Do You Pay Taxes On Social Security

You have to pay federal income taxes if you meet certain combined income thresholds based on your filing status. Combined income includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits. For example, if you file as an individual and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If your income is more than $34,000, you may have to pay taxes on up to 85% of your benefits. Taxes are limited to 85% of your Social Security benefits.

How Do I Affect Withholding Now

Since the 2020 W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The loss of allowances on the form might seem especially irksome, but not to worry. There are still plenty of ways to affect your withholding.

First, its important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in.

Second, the total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents in Step 3.

Finally, Section 4 of the W-4 is a bit more open ended. Here youll be able to state other income and list your deductions, which can be used to reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues.

Types Of Income / Heads Of Income

Everyone who earns or gets an income in India is subject to income tax..For simpler classification, the Income tax department breaks down income into five main heads:

| Head of Income |

|---|

| 30% | Rs 1,12,500+ 30% of income above Rs 10 lakhs |

There are two other tax slabs for two other age groups: those who are 60 and older and those who are above 80.A word of note: People often misunderstand that if they earn letâs say Rs.12 lakhs, they will be paying a 30% tax on Rs.12 lakhs i.e Rs.3,60,000. Thatâs incorrect. A person earning 12 lakhs in the progressive tax system, will pay Rs.1,12,500+ Rs.60,000 = Rs. 1,72,500. Check out the income tax slabs for previous years and other age brackets.

You May Like: Where’s My Tax Refund Ga

Penalties And Interest Rates

Q. What are the applicable interest and penalty rates for underpayments of Delaware Income Tax?

A. The interest and penalty rates for underpayment of Delaware Income Tax are as follows:

When You’ll Get Paid

When you receive your paycheck depends on the timing of the company’s payroll. Employees typically receive a paycheck either weekly or every other week. Receiving a paycheck monthly is less common.

Compensation is typically paid via check or direct deposit directly into the employee’s checking account.

When you’re hired, you should be notified about payroll timing and options for getting paid. Starting a new jobor leaving your current position sometime soon? You might not receive your check at the regularly expected time.

Depending on the payroll cycle, company policy, and state law, your pay may lag. For example, when youre starting a new job, its not uncommon to receive your first paycheck a week or two after the usual time.

And, when you leave a job, you may receive your check on the last day youve worked or on the last regular pay date for the pay period. There are no federal laws mandating exactly when the last check must be issued, although some states specify that you must be paid immediately. In any case, you must be paid for the time youve worked.

Also Check: Have My Taxes Been Accepted

Where Does The Us Government Get Its Money

The US Constitution can be vague at times, but when it comes to taxes, there is little question about the governments power. The Congress, James Madison writes, shall have Power to lay and collect Taxes, Duties, Imposts and Excises. In modern language, the government can tax its citizens, and it does. But just because the government has the power to do something doesnt mean it should. Despite the Constitutions clear mandate that the federal government may tax its citizens, taxes are a very complicated and often problematic part of American life. The US tax code is around 2,600 pages long. And there are additional tens of thousands of pages about the tax code: IRS regulations, revenue rulings, and case law covering court proceedings around the code. But a few fundamental questions can get to the root of how American taxes relate to the US debt.

Taxes On Pension Income

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs, 401s, 403s and similar retirement plans, and tax-deferred annuitiesin the year you take the money. The taxes that are due reduce the amount you have left to spend.

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money. In either case, your employer will withhold taxes as the payments are made, so at least some of what’s due will have been prepaid. If you transfer a lump sum directly to an IRA, taxes will be deferred until you start withdrawing funds.

Smart Tip: Taxes on Pension Income Vary by StateIts a good idea to check the different state tax rules on pension income. Some states do not tax pension payments while others doand that can influence people to consider moving when they retire. States cant tax pension money you earned within their borders if youve moved your legal residence to another state. For instance, if you worked in Minnesota, but now live in Florida, which has no state income tax, you dont owe any Minnesota income tax on the pension you receive from your former employer.

Read Also: Protesting Harris County Property Tax

What Is The Percentage Taken Out For Taxes On A Paycheck

Precise percentages vary based on state, but according to the Ventures Scholars Program, four primary taxes are withheld from paychecks: federal income tax, state income tax, social security tax and Medicare tax. According to The Law Dictionary, taxes are withheld on a sliding scale that extracts more income from higher-earning individuals, topping out at 39.6 percent in 2014.

The IRS website provides a calculator that allows employees to determine whether the correct amount of federal income tax is being withheld. Withholding tax is paid out of an employee’s wages directly from the employer to the IRS and is used to fund social security, Medicare, unemployment compensation and worker’s compensation. The amount is determined by the W-4 form, which is used by employers to calculate how much to deduct. The IRS recommends that a new W-4 be submitted whenever an employee’s financial situation changes. The W-4 also allows filers to control to some extent how much is withheld, but the U.S. Tax Center advises that the withholding tax match the actual tax liability as closely as possible. While receiving a large tax refund is enjoyable, tax refunds are interest-free loans provided to the government. Withholding too little results in owing the IRS, who may also charge penalties and interest.

