Hot Bags + Courier Backpacks

Whether you use your car for the deliveries or you are a Doordash biker, Doordash requires you to use an insulatedbag to keep the customers food nice, neat and fresh.

Remember that Doordash customers can rateyour performance. Do not take the risk to make your customer angry by delivering a cold pizza.

The insulated bag is ordinary and necessary for your job and qualifies as a tax-deductible expense. Take a lookat our guide to Doordash gear.

How Income Tax And Self

The important thing to remember when filing your federal taxes, you’re filing BOTH income tax and self-employment tax at the same time. You will calculate both tax bills. Then, after counting credits and what you paid in, you’ll either pay in or get a refund.

But there’s some important differences to be aware of:

Income tax is based on the total of all of your income. Self-employment tax is only calculated from your business profits.

There are several deductions that will reduce your taxable income for income tax. Those deductions do not apply to self-employment tax. Just like an employee’s FICA taxes, self-employment tax is charged on every dollar.

The income tax rate increases as your income increases. Self-employment tax is the same on every dollar you earn, up to a certain point . At that point the Social Security part is removed but Medicare tax continues to be charged.

Some tax credits are applied only to income tax but will not reduce self-employment tax. Those are called non-refundable tax credits.

Three Important Things To Understand About Your Tax Impact

Here’s the deal: You make more money, you owe more taxes because of that money.

The trick is, how do you know how much difference it makes?

We won’t go into a lot of detail on all of these things. That could make this crazy long

That said, here are three basic things that help you understand how your Doordash earnings will impact your taxes .

You May Like: How To Pay Taxes For Free

What To Do If You Do Not Get A Doordash 1099

If you meet any of these requirements and you didn’t receive a tax form, there are a few reasons why.

- There is an error in the business details on your account

- You made less than $600 from delivery payments. The IRS requires companies to deliver a 1099 tax form if a business paid out a contractor $600 or more. So, Dashers who earned $600 or more within a calendar year will be given a 1099 form

Note that just because you do not get a 1099, you will still need to report your income when filing taxes.

All you need to do is contact DoorDash and file a support case.

Tax Policies And Resources Of 5 Popular Apps

What forms you receive and what tax service you choose to file with depends on the company youre working for. Each company has slightly different tax policies and may offer discounts for different tax-filing software services. Heres how they stack up.

Before you shell out money to file, check to see if your gig app partners with a tax software company. Review the IRSs new resources for gig workers, and dont forget about IRS Free File.

You May Like: How To Correct State Tax Return

The Types Of Doordash 1099 Forms You’ll Receive For Reporting Your Income

When you are a DoorDash independent contractor, you are part of the growing gig economy. There are a few different forms you’ll receive. The first form is the 1099-NEC and the second one is the 1099-K.

These will be used to identify your tax information on all of the other documents that are provided by DoorDash throughout the year in order to file taxes. The IRS requires companies to deliver or mail these forms by January 31. It could take 3-5 days, so you’ll receive a form 1099 within that time frame after February 1st.

There are different requirements for independent contractors to receive each one that we’ll break down in the next section.

S To Create An Invisible Investor Strategy

The greatest mistake that people make when it comes to asset protection for real estate is not understanding the risks that are waiting out there for them. This eBook reveals the structure you should follow to ensure your hard earned money is protected from frivolous lawsuits and costly tax mistakes.

Also Check: How Much Income To File Taxes

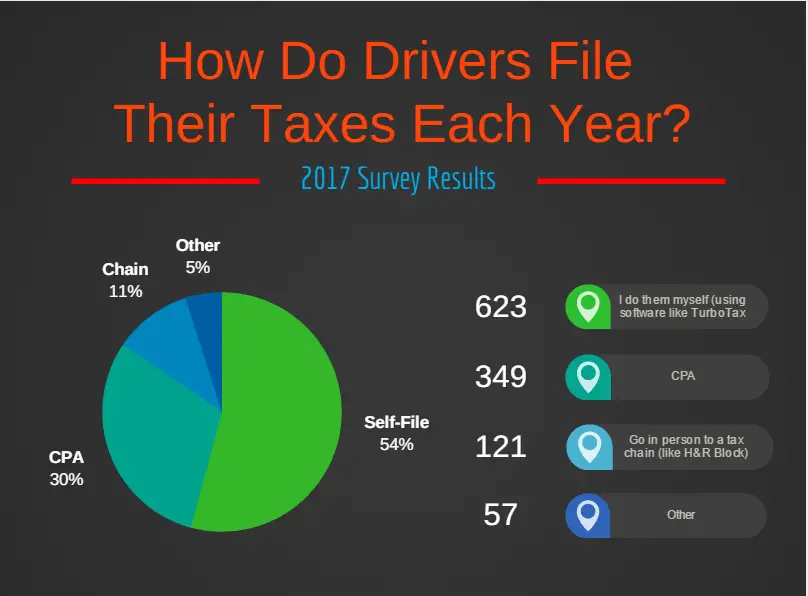

What Tax Tools Are Out There

There are several financial services for filing your taxes. Here are some highly credible ones :

The benefits of these services are:

- They help you understand the tax code a lot better.

