Know Your Obligations As An Employer

In addition to the tax requirements discussed above, there may be other obligations that come with being an employer. These may include complying with minimum wage and overtime requirements, and documenting immigration status. You may also want to consider having insurance covering the liability of employing people in your home. Have questions about how this could affect your taxes? Our tax experts are here to help. Contact Us.

How To Pay Nanny Taxes

Now lets get into the process of actually managing nanny taxes. There are four main action items that families need to take care of:

Apply for Tax ID numbers: You need both federal and state tax identification numbers in order to report your nanny taxes. You can get your federal employer identification number from the IRS and use this number to obtain your state identification number from the appropriate tax agency in your state.

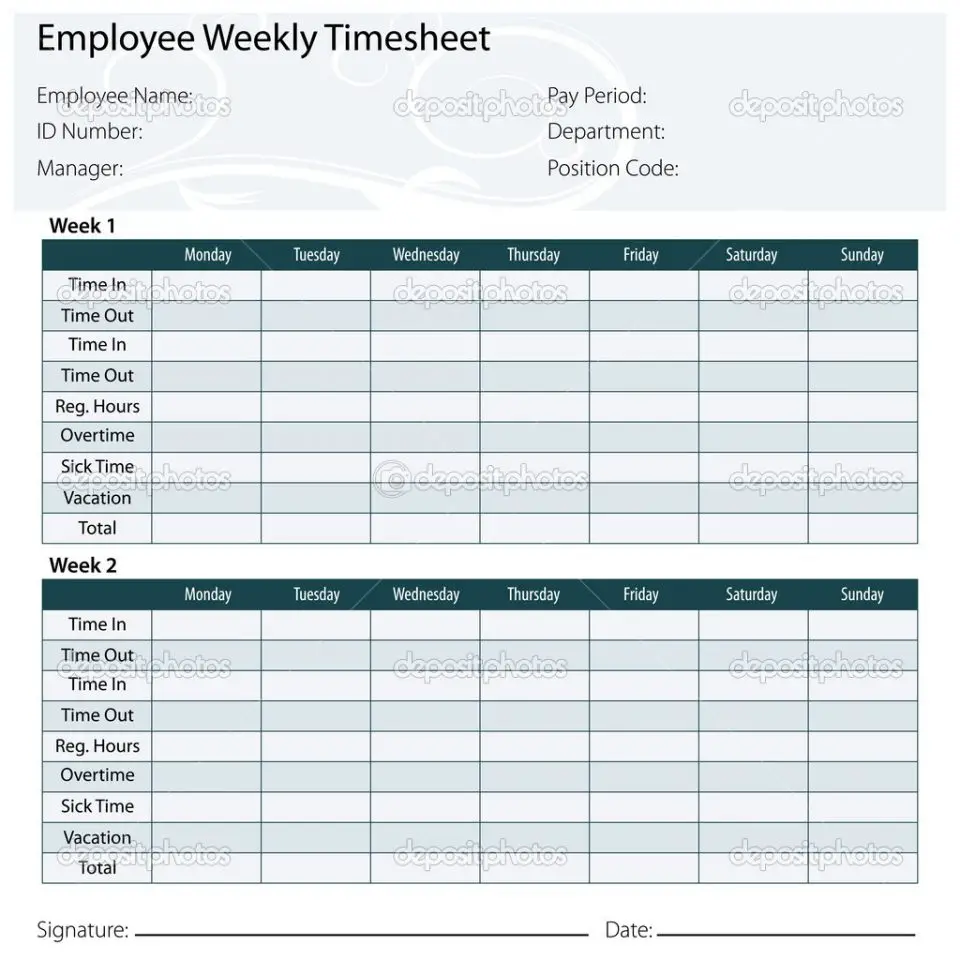

Calculate and track payroll: You need to accurately calculate your nannys gross pay, the taxes withheld from them and your corresponding employer taxes each pay period. .

File tax returns year-round:

Typically on a quarterly basis, you will need to file state tax returns. Some states do require monthly or annual filings, so check the details in your area to be sure.

You should send 1040 estimated payments to the IRS four times per year.

Complete year-end tax forms:

You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return.

