Making Estimated Tax Payments To The Dor

Taxpayers who expect to earn at least $8,000 in taxable income should set up an estimated payment schedule. Failure to do so will mean that the total tax owed will be due as a balloon payment on April 15, and underpayment penalties may apply. The Department recommends making regular payments based on a Safe Harbor Amount, which is equal to the previous year’s total income multiplied by the current tax rate. For the initial payment, use Form PA-40ESR, which should be sent to: PA Department of Revenue Bureau of Imaging & Document Management P.O. Box 280403

Amending A State Return Without Incurring Penalties

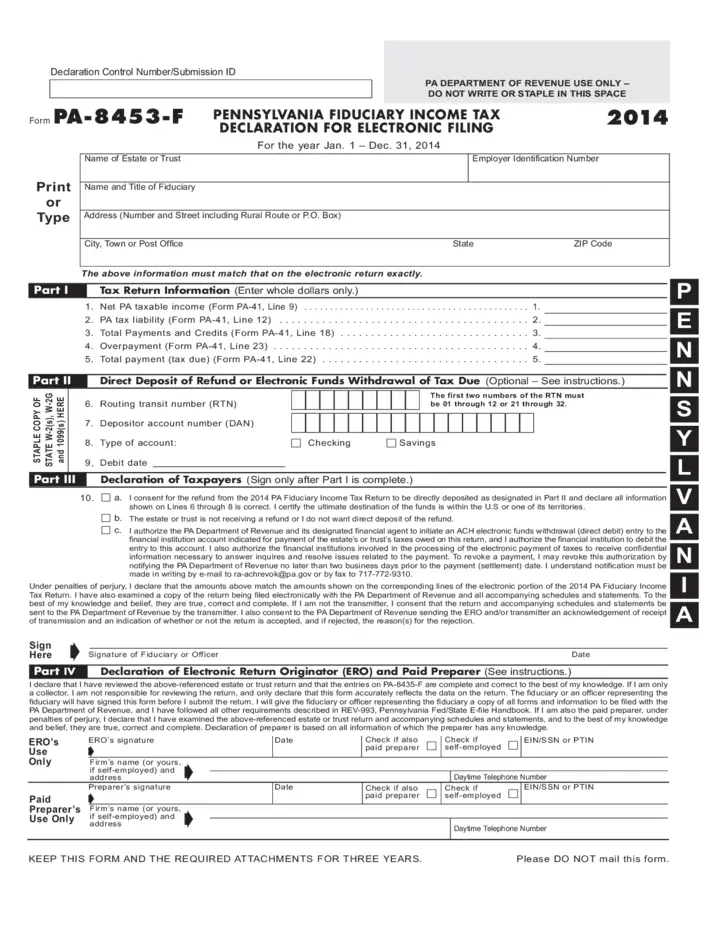

Under or over-reporting income, erroneous deductions or improper tax credits can be corrected by filing an amended return using Form PA-40 and PA-40X. To correct errors on current-year returns without incurring penalties, file amended PA tax returns within 30 days from the original date of filing. For older returns, amendments should be made within two years from the date taxes were paid or three years in all other cases.