Change In Withholding When You Start Social Security

Many retirees who have a pension are surprised by the increase in their taxes when they start Social Security. The amount of your Social Security benefits subject to taxation depends on your other sources of income. If your pension started a few years ago, and now you are starting Social Security benefits, you will likely need to increase your tax withholding.

Recommended Reading: How Much Does H& r Block Charge For Doing Taxes

How Much Money Is Typically Taken Out Of A Paycheck

The 2017 Social Security withholdings total 12.4 percent and Medicare withholding rates total 2.9 percent, according to the IRS. An employer withholds these funds from the paycheck as well as income taxes and other deductions.

Income Taxes When first hired at a job, employees fill out several forms. One of these forms is a W-4, which dictates how much money to withhold and pay to the federal government. The amount paid varies depending on how much an employee earns and how many allowances they claim. Claiming zero allowances results in the maximum amount withheld from a paycheck. The more allowances claimed, the lower the amount withheld. If more money is withheld than necessary, then the employee may be eligible for a refund when they file an income tax return. Depending on the location, state and local taxes might also be withheld.

Social Security Federal Insurance Contributions Act taxes are also listed as a deduction on a paycheck. This tax consists of two parts. The first being Social Security, which is a federal program designed to provide citizens with an income after retirement. In order to fund this program, the government withholds a percentage of earnings. For 2017, the Social Security withholding rate is 6.2 percent for employer and employee, or 12.4 percent total, as stated by the IRS. The wage base limit is $127,200, meaning that only wages up to that amount are subject to the Social Security tax.

How Much Of Your Fers Pension Will The Government Take In Retirement

Is your FERS pension taxable? As the author explains, federal employees could wind up with a smaller monthly income in retirement than they were expecting.

This is a very important topic for federal employees to understand when it comes to planning for retirement. If you understand it then you will have much fewer surprises down the road.

A huge misconception that I see all the time is about taxes in retirement and specifically, on your pension. Many people believe that after putting in 20 or 30 years the tax rules will lighten up in retirement. In some ways they do but in many ways they dont.

Also Check: How To Buy Tax Lien Certificates In California

What Is A Paycheck Calculator

A paycheck calculator lets you know what amount of money will be reserved for taxes, and what amount you will actually receive. Generally, paycheck calculators will show the take-home salary for salaried and hourly workers they can also help calculate the amount of overtime pay will be paid out directly in your check.

To get the most accurate estimate, look at your pay stub, paying attention to withholdings for federal, state, and local taxes, FICA deductions for Social Security and Medicare, and any other deductions for health insurance, retirement, and flex spending accounts.

Federal And State Taxes And Your Paycheck

The amount of tax withheld is found on your Form W-2, Wage and Tax Statement. Your employer furnishes this form to you annually. The amount of tax that is withheld from your paycheck depends on the information you provide your employer with the W-4 form, which you fill out when you begin employment for an employer. On the W-4, you let your employer know whether to withhold tax at the higher single rate or the lower married rate, depending on your marital status. You can also claim allowances to have additional tax withheld. If you have too much tax withheld from your wages, you receive a refund after filing your annual income tax return. If you don’t have sufficient tax withheld, you could pay a penalty. The IRS charges the penalty if your withholding amount doesnt account for 90 percent of your tax liability for the current year or 100 percent of the previous year. The IRS uses the lesser amount of the two as the standard.

