Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

How Much Do I Owe The Irs 4 Ways To Find Out

No one wants to owe the Internal Revenue Service. Ideally, youd pay the exact right amount of income taxes and be on your way without a second thought. Or maybe youd just end up with a surprising but welcome tax refund once you file. But thats not always what happens.

Sometimes, an unexpected amount of back taxes can pile up. You may know you have a federal tax balance but still wonder, How much do I owe the IRS? Dont wait for those scary IRS notices to find out. We can help you figure it out, using one of four easy methods.

How Do I Find Out If I Owe Ohio State Taxes

Ohio State TaxStatusTaxescanstatusOhioOhioTaxationOhioandifowes

. Consequently, how do I find out if I owe state taxes?

You can find out if you owe state taxes using one of several free methods. Visit the state’s Department of Revenue website. Some states list delinquent taxpayer information online, depending on how much you owe. In many cases, a state will file a tax lien against a person who owes back taxes.

Similarly, how do I pay my Ohio State taxes? We also accept credit card payments by telephone and online through Official Payments Corporation .

One may also ask, how do I look up a tax lien in Ohio?

1) Contact the Ohio Attorney General’s office at 614-466-4986 to see how much you owe. The Common Pleas Court does not collect the tax. It must be paid to the State of Ohio, usually through the Attorney General’s office.

Who do I make my Ohio State Tax check out to?

If you have already e-filed your Ohio tax return you would need to mail in the Ohio IT 40P payment voucher along with your check or money order, make payable to Ohio Treasurer of State. The payment voucher should be included with your printed tax return.

Recommended Reading: Do They Take Taxes Out Of Doordash

How Does The Refund Offset Process Work

Certain government agencies can submit eligible delinquent debts for inclusion in state and federal offset programs.

Claims eligible for offset include eligible debt owed to:

- Virginia Tax

- The Department of Social Services

- Other Virginia state agencies and courts

- Local Virginia governments cities, towns, or counties

- The IRS

- Some federal government agencies

Before we issue a refund, our systems check against these claims. If there is a pending claim, or multiple claims, we will withhold or reduce your refund by the amount of the debt owed. We will send you the details of the debt, including the agency making the claim, how much of your refund was applied or withheld, and a phone number to call in case you have questions.

Individual and business tax refunds are subject to offset for debts from most agencies, however claims for federal non-tax debts can only be applied to individual income tax refunds.

If you have a remaining refund after your debts are paid, we will send you a check for the leftover amount.

Why Do I Owe If I Didnt Owe Last Year

If you owe taxes that you didnt owe last year, it may be due to some changes in your life, such as:

Older Children A change that was made in the tax reform was the Child Tax Credit increase. It is $2,000 for children who qualify. Nevertheless, only children who were less than 17 years old at the end of the year will be able to claim the credit. Otherwise, you can only claim a $500 credit for the other dependents.

Job Changes Has there been any job change for you or your spouse? If so, a new Form W-4 should have been completed. If you made some changes in how you filed it, it may be why it affected your situation.

Side Job If you are a contract worker or freelancer, then you will have to pay quarterly taxes too. You will be responsible for keeping up with payments since you have no paycheck withholding. You may owe taxes to the IRS if you are a freelancer and you havent been paying the estimated quarterly taxes.

Income changes or students who were previously able to claim the American Opportunity Credit, yet became ineligible due to an enrollment status change may also affect the tax situation.

Filling Changes If you went through a divorce, marriage or you got a dependent, the filing status for which you are eligible and the way youre taxed can change. This might affect your tax bracket thats why you might owe taxes now.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Request Account Transcripts From The Irs

You can request your account transcripts online or have them delivered to you by mail. Account transcripts only cover a single tax year, but you can request multiple years of transcripts.

Keep in mind that your account transcripts wont reflect the most up-to-date information about how much you owe. Recent payments, tax assessments, or interest and penalties accrued may not show on your tax transcripts.

You can request your transcripts online by registering and providing the following information:

- SSN

- Mailing address from your most recently filed tax return

- Access to your email account

- Your personal account number from a credit card, mortgage loan, home equity loan or line of credit, or auto loan

- A mobile phone with your name listed on the account

You can access your account transcript for the most recent tax year and up to 10 prior tax years online. If you are unable to verify your identity, you wont be able to request your transcripts online.

You can also request your transcripts be delivered by mail, by mailing or faxing Form 4506-T, Request for Transcript of Tax Return, or by calling the automated phone transcript service at 1-800-908-9946. If you request transcripts by mail or phone, you can only receive account transcripts from the current year and the previous three tax years.

A tax professional can also request transcripts on your behalf and help you understand what the information on the transcripts means.

Preventing A High California Tax Bill

To prevent unexpectedly high tax bills in the future, carefully manage your income tax withholdings and estimated payments. Learn what the current tax rates are, withhold sufficient amounts from your paycheck or pension payment. If you are self-employed, your estimated tax payment should be increased.

