Employer Registration & Account Update

Use the forms below to register or update your unemployment tax account:

- Employer’s Registration – Status Report – enables TWC to establish a new account for a non-farm employer. Print this form and mail it in or register online.

- Farm & Ranch Employment Registration – Status Report – enables TWC to establish a new account for a Farm or Ranch employer. Print this form and mail it in or register online.

- Amended Status Report – notifies TWC of a change in the status of an employer account. The changes can include a change in officer or owner or the acquisition or sale of a business. The form is for use by employers with existing TWC tax accounts.

- Status Change Form – notifies TWC that a business has been discontinued, business is continuing without employment or the business has been acquired by a successor. The form can also be used to correct a name, tax mailing address, account number, Federal ID number or a telephone number that has been omitted or is incorrect on preprinted tax forms.Note: To change a designated address for receiving notices of unemployment insurance claims filed and determinations made on those claims, see Designate an Employer Mailing Address.

- Notice that Employment/Business Discontinued – notifies TWC that a business has been discontinued or no longer has employees.

- Transfer of Compensation Experience Questionnaire – helps TWC determine if a tax rate issued to the previous owner can be transferred.

Will I Receive Form 5498

Only taxpapers who hold one of the IRA contract types listed above and have made at least one applicable transaction will receive an IRS Form 5498.

If you meet only one of these conditions but not the other, then you will not receive the form. For instance, if you hold a Traditional IRA but did not make any contributions, rollovers, conversions, or recharacterizations to it in the previous tax year, then you should not expect to receive one.

However, the IRS will still receive information on the fair market value of your contract, even if Form 5498 isnt generated. Note that if you are expecting to receive a copy of this form but it hasnt arrived, then there could be other issues at work.

For instance, there may be a shipping delay or an error with your mailing information. Contact your trustee to make sure they have your correct mailing information on file. You may also be able to log into your online account and check the status there.

How Do I Track My Arkansas Tax Refund

To track the status of your Arkansas AR1000F income tax refund online, visit the Arkansas Department of Finance and Administration website and use their Where’s My Refund service. Arkansas Department of Finance and Administration states that electronically filed income tax refunds generally process within 10 days of entering their system. Paper filed Arkansas income tax forms generally process in 6 weeks.

To track the status of your Arkansas income tax refund for 2021 you will need the following information:

- Social Security Number

- Amount of your refund

The requested information must match what was submitted on your 2021 Arkansas Form AR1000F. The Arkansas Department of Finance and Administration refund status lookup service can not be used to query prior year tax returns or amended returns. Contact the Arkansas Department of Finance and Administration service center by phone or mail if you are having trouble using the refund status service or need to look up prior year income tax returns.

To contact the Arkansas Department of Finance and Administration service center by phone or email, use the check your refund status link above. Alternatively, read or print the 2021 Arkansas Form AR1000F instructions to obtain the proper phone number and mailing address.

Also Check: How To Appeal Property Taxes Cook County

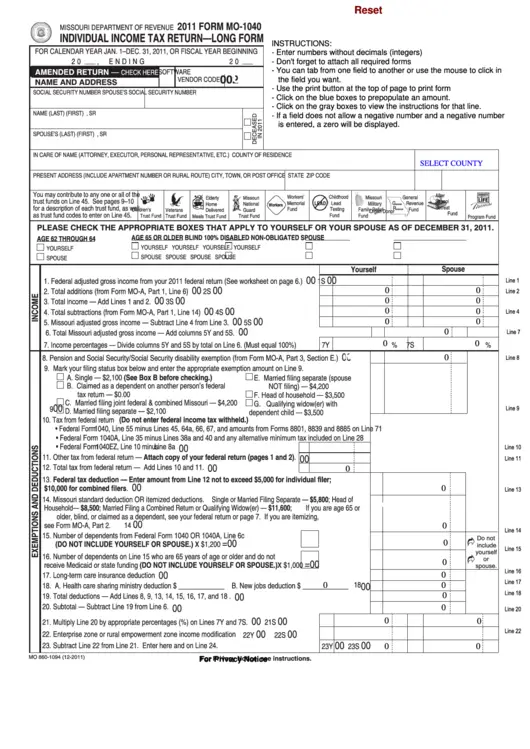

Choose The Right Income Tax Form

Your residency status largely determines which form you will need to file for your personal income tax return.

