Taxes In North Carolina

North Carolina State Tax Quick Facts

- Income tax: 5.25% flat rate

- Sales tax: 6.75% – 7.50%

- Property tax: 0.77% average effective rate

- Gas tax: 36.10 cents per gallon both of regular gasoline and diesel

In 2013, the North Carolina Tax Simplification and Reduction Act radically changed the states tax structure. Previously, North Carolina had a progressive income tax, with rates ranging from 6% to 7.75%. The new law introduced a flat rate income tax and more than doubled the standard deduction for North Carolina taxpayers. The effect was a significant overall reduction in taxes for taxpayers of all income levels.

Along with the state income tax, other taxes paid by North Carolinians include sales taxes , property taxes and a gas tax. North Carolinas estate tax was repealed as part of the 2013 law.

A financial advisor in North Carolina can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial planning – including retirement, homeownership, insurance and more – to make sure you are preparing for the future.

North Carolina Real Estate Transfer Taxes: An In

When you are looking to buy or sell a home, it’s important to understand all the financial implications that come with it. One of the more common fees that people face is transfer taxes. Here is an in-depth guide on everything regarding transfer taxes.

There are various taxes and fees associated with the buying and selling of a home. A lot of buyers and sellers are not aware of them when they choose to do anything in real estate. Some of the more common costs are closing costs, transfer taxes, property taxes, and real estate commission. The average homeowner who purchases a home for $200,000 can pay anywhere from 2% to 5% of the sale price in closing costs. This means anywhere from $4,000 to $10,000 just in closing costs.

As you can see, these costs and fees can add up fairly quickly and come as a surprise when you walk away from selling or buying a home and either don’t make a profit or spend more than you budgeted for. It’s important to do research and account for these costs to make sure you are financially prepared to deal with real estate transactions.

One of the costs that a lot of buyers and sellers aren’t aware of is the transfer tax. A transfer tax is any kind of tax that can be levied on the transfer of ownership of a property from one person to another.

General State And Local Taxes

The State of North Carolina levies a general retail sales and use tax of 4.75%. Pitt County levies a sales and use tax of 2.25%, for a total sales tax of 7% in Pitt County.

Electricity and support equipment at a qualifying data center and computer software at any data center

Other Exemptions:

North Carolina taxable income is adjusted gross income as calculated for federal income tax purposes with certain modifications.

This rate was reduced to a flat rate of 5.25% in 2019.

Recommended Reading: Tax Write Off For Doordash

North Carolina Unauthorized Substances Tax

According to North Carolina law, anyone who possesses an unauthorized substance, including marijuana, cocaine, moonshine, mash and illicit mixed beverages, will have the substances confiscated and must then pay an excise tax within 48 hours.

- Basketball legend Michael Jordan is from Wilmington, North Carolina, where he was famously cut from the varsity basketball team at Emsley A. Laney High School as a sophomore.

- North Carolina is one of the top states in the country that produces sweet potatoes.

How Do North Carolina Tax Brackets Work

Technically, you don’t have just one “tax bracket” – you pay all of the North Carolina marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your North Carolina tax bracket is the tax bracket in which your last earned dollar in any given tax period falls.

You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. The chart below breaks down the North Carolina tax brackets using this model:

| $0.00 | $0.00 |

The standard deduction, which North Carolina has, is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deduction.Essentially, it translates to $8,750.00 per year of tax-free income for single North Carolina taxpayers, and $17,500.00 for those filing jointly.

The Personal Exemption, which is not supported by the North Carolina income tax, is an additional deduction you can take if you are primarily responsible for your own living expenses. Likewise, you can take an additional dependent exemption for each qualifying dependent , who you financially support.

The Federal income tax also has a standard deduction, personal exemptions, and dependant deductions, though they are different amounts than North Carolina’s and may have different rules.

Also Check: Do You Pay Taxes On Donating Plasma

How Your North Carolina Paycheck Works

When you get paid in North Carolina, you will notice that money has been withheld from your wages for FICA, federal and state income taxes. FICA tax is a federal payroll tax paid by both employees and employers. The tax is made up of both Social Security and Medicare taxes. Social Security is taxed at 6.2% of your salary and Medicare at 1.45%. Your employer matches these rates, so the total contribution is doubled. If you make in excess of $200,000, those wages are subject to a 0.9% Medicare surtax. Employers do not match Medicare surtax payments.

Besides FICA taxes, you will see federal income taxes are also taken out of your paychecks. This money goes to the IRS, where it is counted toward your annual income taxes. How much someone might pay in federal income taxes varies from person to person, and depends on factors such as your salary, marital status and number of dependents.

When you start a new job in North Carolina or any other state, you have to fill out a new W-4 form. Your employer will then use the information you provide on this form to determine how much to withhold for taxes from your paycheck.

The IRS has made significant changes to the Form W-4 in recent years. For starters, the new form removes the option to claim allowances and it applies a five-step process that lets you indicate any additional income.

