New Jersey Enhances Child And Dependent Care Credit

New Jersey Governor, Phil Murphy, signed Bill S4065, which enhances the child and dependent care credit, into effect on December 3rd, 2021. This enhancement is effective retroactively for tax years beginning on or after January 1, 2021. Bill S4065 removes the $500 and $1,000 maximum credit and the credit is now refundable. Previously, this credit was fully phased out once a taxpayer had $60,000 of taxable income. Bill S4065 increases the taxable income phase out threshold to $150,000 of taxable income. Regardless of filing status, the New Jersey credit percentages are:

- Income between $0 and $30,000 50% of the federal credit

- Income between $30,000 and $60,000 40% of the federal credit

- Income between $60,000 and $90,000 30% of the federal credit

- Income between $90,000 and $120,000 20% of the federal credit

- Income between $120,000 and $150,000 10% of the federal credit

- Income greater than $150,000 0% of the federal credit

New Jersey Division Of Taxation Promises Guidance On End Of Public Health Emergency

As a result of the State formally ending the public health emergency in relation to COVID-19 as of June 4, 2021, the New Jersey Division of Taxation has posted on its website, advising that its policies, procedures, and provisions that were revised or relaxed due to the pandemic will now be impacted by the rescission of the public health emergency. Therefore, the New Jersey Division of Taxation is currently reviewing these policies and statutory provisions and will provide guidance to the public as soon as possible. If you are an out-of-state business and have employees working for you or rendering services in New Jersey, you may have nexus in the State thereby triggering filing and reporting obligations. Please reach out to Withums state and local tax group with any questions you may have.

New Jersey Grants Tax Relief For Hurricane Henri And Ida Victims

The New Jersey Department of Revenue announced the state will honor the recent Internal Revenue Service special tax relief for individual or business taxpayers qualifying for assistance in Hurricane Ida in disaster areas. Affected taxpayers include businesses and individuals located in the disaster areas and those whose tax records are in the disaster areas, and relief workers, and as such this guidance applies to the entire state. This relief allows for taxpayers who reside or have a business with certain tax-filing and tax-payment deadlines falling on or after September 1, 2021, to be postponed to January 3, 2022. This includes the filing and paying of tax due for payroll tax that are normally due on November 1, 2021 to be extended to January 3, 2022. The tax types that qualify for this relief include individual income tax, corporate income tax, income tax withholdings, payroll tax and limited liability entity tax. The extension to file and pay taxes does not apply to sales tax and other tax types however, taxpayers may contact the DOR to request an extension or waiver of penalties if affected by disaster-related delays. All individuals may be eligible for abatement of penalty and interest on tax that normally accrues during the extension period.

Recommended Reading: How Can I Make Payments For My Taxes

Residency Status Information For New Jersey Returns

Residents: Individuals for whom

- New Jersey was their domicile for the entire year, or

- New Jersey was not their domicile, but they maintained a permanent home in the state for the entire year and spent more than 183 days in the state.

Part-year resident: Individuals for whom

- New Jersey was their domicile for part of the year, or

- New Jersey was not their domicile, but they maintained a permanent home in the state for part of the year and spent more than 183 days in the state.

A part-year resident may have to file both a part-year resident and a part-year nonresident return if they received income from New Jersey sources while a nonresident.

Nonresidents: Individuals for whom

- New Jersey was not their domicile, and they spent 183 days or less in the state, or

- New Jersey was not their domicile, they spent more than 183 days in the state, but did not maintain a permanent home in the state.

Individuals may also be considered a nonresident for New Jersey tax purposes if they were domiciled in New Jersey and met all three of the following conditions for the entire year:

- They did not maintain a permanent home in New Jersey

- They did maintain a permanent home outside New Jersey

- They did not spend more than 30 days in New Jersey

New Jersey Discusses Tax Credits For Manufacturing Personal Equipment

The New Jersey Economic Development Authority recently recapped the qualifications for the Personal Protective Equipment Manufacturing Tax Credit program. To receive the tax credits, a project must meet the following requirements:

Tax credits are only available for full-time employees with a minimum of 35 hours per week and at a minimum wage rate of $15 per hour with approved health care. Employers must commit to retaining the jobs qualifying for the credit for a period of least 5 years. Projects can receive up $10,000 of a base tax credit per new job created with an annual program cap of $10 million. Individual projects are subject to an annual cap of $500,000.

Don’t Miss: Mcl 206.707

Pay Any Estimated Taxes By The Original Due Date Of The Return

An extension of time to file your state income tax return does not also mean an extension to pay any taxes you may owe. If you end up owing owe tax at the end of the year, you may be subject to late-payment penalties if you fail to submit a payment by the original tax deadline. To avoid paying any penalties, its a good idea to calculate a quick estimate of what you might owe and submit a payment. Even if you overpay, you can always claim a refund in a few months when you eventually file your state tax return.

