Is Social Security Taxable Income For Seniors

If social security is a taxpayers only income, its not taxable.

For taxpayers with over income, you must calculate your provisional income to determine how much of your social security benefits are taxpayers. Provisional income is equal to 50% of your social security income plus your tax-exempt interest plus all other taxable income.

Single people with provisional income between $25,000 and $34,000 and married couples with provisional income between $32,000 and $44,000 will have 50% of their social security benefits included in their taxable income.

Once your provisional income is above those amounts, 85% of your social security benefits are included in your taxable income. The amount of social security income included in your taxable income will never exceed 85%.

If the taxpayers filing status is married filing separately but lives with their spouse at any point during the year, then 85% of the taxpayers social security income is taxable.

Are There Ways To Reduce Your Tax Liability

If you cant stop filing your taxes yet, look into available credits to help reduce your overall tax burden. For instance, a tax credit for filers designed specifically for senior citizens is known as the. This tax credit is in addition to the standard deduction and ranges between $3,750 and $7,500.

Tax credits like this one could potentially bump you into a lower tax bracket or even yield a tax refund.

When To Expect 2023 Irs Income Tax Refunds Estimated Date Chart For Tax Refunds

This chart shows an estimated timeline for when a taxpayer is likely to receive their refund, based on information we have now, and using projections based on previous years- and depending on when a person files their return.

Its still a bit too early to think about it, but in case you are wondering, heres our annual chart for the #1 question we get every year: When will I get my tax refund? The answer is never exact, but we are able to make some educated guesses based on a few factors.

Now is also a good time to take advantage of year-end strategies that can lower your tax bill, or increase your refund.

If youve had major income changes this year, had a child, got married or divorced, retired, bought a house, or changed investments, or made any other really significant life changes, you should definitely seek the advice of a tax professional like a CPA or EA before the end of the year. The sooner the better. Even if you cant reach one until early January, such a professional can still offer valuable advice that can make a real different on your taxes.

Most individual taxpayers wont have such issues for this tax season. For clarification, the weeks leading up to the , deadline is when Americans file tax returns for income they received during the 2022 calendar year, or they can file an automatic extension, which gives them an additional six months to file.

Also Check: How To File Prior Year Taxes Online

Deadline For Filing Your Income Tax Return

The deadline for sending us your personal income tax return is April 30. If you or your spouse carried on a business or earned income as a person responsible for a family-type resource or an intermediate resource, you have until June 15 to file your return.

Any balance due must be paid by April 30.

NoteannonceIncome tax filing deadline extended

Since the regular filing deadline falls on a Saturday this year, you have until May 2, 2022, to file your 2021 income tax return and pay any income tax you may owe. No interest or penalty will be charged.

End of noteNote

Even if you are unable to pay the full amount of your balance due by April 30, file your return no later than the deadline to avoid a late-filing penalty.

End of note

S You Can Take Now To Make Tax Filing Easier In 2023

Use online account to securely access the latest information available about your federal tax account and see information from your most recently filed tax return.

You can:

- View your tax owed, payments, and payment plans

- Make payments and apply for payment plans

- Access your tax records

- Sign Power of Attorney authorizations electronically from your tax professional

- Manage your communication preferences from the IRS

Organized tax records make preparing a complete and accurate tax return easier. It helps you avoid errors that lead to processing delays that slow your refund and may also help you find overlooked deductions or credits.

Wait to file until you have your tax records including:

- Form 1099-INT if you were paid interest

- Other income documents and records of digital asset transactions

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance payments or claims Premium Tax Credits for 2022 Marketplace coverage

- IRS or other agency letters

- CP01A Notice with your new Identity Protection PIN

Notify the IRS if your address changes and notify the Social Security Administration of a legal name change.

Remember, most income is taxable. This includes:

Check your Individual Tax Identification Number

If your ITIN wasn’t included on a U.S. federal tax return at least once for tax years 2019, 2020, and 2021, your ITIN will expire on December 31, 2022.

Make sure you’ve withheld enough tax

Log in to your online account to make a payment online or go to IRS.gov/payments.