Other North Carolina Tax Facts

North Carolina taxpayers can check the status of their state returns online.

Taxpayers can have their state refund money directly deposited into a bank account , sent as a paper check, credited to their estimated income tax account or credited as a contribution to the states wildlife fund.

The North Carolina Department of Revenue publishes the names of individuals and businesses that owe delinquent state taxes.

For more information, visit the North Carolina Department of Revenue website.

To download tax forms on this site, you will need to install a free copy of Adobe Acrobat Reader. Click here for instructions.

Related Links:

Read Also: Pastyeartax.com Reviews

Personal And Real Property Taxes

The property tax in North Carolina is a locally assessed tax collected by the counties. The state Department of Revenue does not send property tax bills or collect property taxes.

The 3 main elements of the property tax system in North Carolina are real property, personal property and motor vehicles.

For almost all the segments of the property tax, Jan. 1 is the tax lien date. In other words, an individual owning property as of that date is liable for property taxes in the county where the property is located.

Listings of the states property tax rates since 1998 are available on the North Carolina Department of Revenue website.

North Carolina offers various property tax exclusions, including tax breaks for the elderly, veterans and the disabled.

For further information regarding property tax, contact your local county assessor.

North Carolina State Tax Tables

The North Carolina State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Carolina State Tax Calculator. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

The North Carolina Department of Revenue is responsible for publishing the latest North Carolina State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in North Carolina. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year. This page contains references to specific North Carolina tax tables, allowances and thresholds with links to supporting North Carolina tax calculators and North Carolina Salary calculator tools.

Don’t Miss: Pay Taxes On Plasma Donation

Can You Deduct Transfer Taxes

We are all typically looking for ways to make tax deductions. While there are many things homeowners can do to maximize their tax deductions, such as utilizing property taxes, transfer taxes is not one of them. This is because the IRS does not consider transfer taxes as a âsales tax.â

However, as a seller, you can include the transfer tax on the cost basis of your property. The way this works is when you sell your house, the goal is to walk away with a profit. This profit is going to be taxed by a capital gains tax. The amount you spent on the transfer tax can be taken from your profit so that your capital gains tax bill can be reduced.

The good news is that you won’t even need to make this reduction if you owned the home for more than two years. A married couple who lived in the house for two of the last five years could exclude $500,000 of capital gains.

North Carolina Income Taxes

North Carolina moved to a flat income tax beginning with tax year 2014. For tax year 2020, all taxpayers pay a flat rate of 5.25%. That rate applies to taxable income, which is income minus all qualifying deductions and exemptions, as well as any contributions to a retirement plan like a 401 or an IRA.

In North Carolina, taxpayers can claim itemized deductions for charitable contributions, mortgage interest and property taxes. The deductions for the latter two categories cannot exceed $20,000. Most other deductions that were previously available in North Carolina, including the Net Business Income deduction and the College Savings Program deduction, are no longer available as of 2014.

Taxpayers who dont itemize their deductions can claim North Carolinas standard deduction. The standard deduction for the 2020 tax year is $10,750 for single filers, $21,500 for joint filers and $16,125 for heads of household. However, there is no personal exemption in North Carolina for filers, spouses or dependents. To file your federal tax return, you can look into tax preparation software or hire a professional accountant.

You May Like: Is Plasma Donation Taxable

How You Can Affect Your North Carolina Paycheck

North Carolina taxpayers who find themselves facing a large IRS bill each tax season should review their W-4 forms, as there’s a simple way to use the form to address this issue. Specifically, you can elect to have an extra dollar amount withheld from each of your paychecks to go toward your taxes. While your paychecks will be slightly smaller, youll lower the chances of owing money to Uncle Sam during tax season.

You can also save on taxes by putting your money into pre-tax accounts like a 401, 403 or health savings account , provided your employer offers these options. Retirement accounts like a 401 and 403 not only help you save money for your future, but can also help lower how much you owe in taxes. The money that goes into these accounts comes out of your paycheck before taxes are deducted, so you are effectively lowering your taxable income while saving for the future. HSAs work in a similar manner and you can use the money you put in there toward medical-related expenses like copays or certain prescriptions.

Not yet a North Carolina taxpayer, but planning a move to the state soon? Take a look at our North Carolina mortgage guide for important information about rates and getting a mortgage in the state.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Also Check: Tsc-ind Ct

How Are Ui Tax Rates Determined In North Carolina

North Carolinas UI tax rates are determined under an experience rating system. Once an employer is eligible to receive a reduced tax rate, the tax rate is determined annually based on experience. Experience rating is affected by payroll, tax paid, timeliness of payments and unemployment insurance benefits charged against the employers account.

Elective Passthrough Entity Tax

A partnership or S corporation may make an irrevocable annual election to pay an entity-level tax on its timely filed return, effective for tax years beginning on or after January 1, 2022.

