Can You Lower Your Property Tax Bill

If you disagree with a property tax bill on your home, you can contest it by challenging your homes assessed valuation. Youll need to show that the assessed value doesnt reflect your propertys true value. If successful, your appeal could result in a lower property tax bill.

-

Make sure the assessment data is accurate and matches with the details of your property.

-

Gather comparable listings or ask a real estate agent to pull records of comparable sales for you. Often, tax records are available online from the local tax assessor.

-

If youre unsatisfied, you might be able to pursue the case with an independent tax appeals board.

Learn more ways to capitalize on your home

-

Our home affordability calculator will show how much house you can afford to buy.

How Underwriters Calculate Property Taxes On New Construction Homes

This Article Is About How Underwriters Calculate Property Taxes On New Construction Homes

Many home buyers are gravitating towards new construction homes offered by builders.

- The final property tax numbers will not be known until the community has been fully developed

- However, mortgage underwriters will need to determine a number when qualifying and underwriting the borrower

- Property tax calculation is easy on pre-existing homes

- However, estimated property taxes will need to be used on new construction homes

- Underwriters want to make sure they do not underestimate property taxes on new construction homes

- The ability to repay the new housing payment is the main focus of the mortgage underwriter

High property taxes on new construction homes will have an impact on the borrowers ability to repay if the borrower has higher debt to income ratios.

How Assessors Compare Assess Homes

Lets take an example of two homes:

- Each home is built on a standard 0.25 acre lot

- Both homes are 2,000 square feet

- Both homes have three bedrooms, two baths, two car attached garages

- However, home number one cost $200,000 to build and the second home cost $500,000 to build

- The second home has top of the line exterior brick, custom millwork, pond with waterfall, top of the line appliances, top of the line kitchens/bath, finished walkout basement

So is the second home assessed at a higher value than the first comparable home under the assessors eyes? The assessor does not care about the bells and whistles the home has. Home Assessment is based on the square footage, bedrooms, bathrooms, and lot size.

You May Like: Do You Have To Pay Tax On Doordash

What Are Property Taxes

Simply put, property taxes are taxes levied on real estate by governments, typically on the state, county and local levels. Property taxes are one of the oldest forms of taxation. In fact, the earliest known record of property taxes dates back to the 6th century B.C. In the U.S., property taxes predate even income taxes. While some states don’t levy an income tax, all states, as well as Washington, D.C., have property taxes.

For state and local governments, property taxes are necessary to function. They account for most of the revenue needed to fund infrastructure, public safety and public schools, not to mention the county government itself.

You may have noticed already that the best public schools are typically in municipalities with high home values and high property taxes. While some states provide state funds for county projects, other states leave counties to levy and use taxes fully at their discretion. For the latter group, this means funding all county services through property taxes.

To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona.

What If I Dont Pay My Real Estate Taxes

Property taxes, like income taxes, are nonnegotiable, meaning you have to pay them. If you dont, you put yourself at risk of mortgage liens or foreclosure.

A mortgage lien is a claim to your property until you make good on your liability, in this case, property taxes. If you dont pay your taxes, the county can put a lien on your property. This means they have the first claim to the proceeds when you sell the home unless you settled the lien before you sold the home.

Sometimes, a mortgage lien can turn into foreclosure if you wait too long to pay the past-due taxes. In a foreclosure, you lose your home to the county who takes the portion owed to them for the taxes.

Also Check: Doordash 1099 Nec

Can I Reduce My Property Taxes

Maybe. There are a number of ways homeowners can try to reduce their property taxes. Most states offer a property tax exemption for disabled veterans. Some states offer property tax reductions for senior citizens or disabled people without military service. Other states offer tax incentives for homeowners with historic properties. If youre a farmer or own the kind of land that can make you look like a farmer, theres a good chance you might qualify for agricultural property tax breaks. If these dont apply to you, youll be pleased to know many cities allow property owners to appeal the assessed value of their homes. If you can get your homes assessed value reduced, your property taxes will also be reduced.

How Is My Property Tax Calculated

Property tax is based on the assessed value of your property. Manitoba Municipal Relations, Assessment Services branch assesses each property for both the land and the buildings of that property by comparing lot sizes, location, local improvements, building age, size, condition and the quality of the construction.