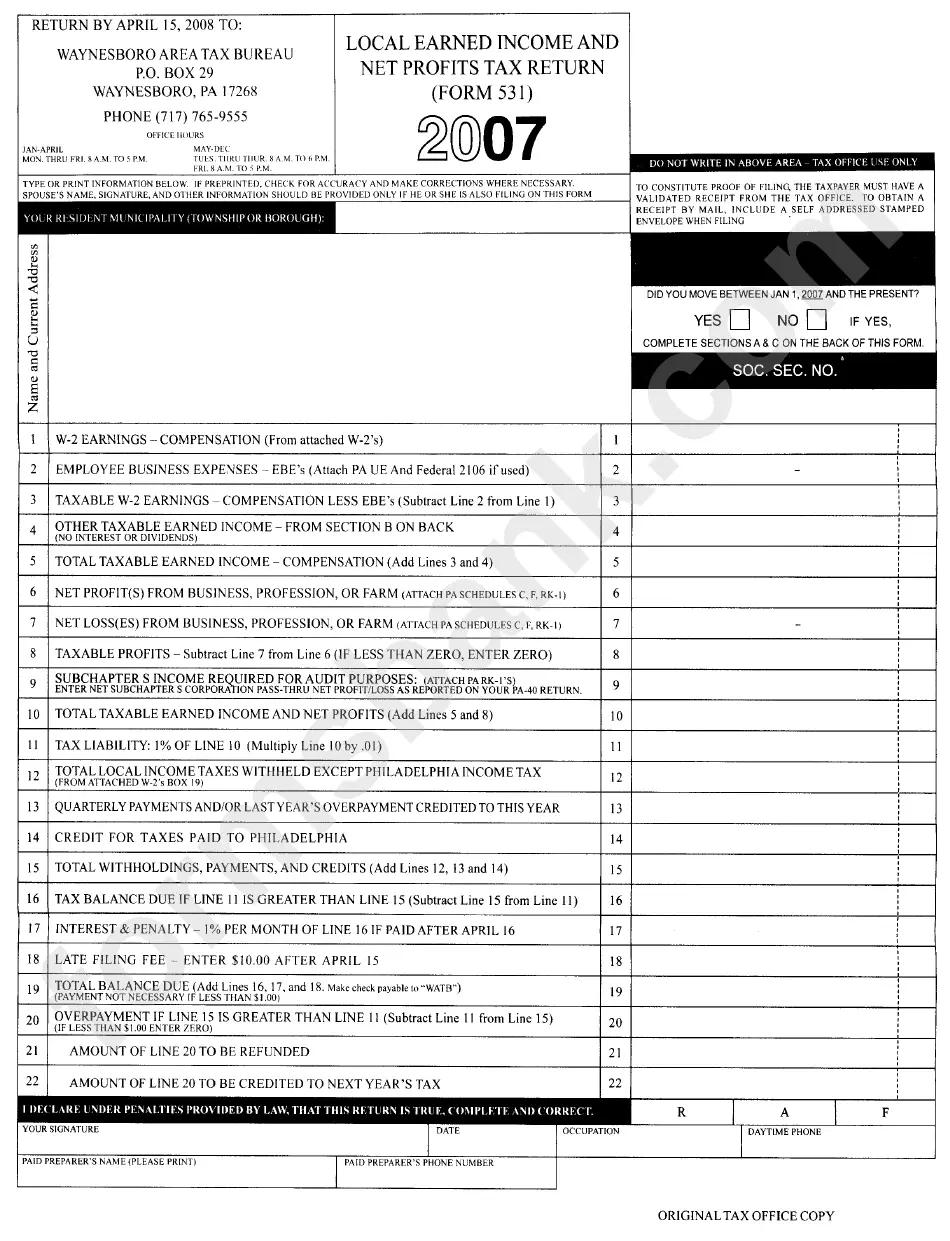

About York Adams Tax Bureau

The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties. All residents of Adams County and all residents of York County file their annual earned income tax returns with YATB. The Bureau also collects Local Services Tax, Delinquent Per Capita Tax and Mercantile/Business Privilege Tax for some of its members.Read More »

Recommended Reading: How Does Taxes Work With Doordash

Basics To Know About Filing State Taxes For Free

Some states allow taxpayers to e-file state returns for free directly through a state website. Others participate in state-level versions of the Free File Alliance.

The Free File Alliance is a group of tax-preparation and tax-filing software vendors and online filing services that has agreed to make free versions of its paid products available to eligible taxpayers. To use Free File software, taxpayers must have an adjusted gross income of $66,000 or less. Additionally, participating vendors may have lower AGI limits or additional limitations based on age, military status or other factors.

