Tax Benefits For Nebraskans

Account owners are eligible to receive a Nebraska state income tax deduction of up to $10,000 for contributions made to their own NEST accounts.2Contributions made beyond the $10,000 mark cannot be carried over to a future year.2

For minor-owned or UGMA/UTMA NEST accounts, the minor is considered the account owner for Nebraska state income tax deductions. The minor must file a Nebraska tax return for the year their contributions are made to be eligible for a tax deduction for their contributions. In the case of a UGMA/UTMA NEST account, contributions from the parent/guardian listed as the Custodian on the UGMA/UTMA NEST account are also eligible for a Nebraska state tax deduction.

Both the contribution and earnings portion of funds that were deposited into a NEST account from a non-Nebraska 529 plan are eligible for the tax deduction.

How Do I Report 529 Contributions On My Taxes

A 529 plan cannot be deducted from your paycheck as an IRA, and therefore you will not have to file a tax return for it. The investment earnings in your account cannot be reported until they are withdrawn from the accounts. During the course of their lifetimes, taxpayers are able to minimize their income tax payments through a 529 plan.

Watch Your Earnings Build

Your NEST contributions are made with after-tax dollars and earnings grow federally and state tax-deferred while invested. So you dont have to pay taxes on the money youre earning while its in the Plan. Any investment growth is yours to use for college expenses.

When its time to use those funds for school, withdrawals can be tax-free if the funds are used for qualified college expenses like tuition, books, and equipment.1

- There is a $500,000 contribution limit for each beneficiary.

- Nebraska account owners receive significant tax advantages for investing in NEST, including up to an annual $10,000 state income tax deduction.2

- Account owners can receive 529 plan tax advantages regardless of where they live.

Don’t Miss: Do You Pay Taxes With Doordash

Tax Deduction Rules For 529 Plans: What Families Need To Know

- Tax Deduction Rules for 529 Plans: What Families Need to Know

April is generally tax season . While filing and paying taxes can be painful, governments offer several deductions that can reduce a familys tax burden and increase any possible refund. Families who invest in 529 plans may be eligible for tax deductions. A 529 plan can be a great alternative to a private student loan. This article will explain the tax deduction rules for 529 plans for current and future investors.

Compound Interest Is A Superpower For Growth

There are other factors to help build up your 529 plan as well as the tax benefits. Compound interest is a major source of growth for any savings program. For a 529 college savings plan, the compound interest is accrued not just on the original contribution but on every contribution. Compound interest is also added to the 529 investment options earnings and the already accumulated interest.

If you would like to see the power of compound interest, use this calculator from U.S. Securities and Exchange Commission to input your information to see how compound interest can build up your college savings account.

The effect of compounding is especially powerful over a long time period as the amount of earned interest can grow larger and larger. This is an excellent reason to start as 529 fund as early as possible for your child.

