How To Calculate Income Tax

Income tax calculation for the Salaried

Income from salary is the sum of Basic salary + HRA + Special Allowance + Transport Allowance + any other allowance. Some components of your salary are exempt from tax, such as telephone bills reimbursement, leave travel allowance. If you receive HRA and live on rent, you can claim exemption on HRA. Calculate exempt portion of HRA, by using this HRA Calculator.

On top of these exemptions, a standard deduction of Rs 40,000 was introduced in budget 2018. This has been increased to Rs 50,000 in budget 2019.

In case you opt for the new tax regime, these exemptions will not be available to you.

Let’s understand income tax calculation under the current tax slabs and new tax slabs by way of an example. Neha receives a Basic Salary of Rs 1,00,000 per month. HRA of Rs 50,000. Special Allowance of Rs 21,000 per month. LTA of Rs 20,000 annually. Neha pays a rent of Rs 40,000 and lives in Delhi.

| Nature |

|---|

To calculate Income tax, include income from all sources. Include:

- Income from Salary

- Income from house property

- Income from capital gains

- Income from business/profession

- Income from other sources

| Nature |

|---|

| Rs 12,500 + Rs 25,500+ Rs 37,500 + Rs 50,000 + Rs 62,500 + Rs 1,77,600 + Rs 14,604 | Rs 3,79,704 |

What are the exemptions/ deductions that are disallowed under the new tax regime?

Individual or HUF opting for taxation under the newly inserted section 115BAC of the Act shall not be entitled to the following exemptions/deductions:

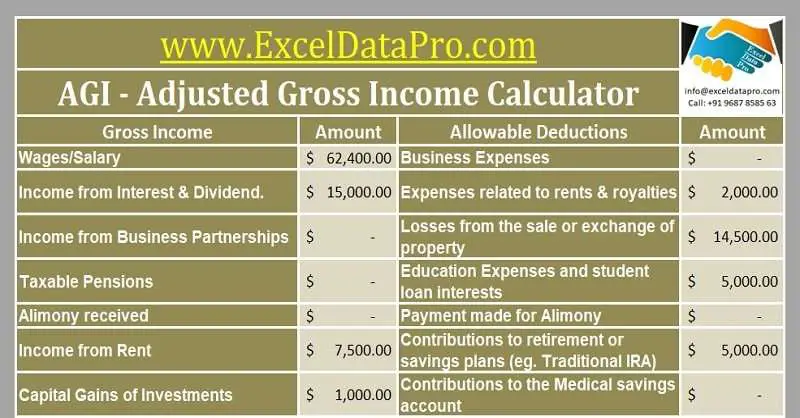

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

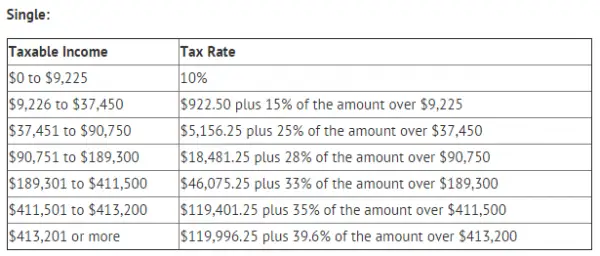

Five: Use The Tax Brackets

Next, your taxable income will be applied to the marginal tax brackets. They’re called marginal tax brackets because not all of your taxable income is taxed at the same rate. For example, consider the single tax brackets for 2017.

|

Tax Bracket |

|---|

|

$121,505.25 plus 39.6% of your income above $418,400 |

Data source: IRS.

What this means is that the 10% tax rate will always be applied to the first $9,325 of income, regardless of how much a taxpayer made.

For our example of a single taxpayer with 2017 taxable income of $58,450, the chart shows that they would fall into the 25% tax bracket. Using the formula in the left column tells us that this taxpayer would have a total federal income tax of $10,351.25 for the 2017 tax year.

For reference, here are complete guides to the 2017 tax brackets and 2018 tax brackets. Be sure to use the correct bracket for your filing status.

It’s also important to realize that the tax brackets for 2017 tax returns are very different than the tax brackets that will be applied to 2018 returns, so be sure you’re looking at the correct tax year.

As far as qualified dividend and long-term capital gains taxes go, they are taxed at different, more favorable rates of 0%, 15%, or 20%, depending on the taxpayer’s marginal tax brackets. High-income taxpayers may also have to pay an additional 3.8% net investment income tax on any dividends or capital gains as well.

You May Like: Efstatus Taxact 2016

Income Tax Rates In Canada

In Canada, the amount of money you make in a given tax year determines how much youll pay in taxes. This is called a graduated, or progressive, tax system. The idea is that people who earn more pay higher taxes people who earn less pay less.

To help decide who pays what, the CRA applies income brackets to determine an applicable tax rate to everyone. Earners in the lowest tax bracket pay a percentage of their earnings. When you enter the next tax bracket up, youll pay that new tax rate on money earned inside that bracket. This is called a marginal tax rate.

