Wheres My State Tax Refund California

Track your state tax refund by visiting the Wheres My Refund? page of the California Franchise Tax Board. You will need to enter the exact amount of your refund in order to check its status.

According to the state, refunds generally take up two weeks to process if you e-file. If you file a paper return, your refund could take up to four weeks. Businesses can expect processing times of up to five months.

Contact the Franchise Tax Board if you have not heard anything within one month of filing an electronic return . Businesses should reach out if they havent heard anything within six months of filing.

Amended returns for both individuals and businesses can take up to four months for processing.

Check Refund Status Online

You can check the status of your refund on Revenue Online. There is no need to login. Simply choose the option “Tax Refund for Individuals” in the box labeled “Where’s my Refund?”. Then, enter your SSN or ITIN and the refund amount you claimed on your current year income tax return. If you do not know the refund amount you claimed, you may either use a Letter ID number from a recent income tax correspondence from the Department.

You will receive the Letter ID within 7-10 business days. After we have received and processed your return, we will provide you with an updated status as the refund moves through our system. It may take a few days for an updated status to appear. Please check back often to verify where your return/refund may be in our process.

The information in Revenue Online is the same information available to our Call Center representatives. You can get the information without waiting on hold.

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax Return. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Recommended Reading: Tax Lien Investing California

How Long Will My Refund Information Be Available

- For U.S. Individual Income Tax Returns filed before July 1: Around the second or third week in December.

- For U.S. Individual Income Tax Returns filed on or after July 1: Throughout the following year until you file a tax return for a more current tax year.

If your refund check was returned to us as undeliverable by the U.S. Post Office, your refund information will remain available throughout the following year until you file a tax return for a more current tax year.

Wheres My Mississippi State Refund

Find your Mississippi State Refund here. Follow the links below to Track your MS Refund.

Waiting for your state tax refund? Track the status of your refund by using the Mississippi Department of Revenues Wheres my Mississippi State refund? tool. Just fill in your Social Security number or Individual Taxpayer Identification Number, expected refund amount, and the filing tax year, and you can get instant information about your refund.

The Mississippi Department of Revenue is a secure, electronic self-service system. It allows you to submit payments securely and view account balances, make payments for returns and assessments, protest appeal assessments, and view copies of correspondence.

For more information about filing your Mississippi state tax return and locating your refund, visit the Mississippi Department of Revenue.

Mississippi Department of Revenue issues most refunds within 21 business days. You may check the status of your refund on-line at Mississippi Department of Revenue. You can start checking on the status of your return within 24 hours after they have received your e-filed return or 4 weeks after you mail a paper return. Their phone and walk-in representatives can research the status of your Mississippi State refund only if it has been 21 days or more since you filed electronically, more than 6 weeks since you mailed your paper return, or Wheres My Mississippi State Refund? directs you to contact them.

Before making an inquiry, please allow:

Don’t Miss: How To Buy Tax Lien Properties In California

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

How Should I Contact The Irs For More Help

The IRS received 167 million calls this tax season, which is four times the number of calls in 2019. And based on the recent report, only 7 percent of calls reached a telephone agent for help. While you could try calling the IRS to check your status, the agency’s live phone assistance is extremely limited right now because the IRS says it’s working hard to get through the backlog. You shouldn’t file a second tax return or contact the IRS about the status of your return.

The IRS is directing people to the Let Us Help You page on its website for more information. It also advises taxpayers to get in-person help at Taxpayer Assistance Centers. You can contact your local IRS office or call to make an appointment: 844-545-5640. You can also contact the Taxpayer Advocate Service if you’re eligible for assistance by calling them: 877-777-4778.

Though the chances of getting live assistance are slim, the IRS says you should only call the agency directly if it’s been 21 days or more since you filed your taxes online, or if the Where’s My Refund tool tells you to contact the IRS. You can call: 800-829-1040 or 800-829-8374 during regular business hours.

Recommended Reading: Do You Have To Report Roth Ira On Taxes

Request Electronic Communications From The Department

The best way to communicate with the Tax Department about your return is to open an Online Services account and request electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

How Long Will I Have To Wait For My Federal Refund Check To Arrive

The IRS usually issues tax refunds within three weeks, but some taxpayers have been waiting months to receive their payments. If there are any errors, or if you filed a claim for an earned income tax credit or the child tax credit, the wait could be lengthy. If there is an issue holding up your return, the resolution “depends on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return,” according to its website.