Currently, 23 states participate in the Free File Alliance. does not participate in the Free File Alliance. Its always free to prepare and file federal and single-state income tax returns with Credit Karma Tax®, regardless of adjusted gross income. But a free Credit Karma account is necessary in order to use the service.

Ways To File Your State Income Tax Online For Free

It isnt too difficult to find a place to file your federal tax return for free, but finding a service to file your state return for free is another story.

So if you are asking where can I file my state taxes for free? you are in for good news!

I did a little digging and found a few options to consider . . . .

Also Check: 1040paytax.com Safe

How Do You Pay Pa Income Tax

You can pay PA income tax the following ways:

+ Via electronic funds transfer from your bank account or by using a credit or debit card.

+ Via Electronic Funds Transfer : Pay Pennsylvania taxes directly through your personal savings or checking account through the departments e-Services Center.

+ Credit or Debit Card Payments: Visit www.officialpayments.com or call, toll-free, at .

How Do I Choose The Right Tax Preparation Method

If you dont feel comfortable using tax software or just want live support, free in-person or virtual tax preparation is your best option. You may be able to find tax support from your local free tax site or Code for Americas Get Your Refund service.

If you feel comfortable filing your taxes with minimal support, free online filing services like MyFreeTaxes or Free File Alliance may provide what you need.

If you have self-employment income or make more money than the income limits for certain free tax filing programs, you can find a paid tax preparer or paid tax software. For paid tax software, use NerdWallets best tax software chart to compare options and find the best choice for your specific tax situation.

If you prefer in-person paid assistance, make sure to research your options first. Unfortunately, the tax industry is not regulated, so be careful when looking for assistance. Although many paid preparers are honest, some preparers take advantage of their clients by not disclosing their fees or offering refund anticipation products.

Also Check: Dasher Tax Form

Get Daily News Weather Breaking News And Alerts Straight To Your Inbox Sign Up For The Abc27 Newsletters Here

We are encouraging people to file their returns online and as soon as possible. That will help us process returns quickly and deliver refunds to the taxpayers who are expecting one, Revenue Secretary Dan Hassell said. myPATH is a great option for filing your state return, especially if youre looking to save some money this tax season and avoid paying someone else a fee to file your return for you.

Residents who file using myPATH do not have to create a username or password. You will need your social security number and either the tax liability for a previous tax year or their birth date. In addition, you will also need a Pennslyvania drivers license or photo id number and its expiration date.

The deadline for filing taxes is April 18, 2022.

Free Pennsylvania Tax Return

Don’t let filing your Pennsylvania Tax Return get you down. We’ll help make it as easy and painless as possible! File Your Pennsylvania state tax return today and get it done!

Prepare, Print, & e-file for FREE using our convenient, private, and secure servers.Get your free federal tax return.

TaxACT is the pioneer of FREE. Our completely FREE tax return supports Form 1040, 1040A and 1040EZ. Users can prepare, print and electronically file one federal return – again all at no-cost! No restrictions, no gimmicks, no mail-in rebates. File Your Tax Return Today!

Read Also: Efstatus Taxactcom

Do You Have Any Tax Preparation Advice

Should I prepare my own return? Are there other options?Many people find preparing their annual tax return themselves a challenging and rewarding annual process. For others, the prospect of doing this without outside help is daunting.

Filing your taxes does not need to be stressful. There are several computer programs you can purchase or download that explain what to do step-by-step. If you do not have access to a computer, tax forms and publications are available at public libraries, post offices and from the IRS, free of charge.

You can also use tax preparation services or consult with financial experts, like certified public accountants or tax attorneys, when filing your return. Reputable tax professionals can assist with complex returns, and their expertise often provides peace of mind to consumers with concerns about their taxes.

If you choose to use a tax preparation service, always ask for a breakdown of the various fees upfront before the return is prepared. The fees may include a charge for preparing the return, for electronic filing and, for automatic deposit of refunds in your bank account. Services like electronic filing and direct deposit are not required, but may be worth the extra cost to you, because they speed up the process.