Don’t Miss: Do You Have To Pay Taxes On Plasma Donations

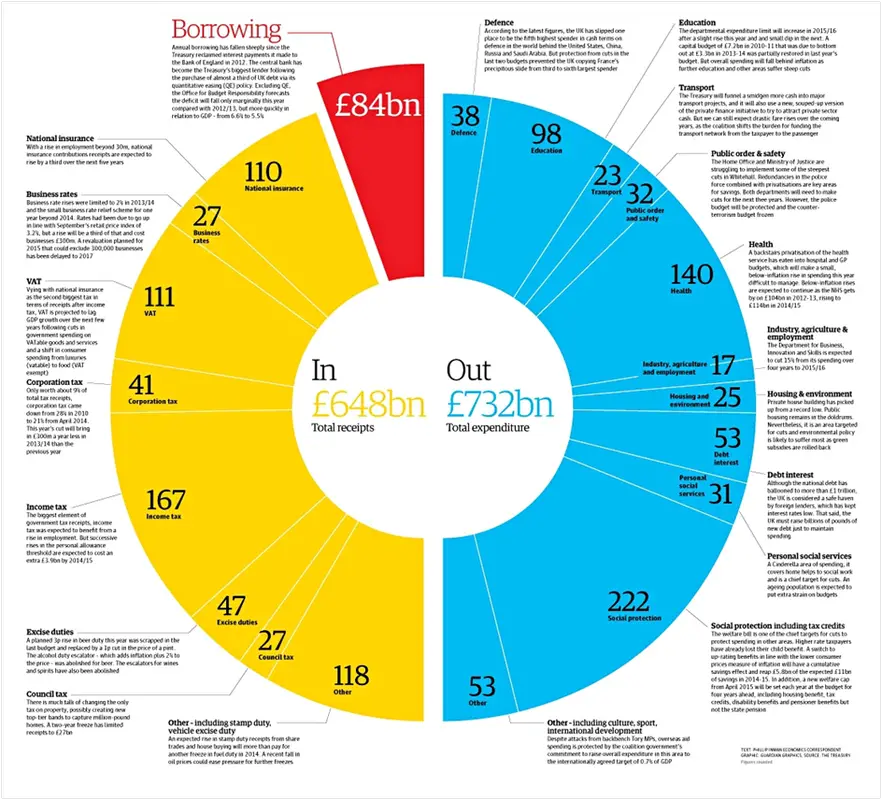

How The Federal Government Generated Money In 2016

All told, the U.S. government collected $3.267 trillion in fiscal 2016. The vast majority of revenue came from the collection of taxes.

Image source: Department of the Treasury.

Individual income tax returns filed by an estimated 150 million-plus people in 2016 resulted in the collection of nearly $1.55 trillion. This figure is all the more impressive when you take into account the fact that 4 in 5 taxpayers receive refunds from the federal government in a given year. In a typical year, the top 1% of income earners in the U.S. pay more than 25% of all federal income tax revenue collected by the IRS.

Running a fairly close second in revenue collection with $1.12 trillion in fiscal 2016 were Social Security and other payroll taxes. Among social programs, Social Security is by far the largest. Not surprisingly, the 12.4% payroll tax that workers pay on earned income between $1 and $118,500 generates a lot of money for the federal government each year. This tax is typically split down the middle between you and your employer , while self-employed people pay the full amount.

Finally, $306 billion was collected from a plethora of additional taxes and duties according to the final monthly statement from the Treasury. This included the collection of more than $95 billion in excise taxes, $21 billion in estate and gift taxes, and $35 billion in custom duties.

The $3.267 trillion collected by the U.S. government in fiscal 2016 is an all-time high.

How To Apply For The Cpp Death Benefit

Who Should Fill Out the FormIf there is an Estate, the Executor, Administrator or a legal representative for the estate should apply for the Death Benefit within 60 days after the date of death.

Otherwise, the person who paid for the funeral should apply.

Sometimes there is no funeral expense. For example, perhaps the body was donated to medical science and cremated by the hospital afterwards. Then the spouse or common-law partner should apply.

And, if no one else can apply, the next of kin can.

Where Can One Get the CPP Death Benefit Application FormThe application form is on the Government website at

If you can stand voice activated telephone systems, you can call and order a kit from the government at 1 800 277 9914 . Those are also the numbers to call for assistance.

What Do I Need to Fill Out the CPP Death Benefit FormThe person completing the form will need

You May Like: Do I Need W2 To File Taxes

Request For Copies Of Returns

Q. How do I request a copy of a tax return I have filed?

A. In order to give you this information, please provide your social security number, name, your filing status for that year, the amount of refund or balance due, and your address on the return at that time. You may email your request by clicking the personal income tax email address in the contact file, or contact our Public Service Bureau at 577-8200.

Taxation Of Social Security Benefits

Many older Americans are surprised to learn they might have to pay tax on part of the Social Security income they receive. Whether you have to pay such taxes will depend on how much overall retirement income you and your spouse receive, and whether you file joint or separate tax returns.

Check the base income amounts in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits. Generally, the higher that total income amount, the greater the taxable part of your benefits. This can range from 50 to 85 percent depending on your income. There is no tax break at all if you’re married and file separate returns.

The IRS also provides worksheets you can use to figure out what’s taxable and how much you might owe in taxes on your retirement income. You can find these worksheets in IRS Publication 554, Tax Guide for Seniors.

You May Like: Does Contributing To Roth Ira Reduce Taxes

How Public Spending Was Calculated In Your Tax Summary

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: .

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/publications/how-public-spending-was-calculated-in-your-tax-summary/how-public-spending-was-calculated-in-your-tax-summary

Who Pays The Most

W2 wage earners – those with a regular paycheck from a business, government entity or non-profit – make up the largest share of tax revenue through income tax and social insurance withholdings, like the payroll tax that funds Social Security, the government retirement program.

Those withholdings can reduce here Americans’ take-home pay by nearly 40%, depending on income, and have made up about 73% of total revenue over the past two fiscal years through August.

Despite high unemployment because of the coronavirus pandemic, withheld income taxes in 2020 have fallen less than 1% from 2019 levels, partly due to higher earnings early in the year and aid to small businesses that kept paychecks coming to many idled employees over the spring and summer months.

Self-employed people, including many business owners, and those paying capital gains or other taxes not withheld from their paychecks, make up the second-largest category, funding around 19% of the total tax revenue during fiscal 2020 through August.

Recommended Reading: How To Appeal Property Taxes Cook County