Virginia Taxes And Your Retirement

Youve worked hard, and now youre ready to move on to the next chapter of your life. As you enter retirement, dont let confusion about your taxes keep you from enjoying everything Virginia has to offer.

With a few exceptions, if a source of income is taxable at the federal level, its taxable to Virginia as well. This includes most sources of retirement income, including:

- 401, 403, and similar investments

- Tier 2 Railroad Retirement

- Traditional IRAs

Individual Retirement Accounts

With a traditional IRA, you usually can deduct the amount you contributed to the account from your federal taxes. Therefore, your distributions are usually taxable.

A Roth IRA is a little bit different. With a Roth IRA, you pay taxes on the money you add to your account when you earn it. Since youve already paid the tax due, you usually dont pay tax on your distributions.

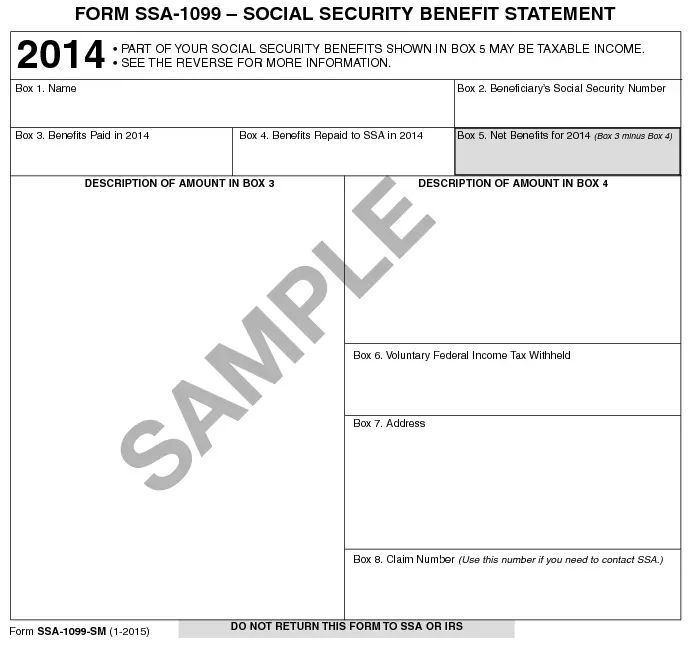

Social Security

Virginia does not tax Social Security benefits. If any portion of your Social Security benefits are taxed at the federal level, you can subtract that amount on your Virginia return. This also applies to Tier 1 Railroad Retirement.

Age Deduction

Virginia offers qualifying individuals ages 65 and older a subtraction that reduces the amount of their income subject to Virginia income tax:

- If you were born on January 1, 1939, or earlier, you can subtract $12,000

- If you were born on January 2, 1939, or later, the amount of allowed subtraction is based on your income.

Personal Property and Real Estate Taxes

Can I Collect My Ex Husband’s Social Security If He Is Remarried

Can I collect Social Security as a divorced spouse if my ex-spouse remarries? Yes. … Your status as a partner in that unit stands, whether or not your ex-husband or ex-wife marries again. However, if you remarry and become part of a new marital unit, your eligibility for benefits based on the previous unit ends.

You Don’t Have To Report Ssi Income To The Irs

kali9 / Getty Images

Supplemental Security Income benefits are considered to be government assistance, which means they aren’t taxable. Like welfare benefits, they don’t have to be reported on a tax return.

Some confusion arises, however, because the Social Security Administrationnot the IRSdoes require you to report income information in order to qualify for SSI. Here’s how income affects SSI.

You May Like: What Can I Itemize On My Taxes

How Social Security Works

The Social Security Administration provides much-needed benefits for tens of millions of American citizens. For many people, Social Security is the sole or main source of financial support. In 2020, the average Social Security retirement pension beneficiary receives $1,514 a month, while the average disability payment recipient gets $1,259 a month. Millions of Americans also get survivor benefits through the SSA as a result of their qualifying dependent relationship with a current or former Social Security beneficiary.

Social Security benefits from all sources are generally paid on a monthly basis, with either direct deposit or paper checks delivered to all recipients in the country. Unlike some government benefits, such as SNAP, Social Security benefits are not earmarked for any particular purpose, but may be saved, invested and spent like any other form of income.

How To Report Your Alaska Permanent Fund Dividend On Your Taxes

Dividends of the Alaska Permanent Fund are paid out from the Alaska Permanent Fund, a trust fund established in 1976 to provide a steady income stream for Alaskans. Federal income tax exemptions for charitable contributions do not apply to dividends however, those who receive dividends are required to file federal income tax returns for the year. Form 1040 should contain these amounts, as well as lines 8f and 8j of Schedule 1. In 2018, you must report all dividends as taxable income if you received a Permanent Fund Dividend . In 2021, the dividend will be $1,114. Taxation of the funds is imposed, but no federal income taxes are withheld. You must report all income received by you and your minor child to the IRS in order to pay all associated taxes.