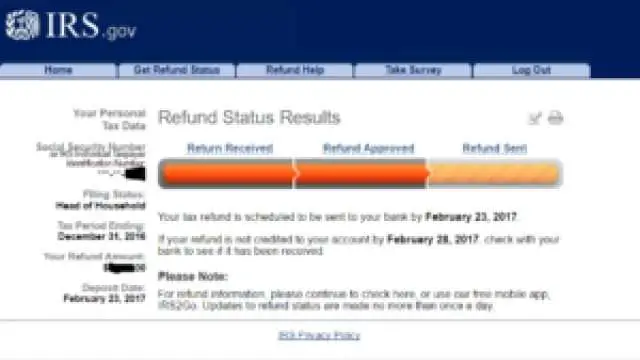

The date you get your tax refund also depends on how you filed your return. For example, with refunds going into your bank account via direct deposit, it could take an additional five days for your bank to post the money to your account. This means if it took the IRS the full 21 days to issue your check and your bank five days to post it, you could be waiting a total of 26 days to get your money. If you submitted a tax return by mail, the IRS says it could take six to eight weeks for your tax refund to arrive once it’s been processed.

Read Also: Can You Change Your Taxes After Filing

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

-

Federal taxes were withheld from your pay

and/or

-

You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

How To Track Your Federal Tax Refund If It Hasn’t Arrived Yet

If you just filed recently, you should know your federal tax refund check could take up to 120 days to arrive. Here’s what else we found.

If you see “IRS TREAS 310” on your bank statement, it could be your income tax refund.

Whether you’ve already filed your taxes or you’re planning to do so by the final due date — that’s Oct. 15 if you file a tax extension — you’ll need to know how to track your refund. Be aware that the IRS is still facing a backlog of unprocessed individual returns, 2020 returns with errors and amended returns that require corrections or special handling. And while refunds typically take around 21 days to process, the IRS says delays could be up to 120 days.

The tax agency is also juggling stimulus checks, child tax credit payment problems and refunds for tax overpayment on unemployment benefits. The money could give families some financial relief but an overdue tax refund could also be a big help. If you don’t file your 2020 tax return soon, you’ll likely owe late fees or more interest — and you could be missing out on your tax refund, stimulus checks or child tax credit payments, which you may only be eligible for with your 2020 tax return.

Read Also: How Can I Make Payments For My Taxes

How To Check The Status Of Your Refund

What you’ll need:

Two ways to check the status:

The Indiana Department of Revenue screens every return in order to protect taxpayer IDs and refunds. For more information about your refund, you may call 317- 232-2240, Monday through Friday, from 8 a.m. to 4:30 p.m., EST. A DOR representative will be happy to assist you.

Refund amounts can be accessed from 1996 to the current tax season.

When Will I Get My Tax Refund

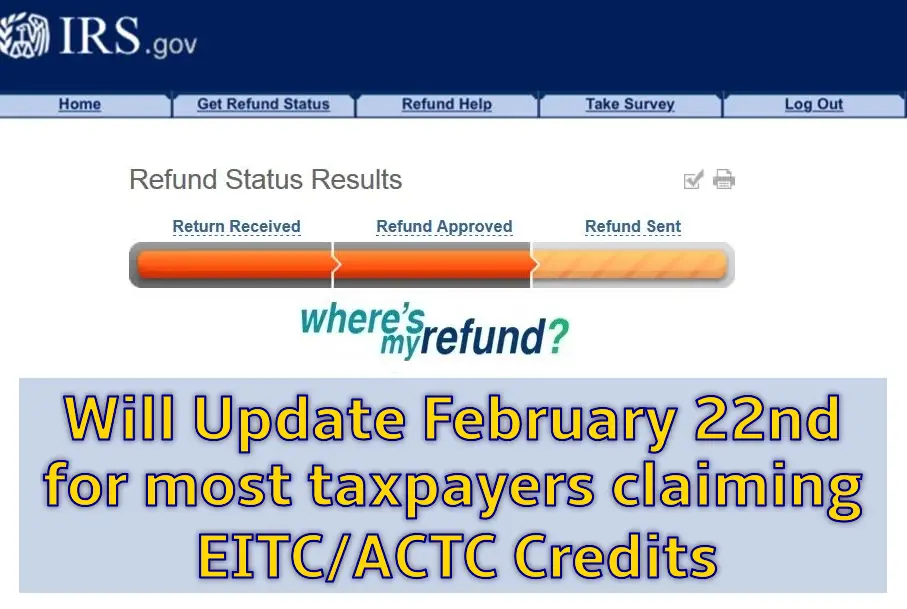

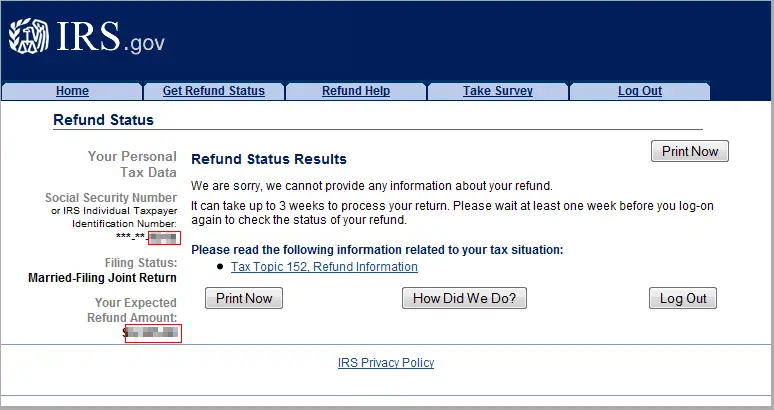

The Wheres My Refund? tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app. If you submit your tax return electronically, you can check the status of your refund within 24 hours. But if you mail your tax return, youll need to wait at least four weeks before you can receive any information about your tax refund. Keep in mind that usually you can file your taxes in January.