For example, in 2022, everyone pays 15 per cent on the first $50,197 of taxable income. But lets say you get a raise or a new job that pays $52,000. Assuming this is your new taxable income, youd pay 15 per cent on that first $50,197 and 20.5 per cent on that extra $1,803. The higher the tax bracket, the higher the tax rate. Heres a breakdown:

- 15 per cent on the first $50,197 of taxable income, plus

- 20.5 per cent on the next portion of taxable income from $50,197 to $100,392, plus

- 26 per cent on the next portion of taxable income from $100,392 to $155,625, plus

- 29 per cent on the next portion of taxable income from 155,625 to $221,708, plus

- 33 per cent of taxable income over $221,708

Hint: You’ll Have To Use A Formula Instead Of A Single Form To Find Out How Much You Owe The Irs

If calculating your income tax ever felt like an unsolved mystery, it’s time to unlock the code and eliminate your concerns — especially since taxes aren’t going away. Here are some steps to show you how the IRS calculates your income tax so you’ll have more control over how much you pay when you file your taxes.

Read Also: How To Pay Doordash Tax

How To Establish Your Total Income

To calculate your refund, add up your income from all sources to get your total income. This amount will be shown on Line 15000 Total Income.

Some examples of income and the slips they are reported on are:

Natalie Fong-Yee, CA, of the Fong-Yee Professional Corporation based in Toronto, says that each persons tax situation is different, but that many people qualify for substantial income tax refunds.

The biggest factor in receiving a refund is a large RRSP contribution and having too much tax deducted from your salary, she explains. When you contribute to an RRSP or make other major deductions, you can subtract the amounts from your total income and get your net income. This ultimately affects your tax payable.

Is Paye Calculated On Gross Or Net Salary

To get a more accurate figure, it is recommended to learn how to calculate PAYE on salary in gross rather than in net. Please note that:

- A pension fund contribution may be tax-deductible depending on whether the pension fund is “approved” or “unapproved.”

- Employees who work only part of a year are liable to benefit from a rebate.

- Disability Benefit Contributions are part of the employee’s fringe benefits and are no longer tax-deductible.

- Lastly, file tax returns whenever SARS opens its eFiling system.

Learning how to calculate PAYE on salary is the best way to monitor your finances. To avoid being scammed by some dubious employers, you should know how much money SARS is deducting from your earnings.

DISCLAIMER: This article is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO:Apply for the UIF certificate of compliance online 2022: All you need to know

Briefly.co.za also shared detailed information regarding how to apply for the UIF certificate of compliance online. A certificate of compliance is a legal statement that verifies that specific criteria have been met.

Read Also: Doordash Taxes California

Estimated Quarterly Tax Payments

Estimated quarterly tax payments can help to avoid a large, unexpected tax bill in the following year. Quarterly payments chip away at your estimated annual tax bill. When done right, many taxpayers have a lower tax bill or may even receive a refund for paying too much. This makes their income tax bill manageable.

Another advantage of estimated quarterly tax payments is that you avoid underpayment and penalties.

At the beginning of the year, if you estimate that your tax liability will be at least $1,000, you must make quarterly estimated tax payments. Self-employed individuals must also make quarterly payments.

Tax Deductions And Tax Credits Explained

Remember that a tax deduction reduces your taxable income, cutting your tax bill indirectly by reducing the income that’s subject to a marginal tax rate. A tax credit is a dollar-for-dollar discount on your tax bill. So, if you owe $1,000 but qualify for a $500 tax credit, your tax bill goes down to $500.

What if youre eligible for tax credits that are greater than what you owe say, $1,000 in tax credits with a $500 liability? Whether you get that $500 difference refunded to you will depend on whether the tax credits you qualify are refundable or not. Refundable tax credits go into your tax refund if they exceed what you owe. By contrast, some tax credits are nonrefundable, which means they have the power to reduce your tax liability down to zero but cant be refunded to you if they exceed your liability. Our tax return calculator will take all of this into account when figuring out what you can expect at tax time.

Read Also: How To Calculate Taxes For Doordash

You Should Also Note That Monthly Travel Allowances Are A Special Case

The employer has to determine how the employee spends their travel allowances. If one spends 20% of the allowance on business trips, 80% will be subject to PAYE deductions. Meanwhile, if the person travels 80% of their working time for official duties, 20% of their travel allowance is taxable.

I.) More than 80% travel rate

Travel allowance deduction = *20%

II.) Less than 80% travel rate

Travel allowance deduction= *80%

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Don’t Miss: How Much To Set Aside For Taxes Doordash

Other Things To Keep In Mind About Local Income Taxes

To help simplify the local income tax process, you can:

- Have a separate bank account for taxes

- Keep detailed records of local taxes

Payroll software can help you streamline the process of withholding local income taxes by handling the calculations for you. And, full-service payroll software can even handle the filing and remitting of taxes for you.