You May Like: Dasher Tax Form

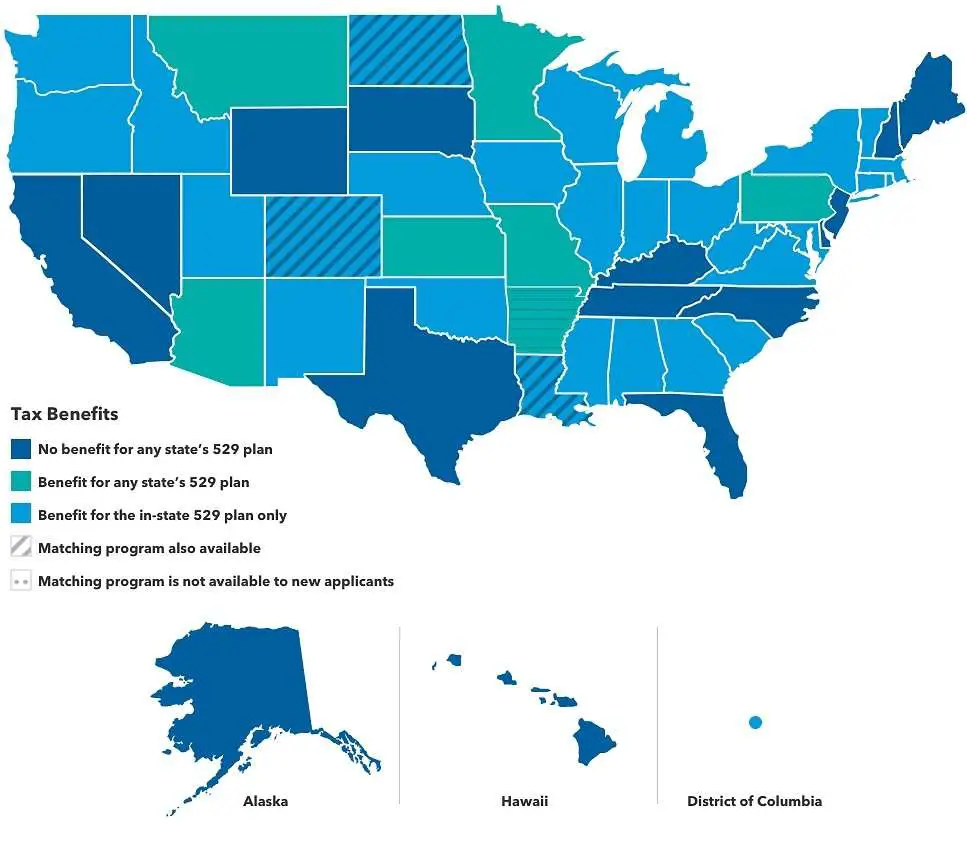

States That Offer Tax Deductions For Any 529 Plan

Although the tax advantages of making 529 plan contributions are typically limited to donations to in-state plans, there are seven states that offer an income tax deduction on additions to any plan, even those administered by other states. If you live in one of the following places, you can enjoy state tax benefits on contributions to whatever 529 plan suits your familyâs needs:

- Arizona â Up to $2,000 per year per person can be deducted on any 529 plan

- Arkansas â Up to $5,000 per year per person for in-state 529 plans, or up to $3,000 per person per year for out-of-state plans rollover contributions qualify for a deduction of $7,500 per person per year

- Kansas â Up to $3,000 per person per year rollover contributions not deductible

- Minnesota â Up to $1,500 per person per year tax credit also offered

- Missouri â Up to $8,000 per year per person, but only for account owner or their spouse

- Montana â Up to $3,000 per person per year, but only account owners are eligible

- Pennsylvania â Up to $15,000 can be deducted per person per year rollovers are not eligible

States That Offer Tax Deductions For In

If you donât live in one of the states listed above, thereâs a good chance that your state offers some kind of tax benefit for contributions to in-state 529 plans. Residents of the following states may want to consider the advantages of enrolling in their stateâs plan, though the tax breaks donât always outweigh the benefits of other 529 plans.

Recommended Reading: How To Take Out Taxes For Doordash

Withdrawals And Interest Aren’t Taxed

California does afford a small tax break for 529 plans. Funds that are withdrawn to pay for qualified educational expenses won’t be taxed as income. That also applies to earnings on the contributions. So if a grandparent contributed $50,000 to a 529 and it earned $10,000 in interest, you can take out $60,000 for qualified college expenses for your child without counting it as income.

States With No Tax Savings

Some states have no deduction or credit for 529 plan contributions. If you are a resident of one of these states, there are still plenty of 529 plan options but no tax breaks for utilizing them.

If you live in one of these states, your best option is to choose a state plan that has low fees and offers the type of investment options you want. In most cases, you do not need to be a resident of a state to invest in a state plan.

Even if you don’t get upfront tax breaks from your state for contributing to a 529 plan, you will still get federal tax benefits down the road as long as you withdraw from them properly.

You May Like: Does Doordash Withhold Taxes

What Is A 529 Plan

A 529 plan named after Section 529 of the Internal Revenue Code is a tuition account established and operated by a state. The plan allows a family to set money aside for a students education. All 50 states and Washington, D.C., offer 529 plans.

There are two types of 529 plans. Both, as explained in more detail later, offer significant tax advantages.

With a prepaid tuition plan, the family identifies a qualifying institution of higher education. The familys contributions go toward the schools tuition and fees. Prepaid plans usually do not allow families to prepay room and board. The primary benefit of prepaid tuition plans is that they are guaranteed to increase in value at the same rate as college tuition, giving families peace of mind.

An education savings plan is a type of investment account where families can save for college. However, unlike a prepaid tuition plan, funds from an education savings plan can be used for tuition and room and board.

How Much Can You Contribute

You can deposit however little or much you want, as there are no contribution requirements. As long as the account balance does not exceed $520,000, all contributions are welcomed.

