Performing A Sales Evaluation

The assessor values the property using comparable sales in the area. Criteria include location, the state of the property, any improvements, and the overall market conditions. The assessor then makes adjustments in the figures to show specific changes to the property, such as new additions and renovations.

Ways To Assess Property Value

Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owner’s property. The assessed value estimates the reasonable for your home. It is based upon prevailing local real estate market conditions.

The assessor will review all relevant information surrounding your property to estimate its overall value. To give you the most accurate assessment, the assessor must look at what comparable properties are selling for under the current market conditions, how much the replacement costs for the property would be, the maintenance costs for the property owner, any improvements that were completed, any income you are making from the property, and how much interest would be charged to purchase or construct a property comparable to yours.

The assessor can estimate the market value of the property by using three different methods, and they have the option of choosing a single one or any combination of the three.

If Someone Else Pays My Property Taxes Can The Bill Be Sent To Them

If someone else pays your property taxes you can specify a designated tax payer for your property tax bill by completing the form and submitting as directed on the form to Taxation and Property Records.

If a property owner designates a taxpayer, both the property owner and the designated taxpayer will receive a copy of the property tax bill.

Don’t Miss: Doordash How Much Should I Set Aside For Taxes

Taxpayers’ Association Files A Lawsuit Against The New Property Tax

The Taxpayers’ Association has filed a lawsuit in the High Court challenging the Municipal Act’s changes for collecting property tax based on capital value. Representatives of the Urban Citizens’ Forum indicated in a meeting on Thursday, 16 September 2021 that the Act’s changes were unconstitutional and that a writ petition had been filed in High Court on 14 September 2021.

22 September 2021

You Have To Itemize Your Deductions

You must itemize to take the property tax deduction, and the total of your itemized deductions should be more than the standard deduction you’re entitled to claim for your filing status to make this worth your while. Otherwise, you’ll be taxed on more income than is necessary, jacking up your tax bill rather than reducing it. Property taxes are claimed on Schedule A.

You might want to prepare your tax return both ways to make sure that itemizing is in your best interest, because the TCJA nearly doubled standard deductions from what they were in 2017. They’re set at these figures for the 2021 tax year:

- $12,550 for single taxpayers and married taxpayers filing separate returns

- $25,100 for married taxpayers filing jointly and qualifying widow

- $18,800 for those who qualify to file as head of household

The total of all your itemized deductionsincluding those for money spent on things like medical expenses, charitable contributions, and mortgage interestshould exceed the amount of your standard deduction to make itemization pay off.

Don’t Miss: Is Plasma Donation Taxable Income

The Role Of Taxes In Ebitda

So, why do you add taxes back in EBITDA, and what is the role of taxes in the equation? You add the income taxes back so your EBITDA equation can reflect how much you pay in taxes more accurately. The more you pay in taxes, the higher your EBITDA.

The role of taxes in the equation is to align your companys EBITDA ratio more closely with other companies in your businesss tax bracket.

But, there is a catch to adding these taxes back to the equation. That catch is your business structure.

What Affects Your Property Tax Bill

In addition to the assessed value of your property, your bill is based on what your property is used for . Some usessuch as land and buildings used for religious or spiritual purposesmay exempt these properties from taxes. Different uses may be taxed at different rates, but taxation should be at a uniform ratethat is, the multiplier should be the same for all properties in the same category. Within that category, factors such as your property’s size, construction type, age, and location can affect your tax rate.

If property tax bills are based on current real estate values in your area, you can expect differences in your bill from year to year. Even if your bill is not affected by the market value of your property, it can still be affected by changes in the tax rate for any component of the property tax.

Tax authorities can increase your bill by increasing the assessed value of your property and/or by increasing the tax rate. Likewise, they can lower your bill by decreasing the assessed value of your property and/or by decreasing the tax rate.

You May Like: Plasma Donation Taxes

The Role Of Tax Assessors

As we previously mentioned, a tax assessor is responsible for estimating the market value for all property owned within their jurisdiction. When assessors prepare the property tax assessments that are sent to all property owners, they take into account the value of the actual home, its land and other personal property such as cars or boats. The tax assessor may also work with the local taxing authority to keep track of local property values.