Also Check: When Is The Tax Filing Deadline For 2021

Recommended Reading: Where Can I Pay My Property Taxes

Control Your Taxes Now & Later

The longer you wait to claim Social Security benefits, the better chance you’ll have to boost the overall tax efficiency of your retirement income plan. Here’s how.

Drawing down traditional tax-deferred assets before collecting Social Security can enable you to control both your current and future taxes.

The amount you withdraw from a traditional IRA, for example, lowers your account balance, which may reduce your future required minimum distributions .

Since your RMD is considered ordinary income, having smaller distributions while you’re collecting benefits may reduce the taxes on your benefitsor keep you from paying taxes altogether.

In addition, managing your retirement income in this way can also help you qualify to pay lower Medicare parts B and D premiums, which are income-based.

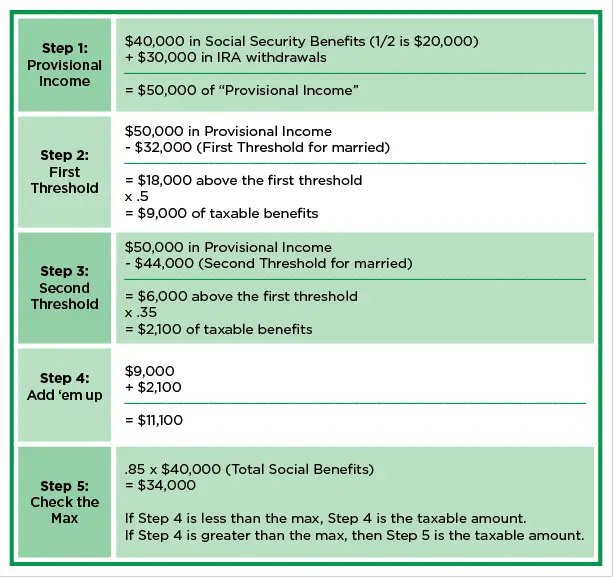

Social Security And Federal Taxes

Even though Social Security money comes directly from the federal government, some of it will be going back to Uncle Sam in the form of federal income taxes. Social Security is treated as regular income for the purpose of taxes. When it comes time to file for taxes, any money you earned including Social Security, money from retirement plans, pension payments and anything you earn from working after you are technically retired will be totaled up to determine your taxable income. Youll then be slotted into a tax bracket and your tax burden calculated.

Recommended Reading: Social Security Office Ann Arbor

Read Also: How Long To Receive Tax Refund

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Only In Certain States Or If Your Income Exceeds The Federal Limits

A Tea Reader: Living Life One Cup at a Time

Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of people who receive Social Security benefits do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for the program have little or no additional income.

You May Like: How To Track Your Taxes Online

Who Qualifies For Turbotax Free Edition

If you make less than $34,000 per year, you can file your taxes for free with TurboTax Free File. This edition is required as part of the industrys deal with the IRS. You can access the TurboTax Free File program here.

TurboTax also offers a Free Edition for people who are filing very simple returns. Warning: The Free Edition puts many people on track to pay is not part of the IRS Free File program.

Remember: If you make under $66,000 per year, you are still eligible to prepare and file your taxes for free under the IRS Free File program.

If you make under $66,000 per year, to find another free tax preparation offer from IRS Free File.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Is There Property Tax In Florida

Do I Need To File A Tax Return

You may not have to file a federal income tax return if your income is below a certain amount. But, you must file a tax return to claim a refundable tax credit or a refund for withheld income tax. Find out if you have to file a tax return.

So I Have To File A Tax Return If I Am Above The $25000 Or The $32000

Not always. Now we have to see if you are above the filing thresholds. For tax year 2021, the amount of taxable income you have to be above, and therefore be required to file, is:

- Single filing status:

- $12,400 if under age 65

- $14,050 if age 65 or older

You May Like: How Can You Find Out If You Owe State Taxes

Ways To Avoid Taxes On Benefits

The simplest way to keep your Social Security benefits free from income tax is to keep your total combined income below the thresholds to pay tax. However, this may not be a realistic goal for everyone, so there are three ways to limit the taxes that you owe.

- Place retirement income in Roth IRAs

- Withdraw taxable income before retiring

- Purchase an annuity

What Is An Itin

The Internal Revenue Service issues Individual Taxpayer Identification Numbers to people who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible for, a Social Security number .

An ITIN does not:

- Allow you to receive Social Security benefits

- Allow you to claim the EITC

- Permit a child to be claimed for the EITC or CTC. A child must have a valid SSN and authorization to legally work in the U.S. to be claimed for the EITC and CTC.)

- Change your immigration status

- Mean that you are an undocumented worker

- Give you the right to work in the U.S. Any individual who is eligible to be legally employed in the U.S. must have an SSN. If you have an ITIN you should not provide it to an employer in place of an SSN, since this would indicate to your employer and to the Social Security Administration that you are not authorized to work.

The ITIN is used in place of an SSN on a tax return to identify you, your spouse, or dependent without an SSN, on the tax return. For example, if you are an immigrant in the U.S. who has applied for legal status to work or reside in the U.S., you would need an ITIN to file a tax return while waiting for a decision.