The tax is applied on the entitys North Carolina taxable income at the personal income tax rate. North Carolina taxable income is computed using each partner/shareholders share of income or loss attributable to the state, plus each resident partner/shareholders share of income or loss not attributable to the state.

Partners may deduct their distributive share of income from the taxed partnership to the extent it was included in the partnerships North Carolina taxable income. Likewise, S corporation shareholders may deduct the amount of their pro rata share of income from the taxed S corporation to the extent included in the S corporations North Carolina taxable income.

An electing partnership may not have another partnership or a corporation as partners.

Observation: The elective passthrough entity tax is intended to provide North Carolina individual taxpayers with a workaround to the state and local tax deduction limitation enacted for federal income tax purposes as part of the Tax Cuts and Jobs Act.

Read Also: Efstatus.taxact 2014

Do I Have To Pay Income Tax In North Carolina

You are required to file a North Carolina tax return if you receive income from North Carolina and you fall into one of the following categories:

- Resident: You have lived in North Carolina for more than 183 days during the taxable year.

- Part-Year Resident: You became a resident of North Carolina during the tax year or moved and became a resident of another state during the tax year.

- Nonresident: You did not live in North Carolina at any time during the tax year but received income from North Carolina sources.

North Carolina State Income Taxes

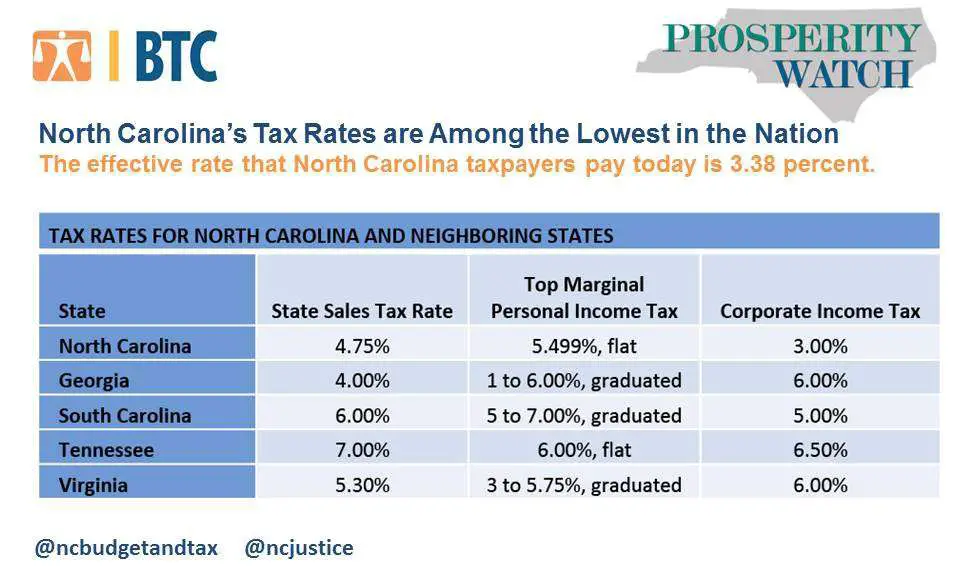

North Carolina income tax is a flat tax, meaning the state charges a consistent rate of 5.499 percent without income tax rates that fall into different tax brackets based on income level. Its one of just eight states that does this. But North Carolinas standard deduction is $8,750 for individuals and $17,500 for married couples filing jointly, so you dont start owing taxes until youve earned at least $8,750.

Dont Miss: Tax Write-Offs You Dont Know About

You May Like: 1040paytax Irs

Where To Send Your North Carolina Tax Return

| Express Delivery |

You can save time and money by electronically filing your North Carolina income tax directly with the . Benefits of e-Filing your North Carolina tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

To e-file your North Carolina and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

The two most popular tax software packages are H& R Block At Home, sold by the H& R Block tax preparation company, and TurboTax Federal & State, sold by the Intuit software company. Both companies produce multiple editions for simple to very complex tax returns, so be sure to carefully compare the features offered by each package.

Llc Taxes In Nc: Everything You Need To Know

LLC taxes in NC are the taxes that a limited liability company must pay to the state of North Carolina.3 min read

LLC taxes in NC are the taxes that a limited liability company must pay to the state of North Carolina. At the federal level, an LLC is a pass-through entity, which allows it to avoid the double taxation that affects corporations. An LLC also has the flexibility to be treated as a partnership, corporation, sole proprietor, or S corp by the IRS.

Don’t Miss: Internal Revenue Service Tax Returns

North Carolina Sales Tax

The base sales tax in North Carolina is 4.75%. In addition to that statewide rate, every county in North Carolina collects a separate sales tax, which ranges from 2% to 2.25% in most counties. In Durham and Orange counties specifically, there is an additional 0.5% tax which is used to fund the Research Triangle Regional Public Transportation Authority. In sum, that means sales tax rates in North Carolina range from 6.75% to 7.50%. Below are the sales tax rates for all the counties in North Carolina.