Property taxes that are collected are provided to school divisions for school taxes and the northern affairs communities to cover the cost of municipal service provided to property owners.

Recommended Reading: Tax Deductible Home Improvements

Where To Find Property Taxes Plus How To Estimate Property Taxes

Thankfully, in many cases, you may not have to calculate your own property taxes. You can often find the exact amount youll pay on listings at realtor.com®, or else you can enter a homes location and price into an online home affordability calculator, which will not only estimate your yearly taxes but also how much you can anticipate paying for your mortgage, home insurance, and other expenses.

Property Tax Rates & Millage

Once the taxable value of a property has been determined by the tax assessor, they calculate the amount of tax due. While every locality has alightly different methods of determining the amount of tax due, the majority of property taxes are collected based on a measurement known as millage.

Millage infers the amount of tax collected per thousand units of property worth. For example, a millage rate of 10 means that for every $1,000 of assessed value the property will be subject to $10 of property tax. This converts to approximately 1% of the property’s assessed value.

Also Check: Do You Have To Pay Taxes On Donating Plasma

How Property Taxes Are Paid

You have options for how to pay your property taxes, though the specific options available to you will be decided at the local level. You may choose to pay property taxes as part of your monthly mortgage payment, or you may instead pay them in annual or semi-annual installments made directly to your local tax authority.

How Much Is My Tax Bill

Your annual tax statement includes the amount of taxes owing as of the date of the statement. If you are making a late payment, you may have been charged with monthly interest. Please contact our office for the up-to-date outstanding amount by toll free number at 1-888-677-6621 or email and remember to include the roll number of the property.

Read Also: Is Doordash 1099

What Can Be Included In The Cost Basis Of A Property

According to accounting pros, its important to consider your cost basis and how its computed as you contemplate a potential sale of your property and how much money you might receive from it. Your cost basis typically includes:

- The original investment you made in the property minus the value of the land on which it sits

- Certain items like legal, abstract, or recording fees incurred in connection with the property

- Any seller debts that a buyer agrees to pay

Qualifying For Mortgage With Direct Lender With No Overlays

Home Buyers of new construction homes who need to qualify for a mortgage with a direct lender with no overlays can contact us at GCA Mortgage Group at 262-716-8151 or text us for a faster response. Or email us at Over 75% of our borrowers are folks who were turned down by other lenders due to their mortgage overlays. We are available 7 days a week, evenings, weekends, and holidays.

Also Check: How Does Doordash Do Taxes

What Is The Education Property Tax Credit Advance How Do I Apply For It

The Education Property Tax Credit is a credit for homeowners and tenants offsetting occupancy costs – property tax for homeowners and 20% of rent for tenants â payable in Manitoba. The Advance is the Education Property Tax Credit applied directly to the municipal property tax statement for homeowners.

The Education Property Tax Credit Advance can only be claimed on a homeownerâs principal residence. The maximum Education Property Tax credit is $700.00. If the EPTCA is not included in you tax bill, you can apply for the credit in the following ways:

- If you notify our office before the printing of the property tax bill for the year, we could directly apply the credit to your tax bill starting in that year.

- If you notify our office after the printing of the property tax bill for the year, you may claim the credit on your personal income tax return for that year and will receive the credit on your property tax bill in subsequent years.