In order to find out the status of your tax refund, youll need to provide your Social Security number , filing status and the exact dollar amount of your expected refund. If you accidentally enter the wrong SSN, it could trigger an IRS Error Code 9001. That may require further identity verification and delay your tax refund.

Most taxpayers receive their refunds within 21 days. If you choose to have your refund deposited directly into your account, you may have to wait five days before you can gain access to it. If you request a refund check, you might have to wait a few weeks for it to arrive. The table below will give you an idea of how long youll wait, from the time you file, until you get your refund.

| Federal Tax Refund Schedule | |

| 1 month | 2 months |

Note that these are just guidelines. Based on how you file, most filers can generally expect to receive a refund within these time frames.

| 2021 IRS Refund Schedule |

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Wheres My State Tax Refund Georgia

Track your Georgia tax refund by visiting the Georgia Tax Center and clicking on Wheres my Refund? in the middle of the page under Individuals. You will be able to check returns for the current tax year and as far back as four years ago. It is possible for a refund to take as long as 90 days to process. If you have not received a refund or notification within that time, contact the states revenue department.

Wheres My State Tax Refund Iowa

You can check the status of your Iowa state tax return through the states Department of Revenue website. There you will find a page called Where Is My Refund. You will be able to check on your refund and the page also answers common questions about state refunds. This page updates in real time. Once the state has processed your return, you will see the date on which it issued your refund.

One good thing to note is that calling will not get you more information about your refund. When you check your refund status on this page, you will have access to all the same information as phone representatives. So the state asks people not to call unless you receive a message asking you to call.

Also Check: How Much Is H& r Block Charge

Wheres My State Tax Refund West Virginia

Check on your state tax return by vising the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

The state is implementing new security measures for the 2017 tax year, which may slow down the turnaround time for your refund. It advises only calling to ask about your refund if more than eight weeks have passed since you filed.

Wheres My State Tax Refund Maryland

Visit the Comptrollers website to check the status of your Maryland tax refund. All you need to do is enter your SSN and your refund amount. Joint filers can check their status by using the first SSN on their return.

According to the state, it usually processes e-filed returns the same day that it receives them. That means you can expect your refund to arrive not too long after you file your taxes. On the other hand, paper returns typically take 30 days to process. For security reasons, it is not possible to verify any of your tax return information over the phone.

You May Like: How Does H And R Block Charge

Tips For Managing Your Taxes

- Your taxes should be accounted for in your long-term financial plan. If you need professional guidance on how to build a financial plan, consider working with a financial advisor. SmartAssets free matching tool can pair you with up to three advisors in your area. Get started now.

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.

We Have Received Your Return And It Is Being Processed No Further Information Is Available At This Time

This is a general processing status. Unless your return is selected for additional review, or we request additional information, this will be your status throughout processing until we schedule an issue date and update your status at that time. While your return is in this stage, our Call Center representatives have no further information available to assist you. As your refund status changes, this message will automatically update in our automated phone system, our online Check your refund status application, and in the account information available to our representatives.

Read Also: How Much Does H& r Block Charge To Do Taxes

Wheres My State Tax Refund Minnesota

Through the Wheres My Refund? System, you can check the status of your Minnesota tax refund. You will need to enter your SSN, your date of birth, your return type , the tax year and the refund amount shown on your return. Its important to be aware that if your tax return does not have your date of birth on it, you cannot check its status.

The refund system is updated overnight, Monday through Friday. If you call, the representatives will have the same information that is available to you in this system.

Wheres My State Tax Refund Hawaii

Hawaii taxpayers can visit the Check Your Individual Tax Refund Status page to see the status of their return. You will need to provide your SSN and the exact amount of your refund.

Refunds can take nine to 10 weeks to process from the date that your tax return is received. If you elect to receive your refund as a paper check, you can expect it to take an additional two weeks. If you e-filed and have not heard anything about your refund within 10 weeks, call the states Department of Taxation.

You May Like: 1040paytax.com Safe

Should You Call The Irs

Expect delays if you mailed a paper return, had to respond to an IRS inquiry about your e-filed return, claimed an incorrect Recovery Rebate Credit amount or used 2019 income to claim the EITC or ACTC. Otherwise, you should only call if it has been:

- 21 days or more since you e-filed

- “Where’s My Refund” tells you to contact the IRS

Do not file a second tax return.

Paycheck Checkup: you can use the IRS Tax Withholding Estimator to help make sure your withholding is right for 2021.