What Do I Need To File Taxes

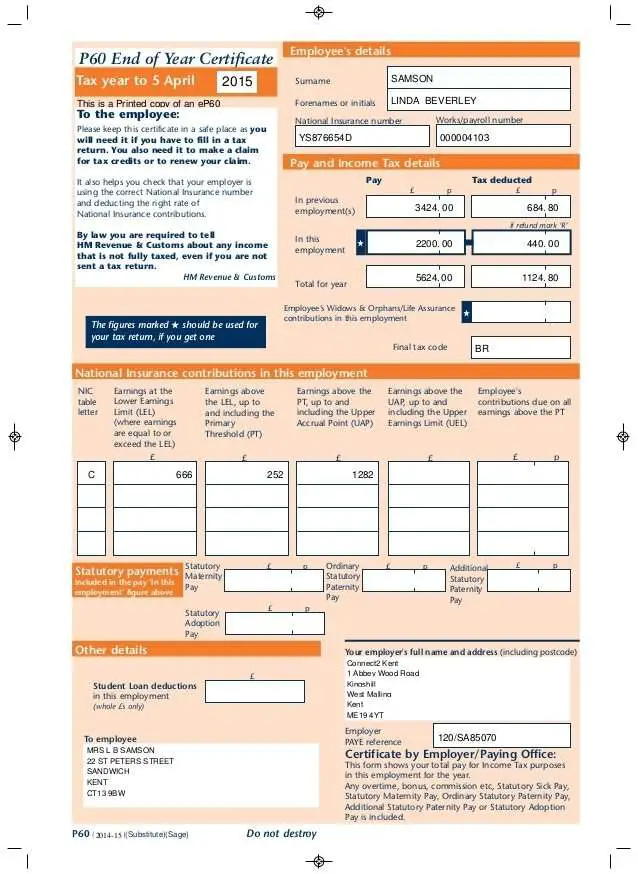

Employees need W-2s and non-employees, including contractors or gig workers, need 1099s. These forms were either mailed to you in February or are available online through your payroll company.

Freelancers:

Banks are also required to send 1099s to customers who received interest or dividends.

If you still don’t have your W-2 by the tax deadline, you can use the W-2 substitute, Form 4852, and estimate your wages and withheld taxes. Note that the IRS could delay your refund while verifying the information.

You’ll also need your adjusted gross income from the previous year to sign and file your tax return.

The Irs Recommends Filing Your Taxes Early

According to the IRS, you should file your taxes early so you can avoid delays when waiting for your tax refund. This means youll get your tax refund the fastest way possible!

With an estimated 153 million tax returns expected to be filed, 80% of which will be submitted through online tax software, its always better to start as soon as possible and avoid any system downtime or painful delays.

Is There Any Extension To Make Tax Payments

Yes, the Arizona Department of Revenue has moved the deadline for filing and paying state individual income taxes for the 2020 tax year from April 15 to May 17, 2021. For making electronic payments, select the day you want the payment to be withdrawn. Payments made on AZTaxes must be completed before 5:00 p.m. Mountain Standard Time the Arizona business day prior to the due date, in order for the payment to settle the next business day.

Recommended Reading: Is Selling Plasma Taxable

Where Do I Send My Taxes

If you file online, there’s nothing to print out or mail, but we recommend you save an electronic copy for your records regardless. This could be especially useful if a third stimulus check is approved, since for the first two rounds of checks, your eligibility was based on your tax returns.

Otherwise, you’ll need to mail your return to the IRS. The specific mailing address depends on which tax form you use and which state you live in. The IRS has published a list of where to file paper tax returns this year here. Be warned, however: The IRS says that due to staffing issues, processing paper returns could take several weeks longer this year.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

But thousands of families wonder what’s next as they eagerly await their last payment. Doubts prevail not only about the remaining payment, but also about the future of the credit since it is still uncertain whether Congress will extend the payments beyond 2022.

Here’s what to expect when you file your taxes next year:

Recommended Reading: Do You Have To Report Plasma Donations On Taxes

Carefully Choose Your Filing Status

Your filing status plays a vital role in your taxes as it ultimately determines your standard deductions and the applicable tax rate.

For instance, for the tax year 2018, the deduction for a single filer stood at $12,000, but a taxpayer who claimed to be the head of a household had a standard deduction set at $18,000.

Depending on your situation you may choose between two distinct or a single option from the following filing statuses:

- Single. This filing status applies to all those taxpayers who are not yet married or living separately under the law .

- Individuals who are married can file for a joint return with their partners, and in case of the demise of a partner during the tax year, an individual can still file for a joint return for the relevant year.

- A married couple can opt to file separately, but this hardly results in a lower tax bill.