What else should I remember at tax time?Remember to safeguard any paperwork that includes personal and financial information like your tax returns and forms to protect you from identity theft.

Money Advisories

Cell Phone & Electronic Device Policy

Effective April 24, 2017, the Board of Directors enacted a policy prohibiting the use of cell phones or other electronic recording devices by visitors in the lobby of either of the Tax Bureau offices. The purpose of this policy is to protect confidential taxpayer information which may be discussed or open to view in the office. Telephone calls and cell phone usage must be continued outside.

Don’t Miss: Find Employers Ein

Get Your Taxes Done For Free

Youve got taxes to file. But do-it-yourself software can be confusing and some paid tax preparation services cost money you might not be able to spend. AARP Foundation Tax-Aide can help.Beginning February 1 and continuing through April 15, AARP Foundation is providing in-person tax assistance and preparation through its Tax-Aide program and its completely free.Last year, AARP Foundation Tax-Aide volunteers helped more than 108,360 Pennsylvania residents claim $76,415 in federal refunds and $5.4 million in earned income tax credits. The program is offered at approximately 283sites in Pennsylvania, including senior centers, libraries and other convenient locations.AARP Foundation Tax-Aide is the nations largest volunteer-run free tax preparation service, said AARP Pennsylvania State Director Bill Johnston-Walsh. Our volunteers are trained and IRS-certified every year to ensure they understand the latest changes to the U.S. Tax Code.Taxpayers who used AARP Foundation Tax-Aide in 2019 received $1.6 billion in income tax refunds and more than $200 million in Earned Income Tax Credits . They also avoided any tax preparation fees and pitches for high-interest tax credit or refund loans. The program is offered in conjunction with the IRS, and AARP membership is not required.To find an AARP Foundation Tax-Aide site or more information, including which documents to bring to the tax site, visit or call 1-888-AARPNOW .

Pa Residents Encouraged To Use Mypath To File 2021 Taxes

HARRISBURG, Pa The Pennsylvania Department of Revenue is encouraging taxpayers to use the free online option to file.

Taxpayers can visit mypath.pa.gov to file their Pennslyvania tax returns. This free and user-friendly service helps the majority of taxpayers file their Personal Income Tax Return , make income tax payments, and access other services.

You May Like: Doing Taxes For Doordash

How To File Your Federal Tax Return For Free

In the past, I have gone to the IRS free file webpage, because they have links to a bunch of tax preparers that offer free tax return filing . Some of them offer a state return to be filed for free as well, but most dont.

If you are interested in this option, you will have to use the links on the IRS page in order to get the free efile deal they are offering. Many of the tax preparation websites listed will not offer you the free efile if you go directly to their website.

Other Free State Income Tax Filing Websites

3. MyFreeTaxes.com This is a not-for-profit with funding from the Walmart Foundation, The United Way and H& R block and they offer free state and federal tax returns if you meet the criteria.

4. On-Line Taxes This one is pretty simple. You have to have an adjusted gross income within a certain range. If you dont qualify both returns cost $7.95. They are a little bit different than many of the other places in that they offer free customer service with a toll-free number, e-mail, and live tax help. They also allow you to view the forms before paying.

Recommended Reading: How Do Taxes Work With Doordash

Pennsylvania Introduces Online Portal To File State Tax Returns

HARRISBURG – Pennsylvania now has a new way to file state tax returns.

The new online portal called “myPath” is free and allows Pennsylvanians to file their state income tax returns and make payments.

As of last week – the IRS announced that they will not begin accepting and processing returns until February 12.

However, those looking to get a jump start can file online.

The deadline to file this year is April 15, unless granted an extension.

The myPath system is active and you can take a look by following this link.

