Otc Monthly Payment Plan

Okee doke cow poke. Monthly Installment Agreements in Oklahoma must be a secret because there isnt much information on the Tax Commissions website.

Hope this helps.

- Dont expect more than 12 months to pay.

- Payments are due on the 15th of each month. First payments are due the 15th of the month following the date you set up the agreement.

- In extreme circumstances, the OTC may consider allowing more than 12 months. Expect to submit financial information. More time also requires approval from the higher ups.

- Do you have a professional license or work for the state of Oklahoma? If yes, you get special treatment, which doesnt mean better treatment.

How To Sell A Oklahoma City House When You Owe Back Taxes

By Carter Steph

Tax liens are like a giant stop sign for property owners who are ready to sell. Especially for those faced with a tax lien placed on their property so high that selling their home is the only option available to repay the debt, which will be due at closing. A word to the wise, working with the government, be it local, state, or the IRS, towards settling a tax lien is a long process, so dont wait until your house sells to contact the tax authorities and begin to work with them towards a solution.

Take action immediately to tackle your tax lien head-on. The more swiftly you deal with the problem, the more money you will save because high penalties and interest will increase the debt day by day, depleting any equity remaining in the property.

While you should always consult a professional tax adviser to discuss your specific circumstances, our experts have gathered the following information about how to sell a Oklahoma City house when you owe back taxes.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Also Check: Do Seniors On Social Security Have To File Taxes

Who Pays Ok Income Tax

Oklahoma residents with a gross income from both within and outside of Oklahoma that surpasses the standard deduction plus personal exemption should file an Oklahoma income tax return.

Non-residents are also required to file a state income tax return when they receive gross income of at least $1,000 of Oklahoma source income.

Oklahoma Extends State Income Tax Deadline Until June 15

OKLAHOMA CITY Following the IRS lead, the state Tax Commission has extended the deadline for Oklahomans to pay their state income taxes without penalty by two months.

The IRS granted federal income tax extensions to Texas, Oklahoma and Louisiana filers following the Februarys historic winter storm, which dumped snow and caused arctic temperatures and rolling power outages across much of the region.

Oklahoma officials said they opted to follow suit earlier this month to help Oklahomans who typically file their federal and state income taxes together.

Clark Jolley, a state tax commissioner, in a video post, said Oklahomas state statutes are very tricky in the way theyre written. Tax commissioners cannot legally change the April 15 date for filing unless its nationally changed in the United States code, he said.

Getting highly technical, we cant technically move it, but we can effectually move it and effectively weve moved it to June 15 by saying were going to waive any and all penalties and interest, he said. So if you do file after April 15, youre not going to be penalized. Youre not going to pay any penalties or interest.

He said the states June 15 extension applies to personal 2020 income tax returns, franchise tax returns and 2021 income tax estimates.

Tags

Recommended Reading: How To Get Social Security Tax Statement

Gather Documents And Information

To simplify the process to pay Oklahoma state taxes online, ensure that you have everything you need to prepare the tax return in one sitting. You will likely need to comb your personal and household files for gathering everything you need. Naturally, you need documents and statements related to wages and earnings, such as a W-2 for employment wages and IRS Form 1099 for other compensation. Other compensation refers to money paid to you as an independent contractor or earnings from investments, rental income or compensation in the form of debts that have been canceled on your behalf.

In addition, have your email address handy, and a valid state ID card or driver’s license. It’s required that you also have your adjusted gross income from your previous year’s federal return, and your current federal tax return documents. If your Oklahoma income tax due is based on combined income for you and a spouse, be sure you have their ID and SSN.

Making An Oklahoma Tax Commission Payment Online

Once you have completed your Oklahoma state income tax return, you’re ready to pay. The Oklahoma Tax Commission Payment Center website is where you start the process for making payment. In addition to income tax, business owners can make corporate estimated tax payments, file sales tax reports and other types of business and individual tax-related payments. For income tax payments, click on the “Pay Your Tax Bills Online Now!” link the site accepts major credit cards, such as VISA, MasterCard, AMEX and Discover. Electronic funds transfer is also available, and if you select that method, you will need the ABA routing number for your bank or credit union, plus your account number.