- Head of a household. This status applies to unmarried individuals supporting a dependent such as a child or parent.

- Qualifying widow with underage children. This status applies to taxpayers whose partner passed away during the current tax or the previous two years and has a dependent child.

The Penalties For Filing Late

As a result of the COVID-19 pandemic, taxpayers were granted an extension for their 2019 taxes. However, the deadline to file 2020 personal income tax returns remains on course for the end of April:

- Return filing deadline:

If you have a balance owing on your tax return, you must pay the amounts by April 30, 2021, to avoid penalties and interest charges. However, some taxpayers may qualify for interest relief if they received COVID-19 benefits and meet the initiatives criteria. Still, taxpayers must file their returns by the deadline.

The CRA charges compound daily interest on any unpaid balances after the due date. If you have a balance owing from previous years, compound daily interest will continue to be charged on those sums. Additionally, the CRA charges interest on your penalties as well.

The interest rates the CRA charges can change every three months. For now, the CRA charges 5% on overdue taxes down 1% from the year before.

If you owe taxes and dont file your return by the deadline, the CRA will also charge you a late-filing penalty. The penalty is 5% of your 2020 balance owing, plus 1% of your balance owing for each full month that your return is late, to a maximum of 12 months.

However, you would also becharged interest compounded daily for overdue taxes and this rate changes every three months.

You May Like: Federal Irs Tax Return

How Do I Prevent Fraud

It’s easy to procrastinate filing your taxes, but putting it off makes you more vulnerable to fraud. If a scammer gets hold of your Social Security number and you haven’t filed a tax return yet, they could easily file a fake one in your name to get a refund.

Scam calls are ubiquitous during tax season. Keep in mind that if the IRS needs to get in touch with a taxpayer, it sends a letter not an email, not a phone call, and definitely not a message over social media. Especially when it’s investigating cases of tax fraud or performing an audit.

Never return a phone call from someone claiming to be with the IRS. Instead, individuals should call the IRS directly at 800-829-1040, and businesses should call 800-829-4933.

The US Department of Justice says the IRS never discusses personal tax issues through unsolicited emails or texts, or over social media. Always be wary if you are contacted by someone claiming to be from the IRS who says you owe money.

If you receive an unexpected and suspicious email from the IRS, forward it to .

Can I Pay My Tax In Installments Over Time

If you find yourself owing more than you can afford, you should still file a return.

- Even if you don’t enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole.

- Attach a Form 9465 Installment Agreement Request to your tax return asking the IRS to set up a monthly payment plan to pay off what you owe.

About 2.5 million taxpayers are paying off their bills under such an arrangement and recently the IRS made it easier to qualify. In the past, before the IRS would okay an installment plan, the agency demanded a look at your financesyour assets, liabilities, cash flow and so onso it could decide how much you could afford to pay.

- That’s no longer required in cases where the amount owed is under $10,000 and the proposed payment plan doesn’t stretch over more than three years.

- You can also now apply online for the installment agreement. More details are available on the IRS website

Don’t think the IRS is a patsy, though. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS.