- In:

Vita Volunteer Income Tax Assistance

VITA provides free tax filing for households with incomes of $57,000 or less. Trained volunteers assist you to file your federal and state taxes and claim the benefits you qualify for, like a credit for having a child, donating to charity, and the Earned Income Tax Credit. If you dont qualify for VITA, another free filing option is MyFreeTaxes.com.Contact your local VITA site to find out if you qualify and make an appointment. If your local site is no longer accepting appointments, read on to learn more about MyFreeTaxes.com. Visit PA 211s listings for VITA sites across PA just enter your zip code to find a location near you. Follow the instructions to get in contact with your local site!

Read Also: Highest Paying Plasma Donation Center Near Me

How To File Your Pennsylvania State Tax

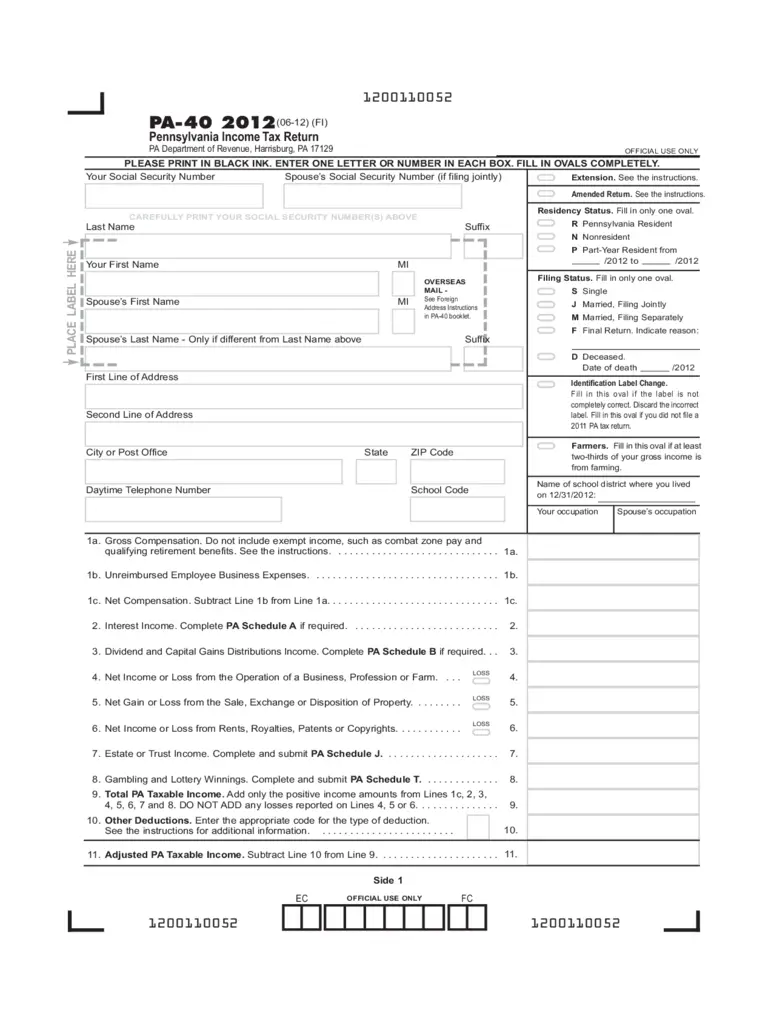

You have a few options for filing your state income tax returns.

First, you can go the old-school route by filling out a paper copy of Form PA-40, which you can download from the Department of Revenues website or request by calling 1-800-362-2050. If sending a payment, mail the payment, tax forms and any supporting documents by the deadline to this address: PA Department of Revenue, Payment Enclosed,1 Revenue Place, Harrisburg, PA 17129-0001

If you want to request a refund or dont have a payment or refund, youll need to mail your documents to other addresses.

Second, qualifying taxpayers can use the following free services:

- , a software provider certified by the Pennsylvania Department of Revenue, can help you calculate and file both your single-state and federal taxes for free.