You May Like: Does Bankruptcy Clear Tax Debt

How To File A Tax Extension

If you need even more time to complete your 2022 federal returns you can request an extension to by filing Form 4868 through your tax professional, tax software or using the Free File link on IRS.gov. Filing Form 4868 gives taxpayers until October 16th, 2023 to file their 2022 tax return but does not grant an extension of time to pay taxes due. Taxpayers should pay their federal income tax due by April 17, 2023, to avoid interest and penalties.

If you mail in your return, it must be postmarked on or before April 17, 2023, or sooner. Heres a tax refund schedule to give you an idea of when to expect your refund after youve filed. Its also important to note that the income tax refund schedule remains unchanged. This serves as an incentive for people to still file sooner rather than later.

When you file your federal extension you typically do not have to file anything else with your state. Most states give you an automatic 6-month extension if you do not file your taxes on time. You should check with your state to be sure, though.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Do You Have To Declare Unemployment On Taxes

How Do I Know That The Data Is Correct

This year, for the first time, you can view third-party data certificates submitted by third party data providers on your behalf. Simply log in to eFiling and following the steps below:

- Once successfully logged in, click on Third Party Data Certificate Search menu option displayed as part of the left menu option.

- Once you have selected the Third Party Data Certificate Search menu option, the Request Third Party Certificates screen will be displayed.

- On the Request Third Party Certificate form, select the Certificate Type and Tax Year.

- Click on the Certificate Type drop down list and select the appropriate certificate type.

- Click on the Tax Year drop down list and select the appropriate tax year.

- Once you have made the applicable selection, click on the Submit Query button displayed at the bottom of the page.

- The Certificate Type selected will be displayed and you will be able to click on to view your Certificate.

- Note the certificate cannot be used to submit to SARS.

If there is an error or the data is incomplete:

Get Your Notice Of Assessment

If youre registered for My Account, you can obtain your in certified tax software. It will be available right after we receive and process your return. This year, your Express NOA is also available in My Account in the same timeframe. The PDF of your NOA will appear in My Account on the assessment date noted on your Express NOA.

Recommended Reading: How Much Will My Social Security Be Taxed

When Can You Start Filing Your 2021 Taxes In Canada

Most Canadians believe there are four seasons in a year, but thats not entirely accurate. There are actually five seasons winter, summer, spring, fall, and tax season! Now, whether you enjoy tax season depends on whether you are expecting to pay more tax or get a hefty tax return. Lets be real after paying tax on virtually everything its nice to get something back once a year.

Use our loan calculator to find out what your loan payments could look like.

Contribute To Your Health Savings Account

This medical account, available to individuals who have a high-deductible health plan, provides a tax-saving way to pay for out-of-pocket costs. You have until the April 18, 2022, tax deadline to contribute to an HSA for the 2021 tax year. The 2021 limits were $3,650 for an individual HSA owner and $7,200 for a family. For 2022, the individual coverage contribution limit is $3,650 and the family coverage limit is $7,300. If you’re 55 or older, you can put an extra $1,000 in your HSA.