Read Also: Stripe Doordash 1099

How Can I File My Taxes

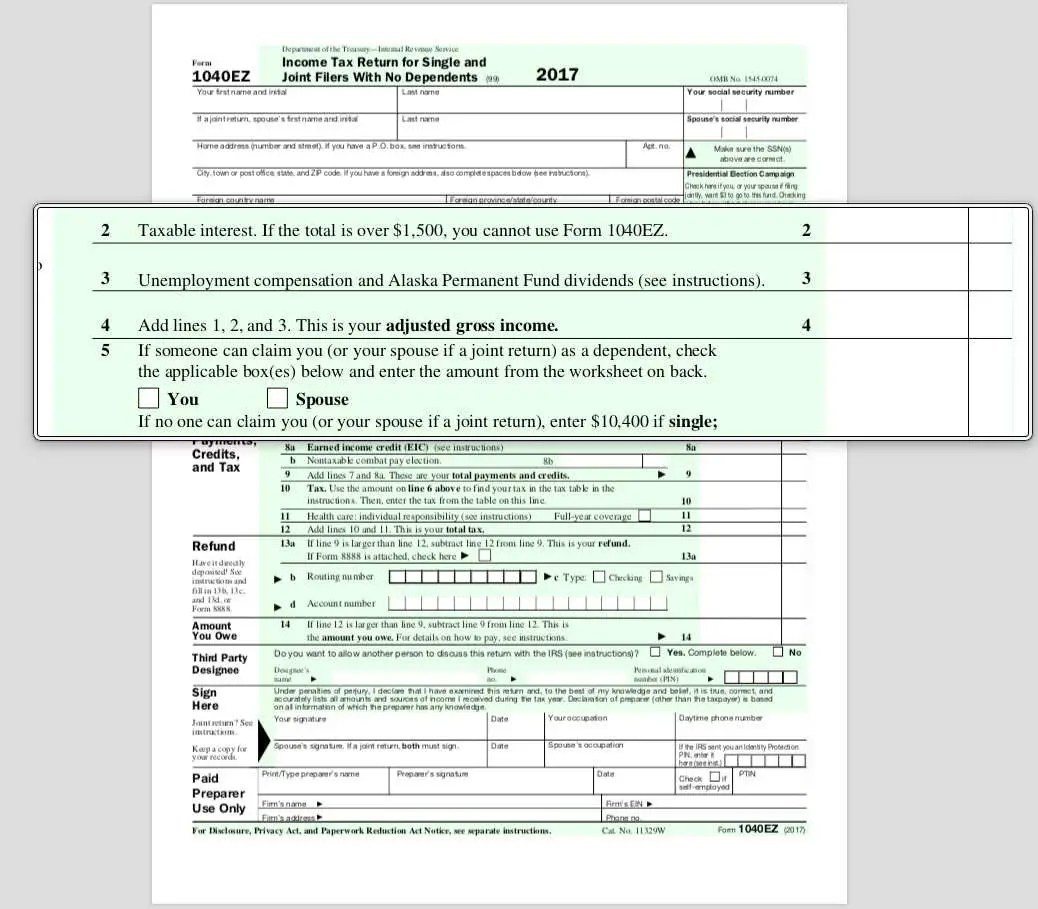

The IRS accepts tax returns filed one of two ways:

A reported 88% of individual tax returns are e-filed per year. Any tax return filed by a tax professional in an H& R Block tax office, using the H& R Block tax software, or through the H& R Block online filing program is usually e-filed. However, you can always choose to have your return printed to mail yourself.

E-file is the quickest filing method and typically helps you receive a tax refund faster.

What Changed Relative To The Previous Year

The new tax law passed in December of 2017 changed many pieces of the previous tax code. Financial experts and analysts find it difficult to pinpoint the exact reason why the changes are affecting people differently.

A significant impact comes from alterations to withholding tables.

Other alterations to the tax code include an increase in the deduction for single filers at $12,000 and married couples filing for $24,000 and a higher tax credit for children which doubled from $1,000 to $2,000 per child as of last year. The new law also eliminated personal exemptions.

Recommended Reading: Property Tax Protest Harris County

When Should I File A Payment Trace For My Missing Money

The IRS also offers a payment trace as a way to find your funds, including from missing stimulus checks. You can request a trace — which means filing an inquiry into the location of your IRS money — by mailing or faxing Form 3911 to the tax agency. Even if the IRS says you’re ineligible for advance payments, it’s best to submit a payment trace in case there’s a portal error.

Your payment will be traceable if it has been at least five days since the deposit date and the bank hasn’t received the money, four weeks since the check was mailed or six weeks if it was mailed to a forwarded address listed by USPS. If the check was mailed to a foreign address, you can ask for a payment trace after nine weeks.

Did Arizona Conform To The Federal Law

Yes. On April 14, 2021, Governor Ducey signed Senate Bill 1752, which conformed to the definition of federal adjusted gross income , including federal changes made during 2020 as well as through the 2021 American Rescue Plan. The bill does not add any new non-conformity additions or subtractions. However, additions and subtractions created for prior non-conformity adjustments for issues such as bonus depreciation are still in place.

2020 conformity includes the federal 2020 Cares Act, the federal Consolidated Appropriations Act of 2021, and the federal American Rescue Plan of 2021.

Recommended Reading: 1040paytax.com Safe

What If I Don’t Normally Have To File Taxes But Want To Claim A Missing Stimulus Check

If you typically aren’t required to file taxes because you’re on SSI or SSDI, you’re retired, or you don’t meet the IRS’ income threshold, but you need to claim missing stimulus money, you will have to file a 2020 tax return. The good news is, you’ll likely be eligible to use the IRS’ Free File program to do so. We’ve got a guide for how nonfilers can get started filing their 2020 tax return to claim stimulus money here.

The Repercussions Of Cheating

Many otherwise honest people fail to report all their income, either inadvertently thanks to the complexities of the tax rules or because theyre actually trying to hide something.

For those who get caught fiddling with their books, the penalties can be severe. Cheating on taxes is a criminal offence punishable by fines equal to several times the amount of tax owing, plus the tax, plus the interest, and possibly even prison time.