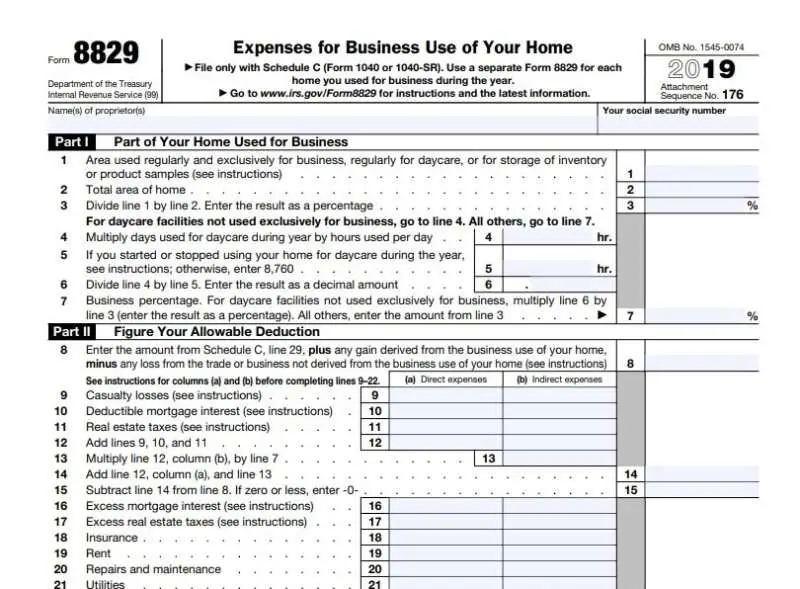

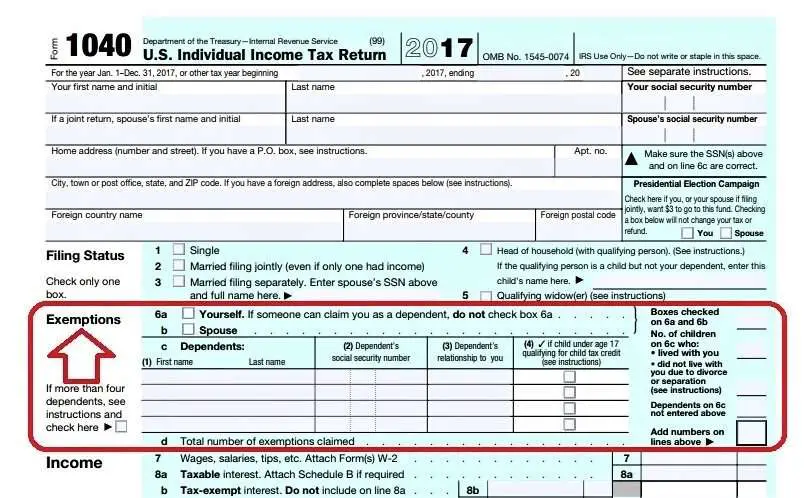

Claiming Property Taxes On Your Tax Return

OVERVIEW

If you pay taxes on your personal property and owned real estate, they may be deductible from your federal income tax bill. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas, and some agencies also tax personal property. If you pay either type of property tax, claiming the tax deduction is a simple matter of itemizing your personal deductions on Schedule A of Form 1040.

Apple Podcasts | Spotify | iHeartRadio

Recommended Reading: Doordash Take Out Taxes

Establish An Escrow Account

If you financed your house, you might be able to set up an escrow account to pay your taxes. Your escrow payment will increase your monthly mortgage payments, but some borrowers are required to have an escrow account.

An escrow account is a separate account set up with your mortgage provider or mortgage servicer. Your servicer will estimate your property taxes for the next year, then break that amount into 12 payments added to your monthly mortgage payment. That money is put into an escrow account and the lender uses that account to pay the taxes for you when theyre due.

Lenders often require an escrow account to avoid borrowers from defaulting on their property taxes. You may apply for an escrow waiver if you dont want an escrow account, but a lender doesnt have to approve it. Approval depends on your loan to value ratio, payment history and the age of your loan.

If you include an escrow account with your mortgage payment, your total monthly payment would include principal, interest, real estate taxes and mortgage insurance monthly.

What Is A Homes Assessed Value

One factor that affects your property taxes is how much your property is worth. You probably have a good understanding of your homes market valuethe amount of money a buyer would pay for your place.

Still, tax municipalities use a slightly different number its called your homes assessed value.

Tax assessors can calculate a homes current assessed value as often as once per year. They also may adjust information when a property is sold, bought, built, or renovated, by examining the permits and paperwork filed with the local municipality.

Theyll look at basic features of your home , the purchase price when it changes hands, and comparisons with similar properties nearby.

Sometimes a homes assessed value will be strikingly similar to its fair market valuebut thats not always the case, particularly in heated markets. In general, you can expect your homes assessed value to amount to about 80% to 90% of its market value. You can check your local assessor or municipalitys website, or call the tax office for a more exact figure for your home. You can also search by state, county, and ZIP code on publicrecords.netronline.com.