- PA Free File allows qualifying taxpayers to file both federal and state taxes in one place.

- Padirectfile allows you to file just your state tax return if youve already taken care of your federal tax return.

The department has a robust database of FAQs for general or specific questions and an Office of Taxpayers Rights Advocate to resolve any lingering concerns.

Retired And Senior Volunteer Program Needs Volunteer Tax Preparers

VITA volunteers receive tax training from the IRS and experienced volunteers to complete income tax returns using approved software for electronic filing. Additionally, online training and testing is available. All volunteers must pass a test and be certified by the IRS prior to assisting clients. VITA assistance is limited to individuals and families with low to moderate income . Individuals with farms, rental properties and deductible moving expenses are not eligible for assistance. Additionally, volunteers receive training to use the software to assist clients with their PA State Returns, local returns and PA Property Tax/Rent Rebates.

Training is available throughout the year, with the majority of the training conducted during November and January. Each volunteer is asked to donate a minimum of 4 to 5 hours per week in the Bellefonte and/or State College area during the tax season, February through April. This commitment is required for the volunteer to achieve the level of knowledge/proficiency necessary for tax preparation. On average, after achieving proficiency, a return should take approximately 1 hour to complete. Each volunteer should anticipate completing 50 or more returns during the tax season.

Centre County RSVP provides tax assistance throughout the county. Call the RSVP Office at 355-6816) for more information and to volunteer.

Don’t Miss: Doordash Taxes How Much

If I Dont Owe State Taxes In Pa Do I Have To File

According to PA Department of Revenue, you need to file a PA return if you meet any of the following requirements:

If you are a PA resident, nonresident or a part-year PA resident, you must file a PA tax return if:

- You received total PA gross taxable income in excess of $33, even if no tax is due with your PA return and/or

- You incurred a loss from any transaction as an individual, sole proprietor, partner in a partnership or PA S corporation shareholder.

PA law does not exempt a minor from the above requirements to file a PA tax return even if claimed as a dependent on a federal return.The executor, administrator, or other person responsible for the affairs of a decedent must file a PA tax return if the decedent met the above requirements.Pennsylvania taxes eight classes of income:

compensation

Yes You Can File Your Pennsylvania Income Taxes Online For Free Heres How

Tax Day is only a week away, and Pennsylvanians have options for preparing both state and federal taxes for free online.

This years deadline for filing personal income taxes is Monday, April 18. The date was extended from the usual April 15 because Washington, D.C., observes a regional holiday, called Emancipation Day, this Friday.

While providers such as eFile, FreeTaxUSA, H& R Block, and TurboTax offer some online services for free, the offering sometimes only covers simple returns and might not apply to the preparation of state taxes.

But in Pennsylvania, filers can prepare their state taxes free of charge at mypath.pa.gov. The Pennsylvania Department of Revenue hosts the service, which does not require a username or password.

The site allows users to file the Pennsylvania Personal Income Tax Return , make payments, respond to department requests for information, and check their refund status. The platform can handle a range of tax documents, including federal forms W-2 and 1099-MISC.

Taxpayers whose adjusted gross income is $73,000 or less qualify for free guided federal tax preparation services, too. The IRS lists eight free-file options on its website. It also offers a free fillable form for those whose adjusted gross income exceeds $73,000, though it warns users that they should know how to prepare their own tax returns using form instructions and IRS resources.

As of April 1, the IRS had issued 63 million refunds averaging about $3,200 each.

Read Also: Is Plasma Money Taxable

If You Owe And Cant Pay

If you owe taxes and cant pay before the due date, dont fret. The Department of Revenue allows you to set up a payment plan by calling its Collections Unit at 1-717-783-3000. However, youll incur a late payment penalty and interest on the amount due, which will continue to add up until you pay off the balance. You should pay as much as youre able by the due date in order to minimize interest and penalties on the unpaid balance.

You can make your tax payments by check, money order, debit card or credit card. Fees will be charged for some payment options.