» MORE: Learn more about the tax effects of HSAs and flexible savings accounts

Also Check: When Are My Taxes Due 2021

When Is Tax Day

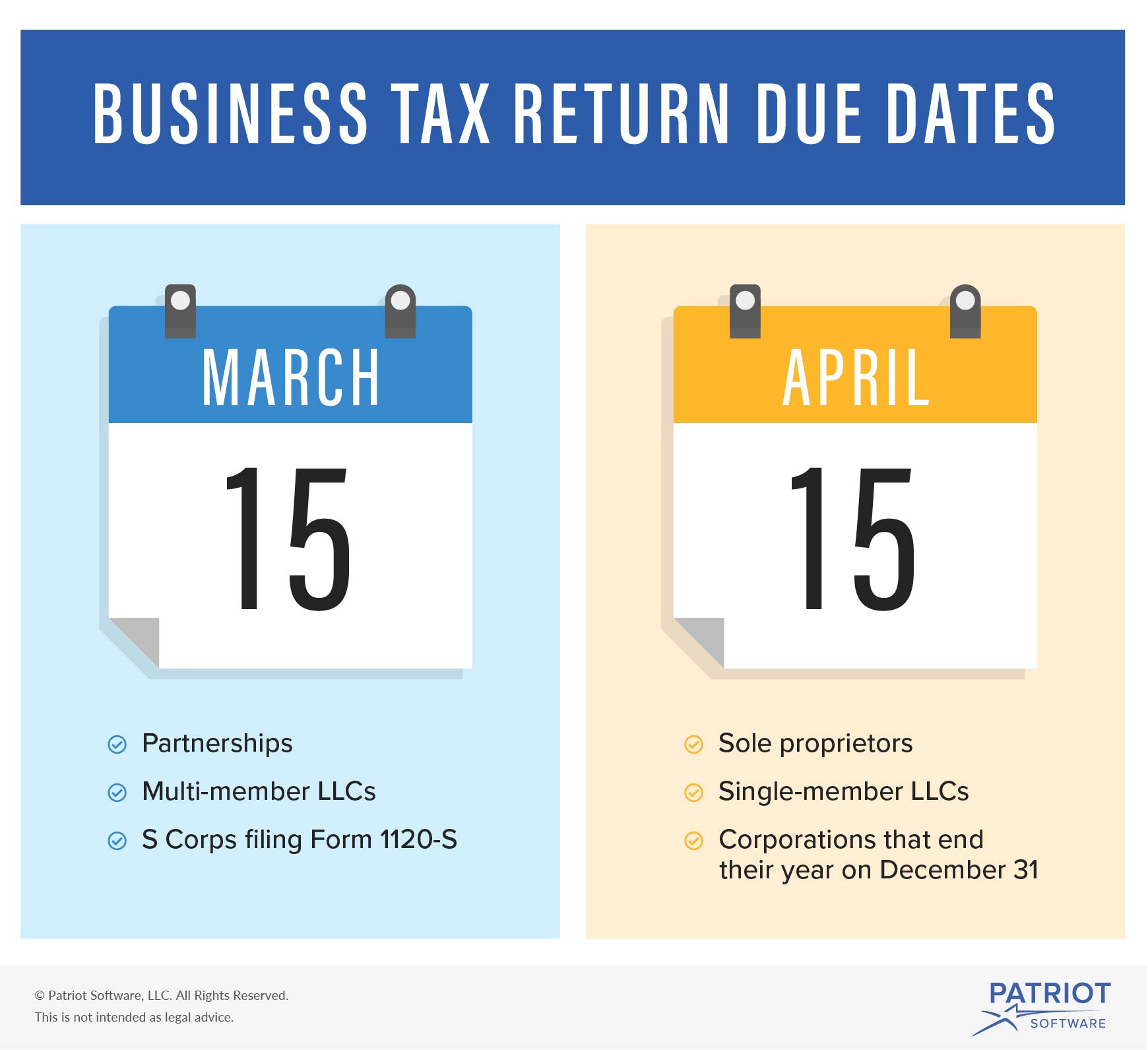

While January to April is called âtax season,â the big âtax dayâ is usually April 15. If that falls on a holiday or weekend, it moves to the next business day.

Because April 15 falls on a Saturday and the 17th is the observation of Emancipation Day, this yearâs tax day is April 18, 2023. This is when individual taxpayers, sole proprietors, and C corporations need to file their taxes.

Note that if you are using a fiscal year that isnât the calendar year, your tax filing deadline is different and depends on your business entity and when your fiscal year ends.

File Electronically And Choose Direct Deposit

To speed refunds, the IRS urges taxpayers to file electronically with direct deposit information as soon as they have everything they need to file an accurate return. If the return includes errors or is incomplete, it may require further review that may slow the tax refund. Having all information available when preparing the 2021 tax return can reduce errors and avoid delays in processing.