However, you should consult your tax advisor to learn of any possible gift tax your contributions may be subject to if you donate high amounts in a year.

Read Also: Wheres My Refund Ga State

The Cost Of 529 Plans Is Set To Rise

As 529 plans mature and more families use them to fund college costs, the price tag to the U.S. Treasury will also rise, unless some reforms are undertaken. Over the next decade, the federal government is set to spend almost $30 billion on 529 tax expenditures, according to Treasurys Office of Tax Analysis. Annual costs are projects to be just under $4 billion by 2026.

Is Contributing To A 529 Tax Deductible

A contribution to a 529 plan is never deductible under federal tax law. A few states may allow tax deductions on 529 contributions, however. If you are eligible, check with the 529 plan you have or your state. Getting some type of tax credit in exchange for saving for college or higher education is possible with a 529 plan.

Don’t Miss: How Do Taxes Work With Doordash

Can A Parent Contribute To A 529 Plan And Claim A Tax Deduction

Gifts to 529 plans can be deducted from state income taxes. In a recent study, Fidelity said 84% of parents who were surveyed would welcome a college savings gift over a traditional gift. This year, it was announced that tax incentives would be awarded for contributions to a 529 plan as a Christmas gift to a gift recipient.

Maximizing The Tax Benefits Of 529 Plans

You are here:

By Kelley Hope, Communications Officer, Virginia529

Tax benefits of 529 plans make them especially attractive to families and individuals looking to maximize their savings. However, thinking about those advantages only when choosing or setting up a plan can cause one to miss out on valuable account growth opportunities, possibly for years down the road.

While making contributions, consider these important questions each year : Am I taking full advantage of a state tax benefit for contributions to my 529 plan? Can I direct deposit a tax refund to my 529 plan?

If youve begun using your account for higher education, ask these questions about withdrawals: What expenses qualify for tax-free withdrawals? How does use of my 529 plan coordinate with other available tax programs, such as the American Opportunity Tax Credit?

Tax benefits for contributionsWhile there is no federal income tax deduction for contributions to a 529 plan, many states offer taxpayers a deduction or credit on personal income tax returns for contributions made to the in-state program. Some states allow a deduction or credit for contributions to any 529 plan.

About the Author

See more

Read Also: Www..1040paytax.com

Is It Better For A Parent Or Grandparent To Own A 529 Plan

How Grandparent 529 Plans Affect Financial Aid. Overall, 529 plans have a minimal effect on financial aid. But, the FAFSA treats parent-owned accounts more favorably. For example, you report 529 plans assets as parent assets, which can only reduce aid eligibility by a maximum 5.64% of the account value.

Managing Cash Flow While In College

Many parents stop making contributions now that their students have arrived at college. This is a mistake and a loss of opportunity. As long as it makes sense, you should still consider contributing to your students CHET 529 account.

If youre up in the air between contributing to your CHET 529 plan or using your cash flow to pay for college, keep in mind that you only get the tax deduction for contributions made to your CHET 529 account.

Also Check: Http Efstatus.taxact.com

Plan Contributions For K

The Tax Cuts and Jobs Act of 2017 expanded the definition of 529 plan qualified expenses to include up to $10,000 in K-12 tuition per year, per beneficiary. However, some states have not conformed with the federal law and consider K-12 tuition a non-qualified 529 plan expense. Families in non-conforming states who use 529 plan funds to pay for K-12 tuition may be subject to state income tax on the earnings portion of the non-qualified distribution, and state income tax benefits may be subject to recapture.

How Much Of My Childs College Tuition Is Tax Deductible

Students can qualify for a partially-refundable tax credit worth up to 2,500 dollars on a per-student per year basis. A student is covered by the AOTC for 100% of the first $2,000 in tuition, fees, and course materials per year and 25% of the second $2,000 once the student has reached the first $2,000 mark.

Don’t Miss: How To Get A License To Do Taxes

Which State Plan To Choose

Tax deductions and credits are great, but they may not add up to much if your states 529 plan charges high fees. Be sure to check on the fees for your states plan . Shop around and compare those fees to those of other states. Other important considerations are investment performance and whether the plan includes investment options, such as target-date funds.

Who Can Open An Account

Any U.S. resident can open a New Yorks 529 College Savings Account. You do not have to be a New York state tax payer or resident.