If you have an ITIN that was issued before 2013, it has expired and you should have already received a notice from IRS to renew it. If you havent used your ITIN on a U.S. federal tax return in the last three years you will need to renew it. For more information, visit ITIN Renewals.

You May Like: Where Do I Find My Agi On My Tax Return

What Are Acceptance Agents

Acceptance Agents are authorized by the IRS to assist you in completing your ITIN application. Some Acceptance Agents do not prepare tax returns. In that case, you must take the completed Form W-7 certified by the Agent to a VITA site or commercial tax preparer and submit it with the tax return.

Acceptance Agents are often found at colleges, financial institutions, accounting firms, nonprofit agencies and some Low Income Taxpayer Clinics. Commercial tax preparers who are Acceptance Agents often charge a fee that can range from $50 to $275 for completing the Form W-7. There is no fee for applying directly with the IRS.

Visit the Acceptance Agent Program on the IRS website for a list of Acceptance Agents by state that is updated quarterly. Low Income Taxpayer Clinics may also be able to help identify local Acceptance Agents.

Note to organizations:

You may want to become an Acceptance Agent. To do so, your organization must:

Request For Copies Of Returns

Q. How do I request a copy of a tax return I have filed?

A. In order to give you this information, please provide your social security number, name, your filing status for that year, the amount of refund or balance due, and your address on the return at that time. You may email your request by clicking the personal income tax email address in the contact file, or contact our Public Service Bureau at 577-8200.

Recommended Reading: How To File Taxes When You Moved States

Social Security Retirement Benefits Vs Ssi

Supplemental Security Income benefits are considered to be assistance, which means they arent taxable. Like welfare benefits, they dont have to be reported on a tax return. However, the IRS differentiates between Social Security retirement benefits and SSI paymentsSSI payments are not taxable, but benefits may be. Retirement benefits are sometimes completely non-taxable, but it depends on a retirees other sources of income.

Unlike Social Security, which you pay into over the course of your working years, SSI isnt funded by taxes contributed by you. Rather, its funded by the federal governments tax revenues.

The distinction can be confusing, because its possible for someone over age 65 to collect both SSI and Social Security retirement benefits. The Social Security Administration oversees both programs, and beneficiaries use the same application for both payments.

Dont Miss: Social Security Office Sikeston Mo

Up To 85% Of A Taxpayer’s Benefits May Be Taxable If They Are:

- Filing single, head of household or qualifying widow or widower with more than $34,000 income.

The Interactive Tax Assistant on IRS.gov can help taxpayers answer the question Are My Social Security or Railroad Retirement Tier I Benefits Taxable?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS.

Read Also: Which States Have No Income Tax

Reporting Income To The Social Security Administration

Although SSI benefits aren’t taxable, you must nonetheless report all sources of your income to the Social Security Administration if you’re collecting SSI. But you do not have to report SSI income to the IRS. The distinction isn’t so much whether benefits are reportable, but to whom they’re reportable and why.

You must report all sources of income to the SSA because your need for financial support might be partiallyif not entirelyerased if you come upon another source of income. This extra income could mean that you would no longer be eligible for SSI.

Understandably, the SSA wants to know about this turn of events. Likewise, if you should become employed so you’re earning , that would most likely reduce your benefits. However, it may not completely eliminate your benefits.

Spousal Tax Relief Eligibility Explorer

Many married taxpayers file a joint tax return because of certain benefits this filing status allows. If you did so, you may be held responsible for monies due, even if your spouse earned all of the income – And this is true even if a divorce decree states that your spouse will be responsible for any amounts due on previously filed joint returns.

To qualify for Spousal Relief, you must meet certain conditions.

Recommended Reading: Where Can I File My Taxes

Can You Claim Your Internet Bill On Taxes

Since an Internet connection is technically a necessity if you work at home, you can deduct some or even all of the expense when it comes time for taxes. Youll enter the deductible expense as part of your home office expenses. Your Internet expenses are only deductible if you use them specifically for work purposes.

Know The Earnings Limits

Those hoping to work in retirement need to be especially careful if they’re planning to claim Social Security benefits early. Even if youâre just working part-time, itâs important to consider how that continuing income will affect your benefits.

The SSA caps how much you are allowed to earn if you start taking your benefits before full retirement age, which is 66 for most baby boomers. For the most recent annual earned income cap, view the current annual contribution limits. For every $2 you earn over the limit, the SSA withholds $1 off the top of your benefits. Once you reach the year that you’ll turn full retirement age, the earned income cap goes up, and for every $3 you go over, itâs a $1 withholding during the months until your birthday.

There is some good news, however: Because the penalty is determined by your individual earned income, if you retire early but your spouse doesn’t, your spouse’s earned income will not be factored into the earnings limit. Additionally, when you reach your full retirement age, the earnings limit disappears and Social Security will recalculate your benefit amount if you were negatively impacted by the earnings limit.

Keep in mind, if you file your tax return jointly, your spouse’s earnings will be included when calculating your combined income for purposes of determining the taxation of your benefits.â1

Read Also: How To Calculate Payroll Tax Expense