- Their software;makes suggestions to help you maximize deductions.

- These companies are established. This is important because you dont want to provide important information to a random tax software and then the company goes out of business. Who knows what theyll end up doing with your private information.

- In some cases, they cost less than having a tax expert help you file your taxes.

Tax Deductions You Can Take Advantage Of On Your Schedule C

A perk of being a Dasher or independent contractor is you can claim tax write-offs to lower your taxable income, and legally avoid paying 1099 taxes. These are expenses related to being a delivery driver or tax deductions.

it is vitally important to keep a clean record of these expenses and to take advantage of what you can. The contractor’s profit or loss is calculated using Schedule C. We’ll walk you through the steps of filing your Form 1040 and Schedule C with the Internal Revenue Service.

Only your net profit as an independent contractor is your taxable income. You can track your expenses by using our free 1099 excel template.

Here is a list of common tax deductions DoorDash drivers can claim on your Schedule C:

- Mileage

- Car maintenance or repair costs

If you need help filling out your Schedule-C, talk to an accountant or tax professional.

Remember, if you use a personal car for dashing, you can only pick one IRS-approved method to report vehicle expenses; the actual expense method or the standard mileage method.

I’ll cover the difference between each one and offer advice on which one you should use.

Don’t Miss: How To Pay Back Taxes Online

Use More Than 1 Delivery App

Try to use other delivery apps, when youâre dashing, such as Uber Eats, Postmates, Grubhub, and Instacart. It will save you from slow shifts, by finding other deliveries you can do.

To make your deliveries more profitable, check these apps for deliveries that resemble the dash youâve accepted. If you happen to find one and take it, it will double your pay, as youâre getting paid from two platforms instead of just one.

But do it only if youâre experienced in the delivery business, because delaying orders too much can impact your ratings.

Where Do I Get My 1099

The 1099 is a tax form you receive from Payable.com if you earn more than $600 in one calendar year. You use this form to report your annual earnings, and its useful that you have it when you go to file your taxes. The 1099 form is meant for the self-employed, but it also can be used to report government payments, interest, dividends, and more.

Your employer has an obligation to send this form to you each year before January 31st. As youre an independent contractor when you work for DoorDash, you get the 1099-MISC form. Via this form, you report all your annual income to the IRS and then pay income tax on the earnings.

Note that you need to report the earnings even if you dont receive the form. In case this happens, it doesnt represent an issue if you still report your income and pay your taxes accordingly. You can do it without the 1099 form, so theres no need to call the employer and remind them to send it. You wont have any trouble with the IRS as long as you file the taxes on time. The only thing you should avoid is waiting for the form and missing your deadline.

To access your 1099-MISC form, you need to accept an invite DoorDash sends you. When you do, you automatically get a Payable account, so you dont have to create one on your own. If you have an account from before, you can see the 1099 form for the current year under DoorDash name.

You May Like: How Much Is Sales Tax In Illinois

What Is Schedule C

As independent contractors, couriers are sole proprietors of their own business and must report their earnings by filling out a Schedule C tax form. This form is used to claim profit or loss from your business expenses as an independent contractor.

Schedule C has six sections :

- Identity section. This is where you describe your business activities. Most important is when filling out this section, on Line B, the six-digit business code for food deliveries businesses is 492000 . If you also drive for Uber and Lyft, the code is 485300 .

- Part I is for Income. This is how much you earned from your delivery gigs . The information youll need to fill this section out is found on the 1099-Misc or 1099-K form, which would be sent to you by the companies you drive for.

- 1099-MISC Explained: If you made more than $400 delivering food, youd receive this form. Postmates would not mail you one if you made less than $600. If you made less than $400, you still have to report the earning. Not receiving this form doesnt mean you dont report that earning.

- 1099-K Explained: This is the form for third-party payment transactions. Youd receive this form if you made more than $20,000 and over 200 transactions for the year. Youre more likely to get this in the mail if you drive for Uber or Lyft.

- Part 2 is for Expenses. This includes all the costs you accumulated during the year as an independent contractor. Below, I answer more questions on what you can report as deductible expenses.

What Deliveries To Avoid And What To Prioritize

Be selective. Driving 8 miles for $3-$4 orders isnât worth your time.

As a rule of thumb, aim for base pay at $2 per mile or more. If it’s a really quick order that you can complete in minutes, $1 per mile is okay but not otherwise.Try to go for orders above $7.

- Go ahead and start your dash 10 minutes before you leave. The first few dashes you’ll get are very likely the ones that have been bounced around and declined by multiple dashers before you.

- Be careful with Walmart grocery deliveries – ALWAYS check how many items youâll deliver. There could be 58 items, 4 cases of water that must be carried to the 5th floor complex with no elevators.

- Be cautious of drive-through fast-food restaurants. Even if youâre running a delivery, youâre going to wait in line with every other customer and waste your time. Unless the base pay or tips make up for it, skip them.