Most individual taxpayers file IRS Form 1040 or Form 1040-SR once they receive Forms W-2 and other earnings information from their employers, issuers like state agencies and payers. The IRS has incorporated recent changes to the tax laws into the forms and instructions and shared the updates with its partners who develop the software used by individuals and tax professionals to prepare and file their returns. Forms 1040 and 1040-SR and the associated instructions are available now on IRS.gov. For the latest IRS forms and instructions, visit the IRS website at IRS.gov/forms .

Read Also: Is Property Insurance Tax Deductible

Visit Our Help Centre For More Information

Looking for more details about a specific service? Need to get a hold of us regarding an existing account? We are here to help!

To qualify for The Foundation, you must have an active account with a bank or financial institution, as approved by Spring Financial, and a valid government-issued Canadian ID. The Foundation is available in all provinces except Saskatchewan, Quebec, and New Brunswick. Results from The Foundation depend on the individual. All guarantee references are made in connection to the Evergreen Loan. To qualify for the Evergreen Loan, you must first successfully complete 12 months on The Foundation and save $750, have an active account with a bank or financial institution, as approved by Spring Financial, and a valid government-issued Canadian ID.

What If I Can’t Pay My Tax Bill

If you can’t afford to pay your tax bill in full on the deadline, don’t pull out your credit card or ignore the situation.

The IRS offers reasonable payment plans at much lower interest rates than most banks. You may even be able to settle the bill for less than you owe, called an offer in compromise, or request a deferment until you can make a payment. Offers in compromise and requests for deferment require additional paperwork and must be approved by the IRS.

Also Check: How To Protest Taxes In Texas

Apply For Tax Deductions

You may be eligible to deduct certain expenses from your tax payments. Moving expenses such as transportation and storage of personal effects, travel, and temporary accommodation may be considered eligible deductions. Save your receipts for the cost of relocating to Canada. However, you cannot deduct moving expenses if your only income at the new location is scholarship, fellowship, or bursary income that is entirely exempt from tax under the current legislation.

You may also deduct childcare expenses, Registered Retirement Savings Plan contributions, and union dues.

Tax Deadline For Quarterly Estimated Payments

If you’re self-employed, an independent contractor or have investment earnings, you might be curious about another set of deadlines: quarterly estimated payments. The IRS requires these quarterly estimated tax payments from many people whose income isnt subject to payroll withholding tax.

For estimated taxes, the answer to “When are taxes due?” varies. The year is divided into four payment periods, and each period has its own payment due date. Check below to see the dates for 2022.