If you live in the state of California or any of the other 42 states that levy an income tax, and you earn an income in one of those states, you will owe state income tax. Always check the tax law in every state you receive earnings from or have lived in to avoid tax penalties at the state level.

Also Check: Taxes For Door Dash

How To Avoid Owing More In State Taxes

If you want to avoid having to ask why do I owe state taxes next year, there are some things you can do to plan ahead. First, check your tax withholding with your employer to see if youre withholding the appropriate amount based on what you earn, your filing status and the deductions or credits you anticipate taking. If necessary, you can fill out a new Form W-4 to update your withholding.

If youre self-employed, review what youre paying in estimated quarterly taxes. Estimated quarterly tax payments allow you to pay into the federal and state tax systems through the year in place of an employers withholding. If you owed state taxes because you underpaid your quarterly taxes, then you may need to increase what you pay in each quarter.

Next, consider any life changes that may have impacted your tax filing. For example, if you got divorced or separated and had to change your filing status that can affect how youre taxed. But you might be able to offset the possibility of a bigger state tax bill by increasing your deductions or qualifying for tax credits.

What Is My Tax Illinois

MyTax Illinois is a free online account management program that offers a centralized location, provided by the Illinois Department of Revenue, for businesses to register for taxes, file returns, make payments, and manage their tax accounts. Most of these features require the taxpayer to create a MyTax Illinois account.

Read Also: How To Do Taxes With Doordash

How Do State Taxes Differ From Federal Taxes

The Internal Revenue Service of the federal government administers income taxes for the entire United States, according to the federal Internal Revenue Code. However, state income tax codes can and do differ from federal law. Each of the 43 states taxing income has different tax laws. Additionally, states can charge sales and use tax there is no federal sales tax.

Each state has its own department of revenue and may have very different tax refund statuses. Before filing in any state, check its specific tax laws or consult a tax professional specializing in that state. California, for example, sometimes differs from the IRS on due dates for estimated quarterly taxes.

When Does Illinois Start Issuing The Real Id

The Illinois SOS has begun issuing federally-compliant REAL ID drivers licenses in addition to non-compliant drivers licenses. As of October 1, 2020, the REAL ID will function as federal identification for domestic travel and entry into federal and military buildings your standard license will not after this date.

Read Also: Is Freetaxusa Legit

How To Resolve Tax Debts Prior To Collection

It is important to resolve any outstanding tax you owe as soon as possible. Penalty and interest will be added to your debt and will continue to grow until the amount is paid in full. Penalty charges can range from 25% to 500% of the tax due, depending on the type of the tax!

If you do not pay your taxes, you may receive a LETTER OF INQUIRY, NOTICE OF INTENT TO ASSESS, and/or a BILL FOR TAXES DUE . This is your opportunity to resolve the debt prior to having the debt referred to collections, by either paying the amount due, appealing the assessment, or entering into an Installment Agreement. Do not wait for the Collection Services Bureau to contact you! You must immediately take action to resolve your debt to avoid collection enforcement action.

The Different Types Of Taxes You Could Be Paying

Some states have a flat tax rate on incomes, also known as the fair tax. In Pennsylvania, the flat tax rate in 2020 was 3.07%, meaning that someone who earns $100,000 would only pay $3,070 in state income tax. There are only 8 states that have a flat tax rate in income, respectively Michigan, Utah, Indiana, Colorado, Illinois, Pennsylvania, North Carolina, and Massachusetts.

Other states have no income tax, but that doesnt mean there are no taxes paid to the state. For example, these states may still have to deal with other taxes, including gasoline tax, property taxes, cigarette tax, and sales tax. The seven states with no income tax are Florida, South Dakota, Texas, Wyoming, Washington, Nevada, and Alaska.

There are also some graduated tax rates that the remaining 36 states and the District of Columbia use. This framework is similar to the one used by the federal government. Under this type of tax, a person would have their income taxed in different brackets at different rates, which increase when the annual income also grows. However, there are fewer brackets compared to the federal tax code, and also lower tax rates.

State income tax can also be individual or corporate.

Also Check: Do You Have To Report Income From Plasma Donations

Mailing The Irs: How To Check Your Balance Owed By Mail

Keep every IRS notice you receive related to your taxes owed. If you owe taxes for multiple years, you may receive different notices with amounts for each year. You also may not have received notices for the most recent tax periods yet.

You can request your tax transcripts by mail to determine how much you owe. However, each account transcript will only show how much you owe for one specific tax year, and the penalty and interest amounts may not be up-to-date.

Contact Tax Industry To Find Out How Much You Owe

Working with a tax liability professional is the simplest way to determine your total debt. At Tax Industry, we have a team of experts specialized in tax resolution.