If you believe the assessor has placed too high a value on your home, you can challenge the calculation of your homes value for tax purposes. You dont need to hire someone to help you reduce your property tax bill. As a homeowner, you may be able to show how you determined that your assessed value is out of line.

Also Check: How To Get Pin To File Taxes

Assessment On Rentals Versus Owner Occupant Homes

Not all single family homes are owner occupant homes.

- Many homeowners do not necessarily sell their owner occupant homes when they upgrade to a larger home

- They may decide in keeping their exiting home as a rental

- Or homeowners who recently purchased a home may get a job transfer to another state without notice and may need to rent out their owner-occupant home

- There are homeowners who rather rent out their exiting home and keeping it as an investment home than selling it

- County Assessors can use the income assessment method on investment rental properties

- Way on how the income assessment method works are it takes into consideration on what the property owner makes after they have satisfied maintenance and other costs of the rental property

- The assessment value of the subject income property is derived after the assessor analyzes the investment property

Investment property owners normally pay higher property taxes than owner occupant homeowners.

What Happens If Property Taxes Are Not Paid

Payment of property taxes is a legal obligation of property owners, as taxes are the means by which local residents contribute to the cost of education and local services in their community. Failure to pay taxes result in a loss of revenue, impacting the communitiesâ ability to provide municipal services such as water, sewer, and waste disposal.

In addition, failure to pay outstanding taxes may result in:

- Your property being placed in tax sale

- Further legal action taken by the provincial government

Also Check: Do I Have To Pay Taxes On Plasma Donation

How To Pay Property Tax Online

The internet has made a huge impact on how the world functions, opening new doors and simplifying lives. Paying property tax was considered a huge hassle in the past, but those days are long gone, thanks to the option of paying property tax online. Most municipal corporations provide the option of paying property tax online, streamlining the process and saving valuable time.

Steps to Pay Property Tax Online

- Step – 1:Log in to the official website of their municipality/city corporation.

- Step – 2: Choose the tab indicating property tax and navigate to the payment option.

- Step – 3: Choose the right form , based on the category under which an individuals property falls. These forms are used to determine if any changes have been made to a property in question.

- Step – 4: Choose the assessment year. This is the year for which property tax needs to be calculated and paid. Most corporations provide an option to clear backlogs in property tax payment.

- Step – 5: Individuals will then be required to fill in their property identification number and any other relevant document pertaining to their property including the owners name.

- Step – 6: Once all relevant information has been entered, individuals can choose the mode of payment, which could be credit/debit cards or internet banking.

- Step – 7: Once payment is made individuals can take a printout of the challan for their reference.

A Word Of Warning On The Home

If you decide to claim the home-office deduction on your income taxes, be aware that it’s the kind of thing that could draw additional scrutiny to your return.

“Many reports claim that home-office deductions can be a potential ‘red flag’ or increased risk of audit by the IRS,” says Jervis. If you’re worried about increased auditing, Jervis recommends using the simplified method. Using the simplified method over the regular method reduces the risk of marginal error.

Bronnenkant also reminds taxpayers to take caution when filing for home-office deductions.

“Claim what you can defend, not as much as you hope to get away with” Bronnenkant says.

Also Check: Does Doordash Tax

Florida Property Tax Rates

Property taxes in Florida are implemented in millage rates. A millage rate is one tenth of a percent, which equates to $1 in taxes for every $1,000 in home value. A number of different authorities, including counties, municipalities, school boards and special districts, can levy these taxes.

The table below shows the median property tax payment and average effective tax rate for every county in Florida. The effective tax rate is the median annual tax payment as a percentage of median home value. It can help compare tax burdens between counties and even between states, as it reflects actual payments and incorporates differences in assessments and exemptions.

| County |

|---|

Want to learn more about your mortgage payments? Check out our mortgage loan calculator.

Whats The Difference Between Property Taxes And Real Estate Taxes

Property taxes and real estate taxes are interchangeable terms. The IRS calls property taxes real estate taxes, but they are the same in all aspects. The money collected helps the government fund services for the community.

Sometimes youll also see a special assessment tax. This occurs when your locality needs to raise money to fund a specific project.

You May Like: Does Doordash Pay Taxes