FICA can range between 15.3% and 16.2%.

You May Like: Www.1040paytax