- Watch out for orders that take you far away from hotspots or popular areas. Youâre getting paid when youâre delivering, not on the way back to hotspots. Only do this, if the payout compensates for the time it takes to drive back or leads you to a different hotspot.

- Prioritize popular restaurants. They are most likely to be busy and have a higher chance of giving you multiple dashes.

Also Check: How Much Money Is Taken Out Of Paycheck For Taxes

Paying The Dreaded Ol’ Self

The self-employment tax is your Medicare and Social Security tax which totals 15.30%.

Dashers will not have their income withheld by the company to pay for these taxes, so you’ll need to pay them on your own. If you earn more than $400 as a freelancer, you must pay self-employed taxes.

If earnings were less than $400 in profit, they do not owe self-employment taxes but contractors must still file income taxes.

It is important to go through each form to spot wrong information like how much you earned. After you check your bank information and calculate all the deposits, if it is wrong on the 1099, contact DoorDash immediately.

You can use Bonsai’s free online 1099 tax calculator to see how much you’ll owe in taxes.

But First: A Disclaimer:

I’m not a tax pro.

This is NOT tax advice.

I really, really, really recommend you get someone to help you with your taxes. Find someone who understands self employment. Get a CPA or accountant, someone who does this for a living.

Get a tax professional, not a tax preparer. That’s the only piece of advice I’m offering here.

The rest of this is about education. The purpose here is to explain how it works, not to give you tax advice. If you need specific advice for your taxes, seek out your own advice from a tax professional.

Is this a contradiction? I say it’s not as mysterious. Then I say get a tax pro.

No, I don’t think it is.

Your tax pro knows the details. They know the more complicated parts of it all. But if you understand how it works, you are able to do more yourself. You make it easier. That keeps your costs down.

I mention Doordash a lot when talking about taxes here. That’s simply because Doordash has become so dominant in gig economy delivery. This stuff applies just as much for Instacart, Uber Eats, Grubhub, Postmates. The basics are pretty much the same for Uber and Lyft and other forms of self-employment.

Now that that’s all out of the way, let’s get started.

Recommended Reading: How Is Capital Gains Tax Calculated On Sale Of Property

How Do I Make Filing Taxes Easier In The Future

- Keep track of your mileages. Use an app or manually keep records.

- Keep track of your receipts for the future.

- Keep track of all your cash tips earning.

- If feasible, get another phone plan for business only.

- If feasible, open a business credit card so you can separate your personal and business expenses.

Subtract Deductions And Adjustments

As I noted at the end of Step 1: Your business expenses don’t go here. You don’t need to itemize to claim those business expenses. What we’re talking about here are your personal tax deductions.

For the sake of simplicity, this calculator is going to do three things:

You May Like: How To Appeal Property Taxes Cook County

Recommended By Our Editors

Each tax prep site we reviewed has its own unique blend of assistance. Generally, the more you pay for an application, the better and more skillfully integrated its help is. Even these sites mobile versions manage to pack a lot of support into the small screens in addition to the ability to prepare and file even a complex tax return.

Here are the kinds of help you may encounter, depending on which version youre using. You might notice that some terms and phrases contain hyperlinks that take you to simply worded, clear explanations of the current topic. There could be a question mark or a Learn More link next to a question that does the same thing. Or you might see context-sensitive Q&As or a related statement off to the side that links to more information.

Every tax preparation website has a database of educational income tax content that you can search by keyword, phrase, or IRS form or schedule number. The best applications come back with numerous hits for your queries , with the most relevant at the top. Most of the time, these articles or brief explanations will have been rewritten to be more understandable, while other times youll be reading what the IRS has provided.

Requirements For A 1099

If you receive deposits from a partner platform like PayPal, you may receive a tax form 1099-K.

A Dasher would need to have conducted 200 transactions and have a gross volume of $20,000 to meet the 1099-K requirements.

Gross Volume, which in DoorDash’s case is the subtotal of payments and tax on processed orders.

However, there is one exception to this rule. If you made more than $600 in total earnings from deliveries in Vermont or Massachusetts, you will receive a 1099-K regardless.

Recommended Reading: When Is Sales Tax Due

Don’t Waste Time At Hotspots

You’re not more likely to get a dash, because you’re waiting outside of a busy restaurant. Anyone within a 2-3 miles radius from the place can get picked.

- It’s better to wait in a place, where you are close to multiple restaurants. When any of the restaurants ask for a delivery service, you’re in proximity of all of them and as a result likely to get more orders.

- Find a parking spot at a mall with multiple restaurants or a busy district, so you can reach the restaurant more quickly.

Tracking Miles For Doordash Taxes

The IRS introduced an easy way to deduct vehicle expenses so they wouldn’t have to hoard or track their receipts.

This method is called the Standard Mileage Deduction. It’s really simple to calculate your deduction. All you need to do is track your mileage for taxes. Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate.

In 2020, the rate was 57.5 cents. So, if you drove 5000 miles for DoorDash, your tax deduction would be $2,875.

Read Also: How To Pay My Federal Taxes Online