The Social Security Administration requires you to file Form W-3 and Form W-2 Copy A. This lets them know that youve properly withheld FICA taxes from your caregiver and remitted FICA taxes of your own throughout the year.

You need to prepare a Schedule H and file it with your federal income tax return.

Your state may also require an Annual Reconciliation form, which summarizes the state income taxes you withheld from your nanny.

Pay State Taxes And File State Household Employment Tax Returns On A Regular Basis

As a household employer, you are required to file state unemployment tax returns, typically on a quarterly basis, and remit unemployment insurance taxes. If you live in a state with income taxes, youll also need to file state income tax returns and send in the income taxes youve withheld from your nanny.

Note: Some states have different filing frequencies and could require monthly or annual deposits. Check the requirements in your state.

Recommended Reading: How Much Does Liberty Tax Charge To File Taxes 2020

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

How Do You Handle The Earned Income Tax Credit

Certain workers can take the earned income tax credit on their federal income tax return. This credit reduces their tax or allows them to receive a payment from the IRS if they do not owe tax. You may have to make advance payments of part of your household employee’s EITC along with the employee’s wages. You also may have to give your employee a notice about the EITC.

You May Like: How To Pay My Federal Taxes Online

What Are The Requirements For Vacation Holidays And Sick Days

Federal law does not require nanny employers to offer benefits such as paid vacation time, paid sick time, medical or life insurance, or retirement savings plans. State and local jurisdictions however are increasingly requiring sick leave, and HI has a health insurance mandate for employers. While legal mandates may not apply, markets are dictating that nanny employers with full time, permanent staff need to offering some basic level of benefits to be competitive in the employment market. These benefits help families not only attract, but also retain the best staff and help your nanny avoid burnout. Typically sick leave benefits include 3-5 days, while vacation leave benefits generally include 5-10 days. Each position is unique, with different lengths of shift, or different numbers of days in a typical work week. As such it is suggested that these benefits be defined in your work agreement in hours, rather than days.

Do I Have Taxes As An Employer

Yes. Household employers can expect to pay the following employment taxes:

- Half of Social Security & Medicare

- Federal and state unemployment insurance

These employer taxes are typically about 10% above the nannys gross payroll. Nanny employers often qualify for favorable tax breaks that will largely offset their employer taxes.

You May Like: Can You Call The Irs For Tax Questions

Nanny Taxes Youre Responsible For Paying

The nanny tax isnt just Social Security and Medicare taxesreferred to as “FICA taxes“that are normally split evenly between an employer and their employee. It also includes federal income tax withholding, although you dont have to contribute to this. It takes into account the federal unemployment tax as well.

Documents For Nanny Payroll

Some of the documents that are typically necessary to process nanny payroll include:

- Form W-2, Wage and Tax Statement You must supply nannies with a Form W-2 by January 31 each year so they can file their taxes appropriately. If their wages were subject to FICA taxes or if you withheld income tax, you may also be required to provide a copy to the Social Security Administration.

- Form W-3, Transmittal of Wage and Tax StatementsSend Form W-3 to the Social Security Administration to show them the total earnings on your nannys Form W-2.

- Form W-4, Employees Withholding Certificate If your nannies have requested that you deduct income tax from their pay, they should complete a Form W-4, detailing their filing status and withholding amounts.

- Schedule H, , Household Employment Taxes If you withheld income tax or paid your nanny cash wages that were subject to FICA or FUTA taxes, use Schedule H to report these totals to the IRS.

Read Also: What Is The Cut Off For Filing Taxes

Make Estimated Tax Payments To The Irs Four Times A Year

To manage your federal household employment taxes, the IRS recommends you make estimated tax payments throughout the year to avoid underpayment penalties. Youll send in the FICA taxes and federal income taxes withheld from your nanny along with the FICA taxes and federal unemployment insurance taxes you owe as a household employer during the following time periods:

How To Set Up Nanny Payroll

No matter how eager you and your nanny are to start working together, its best to have your payroll process in place first. Here are some basic steps to setting up household payroll:

- Verify which taxes apply to your nanny

- Obtain workers compensation insurance

- File a new hire report with your designated state agency

Additional steps may be required. Employers are advised to consult IRS Publication 926 and relevant state and local guidance.