If you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000.

If you lived in Maryland only part of the year, you must file Form 502.

If you are a nonresident, you must file Form 505 and Form 505NR.

If you are a nonresident and need to amend your return, you must file Form 505X.

If you are a nonresident employed in Maryland but living in a jurisdiction that levies a local income or earnings tax on Maryland residents, you must file Form 515.

Special situations

If you are self-employed or do not have Maryland income taxes withheld by an employer, you can make quarterly estimated tax payments as part of a pay-as-you-go plan, using Form PV. Please refer to Payment Voucher Worksheet for estimated tax and extension payments instructions.

If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020. You should file Form PV only if you are making a payment with your extension request.

If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return.

Individual Income Tax Forms

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2022 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS upon e-file season opening. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

Don’t Miss: Irs Gov Cp63

Are There Specific Reporting Guidelines For Sep

Did your employer make a contribution to your SEP-IRA or SIMPLE IRA this year? If so, then your trustee will report those contributions for the calendar year in which they received them. This is the case regardless of what the specific payment instructions noted.

Keep in mind, however, that you can still deduct the IRA portion of the contribution as required. You will simply need to report this transaction on your individual tax return. If you have any questions about how that process works or how to proceed, then contact your local experienced tax attorneys.

Choose The Right Corporation Income Tax Form

Form 500: Corporation Income Tax Return is used by a corporation and certain other organizations to file an income tax return for a specific tax year or period.

Form 500CR: Business Tax Credits is used by individuals and businesses to claim allowable business tax credits. For tax years beginning after 2012, this form must be submitted electronically.

Form 500D: Declaration of Estimated Corporation Income Tax is used by a corporation to declare and remit estimated income tax.

Form 500DM: Decoupling Modification is used by corporations to determine the amount of required modification associated with the provisions of federal law.

Form 500E: Application for Extension of Time to File Corporation Income Tax Return is used by a corporation to request an extension of time to file the corporation income tax return and to remit any balance of tax due.

Form 500UP: Underpayment of Estimated Income Tax by Corporations is used by a corporation to calculate the amount of interest and penalty for failure to pay the required amount of estimated income tax when due.

Form 500X: Amended Corporation Income Tax Return is used by a corporation to correct an error in a previously filed tax return .

Generally, S corporations, partnerships and limited liability companies should not file a corporation income tax return. These businesses must file as pass-through entities.

- Restart Safari, then try opening the .PDF in the Safari browser.

Tax Forms Containing 2-D Barcodes

Adobe Reader for Mobile

Read Also: Protesting Harris County Property Tax

How Do Form Corrections Work

Your trustee cannot make any changes or corrections to a Form 5498 filed for the previous tax year. This is the case even if you make an excessive contribution and subsequently withdraw a portion of money from the account.

If that happens, then the form will reveal the excessive contribution amount to the IRS. The only action allowed will take place in January of the following year. At that time, the company can file IRS Form 1099-R to reflect the withdrawal that occurred.

While that type of issue is transaction-based, you might wonder what will happen if you notice that your trustee coded a portion of File 5498 incorrectly. In that case, then the issue can be corrected for the tax year in question. However, note that this correction will not take place automatically, so youll need to contact your trustee to learn the next steps.

One caveat? If you notice a coding error for a previous tax year, then those cannot be corrected in retrospect.

Locations To Pickup Tax Forms

OTR Customer Service Center1101 4th Street, SW, Suite W2708:15 am to 5:30 pm

John A. Wilson Building1350 Pennsylvania Avenue, NW, lobby8 am to 6 pm

Judiciary Square441 4th Street, NW, lobby7 am – 7 pm

901 G Street, NWNote: MLK Library is closed for renovations but can be obtained from libraries across the city

Municipal Center6:30 am to 8 pm

Reeves Center7 am to 7 pm

You May Like: Doordash 1099 Example

The $8000 Child Tax Credit That Many Parents May Not Know About

Most U.S. families with children are familiar with the federal Child Tax Credit, given that parents of more than 60 million kids received enhanced payments in 2021. But there’s another tax benefit geared to parents that may be less well known than the CTC but that can be far more generous, providing up to $8,000 in tax credits this year.