Also Check: How To Do Taxes Freelance

General Tax Return Information

Due Date – Individual Returns – E-filed returns are due April 20. Paper filed returns are due April 15.

Extensions – Oklahoma allows an automatic six month extension if no additional tax is due and if a federal extension has been timely filed. A copy of the federal extension must be provided with your Oklahoma return. If the federal return is not extended or an Oklahoma liability is owed, an extension of time to file the Oklahoma return can be granted on Form 504-I. 90% of the tax liability must be paid by the original due date of the return to avoid penalty charges for late payment. Interest will be charged from the original due date of the return.

Extension requests cannot be e-filed. To access Form 504-I, from the main menu of the Oklahoma return select Oklahoma Extension of Time To File.

Drivers License/Government Issued Photo Identification: Oklahoma does not require this information to file the tax return. Providing the information will help confirm the taxpayer’s identity and can prevent unnecessary delays in tax return processing. To enter Identification Information, from the main menu of the Oklahoma return select Personal Information > Driver’s License Information.

How Do Oklahoma Property Taxes Work

In Oklahoma , property taxes are based on the value of your property. Unlike other types of state taxes like sales or income tax, property taxes are administered at a local level.

This means, your county officials will value your property, set your tax rates, and collect taxes.

Here is additional information from the state of Oklahoma:

The county assessor uses mass appraisal to appraise large numbers of properties. In a mass appraisal, the assessor first collects detailed descriptions of each taxable property in the district. Then property is classified according to a variety of factors, such as size, quality, use, and construction type. Using data from recent property sales, the assessor appraises the value of typical properties in each class. Taking into account differences such as age or location, the assessor uses the typical property values to appraise all the properties in the class.

For individual properties, the assessor may use three common methods to value property: market, income and cost approach. The market approach is most often used and simply asks, What are properties similar to this property selling for? The value of your home is an estimate of the price your home would sell for. The assessor compares your home to similar homes that have sold recently and determines your homes value.

Don’t Miss: Do You Pay Sales Tax On Services

How Do I Contact Oklahoma Unemployment Office

You can reach the OESC at the contact information below:

Oklahoma Unemployment Service Center Phone Number 405-525-1500

Employment services and in-person assistance You can also visit your local Oklahoma Works offices located throughout the state.

To locate an office near you, .

Text Telephone System :800-722-0353 To have calls relayed800-522-8506 Voice Calls

To report a fraudulent unemployment claim, use the online fraud form.

Unemployment Debit Card Customer Service:

You can call the Way2Go customer service with questions or issues concerning benefit payments, debit cards, and automatic transfers at 866-320-8699 or by visiting goprogram.com.

Starting this coming Monday 10/4, the new Tulsa office location will be open to support claimants. The Tulsa staff has been temporarily combined with the Sapulpa office during this transition, but, as of Monday, claimants will be served from both locations.