|

If you earned income during this period |

Estimated tax payment deadline |

|---|

Don’t Miss: When You File Taxes Is It For The Previous Year

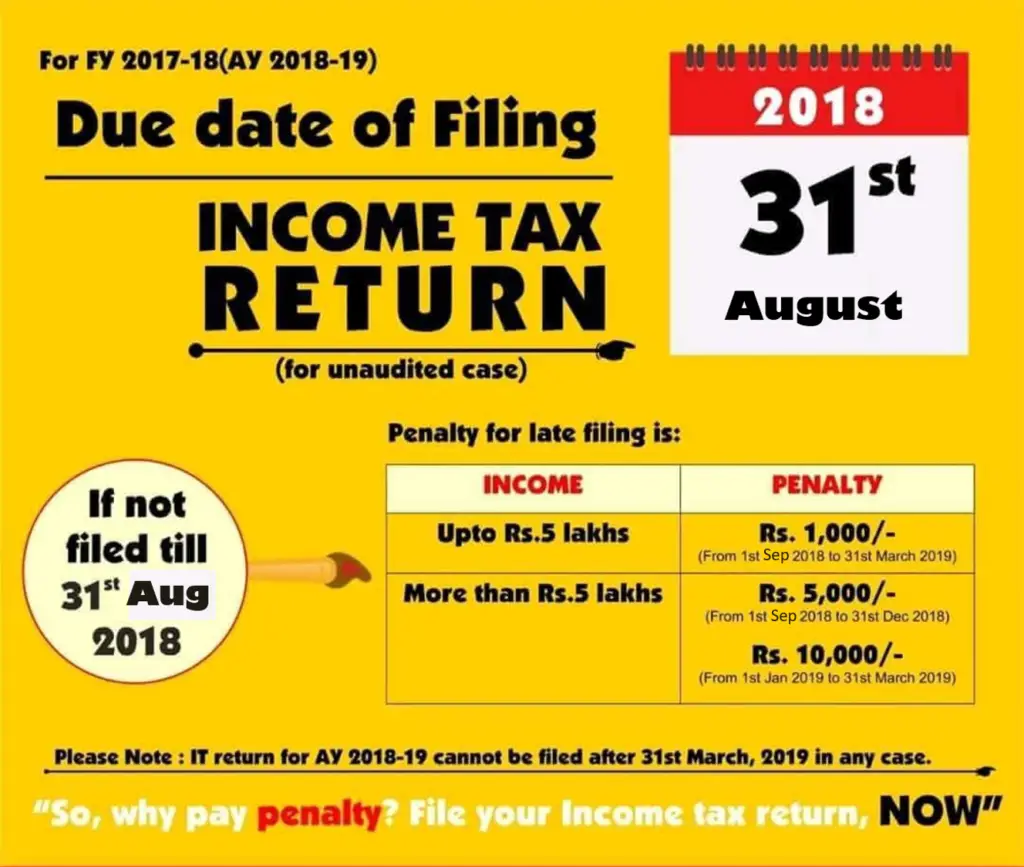

Deadline To Pay Tax Owing: Balance

A taxpayer must pay the tax owing for that year by the taxpayers balance-due date for that year. After that date, interest will begin to accrue on any tax owing but not yet paid.

- Individuals: For an individual who died on or after October 1st in a particular year and on or before April 30th of the following year, the balance-due date is six months after the date of death. In any other case, the balance-due date for a particular tax year is April 30th of the immediately following year. Further, an individual must make instalment payments for income-tax owing if the individuals income-tax owing for the year is greater than $3,000 , and that amount isnt subject to withholding at source.

- Corporation: Generally, a corporations balance-due date is two months after the end of its taxation year. A corporation that qualifies for the small business deduction will generally receive an extra monthi.e., its balance-due date is three months after the end of its taxation year. In addition, a non-Canadian-controlled private corporation must generally make monthly instalment payments for the years estimated income-tax owing.

- Trusts and Estates: A trusts balance-due date is 90 days from the end of its taxation year.

H& r Block Federal Free Edition

The cheapest filing option is the free option. It lets you file your federal tax return and all state returns for free. This choice works best for basic returns. The primary tax forms it supports are the 1040, Schedule EIC for the earned income tax credit, and Schedule 8812 for the Additional Child Tax Credit.

You can also use this form with some other common tax forms: Form 1099 , 1098 , and 1095 . However, filing other forms will require you to upgrade to a paid plan.

You May Like: How You Do Your Own Taxes

Turbotax Federal Free Edition

Like H& R Block, TurboTax has a Free tax filing option that allows you to file your federal return and one state return for free. However, the free option only supports simple returns with form 1040. The free option includes one free state return. In addition, TurboTaxs free option supports form 1040 with some child tax credits.

Filing Early Also Helps Protect Against Fraud

Filing early provides the added benefit of helping protect you against fraud. Tax fraud was common before 2020, but tax fraud incidents have increased by 45% since the pandemic hit.

Committing tax fraud is easier than you may think. All someone has to do is file a return in your name with your Social Security number before you do. For attempts to amend or report the first return filed with the IRS as fraudulent, the burden of proof falls on you.

Getting your return in ahead of the fraudsters means that they wont be able to complete the crime.

If you are a victim of tax identity theft, the IRS instructs you to call them ASAP and file form 14039. Calling can be problematic, as the IRS is known for long wait times. Getting through to a representative can take a lot of time.

Even after that, there isnt a quick fix to tax identity theft. The best move is to avoid this situation altogether by filing early.

You May Like: How To Efile Just State Taxes