How Does An Assessor Value Property

Residential, multiresidential, commercial and industrial real estate is assessed at 100% of market value with few exceptions.

The assessor must determine the fair market value of the property. To do this, the assessor generally uses three approaches to value.

- Cost Approach: Estimate how much money at current labor and material prices it would take to replace the property with one similar to it. This is useful when no sales of comparable properties exist.

Income Approach: If the property produces income, such as with an apartment or office building, estimate its ability to produce income and capitalize this into an estimated value.

Agricultural real estate is assessed at 100% of productivity and net earning capacity value.

The assessor considers the productivity and net earning capacity of the property. Agricultural income as reflected by production, prices, expenses, and various local conditions are taken into account.

You May Like: How To Look Up Employer Tax Id Number

Do I Need To Pay Property Taxes

Property taxes are an ongoing obligation. They don’t end when you pay off your mortgage, even if your tax obligation has been included in your mortgage payment all along. Your property taxes simply become a separate bill when your home is paid off.

Penalties and interest will accrue if you pay late, and you can lose your property to foreclosure if you don’t pay at all.

Many governments allow property owners to claim exemptions to reduce their assessments, however. You might be eligible for a homestead exemption if you actually live in the residence, or for a senior exemption if you’re retired. Many states also offer property tax exemptions for veterans. Some areas only allow exemptions for religious groups or not-for-profit groups.

And you can at least claim a federal tax deduction for property taxes you pay locally, although you must itemize your deductions to do so. This might not be in your best interest unless the total of all your itemized deductions exceeds the amount of the standard deduction for your filing status. You can’t itemize and claim the standard deduction, too. It’s an either/or decision.

For tax year 2020, you could claim a deduction for up to $10,000 total in property, state, and local taxes. All these taxes are included under the same $10,000 umbrella.

What Taxes Are Added Back To Ebitda

When you already know the answer to What is EBITDA, its time to look at the taxes included in the equation. As a refresher, here is the EBITDA calculation:

EBITDA = Earnings + Interest + Taxes + Depreciation + Amortization

Business owners pay a number of taxes, including:

- Income

- Sales

- Use

And the list goes on. So when it comes to knowing which taxes to include, its easy to confuse which taxes you should use in EBITDA.

EBITDA taxes are specifically income taxes, including:

- Federal

- State

- Local

Keep in mind that the income taxes in the EBITDA calculation are corporate income taxes, not the payroll incomes taxes for employees.

Also Check: How Much Does Doordash Take In Taxes

Online Property Tax Payment Facility Launched By Muda

B.A. Basavaraj, Minister for Urban Development, launched Mysuru Urban Development Authoritys online portal for property tax collection on Saturday, 17 July 2021. The online portal allows property owners from MUDA layouts and MUDA-approved layouts to pay their house tax and vacant site tax online. This launch is being considered a major milestone for MUDA, which has been collecting property tax through a challan system since 1991.

19 July 2021

Property Tax Frequently Asked Questions

General information on Property Assessment and Taxation in the General Taxation Area :

14. Does the government of the NWT offer any relief to property owners?

1. What is property assessment?

Property assessment is the process used to assign a value to all property in the Northwest Territories. Consistent guidelines and techniques allow property assessors to ensure that similar kinds of property are assessed the same way and that assessed values for each property are fair and equitable.

Only land and improvements are assessed. Improvements include buildings, mobile units, pipelines, works and transmission lines. Personal property such as jewelry, cars, televisions and other personal possessions are not assessed. For more about: Property Assessment and Taxation.

2. What is property taxation?A system of taxation that requires lessees, owners or occupiers of land and buildings to pay an amount of money based on the value of their land and buildings. Everyone who owns or occupies property, including individuals, businesses and industry pays property tax.

3. Why do we have to pay property tax?

Like most other taxes, property tax is imposed by government to generate money for a public purpose. It is compulsory and enforceable by law.