To get help estimating your taxes, use TurboTax Online.

New Jersey Angel Investor Tax Credit Update

The New Jersey Angel Investor Tax Credit Program provides tax credits against corporate or gross income taxes for qualifying investments in a New Jersey emerging technology business. Governor Phil Murphy increased the annual cap from $25 million to $35 million earlier this year. Applicants have six months from the investment date to submit the dual application, consisting of an investor section and a technology company representative section. All applicants must file NJ taxes for the year. Any applicants who submit an investment but cannot coordinate with a NJ emerging technology company to submit the dual application as of October 1, 2021, will not be recommended for the program.

Also Check: How To Appeal Property Taxes Cook County

Nj Extends Tax Deadline To May 17 Matching Federal Change

New Jersey has extended its tax deadline to meet the federal extension. AP

New Jersey has extended its deadline for the 2020 tax year to May 17, matching the extended deadline set by the federal government earlier this week, according to state officials.

This extension applies to individual taxpayers, including people who pay self-employment tax, officials said in a statement.

But there will not be an extension for first quarter 2021 individual estimated tax payments, the statement said. Those will still be due on April 15.

As we continue the arduous job of emerging from this pandemic, we are extending this relief to taxpayers in what we know is a very difficult time, Gov. Phil Murphy said. Our hope is that the extension gives taxpayers with difficult circumstances, including filings made more complicated by various relief programs and employment changes, the extra the time they may need.

Senator Paul Sarlo, chairman of the Senate Budget and Appropriations Committee, said its important for the state to match federal timetables.

New Jersey: State Tax Deadlines Delayed

The New Jersey Division of Taxation announced they are following the guidance of the IRS. Affected taxpayers include businesses and individuals located in the disaster areas and those whose tax records are in the disaster areas, and relief workers. According to the news release:

Taxpayers affected by Hurricane Ida now have until January 3, 2022, to file their New Jersey tax returns and submit payments for any return and/or payment, including estimated payments, which have either an original or extended due date between August 26, 2021, and before January 3, 2022. This means that individuals who had a valid extension to file their 2020 returns, due to run out on October 15, will now have until January 3, 2022, to file. In addition, you may be eligible for abatement of penalty and interest on underpaid tax that would normally accrue during this the period of the postponement. This also means individuals who had a valid extension to file their 2020 return due to run out on Oct. 15, 2021, will now have until Jan. 3, 2022, to file. However, because tax payments related to these 2020 returns were due on May 17, 2021, those payments are not eligible for this relief. If the IRS further extends the filing deadline for federal tax purposes, the deadline for New Jersey returns and payments will also be extended.

As of this time, the state of New York has not announced how or if they are extending their state tax deadline in a similar manner for Hurricane Ida victims.

Don’t Miss: Where’s My Tax Refund Ga

New Jersey Reiterates Nonconformity To Cares Act Provisions Applicable To Iras

The New Jersey Division of Taxation has reiterated that it does not follow IRC section 72 nor does the State conform to the CARES Act provisions that enable coronavirus-related distributions to be includible in income over a three-year period, and, to the extent the distribution is eligible for tax-free rollover treatment and is contributed to an eligible retirement plan within a three-year period, to not be includible in income. New Jersey has its own methods for reporting distributions. For New Jerseys specific rules on reporting pension income, please see GIT-1& 2.

New Jersey State Tax Extension

Filing an Extension in New Jersey

The New Jersey Division of Taxation grants an automatic six-month extension of time to file until October 15, 2021 if you are filing for a federal extension and have paid at least 80% of your total 2019 tax liability.

You are only required to file for a New Jersey extension, if:

If you are not applying for a federal extension, you can still obtain an extension to file your New Jersey gross income tax return by doing the following:

An extension to file your return is not an extension of time to pay your taxes.

If You Owe

To avoid interest and penalties you must have paid at least 80% of your current year tax liability by April 15, 2021 and submit your New Jersey return by October 15, 2021.

Pay Online

Pay your taxes online at the New Jersey Division of Taxation website. E-Check and credit cards are accepted. There is no need to send in the payment voucher if you pay online.

You can also pay your taxes online at Official Payments Corporation. Visa, MasterCard, Discover Network, and American Express credit and debit cards, and other forms of payment, such as Bill Me Later® are accepted. To make a debit card payment you can use a MasterCard or Visa Debit Card or any debit card with Nyce, Pulse or Star logos. There is no need to send in the payment voucher if you pay online.