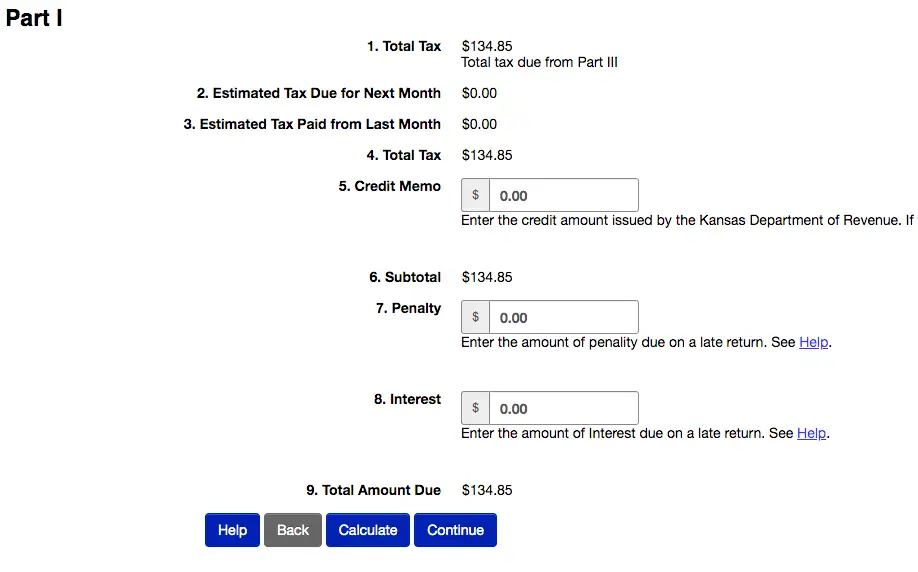

S For Filling Out Oklahomas Sales Tax Return

Step 1: The first step in filing your Oklahoma sales tax return is to log into the website at

If you do not have a username and password, you will need to click on Register here and then follow the instructions for signing up. You can also reference this blog, How to Register for a Sales Tax Permit in Oklahoma, for more information.

Step 2: You should now be on your homepage. Click on File return listed under the appropriate account. In this case, we are using a Vendor Use Tax account .

Step 3: Enter your sales information and click Next.

Step 4: The Oklahoma return uses the term Sales Price. This is really your gross sales.

If you have marketplace sales, enter the sales amount as Other Legal Sales Tax Exemptions and include an explanation that states remitted by marketplace.

Step 5: Now you need to put in your city/county detail. If you have a lot of jurisdictions, you may want to use the import feature. You can click on the examples and the tips & tricks for additional instructions.

Once you are done entering the jurisdictions, click Next.

Step 6: You now will see the total amount of tax due. Review this information to make sure it matches your records. If all looks good, click Submit. If the information does not look correct, then click Previous and make your changes. Please note that once you click Submit you will not be able to make changes.

Hooray! You have now filed your return.

You May Like: Can I Use Bank Statements As Receipts For Taxes

How Your Oklahoma Paycheck Works

You dont receive your full, quoted salary each year because your employer also withholds taxes from your paychecks. Regardless of where you live in the U.S., your employer withholds money to pay FICA and federal income taxes.

Federal income tax is sent to the IRS, where it counts toward your annual income taxes. Instead of paying your taxes in one lump sum during tax season, you pay gradually throughout the year. How much your employer withholds from your paychecks for federal income taxes depends on factors like your salary, marital status and number of dependents. Information about your filing status is on your W-4, and your employer uses it to figure out how much to withhold. This is why you need to fill out a new W-4 whenever you start a new job or experience a big life change, like a marriage. You can also make changes to your W-4 throughout the year if you simply want to adjust the taxes coming out of your paycheck.

The IRS made a few notable changes to the W-4 in recent years. One big change is that the new form doesn’t let you claim allowances anymore. Instead, it utilizes a five-step process that allows filers to indicate any additional income or jobs, income tax credits and more. If you were hired on or after Jan. 1, 2020, you must fill out the revised W-4. If you were hired before the calendar flipped to 2020, you don’t need to fill out the new form unless you change jobs or adjust your withholdings.

Way2go Debit Card About To Expire

If your Way2Go is about to expire, there is nothing you have to do.

Way2Go will mail you a new card automatically prior to the expiration date of your current card.

However, if your card has already expired and you did not receive a replacement card, you should call customer service at the number listed below.

You May Like: How Much Is Tax Preparation

Option 1 Call Customer Service

You can call Oklahoma Way2Go at 1-866-320-8699 for assistance.