The Child and Dependent Care Credit was supercharged through the 2021 American Rescue Plan, with the pandemic aid bill boosting how much parents can claim on their tax returns for child care expenses as well as making it fully refundable. The latter is important because if the tax credit exceeds what you owe the IRS, you’ll get the difference in your tax refund.

The Child and Dependent Care Credit isn’t new it’s been around since the 1970s, and was designed to help working parents offset the cost of daycare, after school programs and summer camps. But the credit hadn’t kept up with the pace of child care costs, with the child advocacy group First Five Years Fund noting in 2018 that it only covered about 10% of the typical annual cost of care for two children in the U.S. at the time.

The expanded Child Tax Credit, by comparison, provides $3,600 for each child under six and $3,000 for children between 6 to 17.

That means tax credits like the Child and Dependent Care Credit are more valuable for taxpayers than deductions and become even more so when they are fully refundable.

What Are The Key Fields To Know

Although you are not personally required to input any information into Form 5498, its important to know the type of data that youll find in the different fields.

On the left side, youll first find contact information about the trustee in charge of overseeing your account. This includes the following information about the company:

- Name

Then, youll see the same information entered about you, or the person who owns the IRA.

Also Check: Tax Write Offs For Doordash

What Types Of Transactions Does It Cover

Form 5498 is used to report certain changes made to your account during the tax year. This can include the following types of transactions:

- Contributions

- Rollovers

- Recharacterizations

This form will also detail the year-end fair market value of your IRA account. Note that for Inherited IRAs, Form 5498 are generated on behalf of the deceased, as well as any beneficiaries.

In terms of recharacterizations, keep in mind that as of January 1, 2018, the Tax Cuts and Jobs Act prohibits you from recharacterizing a rollover or conversion to a Roth IRA. However, you can recharacterize a contribution that youve made to one type of IRA to another type. If you wish to do so, then contact your IRA trustee and instruct them to transfer your contribution amount, including any earnings, to the different contract type.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Read Also: Efstatus Taxact Online

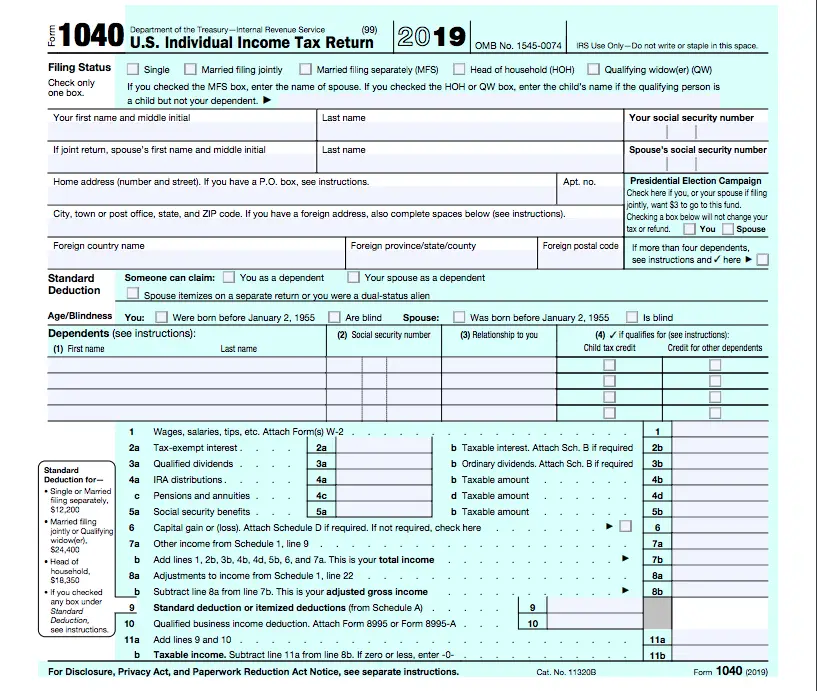

Get Your Refund Faster By Filing Online

Filing income taxes online is usually safer, quicker, and more straightforward. Also, you can get your tax refund a lot faster should you opt for the Direct Deposit method. While there are a few income tax forms to pick from when preparing your federal income taxes, a reliable option is to use IRS Form 1040 when you are unsure if you will be eligible for the 1040A or 1040EZ.