With their services, you can avoid lengthy processes of contacting the IRS. Further, they can help you negotiate favorable installment repayment terms and forgiveness programs. Contact us now to consult with a tax liability expert.

Read Also: Does Doordash Provide W2

Collection Process For Delinquent Taxes

Taxpayers are required to meet certain obligations under Michigan law. You are responsible for filing your tax returns on time with correct payments and ensuring that your returns are correct no matter who prepares them. Remember, you are responsible for the information in your return.

The following information will provide an overview of the Collection Process for Delinquent Taxes.

Why Did I Not Receive A State Tax Refund

Don’t Miss: Doordash Driver Tax Calculator

What Is The Office Of State Revenue In Queensland

Revenue and taxation Queensland Treasury The Office of State Revenue, as a part of Queensland Treasury, administers duties, payroll tax, land tax, royalties and home owner grants in Queensland. The Office of State Revenue, as a part of Queensland Treasury, administers duties, payroll tax, land tax, royalties and home owner grants in Queensland.

Balance Owing On Your Tax Return

If you have an amount on line 48500, you have a balance owing.

Your 2020 balance owing is due on or before .

You should file your tax return, pay any amounts you owe, or make a post-dated payment to cover your balance owing by the due date to avoid paying interest and late-filing penalties. If your balance owing is $2 or less, you do not have to make a payment.

Recommended Reading: Efstatus.taxact.com.