There is a convenience fee for this service which is paid directly to the company. The amount of the fee is based on the amount of your payment.

Pay by Phone

Pay by Mail

Recommended Reading: How To Get Stimulus Check 2021 Without Filing Taxes

Film And Digital Media Credit

New Jerseys film and digital media tax credit program has been expanded by the passing of Assembly Bill 5580, which increases the annual cap on incentives for film and television productions to $100 million a year and extends the provisions through 2028. The demand for tax credits was greater than the supply therefore, more production companies were applying than there were dollars available. The enactment of this provision will lead to job growth and spur economic activity as studios seek film locations in New Jersey. The digital media tax break will remain capped at $10 million.

To learn more about the qualifications of this tax credit, .

Notice: Automatic Extension For 2020 Cbt Returns For Certain Filers

One of the changes resulting from the enactment of P.L. 2020, c. 118 , was a change in the original due date of a Corporation Business Tax return to 30 days after the due date of the federal return. In general, this means that a return is due on the 15th day of the month following the due date of the federal return. This may impact some taxpayers’ original due dates.

The release of 2020 Corporation Business Tax returns was delayed while the forms were updated to incorporate the new law’s changes. Therefore, the Division granted an automatic extension for certain filers.

Taxpayers with returns that have an original due date that falls anytime between November 15, 2020 and April 15, 2021, are granted an automatic extension to file their tax returns by May 15, 2021. A taxpayer will not be charged late filing penalties if the return is filed by May 15, 2021 . This extension applies only to the filing of the return and does not extend the time to make all required payments. The Division had previously issued an automatic extension allowing taxpayers with returns that had an original due date of anytime between November 15, 2020 and March 15, 2021, to file by April 15. However, the automatic extension was expanded to include those filers with original dues through April and further extended the deadline to May 15.