International callers should call 334-6616

Here are the customer service hours:

Oklahoma Way2Go Customer Service is available 24 hours a day, 7 days a week, and handles calls related to:

- Reporting lost or stolen cards

- Balance inquiries

- Registering a complaint about a card issue

- Questions about card usage

- Questions about international card usage

No Oklahoma Annual Reconciliation

The federal government and many other states require employers to file an annual reconciliation after the end of the year. The annual reconciliation, where required, is in addition to the requirement to provide each of your employees with a federal form W-2 summarizing the employee’s withholding for the year. Oklahoma, however, does not require you to file an annual reconciliation.

Read Also: When Will The Child Tax Credit Payments Start

Oklahomas Tax Deadline Is June 15 What You Need To Know

- to copyLink copied!

- to copyLink copied!

- to copyLink copied!

OKLAHOMA CITY

Monday is the deadline to file taxes in many states across the country but in Oklahoma, the deadline to file taxes has been pushed back to June 15.

This is due to the historic winter weather back in February. As a result of the disaster declaration issued by FEMA, the Internal Revenue Service announced the tax deadline extension for all Oklahomans who live in or own a business in all of Oklahomas 77 counties to provide relief for those affected by Februarys historic winter storms.

Following the announcement from the IRS, the Oklahoma Tax Commission ordered the payment deadline extension to provide further relief to Oklahoma taxpayers. The Oklahoma Tax Commissioners decided to adjust the payment deadline extension from April 15 to June 15 for everyone who lives in or owns a business in Oklahoma.

Forgot Your Ok Way2go Card User Id

If you lost your Way to Go Card Oklahoma User ID we can help walk you through the steps on how to recover that information so you can log in to your FL Way2Go account.

How to recover lost Way2Go OK User ID

Follow these steps to recover your lost Way2Go Card Oklahoma User ID login information.

Once you are logged into your Oklahoma Way2Go Debit MasterCard account, you can:

- You can check your card balance online.

- Set up Direct Deposit

- Review transactions and any fees that might have been applied to your account.

- Manage your automatic alerts, including receiving email or text alerts when you get a deposit.

You can also set up alerts by calling 1-866-320-8699.

You May Like: Do You Pay Income Tax On Unemployment

Satisfy The Delinquent Tax

Paying off the lien before selling your Oklahoma City house when you owe back taxes is the easiest way to avoid any problems with the closing. A tax attorney may also be able to negotiate a settlement on your behalf to satisfy your debt. Protect yourself by verifying the recording of the lien release.

Gov Stitt’s Mcgirt Rhetoric

In a recent visit to Enid, Stitt said the Oklahoma Tax Commission has 3,000 protests from Native Americans in Eastern Oklahoma who are seeking to be exempt from paying state income tax in light of the McGirt decision, according to the Enid News and Eagle.

However, Tax Commission officials say that’s not the case. Doyle said that 3,000 figure is the number of Native Americans that have sought a tax exemption because they say they live and work on tribal land. So, that number includes tribal citizens who, for years, have claimed such an exemption.

“Those are definitely not protests at this point, those are just those that are filing,” Doyle said.

More:Indian criminal cases consume state, federal prosecutors

In his State of the State speech this year, Stitt called the McGirt decision the most pressing issue facing the state. He said the ruling raises many unanswered decisions, including those related to taxation.

In the McGirt decision, the Supreme Court ruled convicted child rapist Jimcy McGirt, who is Native American, was improperly tried in state court when his crimes were committed on the Creek reservation, which was never disestablished.

Federal law states that the federal government, as opposed to the state, prosecutes major crimes involving tribal members committed on reservation land.

Recommended Reading: How To Pay Taxes For Free

How Can I Pay My Oklahoma State Taxes

A year before Oklahoma suffered tremendous economic and employment losses as a result of the Great Depression, the Oklahoma Tax Commission was formed in 1931. Its purpose was to collect taxes and fees and administer licenses for the benefit of Oklahoma residents. The OTC experienced several organizational iterations over the years until 1995 when it reorganized, holding true to its promise of being the type of organization that would adapt to meet the needs of Oklahomans. When you pay your Oklahoma taxes online, you are essentially making an online Oklahoma Tax Commission payment.