Also Check: How Do You Figure Out Your Tax Liability

Fined For Not Paying Unemployment Taxes

Your kids are now in school so you dont need a full-time caregiver or maybe its not working out with your nanny. However it happens, you and your employee part ways through no fault of your nanny. She files for unemployment to help with her bills while she looks for a new job. But shes denied benefits as there is no record of her holding a job or even your family being an employer. Since you dont pay nanny taxes, including unemployment taxes, you can expect a call from your state with failure-to-pay and failure-to-file penalties, which can add up to 50 percent of the tax due. Thats on top of the unemployment taxes you neglected to pay while employing your nanny.

Withholding Taxes For Your Nanny

As a household employer, youre required to withhold your nannys share of FICA taxes. They owe the same percentage of their gross wages.

While its not required for a household employer to do so, you can also withhold your nannys income taxes based on their Form W-4. This is recommended so your employee doesnt owe their entire income tax obligation when they file their personal tax return.

In three states , your nanny will also owe unemployment taxes, which will need to be withheld from their pay.

You may also need to withhold your employees contribution to any state-sponsored paid family and/or medical leave. These programs replace a portion of your nannys wages if they need to take time off from work for a qualified reason.

Check if your state has a paid family and medical leave program.

You May Like: What Is Low Income Tax Credit

What Nanny Taxes Do You Need To Pay

For the most part, youll need to withhold and pay nanny taxes when you pay your nanny. Nanny taxes include:

- Social Security tax: 6.2% of earnings paid by the employee, 6.2% of earnings paid by the employer

- Medicare tax: 1.45% of earnings paid by the employee, 1.45% of earnings paid by the employer

- Federal unemployment taxes: Generally $42 per employee paid by the employer

- State unemployment taxes: Varies by state, expect about $350 per employee

There are some exceptions to the tax rules:

- If you pay your nanny less than $2,400 in 2022, you dont have to pay Social Security or Medicare tax on their earnings.

- You only need to pay federal and state unemployment tax if you pay your employee more than $1,000 during any quarter of the year, with some state thresholds lower.

- If your spouse watches the kids or one of your children under the age of 21 watches their siblings, you dont need to pay the nanny tax.

Determining Your Employees Work Eligibility

Your employee must have a Social Security Number or an Individual Taxpayer Identification Number . If they are not a U.S. citizen, they must be authorized to work in the country by the Department of Homeland Security. Never assume your employee has a Social Security Number and be sure to verify all numbers with the Social Security Administration.

Don’t Miss: Can I Pay My Estimated Taxes Online

Contacted By Irs For Failing To Provide A W

Household employees enjoy many benefits when theyre paid legally. They have verifiable incomes and work histories when applying for credit or loans. Theyre contributing to their Social Security and Medicare accounts for when theyre older and not working.

None of this happens if you dont pay nanny taxes. Your nanny sees other nannies and friends working traditional jobs enjoying these benefits. Now they want in. They want you to withhold taxes and treat them like an employee. However, you refuse.

If your nanny doesnt receive a W-2 by mid-February, they can contact the IRS and provide your information along with their dates of employment and estimated wages earned. The IRS will follow up with you about the missing W-2. Not only do you need to pay back taxes, but the IRS is also authorized to penalize you up to 100 percent of the tax you owe.

How To Pay Federal Income Taxes On Unemployment Benefits

Perhaps the easiest way to pay taxes on unemployment compensation is to have federal income taxes withheld from your weekly payments. To have federal income taxes withheld, file Form W-4V with your states unemployment office to instruct them to withhold taxes.

If you request tax withholding, the state will withhold 10% of each paymentno other amounts or percentages are allowed.

Another option is to make estimated quarterly payments by mailing a check with Form 1040-ES or making a payment online via IRS Direct Pay. However, this option is fairly high maintenance compared to having tax withheld from your unemployment benefits.

First, you need to estimate the amount youll owe using your tax software or the worksheet accompanying Form 1040-ES. Then you need to make four quarterly payments, generally due April 15, June 15, September 15, and January 15 of the following year.

The final option is to wait until you file your tax return to see how much youll owe. However, this option can be risky because it can leave you with a large tax bill and underpayment penalties in April.