To keep your local taxes neat and organized, consider opening a separate bank account specifically for taxes. That way, you dont mix up your tax money with your other business funds.

Finally, all businesses need to keep detailed records of local taxes in case of an audit. You can keep your records organized in a filing cabinet or by using a digital storage system.

Do you need help figuring out your local tax obligations? Our Full Service payroll services will calculate how much to withhold from employee wages, and we will submit the taxes for you. Try it for free today!

This article is updated from its original publication date of March 2, 2015.

This is not intended as legal advice for more information, please

What Is The Cpp

The CPP, short for the Canada Pension Plan, is a mandatory public retirement pension plan run by the Government of Canada. All Canadians over the age of 18 with employment income are required to contribute towards the CPP, with the exception of those employed in Quebec. Instead of the Canada Pension Plan, the Province of Quebec administers a similar pension plan, called the Quebec Pension Plan.

Recommended Reading: Ein Number Lookup Irs

Determine Your Filing Status

To calculate your taxable income for an individual tax return, you first need to determine your filing status. If you are unmarried, you can file your taxes either as a single filer or, if you have a qualifying person for whom you pay more than half of the support and housing costs as head of household .

If you are married, you will most likely want to file as . However, there are some limited instances when it may make sense to file as .

How To Calculate Federal Tax Credits

Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

For example, if you calculate that you have tax liability of $1,000 based on your taxable income and your tax bracket, and you are eligible for a tax credit of $200, that would reduce your liability to $800. In other words, you would only owe $800 to the federal government.

Tax credits are only awarded in certain circumstances, however. Some credits are refundable, which means you can receive payment for them even if you dont owe any income tax. By contrast, nonrefundable tax credits can reduce your liability no lower than zero. The list below describes the most common federal income tax credits.

- The Earned Income Tax Credit is a refundable credit for taxpayers with income below a certain level. The 2021 credit can be up to $6,728 for taxpayers with three or more children, or lower amounts for taxpayers with two, one or no children.

- The Child and Dependent Care Credit is a nonrefundable credit of up to $4,000 or $8,000 related to childcare expenses incurred while working or looking for work.

- The Adoption Credit is a nonrefundable credit equal to certain expenses related to the adoption of a child.

- The American Opportunity Tax Credit is a partially refundable credit of up to $2,500 per year for enrollment fees, tuition, course materials and other qualified expenses for your first four years of post-secondary education.

Don’t Miss: How Do You File Doordash On Your Taxes

Estimate Your Income Tax For The Current Year

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year .

This tells you your take-home pay if you do not have any other deductions, such as pension contributions or student loans.

If youre self-employed, the self-employed ready reckoner tool can help you budget for your tax bill.

You may be able to claim a refund if youve paid too much tax.

Making Estimated Tax Payments

Many business owners think that the income tax payment deadline is on âtax day,â which falls in mid-April. However, federal income taxes must be paid as they are incurred. This means that most small businesses must make estimated tax payments throughout the year based on an estimate of their total taxable income at the end of the year.

You May Like: Where Can I Amend My Taxes For Free

Calculate Employee Tax Withholdings

Once you know an employees gross pay and the number of allowances from their W-4, you can figure out how much you need to withhold to cover their taxes. In most states, youll need to withhold federal and state taxes and FICA taxes from each paycheck.

FICA TAXES

The Federal Insurance Contributions Act taxes are Social Security and Medicare, which must be withheld from all employees unless otherwise exempt.

- Social Security is a flat 6.2% withholding tax for wages up to $142,800 for the 2021 tax year. Any annual salaries above $142,800 are exempt, which means that the cumulative yearly Social Security withholding cannot exceed $8,853.60 . For our example employees, we would take their gross wage of $2,083.33, multiply it by 6.2%, and withhold $129.17 from their paycheck.

- Medicare is also a flat tax, at a rate of 1.45%. There is no annual limit for Medicare taxes, but employees who earn more than $200,000 a year are subject to the Additional Medicare Tax of 0.9%. We multiply our employees gross wage of $2,083.33 by 1.45% and arrive at $30.21 for Medicare tax.

Our employees FICA tax per pay period is thus $129.17 + $30.21 = $159.38.

State and Local Taxes

Some states have no state income taxes, so you may be off the hook. But if youre required to pay state taxes, youll want to make sure your calculations are done right.

How Do You Calculate Your Tax Installment Payment

- May 29, 2017

Tax installments got you scratching your brain?

Let us help! Tax installments are pre-payments made to the CRA on certain dates so that you can avoid paying a large tax bill on April 30th.

If at any point you are projected to owe or have owed a net tax of $3,000 or more in any given year it likely that you will receive an installment reminder from the CRA that requests you prepay a set amount of your income tax by installments. This can occur if no taxes or not enough taxes are deducted from your income during a given year. While this is common for those with self-employment and rental income, income from some pension plans, investments and second jobs may also be subject to installment tax payments.

You May Like: Federal Tax Id Reverse Lookup