You May Like: Buying Tax Liens California

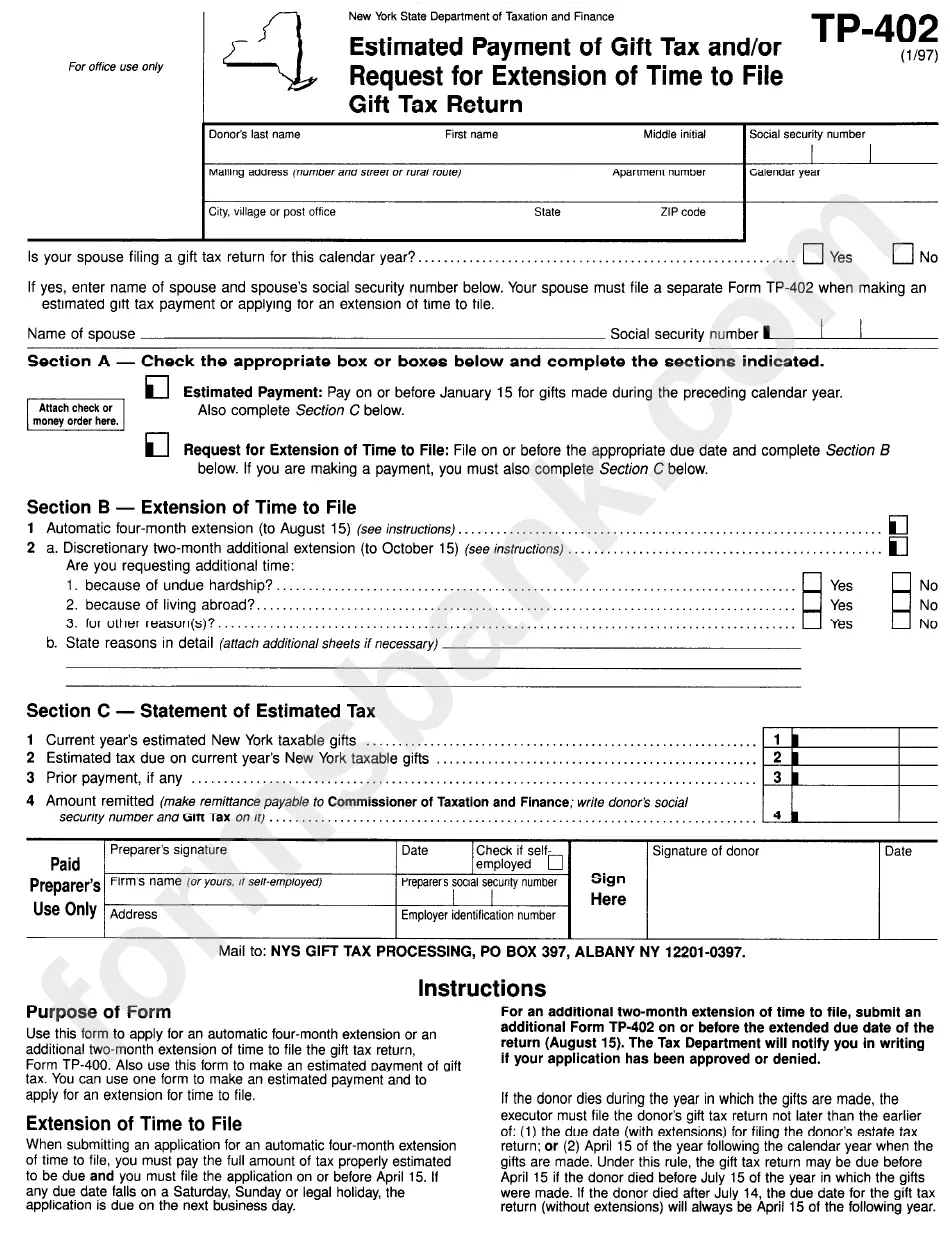

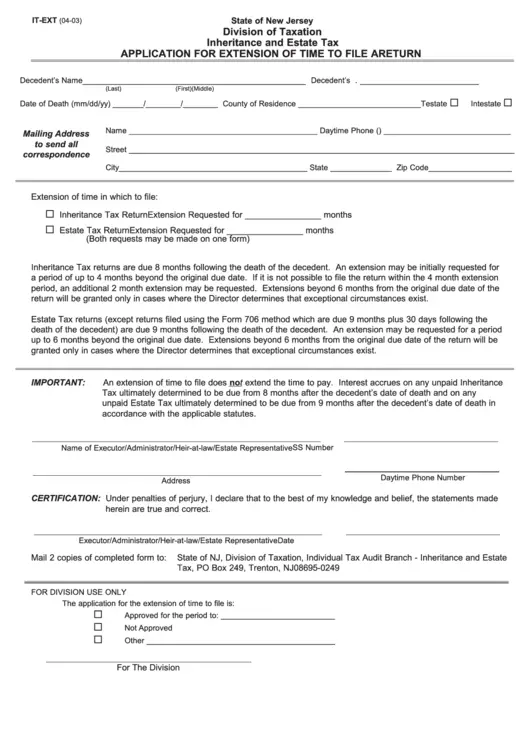

How To File For An Extension Of State Taxes

OVERVIEW

While the IRS requires you to file Form 4868 to request a tax extension, each state has its own requirements for obtaining a similar extension.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

While the IRS requires you to file Form 4868 in order to request a tax extension, each state has its own requirements for obtaining a similar extension. Some states such as California offer automatic extensions to all taxpayers, while other states require you to file a specific form by the original due date of the return. Here are some tips to help walk you through what you need to do when filing state taxes in your area:

Virginia California Georgia And More

Virginia Gov. Ralph Northam announced Friday he had directed the Department of Taxation to extend the individual filing deadline to May 17.

Individuals who dont file by April 15 may still be charged interest under current Virginia law, though legislation to waive those fees and will be considered in the legislative session in April, according to a news release.

Californias Franchise Tax Board also announced the same new statewide filing date. Any late fees or interest for not filing by the old April 15 date will be automatically waived.

Georgia is automatically extending individual income filing and payment dates without penalties or interest as well, the states Department of Revenue announced Friday.

Aligning with this decision makes filing and paying both state and federal taxes as easy as possible for Georgia taxpayers, said Revenue Commissioner David Curry, who has the authority to extend deadlines on his own since there has been a presidentially declared disaster.

The Massachusetts, Tennessee, and Arkansas revenue departments also announced May 17 extensions on Friday.

In Idaho, however, the State Tax Commission said Friday that the state filing deadline remains April 15, and that the question of matching the federal date will be before the Legislature when it reconvenes April 6.

To contact the reporters on this story: Donna Borak

Read Also: How Can I Make Payments For My Taxes

General Tax Return Information

Due Date – Individual Returns – April 15 or same as IRS

Extensions – A six month extension request must be filed on form NJ-630 no later than the original due date of the return. Any extension granted is for time to file and does NOT extend time to pay.

The NJ-630 is not needed if at least 80% of the final tax liability has been paid by the original due date and a Federal application for an automatic extension of time to file has been applied for and a copy is enclosed with the New Jersey Return when filed.

Drivers License/Government Issued Photo Identification: New Jersey does not require this information to file the tax return.

Submit Your Return By The Extension Deadline

In most cases, your state tax return is due by October 15 after you file for an extension. However, if you fail to file a complete return by this date, your state may charge you penalties just for filing your return late.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Recommended Reading: How To Report Ppp Loan Forgiveness On Tax Return