Read Also: How To Claim Inheritance Money On Taxes

Know That Your Nanny Should Be Classified As A Household Employee

The IRS has ruled that, with very few exceptions, nannies are employees of the families for whom they work not independent contractors. This is regardless of the amount of hours worked, wages paid or whats written in an employment contract. This means your nanny should be given a W-2 form, rather than a 1099 form, to file their taxes. Worker misclassification is considered a form of tax evasion and is a risk you should not be willing to take.

Remitting Your Nanny Taxes

You can remit your FICA and FUTA taxes along with your nannys share of FICA and federal income taxes quarterly using Form 1040-ES.

Its highly recommended to pay your nanny taxes quarterly rather than all at once at the end of the year. Since nanny taxes are calculated on Schedule H, which is filed with your personal tax return, you could face an underpayment penalty if you wind up owing too much.

Check your states tax agency website for instructions on how to remit your state taxes. When you obtain your state tax identification, youll likely be given directions on how to pay taxes. Most states require you to remit unemployment and income taxes on a quarterly basis.

Paid family and medical leave programs may have different instructions for remitting contributions.

Don’t Miss: What Is The Tax Rate On Unemployment

Employer’s Annual Or Final Summary Of Virginia Income Tax Withheld

All filers must file Form VA-6, Employer’s Annual Summary of Virginia Income Tax Withheld or Form VA-6H, Household Employer’s Annual Summary of Virginia Income Tax Withheld. The VA-6 and VA-6H are due to Virginia Tax by of the following calendar year, or within 30 days after the final payment of wages by your company. You may file your VA-6 or VA-6H using eForms, Web Upload, or your Business Account.

When you file Form VA-6, you must submit each federal Form W-2, W-2G, 1099, or 1099-R that shows Virginia income tax withheld. You must submit these forms electronically using eForms or Web Upload.

Can Household Employees Qualify For Tax Credits

If you work as a household employee, you may qualify for a special tax credit for low-to-moderate-income workers, the Earned Income Credit . This credit can lower your taxes and may result in a refund. The EIC has specific qualifications and income limits, so you’ll have to do some research to see if you’re eligible.

Household employers, on the other hand, can qualify for the Child and Dependent Care Credit.

For 2022, this credit can reduce the cost of child care expenses from hiring a nanny and can be worth as much as 20% to 35% of up to $3,000 of child care or similar costs for a child under 13, or up to $6,000 for two or more dependents.

For 2021, the American Rescue Plan brings significant changes to the amount and way that the child and dependent care tax credit can be claimed. The plan increases the amount of expense eligible for the credit, relaxes the credit reduction due to income levels, and also makes it fully refundable. This means that, unlike in other years, you can still get the credit even if you dont owe taxes.

For tax year 2021:

- The amount of qualifying expenses increases from $3,000 to $8,000 for one qualifying person and from $6,000 to $16,000 for two or more qualifying individuals

- The percentage of qualifying expenses eligible for the credit increases from 35% to 50%

- The beginning of the reduction of the credit is increased from $15,000 to $125,000 of adjusted gross income .

Also Check: How To Apply For Tax Id

How To File And Pay Nanny Taxes

Youll need an employer identification number if youre responsible for paying a nanny tax, but this doesnt have to be a challenge. Its a simple matter of going online and applying for one. You can also mail or fax Form SS-4 to the IRS to apply. Your EIN must appear on all tax forms you complete and submit, and its different from your Social Security number.

You must file and provide a variety of documents as tax time approaches:

- Prepare a Form W-2 for your employee for the previous years wages and give them Copies B, C, and 2 by Jan. 31 of the following tax year. FICA wages go in Boxes 4 and 6. Overall wages go in Box 1, and they include FICA wages. You must prepare a separate Form W-2 for each household employee if you have more than one.

- Send Copy A of the W-2 to the Social Security Administration, along with Form W-3, which acts as something of a transmittal letter. This deadline is also Jan. 31, and you can take care of this online. The Social Security website provides instructions.

- File Schedule H with your Form 1040 by April 15, 2022, for tax year 2021, and by April 18, 2023, for tax year 2022. You can file the schedule by itself if you dont have to file a federal tax return. If you file for a 1040 extension, the extension applies to Schedule H as well.