- The standard guideline is: If uncertain, submit Tax Form 1040.

- You have to submit Form 1040 once any of the following apply:

- You have taxable earnings of $100,000 or higher

- You have self-employment earnings of $400 and up

- You had income tax being taken from paychecks

- You made anticipated income tax payments or have overpayment that applies to the current tax year

- You have listed deductions

- You generate revenue from a company, S-corporation, partnership, trust, rental, or farm

- You have sold real estate, stocks, bonds, or mutual funds

- You are claiming revenue alterations

- You got an advance payment for Earned Income Tax Credit from a company

- You have a W-2 that indicates uncollected tax or a W-2 that demonstrates a code Z

- You owe excise tax on insider stock payment

- You are a person in debt in a Chapter 11 personal bankruptcy case

- You make foreign income, paid foreign income taxes, or are claiming tax treaty benefits

- You are obligated to repay any further special taxes

Where Can I Get Arkansas Tax Forms

Printable Arkansas tax forms for 2021 are available for download below on this page. These are the official PDF files published by the Arkansas Department of Finance and Administration, we do not alter them in any way. The PDF file format allows you to safely print, fill in, and mail in your 2021 Arkansas tax forms.

To get started, download the forms and instructions files you need to prepare your 2021 Arkansas income tax return. Then, open Adobe Acrobat Reader on your desktop or laptop computer. Do not attempt to fill in or print these files from your browser.

From Adobe Acrobat Reader use the Ctrl + O shortcut or select File / Open and navigate to your 2021 Arkansas tax forms. Open the files to read the instructions, and, remember to save any fillable forms periodically while filling them in. Print all Arkansas state tax forms at 100%, actual size, without any scaling.

| Other Income/Loss And Depreciation Differences |

Also Check: How To Buy Tax Lien Certificates In California

What Is Irs Form 5498

The full name of this document is IRA Form 5498: IRA Contributions Information. This is the form that your IRA trustee or IRA custodian will use to report your annual IRA contributions to the IRS.

Note that as an individual taxpayer, you will not need to file this form with the IRS, nor should you include it in your tax return. However, your tax advisor can provide you with a copy of the completed form to keep in your records. Still, your copy is for informational purposes only.

This form covers a range of different types of IRA contracts, including:

- Traditional IRAs

- Inherited IRAs

- Deemed IRAs

You will receive Form 5498 for each type of IRA account that you contribute to. For instance, if you have both a traditional IRA and a Roth IRA, then youll receive separate forms for each contract.

Note that a Deemed IRA is a special type of employee contribution plan, set up as a traditional IRA or a Roth IRA. Its added to your employers qualified retirement plan.

While those are the high-level details, theres much more to know. Next, lets take a look at some of the most frequently asked questions about Form 5498.

When Getting Ready To Fill Out Your Tax Forms

Even before you start doing your 1040 tax forms, you need to have the following material ready:

- Valid identification

- Submitting status and Residency status

- Social Security Numbers for yourself

- Birth dates for yourself

- A duplicate of your previous income tax return

- Documents of salary received

- Statements of interest/dividends from finance institutions, brokerages, etc.

- Evidence of any tax credits, tax deductions, or tax exemption

- Your checking account number and routing number

Keep in mind that IRS Tax Form 1040, with the payment amount, is owed by April 15. A 6-month tax continuance may be allowed for overdue submitting. However, payments still have to be made by April 15. You can file Form 1040 by paper mail, via IRS e-file, or by way of a certified tax preparer.

Also Check: Property Tax Protest Harris County