Moreover, you do not need any knowledge of mutual funds. Vanguard Inc. and Ascensus Broker Dealer offer several easy-to-digest investment options for you to choose from. The age-based investment path is one that stands out, but you do not have to choose it if you dont want to.

You May Like: Pastyeartax Com Review

Wondering How To Save For College

A 529 plan is an excellent way to save for the future, but only if youâve done your homework. As a student loan attorney, Iâm well-versed in the ins and outs of saving for college and would love to help you select the best plan. Just schedule a free 10-minute consultation.

Subscribe to receive the best student loan information and suggestions delivered directly to your inbox. to stay up to date on all you need to know about student loans.

Stop Stressing.

Hey, Iâm Tate.

I’m a student loan lawyer that helps people like you with their federal and private student loans wherever they live.

What Are 529s And How Do They Work

529 plans are state-operated savings accounts, named after Section 529 of the IRS Code that codified them in 1996. The original 1996 legislation deferred tax on undistributed earnings. The Economic Growth and Tax Relief Reconciliation Act of 2001, signed by George W. Bush, then made earnings growth completely tax-free . The provision became permanent in 2006.

Since the mid-2000s, the growth in 529 plans has been considerable. By the end of 2016, total asset values in 529 plans reached $275 billion. But in the general population, 529 plans are little understood and little used in one survey, 72 percent of respondents did not know what they were.

529 plans have several defining features:

- Funds must be used for qualified educational expenditures

- No income-eligibility threshold

- Waiver from the standard gift expensing rule allows families to superfund accounts

- Grandparents are allowed to contribute

- Only a small fraction of 529 assets count in making financial aid calculations2

- Many states offer income tax deductions for contributions

- No residency requirement

A few of these provisions are relatively unusual, so we provide a few more details here.

Qualified educational expenses

Waiver on tax rules for gifts

State-level benefits

Read Also: Doordash Driver Tax Information

Investment Strategies With Which You Can Be Comfortable

Whether youve started saving for your childs higher education before they are born or if you are getting a later start, Ohios 529 Plan offers account strategies based on your childs age. These life milestones are the perfect opportunity to start, ramp up your saving, and take advantage of Ugift and Upromise. Based on your childs age baby to toddler, kindergarten to elementary school, middle school, high school, and college review the appropriate guidance and choose for yourself the best path for your 529 account.

Are Earnings From A 529 Plan Subject To Taxes

Although contributions arenât tax-deductible, the earnings in a 529 account arenât subject to tax treatment by the state or federal government when theyâre used to pay for education.

The growth of your account isnât taxed, either. If you invest $1,000 and earn 5% during a year, youâre not taxed on the $50 you earned.

529 account investments can also be sold and used to pay for eligible education-related expenses without incurring federal income tax if you use the money to pay for those fees.

How do I claim 529 contributions on my taxes? You donât have to claim 529 contributions on your federal taxes because theyâre exempt. If you received a form 1099-Q from a 529 plan distribution, you only have to report those earnings on your federal taxes if they were not spent on qualified education expenses .

You may be taxed on the earnings by your state if you use the funds for non-qualified expenses. There may also be other tax consequences, such as an additional 10% federal tax.

If you have 529 funds, you can use them on everything from tuition to internet access for a student. After the Secure Act was signed into law in 2019, the rules for using money in a 529 plan were further reduced.

Up to $10,000 can be used by the beneficiaries of 529 savings plans to pay down student loans. 529 plans can also be used to pay for homeschooling, apprenticeships, private elementary, and/or secondary education.

Recommended Reading: Efstatus Taxact Online

Tax Benefits When Contributing To Another State’s 529 Plan

In most cases, you need to contribute to your own state’s 529 plan that is, the one where you live and pay income taxes to receive the state tax benefits.

However, there are seven states that offer “tax parity” on your contributions. This means that you’ll receive the same tax benefit when contributing to any 529 college savings account even if it’s sponsored by another state.

- Arizona

- Montana

- Pennsylvania

Although you can receive state tax benefits in these seven states when contributing to another state’s 529 plan, some states offer incentives to use their plan instead. For example:

- Arkansas offers a larger deduction for those investing in the homegrown Gift529 program up to $10,000 , vs just $6,000 if you invest “abroad.”

- Pennsylvania 529 accounts are exempt from state inheritance taxes, are not counted for state college financial aid calculations, and are protected from state-based creditors.