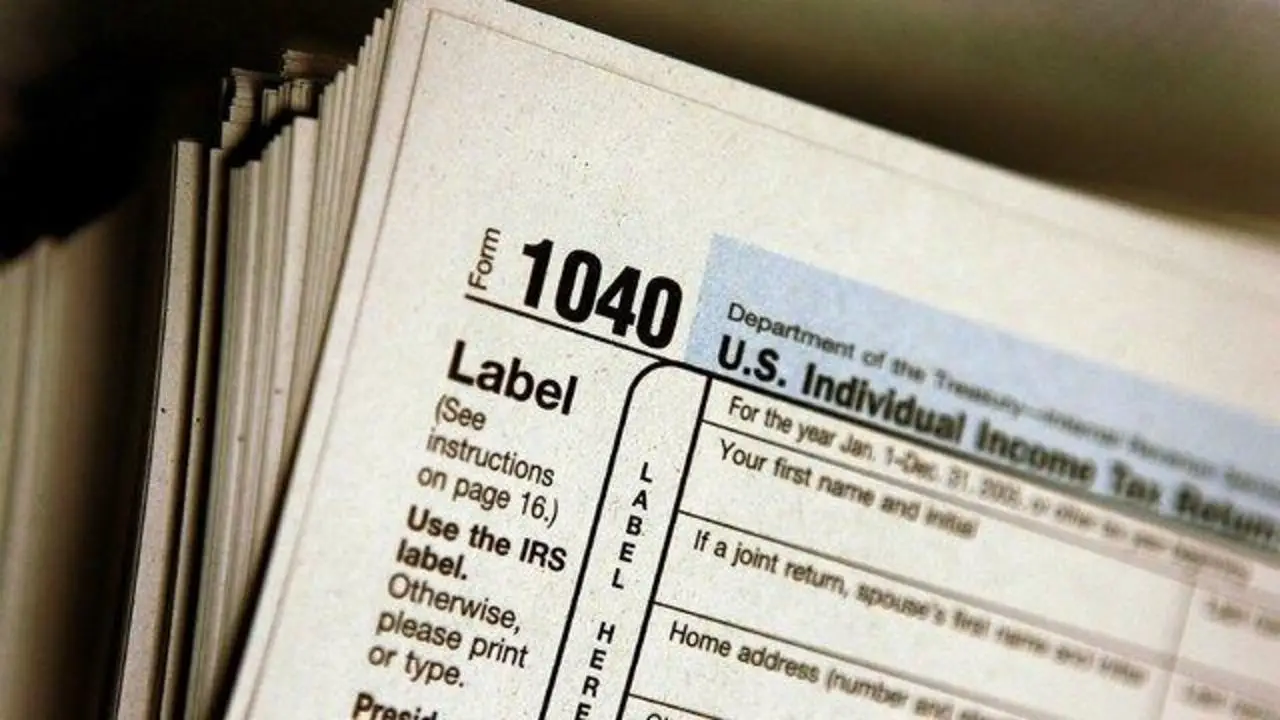

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

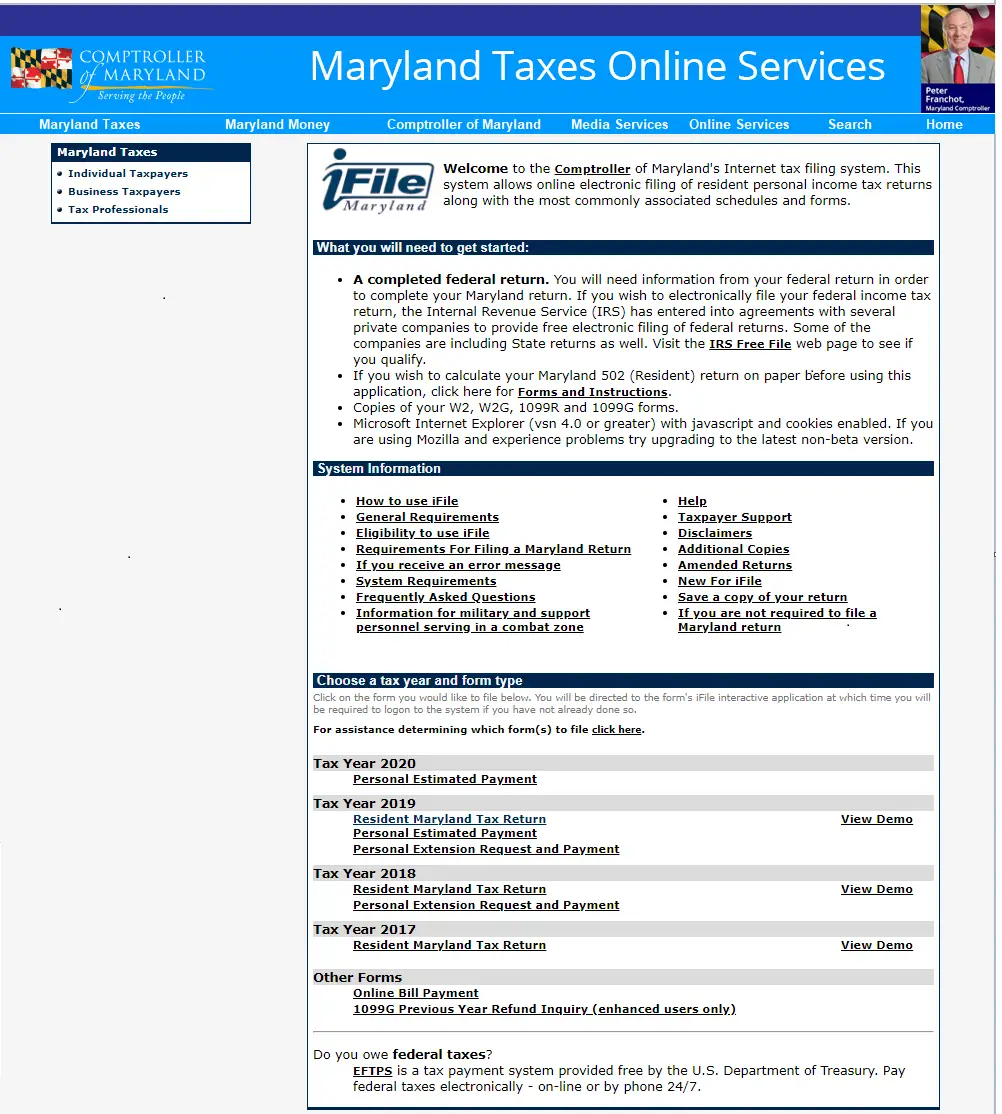

Notice Of Income Tax Assessment

A Notice of Income Tax Assessment is issued when there is no response to an initial notice or when a tax liability is not resolved or paid within the time indicated on the initial notice. The NITA includes updated interest and a penalty of up to 25% based on the unpaid tax. Appeal rights are provided on this notice.

The Compliance Program Section conducts numerous audits to ensure that tax returns filed with the State of Maryland are in compliance with federal and Maryland income tax laws. Listed below are some of our most common audit programs. You may have received a notice if one of our programs indicated that we need more information, made an adjustment, or an assessment. Look up your notice under “I Received a Notice” to learn more about a notice you may have received.

Statute of Limitations

Generally the Comptroller’s Office has three years to audit a tax return from the due date of the return or the date the return was filed, whichever is later. However, there is no statue of limitations when there has been a change made to the federal return by the IRS and the taxpayer fails to notify the Comptroller’s Office within ninety days of the final determination by the IRS. If the Comptroller’s Office is notified within the ninety days, the Comptroller’s Office has one year to assess the deficiency.

If you have question regarding any of our audit programs, you may call 767-1966 or toll free at 1 648-9638.

If you need additional help, please contact us to Get Help!

Also Check: Look Ein Number

Consulting Tax Relief Professionals

The best way to determine your tax debt is by consulting liability experts. Such include tax attorneys, CPAs, and enrolled agents.

When working with these experts, all you need is to provide them with various identifying details. After that, they will determine the exact amount you owe, including penalties.

The main benefit of working with tax liability experts is that you will have an accurate figure of your debt. Besides, they can guide you in selecting a repayment program that is suitable for your financial status.