And, contrary to popular belief, theres no time limit for the CRA to prosecute you for cheating or filing late. Its never too late to be brought up on tax charges from years ago.

Furthermore, waiting until youre caught, or until an investigation on your return has begun, means your bargaining power is reduced. If youve made a mistake, finance professionals advise that its better to fess up as soon as possible and then look into the possibility of amnesty or reprieve.

Recommended Reading: Is Plasma Money Taxable

Better To File Late Than Never

Some people may neglect to file one year and then freeze when it comes to the following years tax return because of prior mistakes.

If you owe the government money, this type of procrastination can hurt you financially. The Canada Revenue Agency will monitor your financial behaviour over time, using identifiers like your SIN and your date of birth to access data from your bank accounts or credit card transactions. When the CRA notices your absent tax return, you may end up owing penalties and interest.

If you notice your mistake before they do, its best to contact the CRA to find out any penalties you may have incurred, as well as the best way to file and pay off your outstanding balance. In some cases, the CRA will waive the penalties if the taxpayer comes forward and submits an application through the Voluntary Disclosures Program . This form gives taxpayers a second chance to make corrections or file returns that were missed.

What Are The Penalties For A Late Tax

The government wants every penny it is owed and wants it in good time. As such, there are penalties for filing a late tax return if you have an unpaid tax balance.

If you are getting a refund or your tax balance is zero, there are no penalties for sending in your return after the deadline date.

The penalties for filing your income tax and benefit return late when you owe the Canada Revenue Agency are as follows:

Recommended Reading: Home Improvement Cost Basis

When Is The Last Day For Filing Taxes

The tax filing deadline for 2022 will most likely be Apr 18.

The IRS website also has a wide variety of tools and information available to prepare taxes easier. In addition, the IRS recommends that you e-file and choose direct deposit as the way to receive your refund. This ensures you keep your information safe, your return is accurate, and that you receive your refund in the fastest amount of time.

Once again, the IRS has projected that nine out of ten returns will receive their refunds in less than 21 days. If you qualify, you should also take advantage of the free tax options available. You can go to IRS.gov to the filing tab to see what options may be available to you.

Filing To Open An Individual Retirement Account

It might seem a little premature for your child to consider opening an individual retirement account the IRS calls it an individual retirement arrangementbut it is perfectly legal if they have earned income. By the way, earned income can come from a job as an employee or through self-employment.

If you can afford to, consider matching your child’s contributions to that IRA. The total contribution must be no more than the child’s total earnings for the year. That lets your child start saving for retirement but keep more of their own earnings. It also teaches them about the idea of matching funds, which they may encounter later if they have a 401 at work.

Recommended Reading: File Amended Tax Return Online Free

How Much You Have To Make To File Taxes

Your first consideration is: Does my level of earnings mean I must file taxes? If your gross income for 2021 is above the thresholds for your age and filing status, you must file a federal tax return. See the table below.

Income requirements for filing a tax return| Filing status |

|---|

| $5 | $5 |

In addition to federal taxes, you may also have to pay state taxes. Currently, nine states dont tax income at all, while two other states only tax investment income. You can find out if you owe state income taxes by going to your states revenue, finance or taxation offices website. The IRS also has a link to every states tax office.

What Is The Due Date For Calendar Corporate Income Tax Returns For Businesses That Received An Extension

The filing extension provides an extension to file the 2020 Arizona corporate returns. The extension due date for calendar year corporate Arizona returns is due October 15, 2021.

The federal calendar year corporate returns are due October 15, 2021.

Corporate income tax payments can also be made on AZTaxes.gov, but registration is required.

You May Like: How Much Are Taxes On Cable And Internet

If You Have A Balance Due:

If you haven’t paid all of the tax you owe by the filing deadline:

- You’ll likely end up owing a late payment penalty of 0.5% per month, or fraction thereof, until the tax is paid.

- The maximum late payment penalty is 25% of the amount due.

- You’ll also likely owe interest on whatever amount you didn’t pay by the filing deadline.

If you didn’t get an extension,

- You are also looking at a late filing penalty of 5% of the unpaid tax per month, plus interest.

- The maximum late filing penalty is 25% of the amount due.

How Do I Check The Status Of My Refund

The IRS website features a handy web-based tool that lets you check the status of your refund, and there’s also a mobile app, IRS2Go. You can usually access your refund status about 24 hours after e-filing or four weeks after mailing in a return. To check your status, you’ll need to provide your Social Security number or ITIN, filing status and the exact amount of your refund. If your status is “received,” the IRS has your return and is processing it. “Approved” means your refund is on its way.

Read more: What’s your 2020 tax return status? How to track it and your refund money with the IRS

Don’t Miss: Square Dashboard 1099