Paying property tax means helping to pay for services, the funding for which is provided by the GNWT or municipality such as:

- fire protection

- general government services

4. How is property assessed?

Recommended Reading: Is Plasma Money Taxable

Idaho State Tax Commission

VISIT »Property Tax Hub for a complete listing of all property tax pages

Property taxes are used to pay for schools, cities, counties, local law enforcement, fire protection, highways, libraries, and more. The state oversees local property tax procedures to make sure they comply with Idaho laws. Also the Idaho State Tax Commission sets property tax values for operating property, which consists mainly of public utilities and railroads.

Most homes, farms, and businesses are subject to property tax. Taxes are determined according to a property’s current market value minus any exemptions. For example, homeowners of owner-occupied property may qualify for a partial exemption. Also, qualified low income homeowners can receive a property tax reduction.

How Are Disputes Over Assessments Handled

If you were to disagree with your property tax assessment, theres a process to appeal it. This process varies according to applicable law. If youre a homeowner interested in appealing your property tax assessment, start by contacting the assessors office. From there, make sure to ask how the assessment was prepared, and then do your own research. Wed suggest looking at comparable property sales or other factors that you believe reflect the true value of your property more accurately.

Also Check: Harris County Property Tax Protest Services

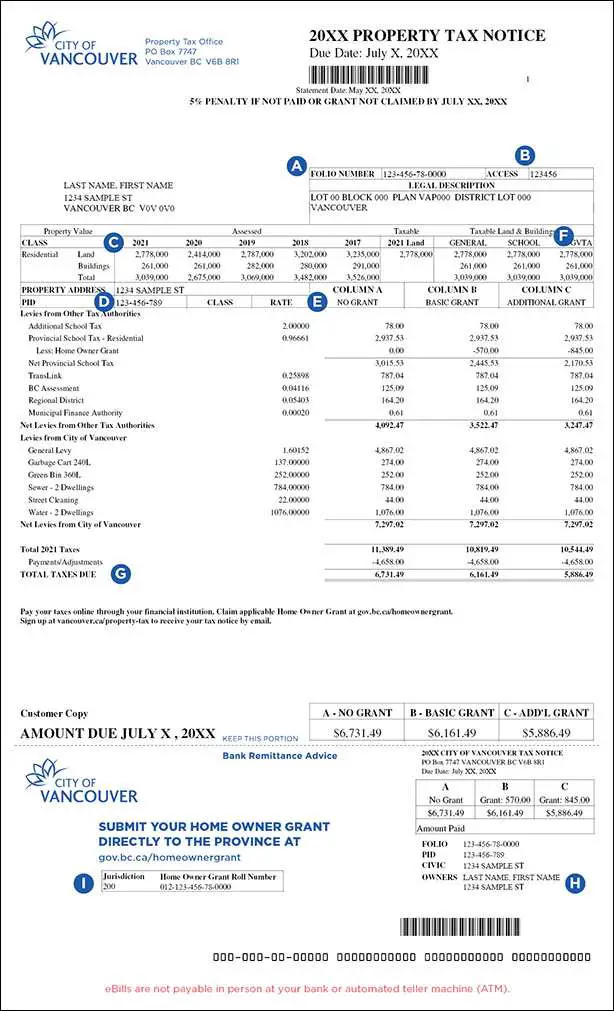

How Are My Annual Property Taxes And Charges Calculated

In this example, it is assumed that you qualify as a resident of Prince Edward Island, you own a noncommercial residential property in Charlottetown valued at $150,000 and the non-commercial municipal tax rate for Charlottetown is $0.67 per $100 of assessment.

Sample Annual Property Taxes and Charges Calculation| Type of Tax or Charge | Dollar Amount |

|---|---|

| $2,710 |

How The Tax Is Calculated

Property tax is calculated based on the:

- general municipal tax rate and any additional municipal tax rates for special services provided by your municipality

- property value

Municipal tax rate

Municipal tax rates are established by your municipality and can vary, depending on the type of property you own.

Each year, municipalities decide how much they want to raise from property taxes to pay for services and determine the tax rate based on that amount.

To learn about the tax rates in your municipality, contact the finance or treasury department of your local municipality. Some municipalities may have a property tax calculator available on their website.

Education tax rate

Education taxes help fund elementary and secondary schools in Ontario. Education tax rates are set by the provincial government.

All residential properties in Ontario are subject to the same education tax rate. The education tax rates can be found in Ontario Regulation 400/98.

Recommended Reading: Www.1040paytax.com.

What Is The Ontario Energy And Property Tax Credit

The OEPTC is designed to help low- to moderate-income Ontario residents with the sales tax on energy and with property taxes. The annual entitlement is usually divided by 12 and issued monthly as part of the Ontario trillium benefit payment . The Canada Revenue Agency administers this program for Ontario.

Make A Direct Payment

If youre allowed and choose to pay your taxes yourself, you will pay them in full when they become due. Like we said earlier, some areas allow you to make quarterly or semi-annual payments to decrease the amount youll pay at once.

Either way, youll make the total required payment by the due date or risk paying penalties and facing a tax lien.

Recommended Reading: H& r Block Early Access W2

Why Might You Pay Higher Taxes Than Your Neighbor

Assessed value of a house depends on land size, square footage, type of construction, age, quality, location, story height, and condition, as well as other factors. Your assessed value is one component of the property tax burden. Other components include the levy rates for the various levy authorities including city, township, county, school district, and other levying authorities. You may also be a different classification than your neighbor, as different classes have a different rollback applied to them. These differences all contribute to different tax burdens.

Your Taxes Increase If

- The budgets increase and the taxable value of all properties remain the same.

- The budgets and taxable value of property in the entire government unit remain the same but the taxable value of the individuals property increases.

- The budgets and taxable value of the individuals property remain the same but the value of the property in the entire government unit decreases.

Also Check: Do You Pay Taxes On Plasma Donations

More Than 50000 People Who Paid Their Property Tax To Get A Rebate Of 5%

The Nagpur Municipal Corporation has provided rebates of 5% to the Nagpur property tax payers who have paid the due taxes for the current fiscal year from 1 July. As many as 52,420 people have been provided with the rebate of 5% by the NMC for their property tax payment. This rebate will be adjusted and forwarded to the next fiscal wherein the overall tax burden will be cut down on the basis of the rebate.

25 August 2021

Walk The Home With The Assessor

Many people allow the tax assessor to wander about their homes unguided during the evaluation process. This can be a mistake. Some assessors will only see the good points in the home such as the new fireplace or marble-topped counters in the kitchen. They’ll overlook the fact that several appliances are out of date, or that some small cracks are appearing in the ceiling.

To prevent this from happening, be sure to walk the home with the assessor and point out the good points as well as the deficiencies. This will ensure you receive the fairest possible valuation for your home.

Don’t Miss: Can Home Improvement Be Tax Deductible

How Does Someone Become An Assessor

Assessors are appointed to 6-year terms. To be eligible, they must have a high school diploma or GED and pass an examination administered by the Iowa Department of Revenue. To be reappointed, they must successfully complete a continuing education program equal to 150 hours of classroom instruction during their 6-year terms.

County assessors are appointed by a conference board composed of the county board of supervisors, the mayors of all incorporated cities, and a board member from each school district who lives in the assessors jurisdiction.

City assessors are appointed by a conference board composed of the county board of supervisors, members of the city council, and all members of each school board.

How To Calculate Property Tax

If youre interested in estimating the value of your property taxes yourself, you can follow this formula:

Property Tax = Assessed Value x Tax Rate

Since there are many factors that go into each portion of this equation, the answer you come up with will only be an estimate and may not mirror how much you actually end up paying in property taxes but it can be good to see an estimate to get a feel for where youre at.

The property value in this equation is the assessed value of your home. Your assessed value can be estimated by looking at comparative properties or calculated by someone like a home assessor. Your tax rate will vary depending on where you live it is usually decided by your county, city or town. However, its important to note that the assessed value doesnt necessarily match the appraised value. Many states have laws that limit assessed value to a percentage of your appraised value.

Heres an example: Lets say you live in Chicago, Illinois, and the assessed value of your home is around $280,000. The average tax rate in Chicago is about 2.1%, so how much should you expect to pay in property tax?

Property Tax = x

$5,880 = x

According to this example, you could expect to pay about $5,880 annually. If youd like to try the formula for yourself, you can likely find your city or countys average tax rate online. There are also many online property tax calculators that can find that information for you.

Recommended Reading: Is Door Dash 1099